-

×

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

TIMfundamentals with Timothy Sykes

1 × $5.00

TIMfundamentals with Timothy Sykes

1 × $5.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Strategies of a Winning Trader 2023 with Gareth Soloway

1 × $209.00

Strategies of a Winning Trader 2023 with Gareth Soloway

1 × $209.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Channel Surfing Video Course

1 × $23.00

Channel Surfing Video Course

1 × $23.00 -

×

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00 -

×

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00 -

×

Video Package

1 × $6.00

Video Package

1 × $6.00 -

×

CFA Level 2 - Examination Book Afternoon Section (1999)

1 × $6.00

CFA Level 2 - Examination Book Afternoon Section (1999)

1 × $6.00 -

×

Interactive Course

1 × $6.00

Interactive Course

1 × $6.00 -

×

A Day Trading Guide

1 × $54.00

A Day Trading Guide

1 × $54.00 -

×

Cheat Code Trading System

1 × $13.00

Cheat Code Trading System

1 × $13.00 -

×

Building Automated Trading Systems C++.NET with Benjamin Van Vliet

1 × $6.00

Building Automated Trading Systems C++.NET with Benjamin Van Vliet

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Access All Areas with Marwood Research

1 × $54.00

Access All Areas with Marwood Research

1 × $54.00 -

×

Charles Cottle Package ( Discount 50% )

1 × $23.00

Charles Cottle Package ( Discount 50% )

1 × $23.00 -

×

Boomerang Day Trader (Aug 2012)

1 × $54.00

Boomerang Day Trader (Aug 2012)

1 × $54.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

IBD Advanced Buying Strategies Home Study Program

1 × $10.00

IBD Advanced Buying Strategies Home Study Program

1 × $10.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00 -

×

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00 -

×

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00 -

×

Radioactive Trading Mastery Course

1 × $6.00

Radioactive Trading Mastery Course

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00 -

×

Private Seminar with Alan Andrew

1 × $6.00

Private Seminar with Alan Andrew

1 × $6.00 -

×

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00 -

×

TRAING IRON CONDORS IN ANY ENVIRONMENT with Sheridan Options Mentoring

1 × $15.00

TRAING IRON CONDORS IN ANY ENVIRONMENT with Sheridan Options Mentoring

1 × $15.00 -

×

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00 -

×

Profit Wave Trade Strategy with Base Camp Trading

1 × $4.00

Profit Wave Trade Strategy with Base Camp Trading

1 × $4.00 -

×

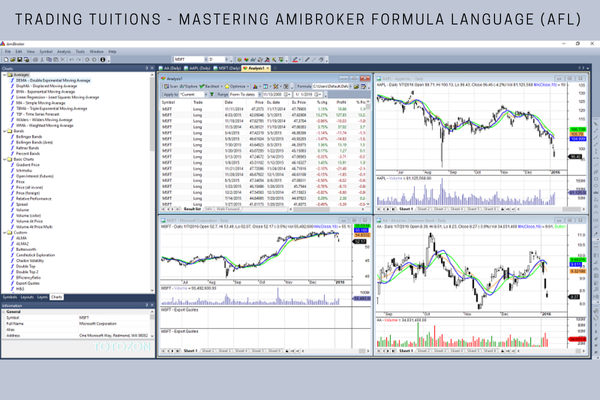

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00 -

×

The Handbook of Commodity Investing with Frank Fabozzi, Roland Fuss & Dieter Kaiser

1 × $6.00

The Handbook of Commodity Investing with Frank Fabozzi, Roland Fuss & Dieter Kaiser

1 × $6.00 -

×

Alexander Elder Package ( Discount 28% )

1 × $31.00

Alexander Elder Package ( Discount 28% )

1 × $31.00 -

×

Market Timing & Technical Analysis with Alan Shaw

1 × $6.00

Market Timing & Technical Analysis with Alan Shaw

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Trading the Elliott Waves with Robert Prechter

1 × $15.00

Trading the Elliott Waves with Robert Prechter

1 × $15.00 -

×

Raghee Horner's Workspace Bundle + Live Trading By Raghee Horner - Simpler Trading

1 × $23.00

Raghee Horner's Workspace Bundle + Live Trading By Raghee Horner - Simpler Trading

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00 -

×

The Superstock Investor with Charles LaLoggia

1 × $6.00

The Superstock Investor with Charles LaLoggia

1 × $6.00 -

×

ICinDER V2 Cycle Analysis and TrendGuide Pack and Bloodhound Ultimate (May 2015)

1 × $31.00

ICinDER V2 Cycle Analysis and TrendGuide Pack and Bloodhound Ultimate (May 2015)

1 × $31.00 -

×

Trade What You See, Not What You Believe with Larry Pesavento

1 × $6.00

Trade What You See, Not What You Believe with Larry Pesavento

1 × $6.00 -

×

Volume Profile Trading Strategy with Critical Trading

1 × $15.00

Volume Profile Trading Strategy with Critical Trading

1 × $15.00 -

×

Use the News with Maria Bartiromo

1 × $6.00

Use the News with Maria Bartiromo

1 × $6.00 -

×

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00

Unusual Options Activity Master Course with Andrew Keene - AlphaShark

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Aeron V5 Scalper+Grid

1 × $23.00

Aeron V5 Scalper+Grid

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Valuation of Internet & Technology Stocks with Brian Kettell

1 × $6.00

Valuation of Internet & Technology Stocks with Brian Kettell

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

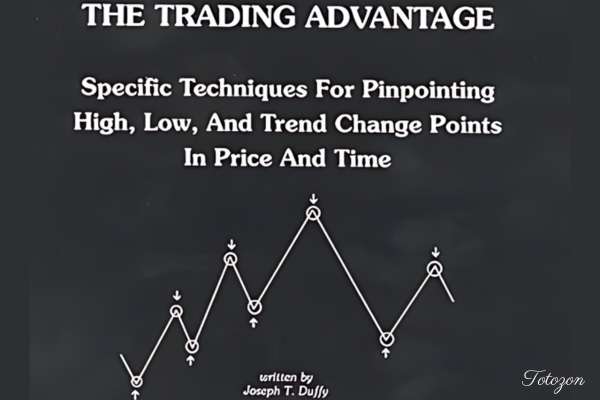

The Trading Avantage with Joseph Duffy

1 × $6.00

The Trading Avantage with Joseph Duffy

1 × $6.00 -

×

Pro9Trader 2016 Ultimate Suite v3.7

1 × $62.00

Pro9Trader 2016 Ultimate Suite v3.7

1 × $62.00 -

×

Bear Market Success Workshop with Base Camp Trading

1 × $15.00

Bear Market Success Workshop with Base Camp Trading

1 × $15.00 -

×

Trading the Post with Ron Friedman

1 × $5.00

Trading the Post with Ron Friedman

1 × $5.00 -

×

ZCFX Trading Course 2023 with ZCFX Trading

1 × $5.00

ZCFX Trading Course 2023 with ZCFX Trading

1 × $5.00 -

×

Wealth, War & Wisdom with Barton Biggs

1 × $6.00

Wealth, War & Wisdom with Barton Biggs

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Activedaytrader - Bond Trading Bootcamp

1 × $8.00

Activedaytrader - Bond Trading Bootcamp

1 × $8.00 -

×

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00 -

×

Low Timeframe Supply & Demand with RROP

1 × $5.00

Low Timeframe Supply & Demand with RROP

1 × $5.00 -

×

Trader University Course

1 × $5.00

Trader University Course

1 × $5.00 -

×

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00 -

×

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00 -

×

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00 -

×

Elliott Wave Swing High Low Indicator for ThinkorSwim with Fibonacci

1 × $6.00

Elliott Wave Swing High Low Indicator for ThinkorSwim with Fibonacci

1 × $6.00 -

×

Triple Squeeze Indicator TOS

1 × $6.00

Triple Squeeze Indicator TOS

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Bulk REO 2.0

1 × $23.00

Bulk REO 2.0

1 × $23.00 -

×

Options University - FX Options Trading Course 2008

1 × $6.00

Options University - FX Options Trading Course 2008

1 × $6.00 -

×

Sacredscience - R.N.Elliott – Nature’s Law. The secret of the Universe

1 × $6.00

Sacredscience - R.N.Elliott – Nature’s Law. The secret of the Universe

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

VXX Made Easy By Option Pit

1 × $62.00

VXX Made Easy By Option Pit

1 × $62.00 -

×

Frontline Forex Vol 1-3 with Steve Nison - Candle Charts

1 × $54.00

Frontline Forex Vol 1-3 with Steve Nison - Candle Charts

1 × $54.00 -

×

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Trade Like a Bookie

1 × $6.00

Trade Like a Bookie

1 × $6.00 -

×

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00 -

×

Options Income Generating Blueprint

1 × $31.00

Options Income Generating Blueprint

1 × $31.00 -

×

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00 -

×

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00 -

×

Precision Timing Your Options Trades Using Fibonacci with Trading Analysis

1 × $15.00

Precision Timing Your Options Trades Using Fibonacci with Trading Analysis

1 × $15.00 -

×

Traders Business Plan with Adrienne Laris Toghraie

1 × $6.00

Traders Business Plan with Adrienne Laris Toghraie

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00 -

×

Stocks with Strauss

1 × $31.00

Stocks with Strauss

1 × $31.00 -

×

Trading Floor Training

1 × $6.00

Trading Floor Training

1 × $6.00 -

×

Forever in Profit

1 × $31.00

Forever in Profit

1 × $31.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Zap Seminar - David Stendahl – Day Trading the E-Minis

1 × $6.00

Zap Seminar - David Stendahl – Day Trading the E-Minis

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

TA_L2 & The Nasdaq

1 × $6.00

TA_L2 & The Nasdaq

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Traders Secret Code Complete Course with Mark McRae

1 × $6.00

Traders Secret Code Complete Course with Mark McRae

1 × $6.00 -

×

Opportunity Investing with Gerald Appel

1 × $6.00

Opportunity Investing with Gerald Appel

1 × $6.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

Multi Squeeze Pro Indicator (PREMIUM)

1 × $69.00

Multi Squeeze Pro Indicator (PREMIUM)

1 × $69.00 -

×

Stock Market Science and Technique

1 × $15.00

Stock Market Science and Technique

1 × $15.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Trends & Trendlines with Albert Yang

1 × $4.00

Trends & Trendlines with Albert Yang

1 × $4.00 -

×

Zm Capitals Full course + Ebook with Zain Mokhles - ZmCapitals

1 × $31.00

Zm Capitals Full course + Ebook with Zain Mokhles - ZmCapitals

1 × $31.00 -

×

Advanced Daytrading Seminar with Ken Calhoun

1 × $155.00

Advanced Daytrading Seminar with Ken Calhoun

1 × $155.00 -

×

BETT Strategy with TopTradeTools

1 × $35.00

BETT Strategy with TopTradeTools

1 × $35.00 -

×

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00 -

×

Big Morning Profits with Base Camp Trading

1 × $4.00

Big Morning Profits with Base Camp Trading

1 × $4.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

SPX All Put Flat ButterFly with Mark Fenton - Sheridan Options Mentoring

1 × $39.00

SPX All Put Flat ButterFly with Mark Fenton - Sheridan Options Mentoring

1 × $39.00 -

×

Trading Earnings Using Measured-Move Targets with AlphaShark

1 × $23.00

Trading Earnings Using Measured-Move Targets with AlphaShark

1 × $23.00 -

×

The WWA Core Concepts Bootcamp

1 × $6.00

The WWA Core Concepts Bootcamp

1 × $6.00 -

×

Time Factor Digital Course with William McLaren

1 × $6.00

Time Factor Digital Course with William McLaren

1 × $6.00 -

×

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

One Week S&P Workshop II with Linda Raschke

1 × $5.00

One Week S&P Workshop II with Linda Raschke

1 × $5.00 -

×

Building Winning Trading Systems

1 × $6.00

Building Winning Trading Systems

1 × $6.00 -

×

Winning the Losers Game with Charles Ellis

1 × $6.00

Winning the Losers Game with Charles Ellis

1 × $6.00 -

×

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00 -

×

Leading Indicators

1 × $23.00

Leading Indicators

1 × $23.00 -

×

All About High-Frequency Trading with Michael Durbin

1 × $6.00

All About High-Frequency Trading with Michael Durbin

1 × $6.00 -

×

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00 -

×

Wallstreet Trappin with Wallstreet Trapper

1 × $31.00

Wallstreet Trappin with Wallstreet Trapper

1 × $31.00 -

×

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00 -

×

Stable Adaptive Control for Nonlinear Systems with Jeffrey Spooner

1 × $6.00

Stable Adaptive Control for Nonlinear Systems with Jeffrey Spooner

1 × $6.00 -

×

Momentum Explained

1 × $6.00

Momentum Explained

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Top 20 VSA Principles & How to Trade Them

1 × $31.00

Top 20 VSA Principles & How to Trade Them

1 × $31.00 -

×

Basic Astrotech

1 × $6.00

Basic Astrotech

1 × $6.00 -

×

Expert Option Trading Course with David Vallieres & Tim Warren

1 × $23.00

Expert Option Trading Course with David Vallieres & Tim Warren

1 × $23.00 -

×

The Photon Course 2023 with Matt - PhotonTradingFX

1 × $5.00

The Photon Course 2023 with Matt - PhotonTradingFX

1 × $5.00

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

$297.00 Original price was: $297.00.$6.00Current price is: $6.00.

File Size: 0.99 GB

Delivery Time: 1–12 hours

Media Type: Online Course

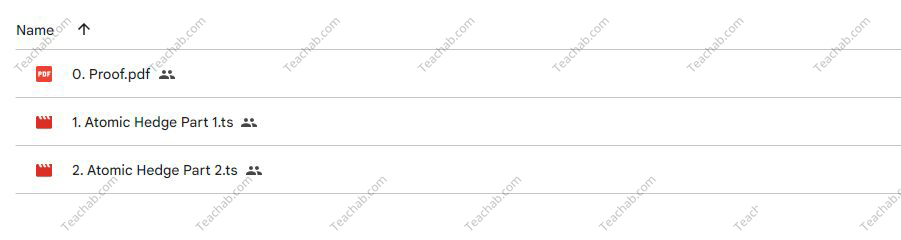

Content Proof: Watch Here!

You may check content proof of “The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman” below:

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

Introduction

In the volatile world of investing, balancing risk and return is a crucial skill. Don Kaufman’s “Reducing Risk and Maximizing Returns Blueprint,” featuring the Atomic Hedge Strategy, offers a sophisticated approach to achieving this balance. This guide delves into the method and practical applications taught in Kaufman’s groundbreaking class.

Understanding the Atomic Hedge Strategy

What is the Atomic Hedge Strategy?

The Atomic Hedge Strategy is an investment approach designed to minimize risk while enhancing potential returns through strategic asset allocation and derivatives use.

Core Principles of the Strategy

This strategy integrates principles of hedging, diversification, and leverage to protect and grow capital.

Components of the Strategy

Risk Assessment Techniques

Tools and methods for assessing potential risks in investment portfolios.

Derivative Instruments

Overview of the derivative instruments used in the Atomic Hedge Strategy, such as options and futures.

Building a Diversified Portfolio

Asset Allocation

How to allocate assets effectively to balance risk and return.

Sector Rotation

Utilizing sector rotation to capitalize on market cycles and economic indicators.

Implementing Hedge Techniques

Options Strategies

Detailed exploration of options strategies used to hedge positions and reduce portfolio volatility.

Using Futures for Hedging

How to use futures contracts as a hedge against market downturns and volatility.

Optimizing the Strategy

Backtesting

The importance of backtesting the strategy to ensure its effectiveness across different market conditions.

Adjustments and Tweaks

How to make necessary adjustments to the strategy as market conditions change.

Risk Management

Setting Stop Losses

Guidance on setting stop losses to protect against significant losses.

Risk/Reward Ratios

Calculating and utilizing risk/reward ratios to make informed trading decisions.

Performance Monitoring

Tracking and Analysis

Methods for monitoring the performance of your investments under the Atomic Hedge Strategy.

Key Performance Indicators (KPIs)

Identifying which KPIs to track to assess the success of your strategy.

Advanced Applications

Leveraging Machine Learning

Exploring how machine learning can enhance prediction accuracy and investment decisions.

Global Macro Strategies

Incorporating global macroeconomic factors into the Atomic Hedge Strategy to improve its robustness and return potential.

Real-World Case Studies

Successful Implementations

Analysis of successful real-world applications of the Atomic Hedge Strategy.

Lessons Learned from Failures

What can be learned from less successful attempts and how to avoid common pitfalls.

Continued Education and Resources

Ongoing Learning

Opportunities for further education through workshops, webinars, and advanced courses offered by Don Kaufman.

Supplementary Materials

Recommendations for books, articles, and online resources to enhance understanding and application of the strategy.

Conclusion

Don Kaufman’s Atomic Hedge Strategy provides a systematic approach to reducing risk while striving for higher returns. By applying the principles outlined in his class, investors can develop a more resilient and dynamic investment portfolio.

FAQs

1. Is the Atomic Hedge Strategy suitable for all types of investors?

The strategy is best suited for investors who have a basic understanding of derivatives and are comfortable with a moderate level of risk.

2. How much capital is needed to effectively implement this strategy?

While there is no set minimum, having a substantial capital base allows for more flexibility in diversification and hedging techniques.

3. Can the Atomic Hedge Strategy be applied during market downturns?

Yes, one of the key strengths of this strategy is its potential to hedge against market downturns effectively.

4. How often should the strategy be reviewed or adjusted?

Regular review, at least quarterly, is recommended to adjust for market changes and rebalance the portfolio as necessary.

5. What are the first steps to take if interested in learning this strategy?

Enrolling in Don Kaufman’s class is an excellent start, providing both foundational knowledge and practical insights.

Be the first to review “The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.