-

×

ValueCharts Ultimate Bundle with Base Camp Trading

1 × $54.00

ValueCharts Ultimate Bundle with Base Camp Trading

1 × $54.00 -

×

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Secret Day - Swing Trading Strategy For Stock, Forex, Crypto with Value Stocks

1 × $5.00

Secret Day - Swing Trading Strategy For Stock, Forex, Crypto with Value Stocks

1 × $5.00 -

×

Andy’s EMini Bar – 60 Min System

1 × $6.00

Andy’s EMini Bar – 60 Min System

1 × $6.00 -

×

CFA Pro Qbank 2007 & 2008 with Schweser

1 × $6.00

CFA Pro Qbank 2007 & 2008 with Schweser

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

How to Value & Sell your Business with Andrew Heslop

1 × $6.00

How to Value & Sell your Business with Andrew Heslop

1 × $6.00 -

×

Momentum Mastery with Traderlion Richard Moglen & Ben Bennett

1 × $15.00

Momentum Mastery with Traderlion Richard Moglen & Ben Bennett

1 × $15.00 -

×

Mastering Income Spread Trading with Dave Aquino - Base Camp Trading

1 × $23.00

Mastering Income Spread Trading with Dave Aquino - Base Camp Trading

1 × $23.00 -

×

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00 -

×

B.O.S.S. SPY Sniper with Pat Mitchell – Trick Trades

1 × $39.00

B.O.S.S. SPY Sniper with Pat Mitchell – Trick Trades

1 × $39.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

Trading Halls Of Knowledge - Road to Consistent Trading Profits with Jarrod Goodwin

1 × $6.00

Trading Halls Of Knowledge - Road to Consistent Trading Profits with Jarrod Goodwin

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

How to Trade in Stocks

1 × $6.00

How to Trade in Stocks

1 × $6.00 -

×

Beginner to Intermediate Intensive Q and A with Rob Hoffman

1 × $6.00

Beginner to Intermediate Intensive Q and A with Rob Hoffman

1 × $6.00 -

×

Volume Profile Video Course with Trader Dale

1 × $8.00

Volume Profile Video Course with Trader Dale

1 × $8.00 -

×

Broke: The New American Dream with Michael Covel

1 × $6.00

Broke: The New American Dream with Michael Covel

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

BalanceTrader II – For Advanced Traders

1 × $6.00

BalanceTrader II – For Advanced Traders

1 × $6.00 -

×

HunterFX Video Course with HunterFX

1 × $6.00

HunterFX Video Course with HunterFX

1 × $6.00 -

×

Football Hedging System with Tony Langley

1 × $54.00

Football Hedging System with Tony Langley

1 × $54.00 -

×

ProfileTraders - 5 course bundle

1 × $23.00

ProfileTraders - 5 course bundle

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

LT Pulse and LT Trend/Ultra

1 × $23.00

LT Pulse and LT Trend/Ultra

1 × $23.00 -

×

How To Win 97% Of Your Options Trader with Jeff Tompkins

1 × $6.00

How To Win 97% Of Your Options Trader with Jeff Tompkins

1 × $6.00 -

×

Scalping the Forex

1 × $6.00

Scalping the Forex

1 × $6.00 -

×

Our 3 Bread and Butter Trades In This Low IV Market Advanced Class with Day Trading Zones

1 × $39.00

Our 3 Bread and Butter Trades In This Low IV Market Advanced Class with Day Trading Zones

1 × $39.00 -

×

Simple Sector Trading Strategies with John Murphy

1 × $6.00

Simple Sector Trading Strategies with John Murphy

1 × $6.00 -

×

The Traders Battle Plan

1 × $6.00

The Traders Battle Plan

1 × $6.00 -

×

How to Create & Manage a Mutal Fund or ETF with Melinda Gerber

1 × $6.00

How to Create & Manage a Mutal Fund or ETF with Melinda Gerber

1 × $6.00 -

×

Magical Forex Trading System

1 × $6.00

Magical Forex Trading System

1 × $6.00 -

×

The Sweep Show with Scott Pulcini Trader

1 × $23.00

The Sweep Show with Scott Pulcini Trader

1 × $23.00 -

×

Buying and Selling Volatility with Kevin B.Connolly

1 × $6.00

Buying and Selling Volatility with Kevin B.Connolly

1 × $6.00 -

×

Price Action Trading with Bill Eykyn

1 × $6.00

Price Action Trading with Bill Eykyn

1 × $6.00 -

×

How to Make the Stock Market Make Money For You with Ted Warren

1 × $6.00

How to Make the Stock Market Make Money For You with Ted Warren

1 × $6.00 -

×

How I Day Trade Course with Traderade

1 × $15.00

How I Day Trade Course with Traderade

1 × $15.00 -

×

Crypto Strategies From Swing Trading To Intraday with Alessio Rutigliano & Roman Bogomazov

1 × $17.00

Crypto Strategies From Swing Trading To Intraday with Alessio Rutigliano & Roman Bogomazov

1 × $17.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Market Gems Manual with Barbara J.Simon

1 × $6.00

Market Gems Manual with Barbara J.Simon

1 × $6.00 -

×

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00 -

×

Algohub 2023 Full Completed with Algohub

1 × $5.00

Algohub 2023 Full Completed with Algohub

1 × $5.00 -

×

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00 -

×

The Ultimate Trader Transformation

1 × $62.00

The Ultimate Trader Transformation

1 × $62.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Master Strategies of Super Achievers By Steven Scott

1 × $23.00

Master Strategies of Super Achievers By Steven Scott

1 × $23.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Charting the Major Forex Pairs: Focus on Major Currencies with James Bickford

1 × $6.00

Charting the Major Forex Pairs: Focus on Major Currencies with James Bickford

1 × $6.00 -

×

Candlesticks Trading Course

1 × $31.00

Candlesticks Trading Course

1 × $31.00 -

×

Zero to Hero Course with EVO Capital

1 × $13.00

Zero to Hero Course with EVO Capital

1 × $13.00 -

×

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00 -

×

Foreign Exchange

1 × $6.00

Foreign Exchange

1 × $6.00 -

×

YouAreTheIndicator Online Course 1.0

1 × $6.00

YouAreTheIndicator Online Course 1.0

1 × $6.00 -

×

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00 -

×

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00 -

×

Become A Quant Trader Bundle with Lachezar Haralampiev & Radoslav Haralampiev - Quant Factory

1 × $17.00

Become A Quant Trader Bundle with Lachezar Haralampiev & Radoslav Haralampiev - Quant Factory

1 × $17.00 -

×

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00 -

×

Vertex Investing Course (2023)

1 × $8.00

Vertex Investing Course (2023)

1 × $8.00 -

×

ITPM Professional Trading Masterclass (PTM) V2.0 with Anton Kreil

1 × $6.00

ITPM Professional Trading Masterclass (PTM) V2.0 with Anton Kreil

1 × $6.00 -

×

Supply and Demand 2023 with Willy Jay

1 × $5.00

Supply and Demand 2023 with Willy Jay

1 × $5.00 -

×

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00 -

×

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00 -

×

Flex EA Correlated Hedge V1.02

1 × $6.00

Flex EA Correlated Hedge V1.02

1 × $6.00 -

×

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00 -

×

Million Dollar Bond Strategies Video with Paul Judd

1 × $6.00

Million Dollar Bond Strategies Video with Paul Judd

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00 -

×

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring

$397.00 Original price was: $397.00.$85.00Current price is: $85.00.

File Size: 4.70 GB

Delivery Time: 1–12 hours

Media Type: Online Course

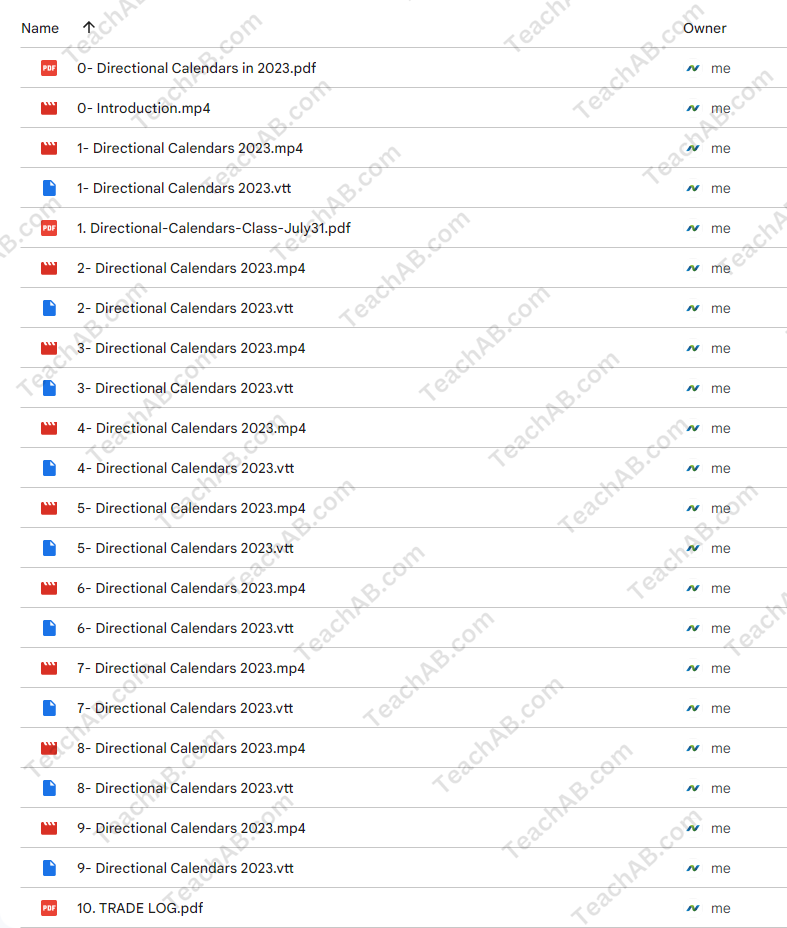

Content Proof: Watch Here!

SKU: Ttz-54971buZsf4

Category: Forex Trading

Tags: Dan Sheridan, Mark Fenton, Sheridan Options Mentoring

You may check content proof of “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” below:

Mastering Directional Calendars in 2023 with Dan Sheridan & Mark Fenton at Sheridan Options Mentoring

Welcome to the innovative world of options trading where directional calendars stand out as a pivotal strategy for 2023. Under the expert guidance of Dan Sheridan and Mark Fenton from Sheridan Options Mentoring, traders of all levels can learn to navigate and exploit market trends effectively. This comprehensive guide offers insight into utilizing directional calendar strategies to enhance trading outcomes.

1. Introduction to Directional Calendars

What Are Directional Calendars?

Directional calendars are an options strategy that involves the simultaneous buying and selling of options with different expiration dates but the same strike prices, aiming to profit from directional moves in the underlying asset.

2. The Expertise of Dan Sheridan

A Legacy of Options Education

Dan Sheridan brings decades of options trading experience to the table, offering deep insights into sophisticated trading strategies like directional calendars.

3. Mark Fenton’s Analytical Approach

Strategic Market Analysis

Alongside Dan, Mark Fenton provides a critical analytical approach to identifying market trends that are perfect for applying directional calendars.

4. Why Use Directional Calendars?

Advantages in Volatile Markets

Explore how directional calendars can be particularly powerful in volatile markets, offering the ability to leverage slight directional moves for significant profit.

5. Setting Up a Directional Calendar

Step-by-Step Setup

A detailed guide on how to set up a directional calendar, including selecting the right strikes and expirations based on current market conditions.

6. Choosing the Right Markets

Market Selection Criteria

Understand which market conditions and underlying assets are most suitable for directional calendars to maximize your success rate.

7. Risk Management Strategies

Protecting Your Positions

Learn effective risk management techniques specifically tailored for directional calendar trades to safeguard your investments.

8. Tools and Resources

Utilizing the Best Tools

Discover the essential tools and software that can aid in implementing and monitoring directional calendar strategies.

9. Case Studies

Real-World Examples

Analyze several case studies that demonstrate the successful application of directional calendars in various market scenarios.

10. Integration with Other Strategies

Combining Trading Approaches

Learn how to effectively combine directional calendars with other trading strategies to diversify risk and increase potential returns.

11. Adjusting and Exiting Trades

Optimal Trade Management

Guidance on how to make adjustments to your directional calendar positions and the best practices for exiting trades profitably.

12. Learning from the Experts

Sheridan Mentoring Sessions

Opportunities for live mentoring sessions where Dan Sheridan and Mark Fenton personally guide you through the nuances of directional calendars.

13. Continuous Education

Ongoing Learning Opportunities

Explore additional educational resources offered by Sheridan Options Mentoring to keep your trading skills sharp and up-to-date.

14. Joining the Community

Becoming Part of a Trading Family

Benefits of joining the Sheridan Options Mentoring community, including forums, webinars, and member-exclusive events.

15. Conclusion

Adopting directional calendars as part of your trading arsenal in 2023 can significantly enhance your trading strategy. With expert insights from Dan Sheridan and Mark Fenton, embark on a journey to mastering this sophisticated options strategy and watch as your trading proficiency reaches new heights.

FAQs

- What level of trading experience is required for using directional calendars? While beneficial for traders with some options experience, newcomers can also learn this strategy effectively with the right educational resources and mentoring.

- How do directional calendars differ from other calendar strategies? Unlike standard calendars that typically aim for non-directional market conditions, directional calendars are designed to capitalize on forecasted directional moves in the underlying asset.

- What is the typical duration for holding a directional calendar trade? The holding period can vary, but most trades span from a few days to several weeks, depending on the market movement and strategy setup.

- Can directional calendars be used in all market conditions? While particularly effective in volatile or moderately trending markets, the success of directional calendars can depend on proper market analysis and execution.

- How can I start learning with Sheridan Options Mentoring? Visit the Sheridan Options Mentoring website to sign up for courses, workshops, or one-on-one mentoring sessions focused on directional calendars and other advanced options strategies.

Be the first to review “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.