-

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00 -

×

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00 -

×

Activedaytrader - Mastering Technicals

1 × $15.00

Activedaytrader - Mastering Technicals

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

All About Technical Analysis with Constance Brown

1 × $6.00

All About Technical Analysis with Constance Brown

1 × $6.00 -

×

ALGO™ Online Retail - Version 2.9

1 × $155.00

ALGO™ Online Retail - Version 2.9

1 × $155.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

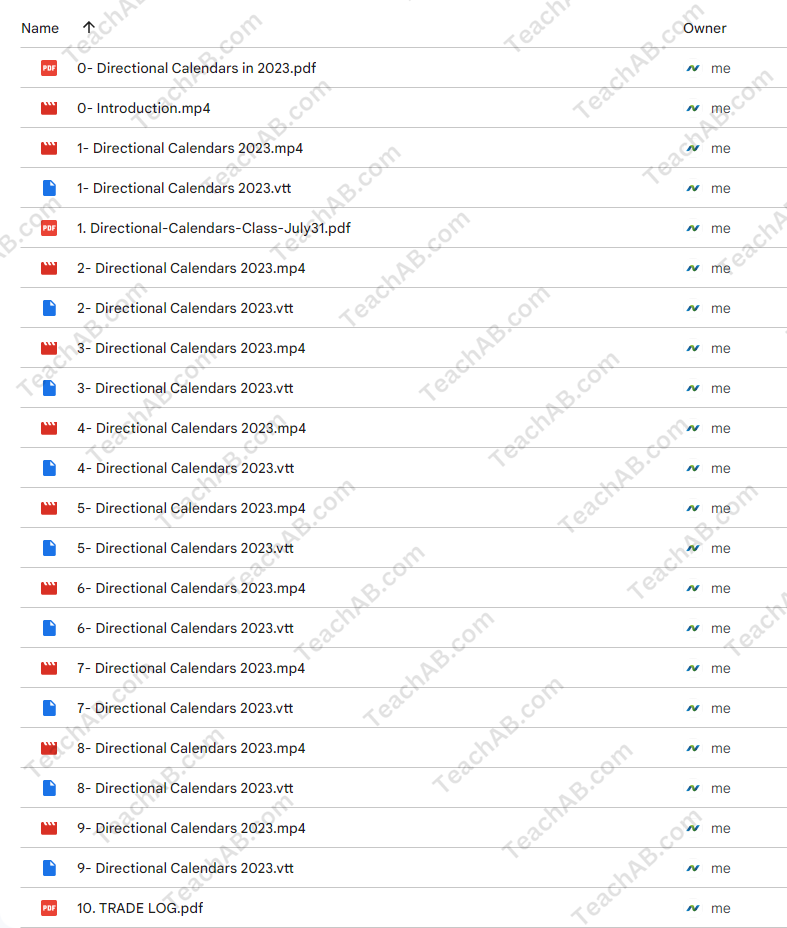

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring

$397.00 Original price was: $397.00.$85.00Current price is: $85.00.

File Size: 4.70 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz-54971buZsf4

Category: Forex Trading

Tags: Dan Sheridan, Mark Fenton, Sheridan Options Mentoring

You may check content proof of “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” below:

Mastering Directional Calendars in 2023 with Dan Sheridan & Mark Fenton at Sheridan Options Mentoring

Welcome to the innovative world of options trading where directional calendars stand out as a pivotal strategy for 2023. Under the expert guidance of Dan Sheridan and Mark Fenton from Sheridan Options Mentoring, traders of all levels can learn to navigate and exploit market trends effectively. This comprehensive guide offers insight into utilizing directional calendar strategies to enhance trading outcomes.

1. Introduction to Directional Calendars

What Are Directional Calendars?

Directional calendars are an options strategy that involves the simultaneous buying and selling of options with different expiration dates but the same strike prices, aiming to profit from directional moves in the underlying asset.

2. The Expertise of Dan Sheridan

A Legacy of Options Education

Dan Sheridan brings decades of options trading experience to the table, offering deep insights into sophisticated trading strategies like directional calendars.

3. Mark Fenton’s Analytical Approach

Strategic Market Analysis

Alongside Dan, Mark Fenton provides a critical analytical approach to identifying market trends that are perfect for applying directional calendars.

4. Why Use Directional Calendars?

Advantages in Volatile Markets

Explore how directional calendars can be particularly powerful in volatile markets, offering the ability to leverage slight directional moves for significant profit.

5. Setting Up a Directional Calendar

Step-by-Step Setup

A detailed guide on how to set up a directional calendar, including selecting the right strikes and expirations based on current market conditions.

6. Choosing the Right Markets

Market Selection Criteria

Understand which market conditions and underlying assets are most suitable for directional calendars to maximize your success rate.

7. Risk Management Strategies

Protecting Your Positions

Learn effective risk management techniques specifically tailored for directional calendar trades to safeguard your investments.

8. Tools and Resources

Utilizing the Best Tools

Discover the essential tools and software that can aid in implementing and monitoring directional calendar strategies.

9. Case Studies

Real-World Examples

Analyze several case studies that demonstrate the successful application of directional calendars in various market scenarios.

10. Integration with Other Strategies

Combining Trading Approaches

Learn how to effectively combine directional calendars with other trading strategies to diversify risk and increase potential returns.

11. Adjusting and Exiting Trades

Optimal Trade Management

Guidance on how to make adjustments to your directional calendar positions and the best practices for exiting trades profitably.

12. Learning from the Experts

Sheridan Mentoring Sessions

Opportunities for live mentoring sessions where Dan Sheridan and Mark Fenton personally guide you through the nuances of directional calendars.

13. Continuous Education

Ongoing Learning Opportunities

Explore additional educational resources offered by Sheridan Options Mentoring to keep your trading skills sharp and up-to-date.

14. Joining the Community

Becoming Part of a Trading Family

Benefits of joining the Sheridan Options Mentoring community, including forums, webinars, and member-exclusive events.

15. Conclusion

Adopting directional calendars as part of your trading arsenal in 2023 can significantly enhance your trading strategy. With expert insights from Dan Sheridan and Mark Fenton, embark on a journey to mastering this sophisticated options strategy and watch as your trading proficiency reaches new heights.

FAQs

- What level of trading experience is required for using directional calendars? While beneficial for traders with some options experience, newcomers can also learn this strategy effectively with the right educational resources and mentoring.

- How do directional calendars differ from other calendar strategies? Unlike standard calendars that typically aim for non-directional market conditions, directional calendars are designed to capitalize on forecasted directional moves in the underlying asset.

- What is the typical duration for holding a directional calendar trade? The holding period can vary, but most trades span from a few days to several weeks, depending on the market movement and strategy setup.

- Can directional calendars be used in all market conditions? While particularly effective in volatile or moderately trending markets, the success of directional calendars can depend on proper market analysis and execution.

- How can I start learning with Sheridan Options Mentoring? Visit the Sheridan Options Mentoring website to sign up for courses, workshops, or one-on-one mentoring sessions focused on directional calendars and other advanced options strategies.

Be the first to review “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.