-

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Active Investor Blueprint with Steve Nison - Candle Charts

1 × $23.00

The Active Investor Blueprint with Steve Nison - Candle Charts

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

How to Trade Options 101 2021 with The Travel Trader

1 × $54.00

How to Trade Options 101 2021 with The Travel Trader

1 × $54.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

Learning Track: Quantitative Approach in Options Trading

1 × $39.00

Learning Track: Quantitative Approach in Options Trading

1 × $39.00 -

×

Pristine - Oliver Velez – Swing Trading Tactics 2001

1 × $6.00

Pristine - Oliver Velez – Swing Trading Tactics 2001

1 × $6.00 -

×

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00 -

×

Lazy Emini Trader Master Class Course - David Frost

1 × $10.00

Lazy Emini Trader Master Class Course - David Frost

1 × $10.00 -

×

Virtual Intensive Trader Training

1 × $31.00

Virtual Intensive Trader Training

1 × $31.00 -

×

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00 -

×

Pocketing Premium Master Class (Basic) with Henrry Gambell

1 × $31.00

Pocketing Premium Master Class (Basic) with Henrry Gambell

1 × $31.00 -

×

Inside the Mind of Trader Stewie - Art of Trading

1 × $23.00

Inside the Mind of Trader Stewie - Art of Trading

1 × $23.00 -

×

We Fund Traders - The Whale Order

1 × $5.00

We Fund Traders - The Whale Order

1 × $5.00 -

×

Zero to Hero Course with EVO Capital

1 × $13.00

Zero to Hero Course with EVO Capital

1 × $13.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

PPC Lead Pro Training Program

1 × $31.00

PPC Lead Pro Training Program

1 × $31.00 -

×

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

1 × $6.00

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

1 × $6.00 -

×

Open Trader Pro Training

1 × $23.00

Open Trader Pro Training

1 × $23.00 -

×

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00 -

×

Advanced Trading Strategies with Larry Connors

1 × $6.00

Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

Video Package

1 × $6.00

Video Package

1 × $6.00 -

×

Optionetics 2007 - Home Study Course, MP3

1 × $6.00

Optionetics 2007 - Home Study Course, MP3

1 × $6.00 -

×

Common Sense Commodities with David Duty

1 × $6.00

Common Sense Commodities with David Duty

1 × $6.00 -

×

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00 -

×

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00 -

×

Layup Trading Strategies and Setups

1 × $54.00

Layup Trading Strategies and Setups

1 × $54.00 -

×

Art of Yen Course (Feb 2014)

1 × $23.00

Art of Yen Course (Feb 2014)

1 × $23.00 -

×

Activedaytrader - Workshop Options For Income

1 × $15.00

Activedaytrader - Workshop Options For Income

1 × $15.00 -

×

Modern Darvas Trading

1 × $6.00

Modern Darvas Trading

1 × $6.00 -

×

Trading Economic Data System with CopperChips

1 × $6.00

Trading Economic Data System with CopperChips

1 × $6.00 -

×

Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett

1 × $6.00

Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett

1 × $6.00 -

×

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00 -

×

Gaining Option Leverage: Using Market Makers Tactics with Jon Najarian

1 × $4.00

Gaining Option Leverage: Using Market Makers Tactics with Jon Najarian

1 × $4.00 -

×

A Traders Astrological Almanac (2001 – 2006) with Jeanne Long

1 × $6.00

A Traders Astrological Almanac (2001 – 2006) with Jeanne Long

1 × $6.00 -

×

Restore & Enhance Your Biofield (Advanced) by Spirituality Zone

1 × $15.40

Restore & Enhance Your Biofield (Advanced) by Spirituality Zone

1 × $15.40 -

×

Renko Mastery Intensive Program

1 × $85.00

Renko Mastery Intensive Program

1 × $85.00 -

×

Market Magic: Riding the Greatest Bull Market of the Century with Louise Yamada

1 × $6.00

Market Magic: Riding the Greatest Bull Market of the Century with Louise Yamada

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Longlived Information & Intraday Pattern (Article) with Back and Andersen

1 × $6.00

Longlived Information & Intraday Pattern (Article) with Back and Andersen

1 × $6.00 -

×

New Generation Market Profile (May 2014)

1 × $15.00

New Generation Market Profile (May 2014)

1 × $15.00 -

×

WickOrTreat Trading Course with WickOrTreat

1 × $6.00

WickOrTreat Trading Course with WickOrTreat

1 × $6.00 -

×

Advanced Option Trading with Broken Wing Butterflys with Greg Loehr

1 × $9.00

Advanced Option Trading with Broken Wing Butterflys with Greg Loehr

1 × $9.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Stock Traders Almanac 2008 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00

Stock Traders Almanac 2008 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

Advanced Forex Mastery Course with Alpha Forex Global

1 × $5.00

Advanced Forex Mastery Course with Alpha Forex Global

1 × $5.00 -

×

Naked Put Selling Acquiring Blue Chip Stocks and Creating Cash Flow with Lee Lowell

1 × $6.00

Naked Put Selling Acquiring Blue Chip Stocks and Creating Cash Flow with Lee Lowell

1 × $6.00 -

×

Profitable Binary Options Strategies

1 × $5.00

Profitable Binary Options Strategies

1 × $5.00 -

×

Indian Time Cycles and Market Forecasting with Barry William Rosen

1 × $7.00

Indian Time Cycles and Market Forecasting with Barry William Rosen

1 × $7.00 -

×

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00 -

×

Investing Under Fire with Alan R.Ackerman

1 × $6.00

Investing Under Fire with Alan R.Ackerman

1 × $6.00 -

×

AstroScan Regulus 4.1E newastro.net

1 × $6.00

AstroScan Regulus 4.1E newastro.net

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00 -

×

Ichimoku Cloud Trading Course with FollowMeTrades

1 × $15.00

Ichimoku Cloud Trading Course with FollowMeTrades

1 × $15.00 -

×

HYDRA 3 Day Bootcamp

1 × $5.00

HYDRA 3 Day Bootcamp

1 × $5.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

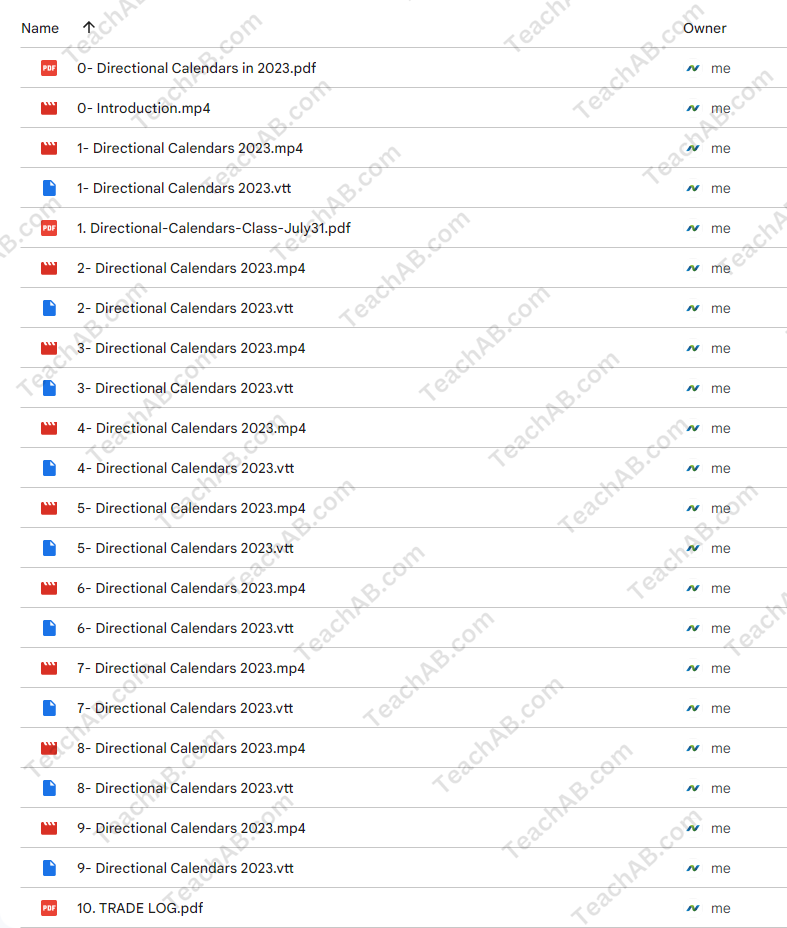

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring

$397.00 Original price was: $397.00.$85.00Current price is: $85.00.

File Size: 4.70 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz-54971buZsf4

Category: Forex Trading

Tags: Dan Sheridan, Mark Fenton, Sheridan Options Mentoring

You may check content proof of “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” below:

Mastering Directional Calendars in 2023 with Dan Sheridan & Mark Fenton at Sheridan Options Mentoring

Welcome to the innovative world of options trading where directional calendars stand out as a pivotal strategy for 2023. Under the expert guidance of Dan Sheridan and Mark Fenton from Sheridan Options Mentoring, traders of all levels can learn to navigate and exploit market trends effectively. This comprehensive guide offers insight into utilizing directional calendar strategies to enhance trading outcomes.

1. Introduction to Directional Calendars

What Are Directional Calendars?

Directional calendars are an options strategy that involves the simultaneous buying and selling of options with different expiration dates but the same strike prices, aiming to profit from directional moves in the underlying asset.

2. The Expertise of Dan Sheridan

A Legacy of Options Education

Dan Sheridan brings decades of options trading experience to the table, offering deep insights into sophisticated trading strategies like directional calendars.

3. Mark Fenton’s Analytical Approach

Strategic Market Analysis

Alongside Dan, Mark Fenton provides a critical analytical approach to identifying market trends that are perfect for applying directional calendars.

4. Why Use Directional Calendars?

Advantages in Volatile Markets

Explore how directional calendars can be particularly powerful in volatile markets, offering the ability to leverage slight directional moves for significant profit.

5. Setting Up a Directional Calendar

Step-by-Step Setup

A detailed guide on how to set up a directional calendar, including selecting the right strikes and expirations based on current market conditions.

6. Choosing the Right Markets

Market Selection Criteria

Understand which market conditions and underlying assets are most suitable for directional calendars to maximize your success rate.

7. Risk Management Strategies

Protecting Your Positions

Learn effective risk management techniques specifically tailored for directional calendar trades to safeguard your investments.

8. Tools and Resources

Utilizing the Best Tools

Discover the essential tools and software that can aid in implementing and monitoring directional calendar strategies.

9. Case Studies

Real-World Examples

Analyze several case studies that demonstrate the successful application of directional calendars in various market scenarios.

10. Integration with Other Strategies

Combining Trading Approaches

Learn how to effectively combine directional calendars with other trading strategies to diversify risk and increase potential returns.

11. Adjusting and Exiting Trades

Optimal Trade Management

Guidance on how to make adjustments to your directional calendar positions and the best practices for exiting trades profitably.

12. Learning from the Experts

Sheridan Mentoring Sessions

Opportunities for live mentoring sessions where Dan Sheridan and Mark Fenton personally guide you through the nuances of directional calendars.

13. Continuous Education

Ongoing Learning Opportunities

Explore additional educational resources offered by Sheridan Options Mentoring to keep your trading skills sharp and up-to-date.

14. Joining the Community

Becoming Part of a Trading Family

Benefits of joining the Sheridan Options Mentoring community, including forums, webinars, and member-exclusive events.

15. Conclusion

Adopting directional calendars as part of your trading arsenal in 2023 can significantly enhance your trading strategy. With expert insights from Dan Sheridan and Mark Fenton, embark on a journey to mastering this sophisticated options strategy and watch as your trading proficiency reaches new heights.

FAQs

- What level of trading experience is required for using directional calendars? While beneficial for traders with some options experience, newcomers can also learn this strategy effectively with the right educational resources and mentoring.

- How do directional calendars differ from other calendar strategies? Unlike standard calendars that typically aim for non-directional market conditions, directional calendars are designed to capitalize on forecasted directional moves in the underlying asset.

- What is the typical duration for holding a directional calendar trade? The holding period can vary, but most trades span from a few days to several weeks, depending on the market movement and strategy setup.

- Can directional calendars be used in all market conditions? While particularly effective in volatile or moderately trending markets, the success of directional calendars can depend on proper market analysis and execution.

- How can I start learning with Sheridan Options Mentoring? Visit the Sheridan Options Mentoring website to sign up for courses, workshops, or one-on-one mentoring sessions focused on directional calendars and other advanced options strategies.

Be the first to review “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.