-

×

NetPicks - Universal Market Trader Course

1 × $6.00

NetPicks - Universal Market Trader Course

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Six Setups Using Ichimoku Kinkō Hyō with Alphashark

1 × $15.00

Six Setups Using Ichimoku Kinkō Hyō with Alphashark

1 × $15.00 -

×

SPIKED COLLARS (Dynamic Hedging)

1 × $15.00

SPIKED COLLARS (Dynamic Hedging)

1 × $15.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00 -

×

Evidence Based Technical Analysis with David Aronson

1 × $6.00

Evidence Based Technical Analysis with David Aronson

1 × $6.00 -

×

Forex Mentor 2007 with Peter Bain

1 × $6.00

Forex Mentor 2007 with Peter Bain

1 × $6.00 -

×

Euro Error with Jean-Jacques Rosa

1 × $6.00

Euro Error with Jean-Jacques Rosa

1 × $6.00 -

×

DynaRange® (PREMIUM)

1 × $78.00

DynaRange® (PREMIUM)

1 × $78.00 -

×

Computerized Trading with Mark Jurik

1 × $6.00

Computerized Trading with Mark Jurik

1 × $6.00 -

×

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00 -

×

Basic of Market Astrophisics with Hans Hannula

1 × $6.00

Basic of Market Astrophisics with Hans Hannula

1 × $6.00 -

×

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

FX Funding Mate Course

1 × $5.00

FX Funding Mate Course

1 × $5.00 -

×

Intra-day Trading Strategies. Proven Steps to Trading Profits

1 × $6.00

Intra-day Trading Strategies. Proven Steps to Trading Profits

1 × $6.00 -

×

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00 -

×

KojoForex Goat Strategy with Kojo Forex Academy

1 × $20.00

KojoForex Goat Strategy with Kojo Forex Academy

1 × $20.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

I Segreti Del Trading Di Breve Termine (Italian) with Larry Williams

1 × $6.00

I Segreti Del Trading Di Breve Termine (Italian) with Larry Williams

1 × $6.00 -

×

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

1 × $6.00

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

1 × $6.00 -

×

Market Forecasting. Stocks and Grain

1 × $6.00

Market Forecasting. Stocks and Grain

1 × $6.00 -

×

The Complete 12 Week Transformation Course

1 × $31.00

The Complete 12 Week Transformation Course

1 × $31.00 -

×

The Aime Workshop with Clay Marafiote

1 × $6.00

The Aime Workshop with Clay Marafiote

1 × $6.00 -

×

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00 -

×

Investment Performance Measurement with Bruce Feibel

1 × $6.00

Investment Performance Measurement with Bruce Feibel

1 × $6.00 -

×

Tradeguider Mentorship Collection

1 × $54.00

Tradeguider Mentorship Collection

1 × $54.00 -

×

Super Structure Trading Home Study Course

1 × $23.00

Super Structure Trading Home Study Course

1 × $23.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Forecast for 2010 with Larry Williams

1 × $6.00

Forecast for 2010 with Larry Williams

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Kaizen On-Demand By Candle Charts

1 × $6.00

Kaizen On-Demand By Candle Charts

1 × $6.00 -

×

Wallstreet Trappin with Wallstreet Trapper

1 × $31.00

Wallstreet Trappin with Wallstreet Trapper

1 × $31.00 -

×

Forex Robotron (Unlocked)

1 × $6.00

Forex Robotron (Unlocked)

1 × $6.00 -

×

Master Commodities Course

1 × $6.00

Master Commodities Course

1 × $6.00 -

×

Dan Sheridan 2011 Calendar Workshop

1 × $6.00

Dan Sheridan 2011 Calendar Workshop

1 × $6.00 -

×

Pips University

1 × $6.00

Pips University

1 × $6.00 -

×

How To Create Your Own Trading Strategy with Simon Klein - Trade Smart

1 × $5.00

How To Create Your Own Trading Strategy with Simon Klein - Trade Smart

1 × $5.00 -

×

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00 -

×

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00 -

×

How to Trade a Vertical Market with Armstrong Economics

1 × $155.00

How to Trade a Vertical Market with Armstrong Economics

1 × $155.00 -

×

Markets In Motion with Ned Davis

1 × $6.00

Markets In Motion with Ned Davis

1 × $6.00 -

×

Day Trading Options Guide PDF with Matt Diamond

1 × $23.00

Day Trading Options Guide PDF with Matt Diamond

1 × $23.00 -

×

REMORA OPTIONS TRADING (Silver Membership)

1 × $23.00

REMORA OPTIONS TRADING (Silver Membership)

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00 -

×

Triple Squeeze Indicator TOS

1 × $6.00

Triple Squeeze Indicator TOS

1 × $6.00 -

×

Practical Approach to Amibroker Backtesting with Rajandran R

1 × $6.00

Practical Approach to Amibroker Backtesting with Rajandran R

1 × $6.00 -

×

Metastock Online Traders Summit

1 × $5.00

Metastock Online Traders Summit

1 × $5.00 -

×

Fibonacci Analysis with Constance Brown

1 × $6.00

Fibonacci Analysis with Constance Brown

1 × $6.00 -

×

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00 -

×

KASH-FX JOURNAL

1 × $10.00

KASH-FX JOURNAL

1 × $10.00 -

×

Evolution Markets Forex Course - Evolution Markets

1 × $5.00

Evolution Markets Forex Course - Evolution Markets

1 × $5.00 -

×

Secret Weapon to Trading Options on ETF's Class with Don Kaufman

1 × $6.00

Secret Weapon to Trading Options on ETF's Class with Don Kaufman

1 × $6.00 -

×

Manage By The Greeks 2016 with Sheridan

1 × $6.00

Manage By The Greeks 2016 with Sheridan

1 × $6.00 -

×

Gold. Symmetrycs Trading Method with Joseph Rondione

1 × $6.00

Gold. Symmetrycs Trading Method with Joseph Rondione

1 × $6.00 -

×

System Building Masterclass

1 × $31.00

System Building Masterclass

1 × $31.00 -

×

POS+ Hindi 30 Days Subscription with Surjeetkakkar

1 × $62.00

POS+ Hindi 30 Days Subscription with Surjeetkakkar

1 × $62.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Flux Investor Package v2.2.1, (Jan 2016) with Back To The Future Trading

1 × $85.00

Flux Investor Package v2.2.1, (Jan 2016) with Back To The Future Trading

1 × $85.00 -

×

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Dominate Stocks 2020 with J. Bravo

1 × $6.00

Dominate Stocks 2020 with J. Bravo

1 × $6.00 -

×

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00

Futures Spreads Crash Course with Base Camp Trading

1 × $54.00 -

×

Consistent Small Account Growth Formula with Matt Williamson

1 × $6.00

Consistent Small Account Growth Formula with Matt Williamson

1 × $6.00 -

×

Mastermind Bootcamp + Core Concepts Mastery with DreamsFX

1 × $6.00

Mastermind Bootcamp + Core Concepts Mastery with DreamsFX

1 × $6.00 -

×

Jeffrey Kennedy’s Package ( Discount 25% )

1 × $31.00

Jeffrey Kennedy’s Package ( Discount 25% )

1 × $31.00 -

×

Strategies for Profiting on Every Trade: Simple Lessons for Mastering the Market with Oliver L. Velez

1 × $6.00

Strategies for Profiting on Every Trade: Simple Lessons for Mastering the Market with Oliver L. Velez

1 × $6.00 -

×

How to Create & Manage a Mutal Fund or ETF with Melinda Gerber

1 × $6.00

How to Create & Manage a Mutal Fund or ETF with Melinda Gerber

1 × $6.00 -

×

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00 -

×

Detecting Trend Direction & Strength (Article) with Barbara Star

1 × $6.00

Detecting Trend Direction & Strength (Article) with Barbara Star

1 × $6.00 -

×

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00

Market Masters. How Traders Think Trade And Invest with Jake Bernstein

1 × $6.00 -

×

Simple Forex Profits with Rayy Bannzz

1 × $31.00

Simple Forex Profits with Rayy Bannzz

1 × $31.00 -

×

Perfect Publishing System Elite with Johnny Andrews

1 × $6.00

Perfect Publishing System Elite with Johnny Andrews

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

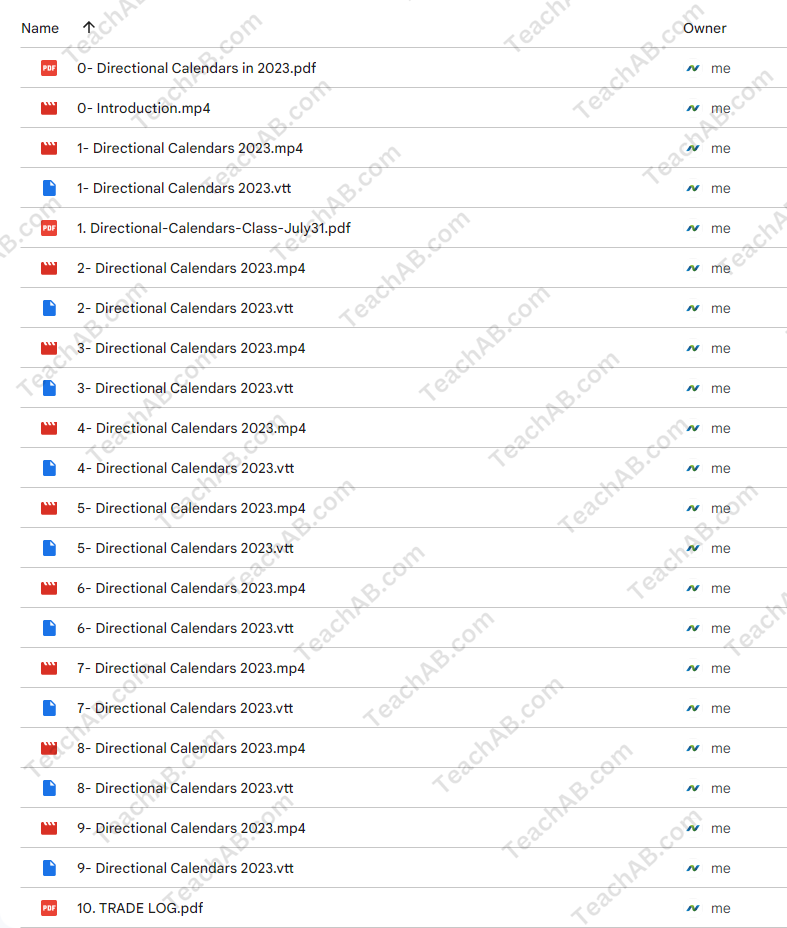

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring

$397.00 Original price was: $397.00.$85.00Current price is: $85.00.

File Size: 4.70 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

SKU: Ttz-54971buZsf4

Category: Forex Trading

Tags: Dan Sheridan, Mark Fenton, Sheridan Options Mentoring

You may check content proof of “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” below:

Mastering Directional Calendars in 2023 with Dan Sheridan & Mark Fenton at Sheridan Options Mentoring

Welcome to the innovative world of options trading where directional calendars stand out as a pivotal strategy for 2023. Under the expert guidance of Dan Sheridan and Mark Fenton from Sheridan Options Mentoring, traders of all levels can learn to navigate and exploit market trends effectively. This comprehensive guide offers insight into utilizing directional calendar strategies to enhance trading outcomes.

1. Introduction to Directional Calendars

What Are Directional Calendars?

Directional calendars are an options strategy that involves the simultaneous buying and selling of options with different expiration dates but the same strike prices, aiming to profit from directional moves in the underlying asset.

2. The Expertise of Dan Sheridan

A Legacy of Options Education

Dan Sheridan brings decades of options trading experience to the table, offering deep insights into sophisticated trading strategies like directional calendars.

3. Mark Fenton’s Analytical Approach

Strategic Market Analysis

Alongside Dan, Mark Fenton provides a critical analytical approach to identifying market trends that are perfect for applying directional calendars.

4. Why Use Directional Calendars?

Advantages in Volatile Markets

Explore how directional calendars can be particularly powerful in volatile markets, offering the ability to leverage slight directional moves for significant profit.

5. Setting Up a Directional Calendar

Step-by-Step Setup

A detailed guide on how to set up a directional calendar, including selecting the right strikes and expirations based on current market conditions.

6. Choosing the Right Markets

Market Selection Criteria

Understand which market conditions and underlying assets are most suitable for directional calendars to maximize your success rate.

7. Risk Management Strategies

Protecting Your Positions

Learn effective risk management techniques specifically tailored for directional calendar trades to safeguard your investments.

8. Tools and Resources

Utilizing the Best Tools

Discover the essential tools and software that can aid in implementing and monitoring directional calendar strategies.

9. Case Studies

Real-World Examples

Analyze several case studies that demonstrate the successful application of directional calendars in various market scenarios.

10. Integration with Other Strategies

Combining Trading Approaches

Learn how to effectively combine directional calendars with other trading strategies to diversify risk and increase potential returns.

11. Adjusting and Exiting Trades

Optimal Trade Management

Guidance on how to make adjustments to your directional calendar positions and the best practices for exiting trades profitably.

12. Learning from the Experts

Sheridan Mentoring Sessions

Opportunities for live mentoring sessions where Dan Sheridan and Mark Fenton personally guide you through the nuances of directional calendars.

13. Continuous Education

Ongoing Learning Opportunities

Explore additional educational resources offered by Sheridan Options Mentoring to keep your trading skills sharp and up-to-date.

14. Joining the Community

Becoming Part of a Trading Family

Benefits of joining the Sheridan Options Mentoring community, including forums, webinars, and member-exclusive events.

15. Conclusion

Adopting directional calendars as part of your trading arsenal in 2023 can significantly enhance your trading strategy. With expert insights from Dan Sheridan and Mark Fenton, embark on a journey to mastering this sophisticated options strategy and watch as your trading proficiency reaches new heights.

FAQs

- What level of trading experience is required for using directional calendars? While beneficial for traders with some options experience, newcomers can also learn this strategy effectively with the right educational resources and mentoring.

- How do directional calendars differ from other calendar strategies? Unlike standard calendars that typically aim for non-directional market conditions, directional calendars are designed to capitalize on forecasted directional moves in the underlying asset.

- What is the typical duration for holding a directional calendar trade? The holding period can vary, but most trades span from a few days to several weeks, depending on the market movement and strategy setup.

- Can directional calendars be used in all market conditions? While particularly effective in volatile or moderately trending markets, the success of directional calendars can depend on proper market analysis and execution.

- How can I start learning with Sheridan Options Mentoring? Visit the Sheridan Options Mentoring website to sign up for courses, workshops, or one-on-one mentoring sessions focused on directional calendars and other advanced options strategies.

Be the first to review “Directional Calendars in 2023 with Dan Sheridan & Mark Fenton – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Reviews

There are no reviews yet.