-

×

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Risk Stop Loss and Position Size with Daryl Guppy

1 × $6.00

Risk Stop Loss and Position Size with Daryl Guppy

1 × $6.00 -

×

Rounded Bottom Breakout Multimedia Course

1 × $31.00

Rounded Bottom Breakout Multimedia Course

1 × $31.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Ichimokutrade - Ichimoku 101

1 × $15.00

Ichimokutrade - Ichimoku 101

1 × $15.00 -

×

Acclimation Course with Base Camp Trading

1 × $10.00

Acclimation Course with Base Camp Trading

1 × $10.00 -

×

The Trading Room Video Course

1 × $23.00

The Trading Room Video Course

1 × $23.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Introduction to Macro Investing with Mike Singleton

1 × $31.00

Introduction to Macro Investing with Mike Singleton

1 × $31.00 -

×

Cotton Trading Manual with Terry Townsend

1 × $6.00

Cotton Trading Manual with Terry Townsend

1 × $6.00 -

×

Applying Fibonacci Analysis to Price Action

1 × $6.00

Applying Fibonacci Analysis to Price Action

1 × $6.00 -

×

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

1 × $6.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

1 × $6.00 -

×

Trading as a Business with Alexander Elder

1 × $6.00

Trading as a Business with Alexander Elder

1 × $6.00 -

×

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00 -

×

Swing Trader Pro with Top Trade Tools

1 × $54.00

Swing Trader Pro with Top Trade Tools

1 × $54.00 -

×

Lepus Proprietary Trading with Richard Jackson

1 × $6.00

Lepus Proprietary Trading with Richard Jackson

1 × $6.00 -

×

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Get 95% Win Rate With The Triple Candy Method - Eden

1 × $5.00

Get 95% Win Rate With The Triple Candy Method - Eden

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Mean Reversion Strategy with The Chartist

1 × $78.00

Mean Reversion Strategy with The Chartist

1 × $78.00 -

×

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00 -

×

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00 -

×

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Value Investing Today with Charles Brandes

1 × $6.00

Value Investing Today with Charles Brandes

1 × $6.00 -

×

Pristine - Greg Capra – Sentiment Internal Indicators. Winning Swing & Position Trading

1 × $6.00

Pristine - Greg Capra – Sentiment Internal Indicators. Winning Swing & Position Trading

1 × $6.00 -

×

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00 -

×

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00 -

×

Learn To Fish Part III - How To Swing Trade for Consistent Gains with Daniel

1 × $15.00

Learn To Fish Part III - How To Swing Trade for Consistent Gains with Daniel

1 × $15.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Simple Sector Trading Strategies with John Murphy

1 × $6.00

Simple Sector Trading Strategies with John Murphy

1 × $6.00 -

×

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00 -

×

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00 -

×

Technical Analysis & Options Strategies with K.H.Shaleen

1 × $6.00

Technical Analysis & Options Strategies with K.H.Shaleen

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00 -

×

Investing Online with Benton E.Gup

1 × $6.00

Investing Online with Benton E.Gup

1 × $6.00 -

×

Pattern Cycles with Alan Farley

1 × $6.00

Pattern Cycles with Alan Farley

1 × $6.00 -

×

HOW TO TRADE GAPS

1 × $15.00

HOW TO TRADE GAPS

1 × $15.00 -

×

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00 -

×

Small Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming Companies with George Angell

1 × $6.00

Small Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming Companies with George Angell

1 × $6.00 -

×

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00 -

×

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00 -

×

Market Forecasting. Stocks and Grain

1 × $6.00

Market Forecasting. Stocks and Grain

1 × $6.00 -

×

How I Trade for a Living with Gary Smith

1 × $6.00

How I Trade for a Living with Gary Smith

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00 -

×

The One Trading Secret That Could Make You Rich Inside Days

1 × $6.00

The One Trading Secret That Could Make You Rich Inside Days

1 × $6.00 -

×

Basic of Market Astrophisics with Hans Hannula

1 × $6.00

Basic of Market Astrophisics with Hans Hannula

1 × $6.00 -

×

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00

You Don't Need No Stinkin' Stockbroker: Taking the Pulse of Your Investment Portfolio with Doug Cappiello & Steve Tanaka

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Slim Miller's Cycle Analysis Workshop with Steve "Slim" Miller

1 × $6.00

Slim Miller's Cycle Analysis Workshop with Steve "Slim" Miller

1 × $6.00 -

×

Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition with John Bogle

1 × $6.00

Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition with John Bogle

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

My Favorite Trades – Trading Mastery

1 × $6.00

My Favorite Trades – Trading Mastery

1 × $6.00 -

×

Options Trading with Adam Grimes - MarketLife

1 × $5.00

Options Trading with Adam Grimes - MarketLife

1 × $5.00 -

×

Real Trade Examples Volume 1 with Steve Burns

1 × $15.00

Real Trade Examples Volume 1 with Steve Burns

1 × $15.00 -

×

Generate Weekly Income by Trend-Trading Stocks Intraday Class with Corey Rosenbloom

1 × $6.00

Generate Weekly Income by Trend-Trading Stocks Intraday Class with Corey Rosenbloom

1 × $6.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

High Yield Investments I & II with Lance Spicer

1 × $6.00

High Yield Investments I & II with Lance Spicer

1 × $6.00 -

×

Newsbeat Master Class Recording

1 × $39.00

Newsbeat Master Class Recording

1 × $39.00 -

×

Price Action Prophet

1 × $54.00

Price Action Prophet

1 × $54.00 -

×

Activedaytrader - Workshop Options For Income

1 × $15.00

Activedaytrader - Workshop Options For Income

1 × $15.00 -

×

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00 -

×

Supercharge your Options Spread Trading with John Summa

1 × $6.00

Supercharge your Options Spread Trading with John Summa

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00

The Aggressive Conservative Investor with Martin Whitman & Martin Shubik

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00 -

×

Options Education FULL Course 30+ Hours with Macrohedged

1 × $23.00

Options Education FULL Course 30+ Hours with Macrohedged

1 × $23.00 -

×

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00

Just What I Said: Bloomberg Economics Columnist Takes on Bonds, Banks, Budgets, and Bubbles with Caroline Baum

1 × $6.00 -

×

eASCTrend Trading Manual (not including 6 trading methods) with Ablesys

1 × $6.00

eASCTrend Trading Manual (not including 6 trading methods) with Ablesys

1 × $6.00

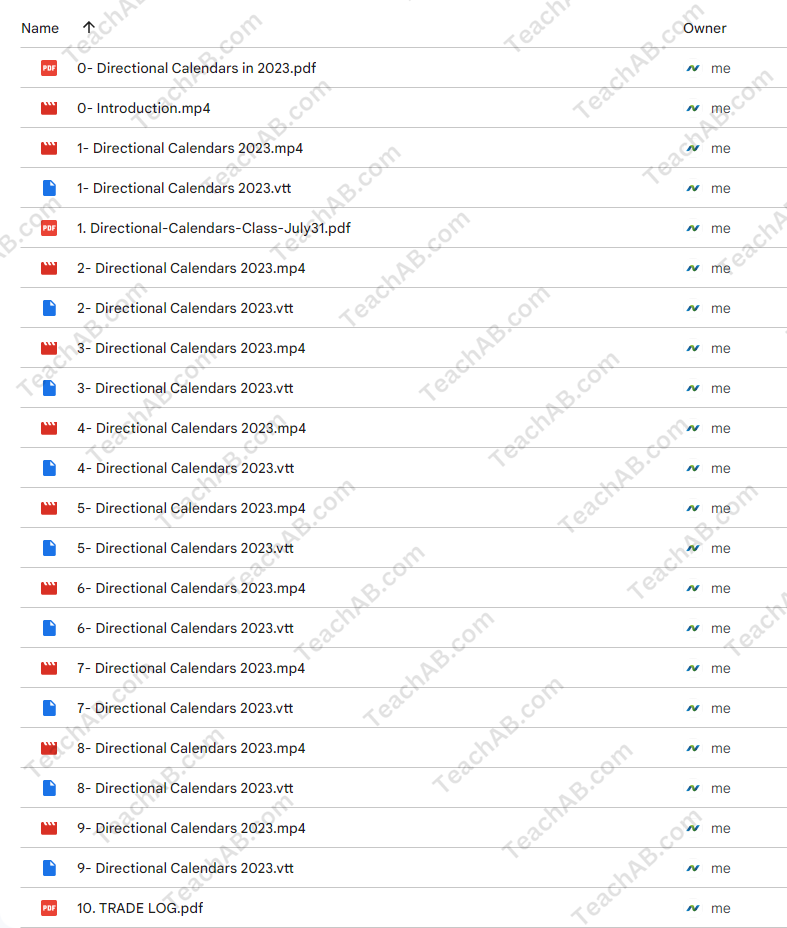

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring

$397.00 Original price was: $397.00.$85.00Current price is: $85.00.

File Size: 4.70 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz-54971buZsf4

Category: Forex Trading

Tags: Dan Sheridan, Mark Fenton, Sheridan Options Mentoring

You may check content proof of “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” below:

Mastering Directional Calendars in 2023 with Dan Sheridan & Mark Fenton at Sheridan Options Mentoring

Welcome to the innovative world of options trading where directional calendars stand out as a pivotal strategy for 2023. Under the expert guidance of Dan Sheridan and Mark Fenton from Sheridan Options Mentoring, traders of all levels can learn to navigate and exploit market trends effectively. This comprehensive guide offers insight into utilizing directional calendar strategies to enhance trading outcomes.

1. Introduction to Directional Calendars

What Are Directional Calendars?

Directional calendars are an options strategy that involves the simultaneous buying and selling of options with different expiration dates but the same strike prices, aiming to profit from directional moves in the underlying asset.

2. The Expertise of Dan Sheridan

A Legacy of Options Education

Dan Sheridan brings decades of options trading experience to the table, offering deep insights into sophisticated trading strategies like directional calendars.

3. Mark Fenton’s Analytical Approach

Strategic Market Analysis

Alongside Dan, Mark Fenton provides a critical analytical approach to identifying market trends that are perfect for applying directional calendars.

4. Why Use Directional Calendars?

Advantages in Volatile Markets

Explore how directional calendars can be particularly powerful in volatile markets, offering the ability to leverage slight directional moves for significant profit.

5. Setting Up a Directional Calendar

Step-by-Step Setup

A detailed guide on how to set up a directional calendar, including selecting the right strikes and expirations based on current market conditions.

6. Choosing the Right Markets

Market Selection Criteria

Understand which market conditions and underlying assets are most suitable for directional calendars to maximize your success rate.

7. Risk Management Strategies

Protecting Your Positions

Learn effective risk management techniques specifically tailored for directional calendar trades to safeguard your investments.

8. Tools and Resources

Utilizing the Best Tools

Discover the essential tools and software that can aid in implementing and monitoring directional calendar strategies.

9. Case Studies

Real-World Examples

Analyze several case studies that demonstrate the successful application of directional calendars in various market scenarios.

10. Integration with Other Strategies

Combining Trading Approaches

Learn how to effectively combine directional calendars with other trading strategies to diversify risk and increase potential returns.

11. Adjusting and Exiting Trades

Optimal Trade Management

Guidance on how to make adjustments to your directional calendar positions and the best practices for exiting trades profitably.

12. Learning from the Experts

Sheridan Mentoring Sessions

Opportunities for live mentoring sessions where Dan Sheridan and Mark Fenton personally guide you through the nuances of directional calendars.

13. Continuous Education

Ongoing Learning Opportunities

Explore additional educational resources offered by Sheridan Options Mentoring to keep your trading skills sharp and up-to-date.

14. Joining the Community

Becoming Part of a Trading Family

Benefits of joining the Sheridan Options Mentoring community, including forums, webinars, and member-exclusive events.

15. Conclusion

Adopting directional calendars as part of your trading arsenal in 2023 can significantly enhance your trading strategy. With expert insights from Dan Sheridan and Mark Fenton, embark on a journey to mastering this sophisticated options strategy and watch as your trading proficiency reaches new heights.

FAQs

- What level of trading experience is required for using directional calendars? While beneficial for traders with some options experience, newcomers can also learn this strategy effectively with the right educational resources and mentoring.

- How do directional calendars differ from other calendar strategies? Unlike standard calendars that typically aim for non-directional market conditions, directional calendars are designed to capitalize on forecasted directional moves in the underlying asset.

- What is the typical duration for holding a directional calendar trade? The holding period can vary, but most trades span from a few days to several weeks, depending on the market movement and strategy setup.

- Can directional calendars be used in all market conditions? While particularly effective in volatile or moderately trending markets, the success of directional calendars can depend on proper market analysis and execution.

- How can I start learning with Sheridan Options Mentoring? Visit the Sheridan Options Mentoring website to sign up for courses, workshops, or one-on-one mentoring sessions focused on directional calendars and other advanced options strategies.

Be the first to review “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.