-

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Inside the Mind of Trader Stewie - Art of Trading

1 × $23.00

Inside the Mind of Trader Stewie - Art of Trading

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Real Options in Practice with Marion A.Brach

1 × $6.00

Real Options in Practice with Marion A.Brach

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Options on Futures Trading Course

1 × $15.00

Options on Futures Trading Course

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Breakthroughs in Technical Analysis: New Thinking From the World's Top Minds (1st Edition) with David Keller

1 × $6.00

Breakthroughs in Technical Analysis: New Thinking From the World's Top Minds (1st Edition) with David Keller

1 × $6.00 -

×

Robotic Trading: Skill Sharpening with Claytrader

1 × $23.00

Robotic Trading: Skill Sharpening with Claytrader

1 × $23.00 -

×

The New Investment Superstars: 13 Great Investors and Their Strategies for Superior Returns - Lois Peltz

1 × $6.00

The New Investment Superstars: 13 Great Investors and Their Strategies for Superior Returns - Lois Peltz

1 × $6.00 -

×

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Market Makers Method Forex Trading with Nick Nechanicky

1 × $5.00

Market Makers Method Forex Trading with Nick Nechanicky

1 × $5.00 -

×

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00 -

×

SMT FX Trading

1 × $5.00

SMT FX Trading

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Trend Trading Techniques with Rob Hoffman

1 × $6.00

Trend Trading Techniques with Rob Hoffman

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Forex Essentials in 15 Trades with John Bland, Jay Meisler & Michael Archer

1 × $6.00

Forex Essentials in 15 Trades with John Bland, Jay Meisler & Michael Archer

1 × $6.00 -

×

Wave Trader Software 2004 with Bryce Gilmore

1 × $6.00

Wave Trader Software 2004 with Bryce Gilmore

1 × $6.00 -

×

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00 -

×

The Secret Mindset Academy 2023 with The Secret Mindset Academy

1 × $5.00

The Secret Mindset Academy 2023 with The Secret Mindset Academy

1 × $5.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Forex Advanced with Prophetic Pips Academy

1 × $5.00

Forex Advanced with Prophetic Pips Academy

1 × $5.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Math for the Trades with LearningExpress

1 × $6.00

Math for the Trades with LearningExpress

1 × $6.00 -

×

Intro to Fibonacci Trading with Neal Hughes

1 × $6.00

Intro to Fibonacci Trading with Neal Hughes

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Fundamental & Technical Analysis Mini Course with Colin Nicholson

1 × $6.00

Fundamental & Technical Analysis Mini Course with Colin Nicholson

1 × $6.00 -

×

Broke: The New American Dream with Michael Covel

1 × $6.00

Broke: The New American Dream with Michael Covel

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Woodies Collection and AutoTrader 7.0.1.6

1 × $31.00

Woodies Collection and AutoTrader 7.0.1.6

1 × $31.00 -

×

TA_L2 & The Nasdaq

1 × $6.00

TA_L2 & The Nasdaq

1 × $6.00 -

×

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00 -

×

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00 -

×

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00 -

×

Options University - Ron Ianieri – The Option Pricing Model

1 × $6.00

Options University - Ron Ianieri – The Option Pricing Model

1 × $6.00 -

×

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Elliott Wave Simplified with Clif Droke

1 × $6.00

Elliott Wave Simplified with Clif Droke

1 × $6.00 -

×

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Understanding the Markets with David Loader

1 × $6.00

Understanding the Markets with David Loader

1 × $6.00 -

×

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00

The Four Biggest Mistakes in Futures Trading (1st Edition) with Jay Kaeppel

1 × $6.00 -

×

Sample and Mock Exams 2008 with CFA Institute

1 × $6.00

Sample and Mock Exams 2008 with CFA Institute

1 × $6.00 -

×

Intra-Day Trading Tactics with Greg Capra

1 × $6.00

Intra-Day Trading Tactics with Greg Capra

1 × $6.00 -

×

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00 -

×

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00 -

×

Trade Your Way to Wealth with Bill Kraft

1 × $6.00

Trade Your Way to Wealth with Bill Kraft

1 × $6.00 -

×

Gann’s Scientific Methods Unveiled (Vol I, II)

1 × $6.00

Gann’s Scientific Methods Unveiled (Vol I, II)

1 × $6.00 -

×

The Handbook of Commodity Investing with Frank Fabozzi, Roland Fuss & Dieter Kaiser

1 × $6.00

The Handbook of Commodity Investing with Frank Fabozzi, Roland Fuss & Dieter Kaiser

1 × $6.00 -

×

Trading Options for Dummies with George Fontanills

1 × $6.00

Trading Options for Dummies with George Fontanills

1 × $6.00 -

×

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00 -

×

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00

CNBC 24-7 Trading with Barbara Rockefeller

1 × $6.00 -

×

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00 -

×

Price Action Trading 101 By Steve Burns

1 × $15.00

Price Action Trading 101 By Steve Burns

1 × $15.00 -

×

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Level II Profit System with Sammy Chua

1 × $6.00

Level II Profit System with Sammy Chua

1 × $6.00 -

×

Geomagnetic Storms & Stock Markets (Article) with Anna Krivelyova, C.Robotti

1 × $6.00

Geomagnetic Storms & Stock Markets (Article) with Anna Krivelyova, C.Robotti

1 × $6.00 -

×

Fractal Markets FX (SMC)

1 × $5.00

Fractal Markets FX (SMC)

1 × $5.00 -

×

Mastering the Trade

1 × $6.00

Mastering the Trade

1 × $6.00 -

×

Documenting and Review Process With Live Trades by Philakone Crypto

1 × $6.00

Documenting and Review Process With Live Trades by Philakone Crypto

1 × $6.00 -

×

John Bollinger on Bollinger Bands

1 × $6.00

John Bollinger on Bollinger Bands

1 × $6.00 -

×

Managing Debt for Dummies with John Ventura

1 × $6.00

Managing Debt for Dummies with John Ventura

1 × $6.00 -

×

LBFX Academy Training Course

1 × $5.00

LBFX Academy Training Course

1 × $5.00 -

×

Killmex Academy Education Course

1 × $5.00

Killmex Academy Education Course

1 × $5.00 -

×

Dow Theory for the 21st Century: Technical Indicators for Improving Your Investment Results with Jack Schannep

1 × $6.00

Dow Theory for the 21st Century: Technical Indicators for Improving Your Investment Results with Jack Schannep

1 × $6.00 -

×

Modeling Financial Markets. Using Visual Basic Net & Databases To Create Pricing Trading & Risk Management Models

1 × $6.00

Modeling Financial Markets. Using Visual Basic Net & Databases To Create Pricing Trading & Risk Management Models

1 × $6.00 -

×

GTA Professional Course with Gova Trading Academy

1 × $5.00

GTA Professional Course with Gova Trading Academy

1 × $5.00 -

×

Dow Jones Secret. Never Lose a Trade with Karl Dittmann

1 × $6.00

Dow Jones Secret. Never Lose a Trade with Karl Dittmann

1 × $6.00 -

×

MATS Market Auction Trading System with Ryan Watts

1 × $6.00

MATS Market Auction Trading System with Ryan Watts

1 × $6.00 -

×

Price Action and Orderflow Course with Young Tilopa

1 × $17.00

Price Action and Orderflow Course with Young Tilopa

1 × $17.00 -

×

Evolved Trader with Mark Croock

1 × $69.00

Evolved Trader with Mark Croock

1 × $69.00 -

×

Sell & Sell Short with Alexander Elder

1 × $6.00

Sell & Sell Short with Alexander Elder

1 × $6.00 -

×

Electronic Trading "TNT" IV Tips Tricks and Other Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" IV Tips Tricks and Other Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

Indicators & BWT Bar Types for NT7

1 × $139.00

Indicators & BWT Bar Types for NT7

1 × $139.00 -

×

Forex Income Engine 1.0 with Bill Poulos

1 × $6.00

Forex Income Engine 1.0 with Bill Poulos

1 × $6.00 -

×

Stocks and Bonds with Elaine Scott

1 × $6.00

Stocks and Bonds with Elaine Scott

1 × $6.00 -

×

Stocks & Commodities Magazine S&C on DVD 11.26 (1982-2008)

1 × $6.00

Stocks & Commodities Magazine S&C on DVD 11.26 (1982-2008)

1 × $6.00 -

×

How to Invest in ETFs By The Investors Podcast

1 × $6.00

How to Invest in ETFs By The Investors Podcast

1 × $6.00 -

×

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00

Market Stalkers Level 3 - Intraday Trading University

1 × $8.00 -

×

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00 -

×

The Complete Guide to Technical Indicators with Mark Larson

1 × $6.00

The Complete Guide to Technical Indicators with Mark Larson

1 × $6.00 -

×

You AreThe Indicator Online Course

1 × $31.00

You AreThe Indicator Online Course

1 × $31.00 -

×

Currency Trading and Intermarket Analysis

1 × $6.00

Currency Trading and Intermarket Analysis

1 × $6.00 -

×

Options Education FULL Course 30+ Hours with Macrohedged

1 × $23.00

Options Education FULL Course 30+ Hours with Macrohedged

1 × $23.00 -

×

Lee Gettess’s Package

1 × $6.00

Lee Gettess’s Package

1 × $6.00 -

×

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00 -

×

Professional Trader Series DVD Set (Full)

1 × $23.00

Professional Trader Series DVD Set (Full)

1 × $23.00 -

×

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00 -

×

Manage the Greeks & the Risk of ODTE & 1-4 day Trades for October 2023 with Sheridan Options Mentoring

1 × $85.00

Manage the Greeks & the Risk of ODTE & 1-4 day Trades for October 2023 with Sheridan Options Mentoring

1 × $85.00 -

×

Forex Trading - Making A Living Online Trading Forex By Luciano Kelly & Learn Forex Mentor

1 × $6.00

Forex Trading - Making A Living Online Trading Forex By Luciano Kelly & Learn Forex Mentor

1 × $6.00 -

×

Technical Analysis & Options Strategies with K.H.Shaleen

1 × $6.00

Technical Analysis & Options Strategies with K.H.Shaleen

1 × $6.00 -

×

Rich in America: Secrets to Creating and Preserving Wealth with Jeffrey Maurer

1 × $6.00

Rich in America: Secrets to Creating and Preserving Wealth with Jeffrey Maurer

1 × $6.00 -

×

XLT - Forex Trading Course

1 × $6.00

XLT - Forex Trading Course

1 × $6.00 -

×

Money Miracle: Use Other Peoples Money to Make You Rich with George Angell

1 × $6.00

Money Miracle: Use Other Peoples Money to Make You Rich with George Angell

1 × $6.00 -

×

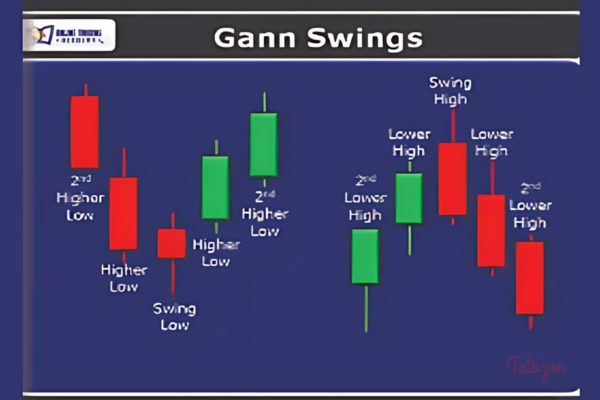

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00 -

×

Intermediate to Advanced Intensive Q and A with Rob Hoffman

1 × $6.00

Intermediate to Advanced Intensive Q and A with Rob Hoffman

1 × $6.00 -

×

Master NFTs in 7 Days with Ben Yu

1 × $23.00

Master NFTs in 7 Days with Ben Yu

1 × $23.00 -

×

Ichimokutrade - Ichimoku 101

1 × $15.00

Ichimokutrade - Ichimoku 101

1 × $15.00 -

×

Mastering the Orderbook with Rowan Crawford

1 × $6.00

Mastering the Orderbook with Rowan Crawford

1 × $6.00

Demystifying Fed’s Monetary Policy

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Demystifying Fed’s Monetary Policy: Understand Its Impact

Introduction

Monetary policy is a powerful tool used by the Federal Reserve (the Fed) to manage the economy. It influences inflation, employment, and overall economic stability. Understanding how the Fed’s monetary policy works can help us comprehend its impact on our daily lives and the broader economy. In this article, we will demystify the Fed’s monetary policy, explaining its mechanisms, goals, and effects in a clear and engaging manner.

What is Monetary Policy?

Monetary policy refers to the actions taken by a central bank to control the money supply and achieve specific economic goals.

Types of Monetary Policy

- Expansionary Policy: Aims to stimulate the economy by increasing the money supply and lowering interest rates.

- Contractionary Policy: Aims to slow down the economy by reducing the money supply and raising interest rates.

Goals of the Fed’s Monetary Policy

The Federal Reserve has three primary objectives:

- Maximum Employment: Striving to achieve the highest possible employment level without causing inflation.

- Stable Prices: Maintaining a low and stable inflation rate.

- Moderate Long-Term Interest Rates: Ensuring interest rates support economic growth.

Tools of the Fed’s Monetary Policy

Open Market Operations (OMO)

OMO involves buying and selling government securities to regulate the money supply.

How OMO Works

- Buying Securities: Increases the money supply and lowers interest rates.

- Selling Securities: Decreases the money supply and raises interest rates.

Discount Rate

The discount rate is the interest rate charged to commercial banks for short-term loans from the Federal Reserve.

Impact of Changing the Discount Rate

- Lowering the Rate: Encourages borrowing and increases the money supply.

- Raising the Rate: Discourages borrowing and decreases the money supply.

Reserve Requirements

Reserve requirements are the amount of funds that a bank must hold in reserve against specified deposit liabilities.

Adjusting Reserve Requirements

- Lowering Requirements: Increases the money supply by freeing up funds for lending.

- Raising Requirements: Decreases the money supply by reducing funds available for lending.

The Federal Funds Rate

The federal funds rate is the interest rate at which banks lend reserves to each other overnight. It serves as a benchmark for other interest rates.

Setting the Federal Funds Rate

The Federal Open Market Committee (FOMC) sets a target for the federal funds rate and uses OMO to achieve it.

Significance of the Federal Funds Rate

- Influences Borrowing Costs: Affects everything from mortgages to business loans.

- Guides Economic Activity: Helps control inflation and stabilize the economy.

The Role of the Federal Open Market Committee (FOMC)

The FOMC is responsible for setting monetary policy.

Structure of the FOMC

- Board of Governors: Seven members appointed by the President and confirmed by the Senate.

- Regional Bank Presidents: Five of the twelve regional bank presidents participate in FOMC meetings on a rotating basis.

FOMC Meetings

The FOMC meets eight times a year to review economic and financial conditions and determine the appropriate stance of monetary policy.

Impact of Monetary Policy on the Economy

Influence on Inflation

Monetary policy can help control inflation by managing the money supply and influencing interest rates.

- Expansionary Policy: Can lead to higher inflation if overused.

- Contractionary Policy: Can reduce inflation by slowing down economic activity.

Effect on Employment

By influencing economic growth, monetary policy affects job creation and unemployment rates.

- Expansionary Policy: Encourages job creation and reduces unemployment.

- Contractionary Policy: Can increase unemployment by slowing down economic growth.

Interest Rates and Investment

Changes in the federal funds rate affect borrowing costs, influencing business investments and consumer spending.

- Lower Rates: Stimulate investment and spending.

- Higher Rates: Discourage investment and spending.

Challenges of Implementing Monetary Policy

Lag Effects

Monetary policy actions take time to affect the economy, making it challenging to time interventions accurately.

Global Influences

Global economic conditions can impact the effectiveness of domestic monetary policy.

Political Pressures

Although the Fed operates independently, political pressures can influence its decision-making.

Recent Developments in Fed’s Monetary Policy

Post-2008 Financial Crisis

The Fed implemented unconventional monetary policies, such as quantitative easing, to support the economy.

Pandemic Response

In response to the COVID-19 pandemic, the Fed took aggressive actions to stabilize financial markets and support economic recovery.

Conclusion

Understanding the Fed’s monetary policy is essential for grasping how economic stability is maintained. By demystifying its tools, goals, and impacts, we can better appreciate the complexity and importance of the Fed’s role in the economy.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Demystifying Fed’s Monetary Policy” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.