-

×

Fisher Investments on Telecom with Dan Sinton, Andrew S.Teufel

1 × $6.00

Fisher Investments on Telecom with Dan Sinton, Andrew S.Teufel

1 × $6.00 -

×

Master Stock Course

1 × $6.00

Master Stock Course

1 × $6.00 -

×

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00 -

×

Gannline. Total School Package

1 × $6.00

Gannline. Total School Package

1 × $6.00 -

×

The Complete Penny Stock Course: Learn How To Generate Profits Consistently By Trading Penny Stocks With Jamil Ben Alluch

1 × $6.00

The Complete Penny Stock Course: Learn How To Generate Profits Consistently By Trading Penny Stocks With Jamil Ben Alluch

1 × $6.00 -

×

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00 -

×

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00 -

×

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00 -

×

Failure Rate Modelling for Reliabiliy & Risk with Maxim Finkelstein

1 × $6.00

Failure Rate Modelling for Reliabiliy & Risk with Maxim Finkelstein

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Forex Profit Formula System with Jason Fielder

1 × $6.00

Forex Profit Formula System with Jason Fielder

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Four Books with J.L.Lord

1 × $23.00

Four Books with J.L.Lord

1 × $23.00 -

×

DNA Wealth Blueprint 3 (Complete)

1 × $54.00

DNA Wealth Blueprint 3 (Complete)

1 × $54.00 -

×

Earnings Engine Class with Sami Abusaad - T3 Live

1 × $23.00

Earnings Engine Class with Sami Abusaad - T3 Live

1 × $23.00 -

×

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00 -

×

Inner Circle Course with Darius Fx

1 × $24.00

Inner Circle Course with Darius Fx

1 × $24.00 -

×

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00 -

×

Rockwell Trading - Money Management - 2 DVDs

1 × $6.00

Rockwell Trading - Money Management - 2 DVDs

1 × $6.00 -

×

Profiletraders - Market Profile Day Trading

1 × $15.00

Profiletraders - Market Profile Day Trading

1 × $15.00 -

×

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00

Offensive & Defensive Strengths of Stocks, Groups & Sectors Gary Anderson

1 × $6.00 -

×

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00 -

×

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00 -

×

Option Express Plugin

1 × $6.00

Option Express Plugin

1 × $6.00 -

×

Mark Sebastian – Gamma Trading Class

1 × $6.00

Mark Sebastian – Gamma Trading Class

1 × $6.00 -

×

How To Read The Trend (Recorded Session) with TradeSmart

1 × $31.00

How To Read The Trend (Recorded Session) with TradeSmart

1 × $31.00 -

×

Scalping Master Class with Day One Traders

1 × $5.00

Scalping Master Class with Day One Traders

1 × $5.00 -

×

Handbook of Computer Vision Algorithms in Image Algebra with Gerhard Ritter & Joseph Wilson

1 × $6.00

Handbook of Computer Vision Algorithms in Image Algebra with Gerhard Ritter & Joseph Wilson

1 × $6.00 -

×

Exploring MetaStock Advanced with Martin Pring

1 × $6.00

Exploring MetaStock Advanced with Martin Pring

1 × $6.00 -

×

Pattern Trader Pro with ForexStore

1 × $6.00

Pattern Trader Pro with ForexStore

1 × $6.00 -

×

Mindover Markets Enhanced: The Intensive Series 2 with Jim Dalton

1 × $20.00

Mindover Markets Enhanced: The Intensive Series 2 with Jim Dalton

1 × $20.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00 -

×

Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray

1 × $6.00

Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00 -

×

Futures Trading (German)

1 × $6.00

Futures Trading (German)

1 × $6.00 -

×

Astro Cycles with Larry Pesavento

1 × $6.00

Astro Cycles with Larry Pesavento

1 × $6.00 -

×

Spartan Renko 2.0 Workshop 2017

1 × $23.00

Spartan Renko 2.0 Workshop 2017

1 × $23.00 -

×

Fractal Market Analysis with Edgar Peters

1 × $6.00

Fractal Market Analysis with Edgar Peters

1 × $6.00 -

×

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00 -

×

Fractal Markets SFX with Tyson Bieniek

1 × $5.00

Fractal Markets SFX with Tyson Bieniek

1 × $5.00 -

×

Money & European Union with Stephen Frank Overturf

1 × $6.00

Money & European Union with Stephen Frank Overturf

1 × $6.00 -

×

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00 -

×

Penny Stock Mastery

1 × $31.00

Penny Stock Mastery

1 × $31.00 -

×

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

1 × $6.00

E-Bonds: An Introduction to the Online Bond Market with Jake Wengroff

1 × $6.00 -

×

Swing Trading for a Living (7 Video Cds & WorkBook 2.1 GB)

1 × $6.00

Swing Trading for a Living (7 Video Cds & WorkBook 2.1 GB)

1 × $6.00 -

×

Mastering Momentum Gaps with Toni Hansen

1 × $6.00

Mastering Momentum Gaps with Toni Hansen

1 × $6.00 -

×

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00 -

×

MATS Market Auction Trading System with Ryan Watts

1 × $6.00

MATS Market Auction Trading System with Ryan Watts

1 × $6.00 -

×

Mentfx Paid Mentoship (2021)

1 × $5.00

Mentfx Paid Mentoship (2021)

1 × $5.00 -

×

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

Complete Trading Bundle with AAA Quants

1 × $27.00

Complete Trading Bundle with AAA Quants

1 × $27.00 -

×

How to Make the Stock Market Make Money For You with Ted Warren

1 × $6.00

How to Make the Stock Market Make Money For You with Ted Warren

1 × $6.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

EFT for Prevention and Treatment of Serious Diseases with Kari Dawson

1 × $6.00

EFT for Prevention and Treatment of Serious Diseases with Kari Dawson

1 × $6.00 -

×

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00 -

×

How I Trade Growth Stocks In Bull And Bear Markets

1 × $54.00

How I Trade Growth Stocks In Bull And Bear Markets

1 × $54.00 -

×

Foolproof Forex Trading with Louise Woof

1 × $6.00

Foolproof Forex Trading with Louise Woof

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Mastering Daily Option Trading with Option Pit

1 × $93.00

Mastering Daily Option Trading with Option Pit

1 × $93.00 -

×

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

Pre-Previews. 23 Articles and Forecasts

1 × $6.00 -

×

Mechanics of Trading Module

1 × $6.00

Mechanics of Trading Module

1 × $6.00 -

×

Volume Profile Formula with Aaron Korbs

1 × $5.00

Volume Profile Formula with Aaron Korbs

1 × $5.00 -

×

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00 -

×

The MMXM Trader – Personal Approach

1 × $5.00

The MMXM Trader – Personal Approach

1 × $5.00 -

×

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00 -

×

Full Volume Forex Training Course with ThatFXTrader

1 × $5.00

Full Volume Forex Training Course with ThatFXTrader

1 × $5.00 -

×

Mastering Amibroker Formula Language

1 × $15.00

Mastering Amibroker Formula Language

1 × $15.00 -

×

TA_L2 & The Nasdaq

1 × $6.00

TA_L2 & The Nasdaq

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00 -

×

Physicists on Wall Street and Other Essays on Science and Society with Jeremy Bernstein

1 × $6.00

Physicists on Wall Street and Other Essays on Science and Society with Jeremy Bernstein

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring

$397.00 Original price was: $397.00.$85.00Current price is: $85.00.

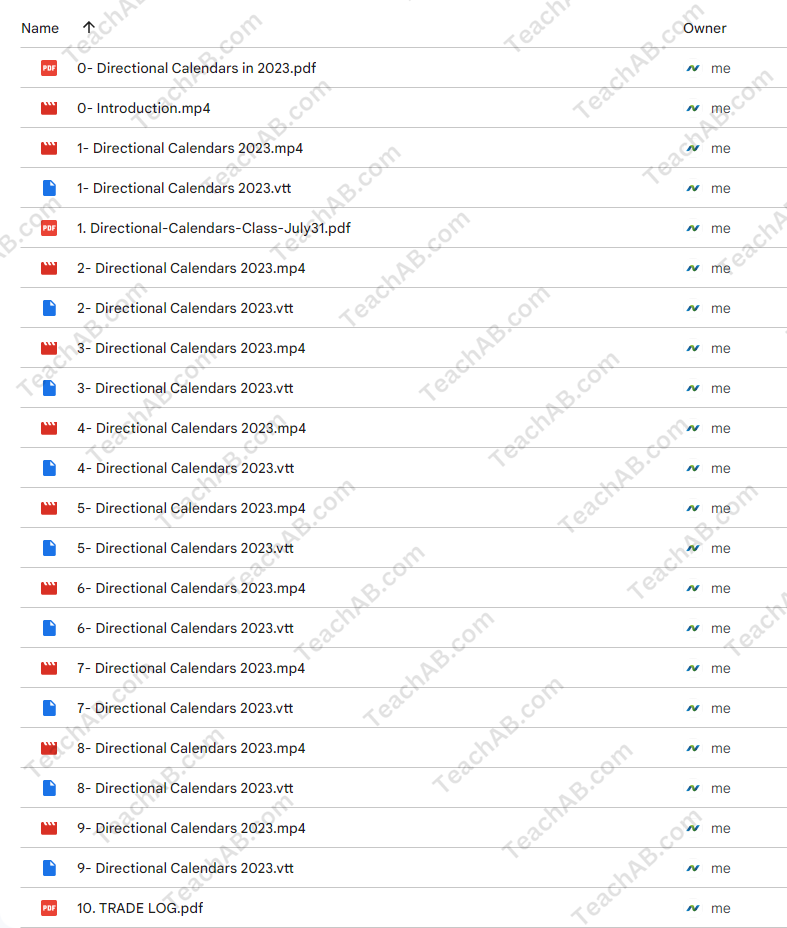

File Size: 4.70 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz-54971buZsf4

Category: Forex Trading

Tags: Dan Sheridan, Mark Fenton, Sheridan Options Mentoring

You may check content proof of “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” below:

Mastering Directional Calendars in 2023 with Dan Sheridan & Mark Fenton at Sheridan Options Mentoring

Welcome to the innovative world of options trading where directional calendars stand out as a pivotal strategy for 2023. Under the expert guidance of Dan Sheridan and Mark Fenton from Sheridan Options Mentoring, traders of all levels can learn to navigate and exploit market trends effectively. This comprehensive guide offers insight into utilizing directional calendar strategies to enhance trading outcomes.

1. Introduction to Directional Calendars

What Are Directional Calendars?

Directional calendars are an options strategy that involves the simultaneous buying and selling of options with different expiration dates but the same strike prices, aiming to profit from directional moves in the underlying asset.

2. The Expertise of Dan Sheridan

A Legacy of Options Education

Dan Sheridan brings decades of options trading experience to the table, offering deep insights into sophisticated trading strategies like directional calendars.

3. Mark Fenton’s Analytical Approach

Strategic Market Analysis

Alongside Dan, Mark Fenton provides a critical analytical approach to identifying market trends that are perfect for applying directional calendars.

4. Why Use Directional Calendars?

Advantages in Volatile Markets

Explore how directional calendars can be particularly powerful in volatile markets, offering the ability to leverage slight directional moves for significant profit.

5. Setting Up a Directional Calendar

Step-by-Step Setup

A detailed guide on how to set up a directional calendar, including selecting the right strikes and expirations based on current market conditions.

6. Choosing the Right Markets

Market Selection Criteria

Understand which market conditions and underlying assets are most suitable for directional calendars to maximize your success rate.

7. Risk Management Strategies

Protecting Your Positions

Learn effective risk management techniques specifically tailored for directional calendar trades to safeguard your investments.

8. Tools and Resources

Utilizing the Best Tools

Discover the essential tools and software that can aid in implementing and monitoring directional calendar strategies.

9. Case Studies

Real-World Examples

Analyze several case studies that demonstrate the successful application of directional calendars in various market scenarios.

10. Integration with Other Strategies

Combining Trading Approaches

Learn how to effectively combine directional calendars with other trading strategies to diversify risk and increase potential returns.

11. Adjusting and Exiting Trades

Optimal Trade Management

Guidance on how to make adjustments to your directional calendar positions and the best practices for exiting trades profitably.

12. Learning from the Experts

Sheridan Mentoring Sessions

Opportunities for live mentoring sessions where Dan Sheridan and Mark Fenton personally guide you through the nuances of directional calendars.

13. Continuous Education

Ongoing Learning Opportunities

Explore additional educational resources offered by Sheridan Options Mentoring to keep your trading skills sharp and up-to-date.

14. Joining the Community

Becoming Part of a Trading Family

Benefits of joining the Sheridan Options Mentoring community, including forums, webinars, and member-exclusive events.

15. Conclusion

Adopting directional calendars as part of your trading arsenal in 2023 can significantly enhance your trading strategy. With expert insights from Dan Sheridan and Mark Fenton, embark on a journey to mastering this sophisticated options strategy and watch as your trading proficiency reaches new heights.

FAQs

- What level of trading experience is required for using directional calendars? While beneficial for traders with some options experience, newcomers can also learn this strategy effectively with the right educational resources and mentoring.

- How do directional calendars differ from other calendar strategies? Unlike standard calendars that typically aim for non-directional market conditions, directional calendars are designed to capitalize on forecasted directional moves in the underlying asset.

- What is the typical duration for holding a directional calendar trade? The holding period can vary, but most trades span from a few days to several weeks, depending on the market movement and strategy setup.

- Can directional calendars be used in all market conditions? While particularly effective in volatile or moderately trending markets, the success of directional calendars can depend on proper market analysis and execution.

- How can I start learning with Sheridan Options Mentoring? Visit the Sheridan Options Mentoring website to sign up for courses, workshops, or one-on-one mentoring sessions focused on directional calendars and other advanced options strategies.

Be the first to review “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.