-

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

Synthetic and Structured Assets: A Practical Guide to Investment and Risk with Erik Banks

1 × $6.00

Synthetic and Structured Assets: A Practical Guide to Investment and Risk with Erik Banks

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Wealth Management with Dimitris Chorafas

1 × $6.00

Wealth Management with Dimitris Chorafas

1 × $6.00 -

×

Capital with Charles D.Ellis

1 × $6.00

Capital with Charles D.Ellis

1 × $6.00 -

×

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Advanced Group Analysis Turorial with David Vomund

1 × $6.00

Advanced Group Analysis Turorial with David Vomund

1 × $6.00 -

×

Researching your Trade

1 × $6.00

Researching your Trade

1 × $6.00 -

×

3_8’s to Wealth (Audio 84 MB+ WorkBooks) with Darlene Nelson

1 × $6.00

3_8’s to Wealth (Audio 84 MB+ WorkBooks) with Darlene Nelson

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

MT4 High Probability Forex Trading Method

1 × $6.00

MT4 High Probability Forex Trading Method

1 × $6.00 -

×

The Complete Turtle Trader with Michael Covel

1 × $6.00

The Complete Turtle Trader with Michael Covel

1 × $6.00 -

×

Live in London (5 DVD) with Martin Pring

1 × $6.00

Live in London (5 DVD) with Martin Pring

1 × $6.00 -

×

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00 -

×

Larry Connors Professional Day Trading for Success Program

1 × $62.00

Larry Connors Professional Day Trading for Success Program

1 × $62.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

1 × $6.00

Better Trading with the Guppy Multiple Moving Average by Daryl Guppy

1 × $6.00 -

×

Equity Trader 101 Course with KeyStone Trading

1 × $6.00

Equity Trader 101 Course with KeyStone Trading

1 × $6.00 -

×

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00 -

×

Advanced Nasdaq Trading Techniques with Alan Rich

1 × $6.00

Advanced Nasdaq Trading Techniques with Alan Rich

1 × $6.00 -

×

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00 -

×

Investing Under Fire with Alan R.Ackerman

1 × $6.00

Investing Under Fire with Alan R.Ackerman

1 × $6.00 -

×

Trading Against the Crowd with John Summa

1 × $6.00

Trading Against the Crowd with John Summa

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Astro Cycles with Larry Pesavento

1 × $6.00

Astro Cycles with Larry Pesavento

1 × $6.00 -

×

Forex Millionaire Course with Willis University

1 × $6.00

Forex Millionaire Course with Willis University

1 × $6.00 -

×

Path to Profits By Scott Redler - T3 Live

1 × $6.00

Path to Profits By Scott Redler - T3 Live

1 × $6.00 -

×

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00

ETFs for the Long Run: What They Are, How They Work, and Simple Strategies for Successful Long-Term Investing - Lawrence Carrel

1 × $6.00 -

×

Ambush Trading Method (EBOOK) with MARCO MAYER - Trading Educators

1 × $256.00

Ambush Trading Method (EBOOK) with MARCO MAYER - Trading Educators

1 × $256.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00 -

×

Get to know the VIX Index (aka The Fear Index)

1 × $15.00

Get to know the VIX Index (aka The Fear Index)

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Small and Mighty Association with Ryan Lee

1 × $6.00

Small and Mighty Association with Ryan Lee

1 × $6.00 -

×

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00 -

×

Planetary Stock Trading with Bill Meridian

1 × $6.00

Planetary Stock Trading with Bill Meridian

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00 -

×

Master The Markets 2.0 with French Trader

1 × $6.00

Master The Markets 2.0 with French Trader

1 × $6.00 -

×

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

Learn Before you Loose

1 × $6.00

Learn Before you Loose

1 × $6.00 -

×

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Core Concepts Mastery with DreamsFX

1 × $5.00

Core Concepts Mastery with DreamsFX

1 × $5.00 -

×

Electronic Trading "TNT" I Gorilla Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" I Gorilla Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00 -

×

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00 -

×

Smart Money Course with Forex XL

1 × $6.00

Smart Money Course with Forex XL

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00 -

×

Trading 3SMA System with Hector DeVille

1 × $6.00

Trading 3SMA System with Hector DeVille

1 × $6.00 -

×

Qualitative - Financial Statement Analysis with Sandesh Banger

1 × $5.00

Qualitative - Financial Statement Analysis with Sandesh Banger

1 × $5.00 -

×

Asset Markets, Portfolio Choice and Macroeconomic Activity: A Keynesian Perspective - Toichiro Asadra, Peter Flaschel, Tarik Mouakil & Christian Proaño

1 × $6.00

Asset Markets, Portfolio Choice and Macroeconomic Activity: A Keynesian Perspective - Toichiro Asadra, Peter Flaschel, Tarik Mouakil & Christian Proaño

1 × $6.00 -

×

HandBook of Parametric and Nonparametric Statistical Procedures with David J.Sheskin

1 × $6.00

HandBook of Parametric and Nonparametric Statistical Procedures with David J.Sheskin

1 × $6.00 -

×

How to Buy Stocks Before They Skyrocket

1 × $6.00

How to Buy Stocks Before They Skyrocket

1 × $6.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00 -

×

Trading as a Business with Alexander Elder

1 × $6.00

Trading as a Business with Alexander Elder

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

AM Trader - Strategy Training Course

1 × $23.00

AM Trader - Strategy Training Course

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring

$397.00 Original price was: $397.00.$85.00Current price is: $85.00.

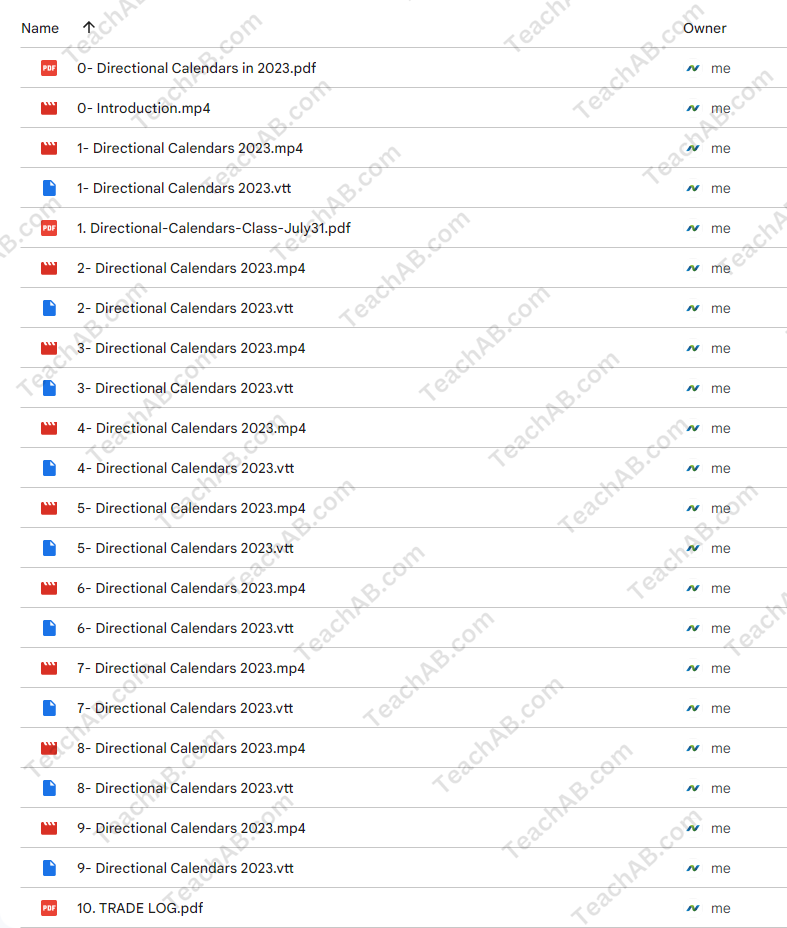

File Size: 4.70 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz-54971buZsf4

Category: Forex Trading

Tags: Dan Sheridan, Mark Fenton, Sheridan Options Mentoring

You may check content proof of “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” below:

Mastering Directional Calendars in 2023 with Dan Sheridan & Mark Fenton at Sheridan Options Mentoring

Welcome to the innovative world of options trading where directional calendars stand out as a pivotal strategy for 2023. Under the expert guidance of Dan Sheridan and Mark Fenton from Sheridan Options Mentoring, traders of all levels can learn to navigate and exploit market trends effectively. This comprehensive guide offers insight into utilizing directional calendar strategies to enhance trading outcomes.

1. Introduction to Directional Calendars

What Are Directional Calendars?

Directional calendars are an options strategy that involves the simultaneous buying and selling of options with different expiration dates but the same strike prices, aiming to profit from directional moves in the underlying asset.

2. The Expertise of Dan Sheridan

A Legacy of Options Education

Dan Sheridan brings decades of options trading experience to the table, offering deep insights into sophisticated trading strategies like directional calendars.

3. Mark Fenton’s Analytical Approach

Strategic Market Analysis

Alongside Dan, Mark Fenton provides a critical analytical approach to identifying market trends that are perfect for applying directional calendars.

4. Why Use Directional Calendars?

Advantages in Volatile Markets

Explore how directional calendars can be particularly powerful in volatile markets, offering the ability to leverage slight directional moves for significant profit.

5. Setting Up a Directional Calendar

Step-by-Step Setup

A detailed guide on how to set up a directional calendar, including selecting the right strikes and expirations based on current market conditions.

6. Choosing the Right Markets

Market Selection Criteria

Understand which market conditions and underlying assets are most suitable for directional calendars to maximize your success rate.

7. Risk Management Strategies

Protecting Your Positions

Learn effective risk management techniques specifically tailored for directional calendar trades to safeguard your investments.

8. Tools and Resources

Utilizing the Best Tools

Discover the essential tools and software that can aid in implementing and monitoring directional calendar strategies.

9. Case Studies

Real-World Examples

Analyze several case studies that demonstrate the successful application of directional calendars in various market scenarios.

10. Integration with Other Strategies

Combining Trading Approaches

Learn how to effectively combine directional calendars with other trading strategies to diversify risk and increase potential returns.

11. Adjusting and Exiting Trades

Optimal Trade Management

Guidance on how to make adjustments to your directional calendar positions and the best practices for exiting trades profitably.

12. Learning from the Experts

Sheridan Mentoring Sessions

Opportunities for live mentoring sessions where Dan Sheridan and Mark Fenton personally guide you through the nuances of directional calendars.

13. Continuous Education

Ongoing Learning Opportunities

Explore additional educational resources offered by Sheridan Options Mentoring to keep your trading skills sharp and up-to-date.

14. Joining the Community

Becoming Part of a Trading Family

Benefits of joining the Sheridan Options Mentoring community, including forums, webinars, and member-exclusive events.

15. Conclusion

Adopting directional calendars as part of your trading arsenal in 2023 can significantly enhance your trading strategy. With expert insights from Dan Sheridan and Mark Fenton, embark on a journey to mastering this sophisticated options strategy and watch as your trading proficiency reaches new heights.

FAQs

- What level of trading experience is required for using directional calendars? While beneficial for traders with some options experience, newcomers can also learn this strategy effectively with the right educational resources and mentoring.

- How do directional calendars differ from other calendar strategies? Unlike standard calendars that typically aim for non-directional market conditions, directional calendars are designed to capitalize on forecasted directional moves in the underlying asset.

- What is the typical duration for holding a directional calendar trade? The holding period can vary, but most trades span from a few days to several weeks, depending on the market movement and strategy setup.

- Can directional calendars be used in all market conditions? While particularly effective in volatile or moderately trending markets, the success of directional calendars can depend on proper market analysis and execution.

- How can I start learning with Sheridan Options Mentoring? Visit the Sheridan Options Mentoring website to sign up for courses, workshops, or one-on-one mentoring sessions focused on directional calendars and other advanced options strategies.

Be the first to review “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.