-

×

Scalp Trading using the Hybrid System with Traders Reality

1 × $27.00

Scalp Trading using the Hybrid System with Traders Reality

1 × $27.00 -

×

Open Trader Pro Training

1 × $23.00

Open Trader Pro Training

1 × $23.00 -

×

Price Action Trading Manual 2010

1 × $6.00

Price Action Trading Manual 2010

1 × $6.00 -

×

Evolution Markets Forex Course - Evolution Markets

1 × $5.00

Evolution Markets Forex Course - Evolution Markets

1 × $5.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Quantitative Finance & Algorithmic Trading in Python with Holczer Balazs

1 × $4.00

Quantitative Finance & Algorithmic Trading in Python with Holczer Balazs

1 × $4.00 -

×

Advanced Day Trading Course with Doyle Exchange

1 × $8.00

Advanced Day Trading Course with Doyle Exchange

1 × $8.00 -

×

Ichimokutrade - Ichimoku 101

1 × $15.00

Ichimokutrade - Ichimoku 101

1 × $15.00 -

×

PDFT (Price Driven Forex Trading) Course with Avi Frister

1 × $6.00

PDFT (Price Driven Forex Trading) Course with Avi Frister

1 × $6.00 -

×

Price Action Trading 101 By Steve Burns

1 × $15.00

Price Action Trading 101 By Steve Burns

1 × $15.00 -

×

FX Simplified

1 × $5.00

FX Simplified

1 × $5.00 -

×

How to Trade a Vertical Market with Armstrong Economics

1 × $155.00

How to Trade a Vertical Market with Armstrong Economics

1 × $155.00 -

×

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00 -

×

MorningSwing Method with Austin Passamonte

1 × $6.00

MorningSwing Method with Austin Passamonte

1 × $6.00 -

×

Hawkeye Indicators for eSignal + Manual (janarps.com)

1 × $6.00

Hawkeye Indicators for eSignal + Manual (janarps.com)

1 × $6.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

High Probability Patterns and Rule Based Trading with Jake Bernstein

1 × $6.00

High Probability Patterns and Rule Based Trading with Jake Bernstein

1 × $6.00 -

×

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00 -

×

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00 -

×

Live in London (5 DVD) with Martin Pring

1 × $6.00

Live in London (5 DVD) with Martin Pring

1 × $6.00 -

×

Wyckoff Analytics Courses Collection

1 × $27.00

Wyckoff Analytics Courses Collection

1 × $27.00 -

×

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00 -

×

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00 -

×

TECHNICAL ANALYSIS MODULE

1 × $6.00

TECHNICAL ANALYSIS MODULE

1 × $6.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

Financial Fortress with TradeSmart University

1 × $6.00

Financial Fortress with TradeSmart University

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Online Course - Why Wave Analysis Belongs in Every Trader's Toolbox with Jeffrey Kennedy - Elliott Wave

1 × $15.00

Online Course - Why Wave Analysis Belongs in Every Trader's Toolbox with Jeffrey Kennedy - Elliott Wave

1 × $15.00 -

×

Master Trader with InvestingSimple

1 × $15.00

Master Trader with InvestingSimple

1 × $15.00 -

×

![ACD Method [Video (6 MP4s)] with Mark Fisher](https://www.totozon.com/wp-content/uploads/2024/05/ACD-Method-Video-6-MP4s-with-Mark-Fisher.jpg) ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00

ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00 -

×

Breakouts with Feibel Trading

1 × $5.00

Breakouts with Feibel Trading

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Mastering Income Spread Trading with Dave Aquino - Base Camp Trading

1 × $23.00

Mastering Income Spread Trading with Dave Aquino - Base Camp Trading

1 × $23.00 -

×

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Game-Maker Forex Trading System

1 × $6.00

Game-Maker Forex Trading System

1 × $6.00 -

×

Intro To Trading - 3 Module Bundle

1 × $23.00

Intro To Trading - 3 Module Bundle

1 × $23.00 -

×

Profiting With Forex: The Most Effective Tools and Techniques for Trading Currencies - John Jagerson & Wade Hansen

1 × $6.00

Profiting With Forex: The Most Effective Tools and Techniques for Trading Currencies - John Jagerson & Wade Hansen

1 × $6.00 -

×

Mechanical Timing Systems. The Key to Consistent Profits & Sharper Trading with Nelson Freeburg

1 × $6.00

Mechanical Timing Systems. The Key to Consistent Profits & Sharper Trading with Nelson Freeburg

1 × $6.00 -

×

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00 -

×

Limitless FX Academy Course

1 × $5.00

Limitless FX Academy Course

1 × $5.00 -

×

Freak Forex Fundamentals with Ken FX Freak

1 × $6.00

Freak Forex Fundamentals with Ken FX Freak

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $85.00

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $85.00 -

×

Stock Selection Course with Dave Landry

1 × $6.00

Stock Selection Course with Dave Landry

1 × $6.00 -

×

Strategy Week: Using High Probability Options Strategies with Don Kaufman

1 × $6.00

Strategy Week: Using High Probability Options Strategies with Don Kaufman

1 × $6.00 -

×

The Methodology Revealed with Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $209.00

The Methodology Revealed with Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $209.00 -

×

Sure Thing Stock Investing with Larry Williams

1 × $6.00

Sure Thing Stock Investing with Larry Williams

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00 -

×

Pristine - Trading the Pristine Method 2

1 × $6.00

Pristine - Trading the Pristine Method 2

1 × $6.00 -

×

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00 -

×

Micro Bull Run Mentorship Program (Autumn 2023) with Brendan Viehman

1 × $23.00

Micro Bull Run Mentorship Program (Autumn 2023) with Brendan Viehman

1 × $23.00 -

×

Using Fundamental Analysis with Andrew Baxter

1 × $6.00

Using Fundamental Analysis with Andrew Baxter

1 × $6.00 -

×

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00 -

×

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00 -

×

FTMO Academy Course

1 × $5.00

FTMO Academy Course

1 × $5.00 -

×

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00 -

×

Developing a Forex Trading Plan Webinar

1 × $6.00

Developing a Forex Trading Plan Webinar

1 × $6.00 -

×

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00 -

×

Double Top Trader Trading System with Anthony Gibson

1 × $6.00

Double Top Trader Trading System with Anthony Gibson

1 × $6.00 -

×

Info Product Mastery - Ron Douglas & Alice Seba

1 × $6.00

Info Product Mastery - Ron Douglas & Alice Seba

1 × $6.00 -

×

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00 -

×

FOREX UNLIMITED WEALTH EA

1 × $6.00

FOREX UNLIMITED WEALTH EA

1 × $6.00 -

×

Smart Money Course with Forex XL

1 × $6.00

Smart Money Course with Forex XL

1 × $6.00 -

×

Learn To Fish Part III - How To Swing Trade for Consistent Gains with Daniel

1 × $15.00

Learn To Fish Part III - How To Swing Trade for Consistent Gains with Daniel

1 × $15.00 -

×

Principles of Artificial Neural Networks (2nd Ed.) with Daniel Graupe

1 × $6.00

Principles of Artificial Neural Networks (2nd Ed.) with Daniel Graupe

1 × $6.00 -

×

Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett

1 × $6.00

Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett

1 × $6.00 -

×

Investment Strategies of Hedge Funds with Filippo Stefanini

1 × $6.00

Investment Strategies of Hedge Funds with Filippo Stefanini

1 × $6.00 -

×

Forex Secrets Exposed

1 × $15.00

Forex Secrets Exposed

1 × $15.00 -

×

Forex Income Engine 1.0 with Bill Poulos

1 × $6.00

Forex Income Engine 1.0 with Bill Poulos

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Dynamic Time Cycles with Peter Eliades

1 × $6.00

Dynamic Time Cycles with Peter Eliades

1 × $6.00 -

×

Rockwell Trading - Money Management - 2 DVDs

1 × $6.00

Rockwell Trading - Money Management - 2 DVDs

1 × $6.00 -

×

Professional Approaches to Directional Option Trading with Option Pit

1 × $23.00

Professional Approaches to Directional Option Trading with Option Pit

1 × $23.00 -

×

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00 -

×

Mind Over Markets

1 × $6.00

Mind Over Markets

1 × $6.00 -

×

Most Woke Trading Methods with Hunter FX

1 × $5.00

Most Woke Trading Methods with Hunter FX

1 × $5.00 -

×

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

How to Overlay Technical Indicators with Keith Raphael

1 × $6.00

How to Overlay Technical Indicators with Keith Raphael

1 × $6.00 -

×

POS+ Hindi 30 Days Subscription with Surjeetkakkar

1 × $62.00

POS+ Hindi 30 Days Subscription with Surjeetkakkar

1 × $62.00 -

×

Metals Webinar

1 × $6.00

Metals Webinar

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00

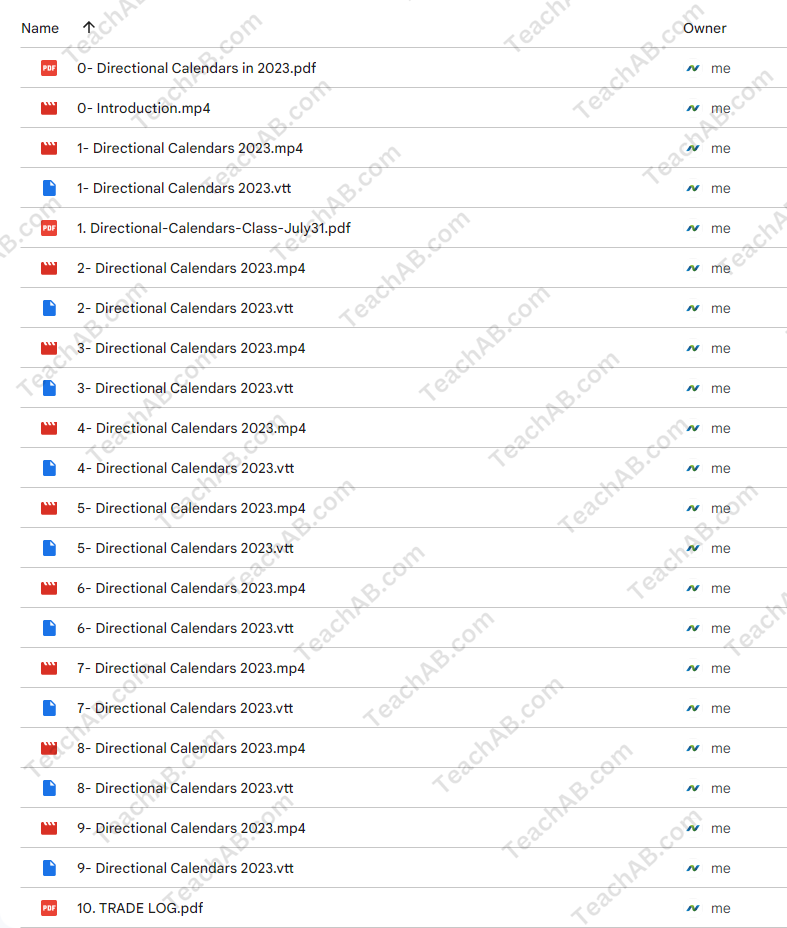

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring

$397.00 Original price was: $397.00.$85.00Current price is: $85.00.

File Size: 4.70 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz-54971buZsf4

Category: Forex Trading

Tags: Dan Sheridan, Mark Fenton, Sheridan Options Mentoring

You may check content proof of “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” below:

Mastering Directional Calendars in 2023 with Dan Sheridan & Mark Fenton at Sheridan Options Mentoring

Welcome to the innovative world of options trading where directional calendars stand out as a pivotal strategy for 2023. Under the expert guidance of Dan Sheridan and Mark Fenton from Sheridan Options Mentoring, traders of all levels can learn to navigate and exploit market trends effectively. This comprehensive guide offers insight into utilizing directional calendar strategies to enhance trading outcomes.

1. Introduction to Directional Calendars

What Are Directional Calendars?

Directional calendars are an options strategy that involves the simultaneous buying and selling of options with different expiration dates but the same strike prices, aiming to profit from directional moves in the underlying asset.

2. The Expertise of Dan Sheridan

A Legacy of Options Education

Dan Sheridan brings decades of options trading experience to the table, offering deep insights into sophisticated trading strategies like directional calendars.

3. Mark Fenton’s Analytical Approach

Strategic Market Analysis

Alongside Dan, Mark Fenton provides a critical analytical approach to identifying market trends that are perfect for applying directional calendars.

4. Why Use Directional Calendars?

Advantages in Volatile Markets

Explore how directional calendars can be particularly powerful in volatile markets, offering the ability to leverage slight directional moves for significant profit.

5. Setting Up a Directional Calendar

Step-by-Step Setup

A detailed guide on how to set up a directional calendar, including selecting the right strikes and expirations based on current market conditions.

6. Choosing the Right Markets

Market Selection Criteria

Understand which market conditions and underlying assets are most suitable for directional calendars to maximize your success rate.

7. Risk Management Strategies

Protecting Your Positions

Learn effective risk management techniques specifically tailored for directional calendar trades to safeguard your investments.

8. Tools and Resources

Utilizing the Best Tools

Discover the essential tools and software that can aid in implementing and monitoring directional calendar strategies.

9. Case Studies

Real-World Examples

Analyze several case studies that demonstrate the successful application of directional calendars in various market scenarios.

10. Integration with Other Strategies

Combining Trading Approaches

Learn how to effectively combine directional calendars with other trading strategies to diversify risk and increase potential returns.

11. Adjusting and Exiting Trades

Optimal Trade Management

Guidance on how to make adjustments to your directional calendar positions and the best practices for exiting trades profitably.

12. Learning from the Experts

Sheridan Mentoring Sessions

Opportunities for live mentoring sessions where Dan Sheridan and Mark Fenton personally guide you through the nuances of directional calendars.

13. Continuous Education

Ongoing Learning Opportunities

Explore additional educational resources offered by Sheridan Options Mentoring to keep your trading skills sharp and up-to-date.

14. Joining the Community

Becoming Part of a Trading Family

Benefits of joining the Sheridan Options Mentoring community, including forums, webinars, and member-exclusive events.

15. Conclusion

Adopting directional calendars as part of your trading arsenal in 2023 can significantly enhance your trading strategy. With expert insights from Dan Sheridan and Mark Fenton, embark on a journey to mastering this sophisticated options strategy and watch as your trading proficiency reaches new heights.

FAQs

- What level of trading experience is required for using directional calendars? While beneficial for traders with some options experience, newcomers can also learn this strategy effectively with the right educational resources and mentoring.

- How do directional calendars differ from other calendar strategies? Unlike standard calendars that typically aim for non-directional market conditions, directional calendars are designed to capitalize on forecasted directional moves in the underlying asset.

- What is the typical duration for holding a directional calendar trade? The holding period can vary, but most trades span from a few days to several weeks, depending on the market movement and strategy setup.

- Can directional calendars be used in all market conditions? While particularly effective in volatile or moderately trending markets, the success of directional calendars can depend on proper market analysis and execution.

- How can I start learning with Sheridan Options Mentoring? Visit the Sheridan Options Mentoring website to sign up for courses, workshops, or one-on-one mentoring sessions focused on directional calendars and other advanced options strategies.

Be the first to review “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.