-

×

How To Backtest Bootcamp

1 × $17.00

How To Backtest Bootcamp

1 × $17.00 -

×

The Handbook of Technical Analysis: A Comprehensive Guide to Analytical Methods, Trading Systems and Technical Indicators with Darrell R. Jobman

1 × $6.00

The Handbook of Technical Analysis: A Comprehensive Guide to Analytical Methods, Trading Systems and Technical Indicators with Darrell R. Jobman

1 × $6.00 -

×

Advanced Trading Strategies with Larry Connors

1 × $6.00

Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

Complete Forex Training Series with 4 x Made Easy

1 × $6.00

Complete Forex Training Series with 4 x Made Easy

1 × $6.00 -

×

Advanced Price Action Course with ZenFX

1 × $5.00

Advanced Price Action Course with ZenFX

1 × $5.00 -

×

Market Fluidity

1 × $6.00

Market Fluidity

1 × $6.00 -

×

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00 -

×

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00 -

×

The Global Money Markets with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00

The Global Money Markets with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00 -

×

Applying Fibonacci Analysis to Price Action

1 × $6.00

Applying Fibonacci Analysis to Price Action

1 × $6.00 -

×

Traders Guide to Emotional Management with Brian McAboy

1 × $4.00

Traders Guide to Emotional Management with Brian McAboy

1 × $4.00 -

×

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00 -

×

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00 -

×

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

1 × $6.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

1 × $6.00 -

×

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00 -

×

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00 -

×

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00 -

×

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00 -

×

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00 -

×

Futures Trading Mastery 2022 | FREE Top 45 Trading Signals!

1 × $5.00

Futures Trading Mastery 2022 | FREE Top 45 Trading Signals!

1 × $5.00 -

×

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Market Structure Matters with Haim Bodek

1 × $62.00

Market Structure Matters with Haim Bodek

1 × $62.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

TRAING IRON CONDORS IN ANY ENVIRONMENT with Sheridan Options Mentoring

1 × $15.00

TRAING IRON CONDORS IN ANY ENVIRONMENT with Sheridan Options Mentoring

1 × $15.00 -

×

ProfileTraders - 5 course bundle

1 × $23.00

ProfileTraders - 5 course bundle

1 × $23.00 -

×

Tharp Think Essentials Video Workshop with Van Tharp

1 × $5.00

Tharp Think Essentials Video Workshop with Van Tharp

1 × $5.00 -

×

Crash Course Special Edition Set with Chris Martenson

1 × $6.00

Crash Course Special Edition Set with Chris Martenson

1 × $6.00 -

×

Strategic Swing Trader with Sami Abusaad

1 × $6.00

Strategic Swing Trader with Sami Abusaad

1 × $6.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00 -

×

7 Day FX Mastery Course with Market Masters

1 × $6.00

7 Day FX Mastery Course with Market Masters

1 × $6.00 -

×

All About Stocks (3rd Ed.) withEsme E.Faerber

1 × $6.00

All About Stocks (3rd Ed.) withEsme E.Faerber

1 × $6.00 -

×

Advanced Options Trading with Lucas Downey

1 × $15.00

Advanced Options Trading with Lucas Downey

1 × $15.00 -

×

The Next Great Bull Market with Matthew McCall

1 × $6.00

The Next Great Bull Market with Matthew McCall

1 × $6.00 -

×

A Trader’s Guide To Discipline

1 × $6.00

A Trader’s Guide To Discipline

1 × $6.00 -

×

SPIKED COLLARS (Dynamic Hedging)

1 × $15.00

SPIKED COLLARS (Dynamic Hedging)

1 × $15.00 -

×

I Segreti Del Trading Di Breve Termine (Italian) with Larry Williams

1 × $6.00

I Segreti Del Trading Di Breve Termine (Italian) with Larry Williams

1 × $6.00 -

×

Market Forecasting. Stocks and Grain

1 × $6.00

Market Forecasting. Stocks and Grain

1 × $6.00 -

×

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00 -

×

Traders World Past Issue Articles on CD with Magazine

1 × $6.00

Traders World Past Issue Articles on CD with Magazine

1 × $6.00 -

×

BookMap Advanced v6.1

1 × $6.00

BookMap Advanced v6.1

1 × $6.00 -

×

War Room Psychology Vol.3 with Trick Trades

1 × $23.00

War Room Psychology Vol.3 with Trick Trades

1 × $23.00 -

×

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00 -

×

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00 -

×

Fantastic 4 Trading Strategies

1 × $15.00

Fantastic 4 Trading Strategies

1 × $15.00 -

×

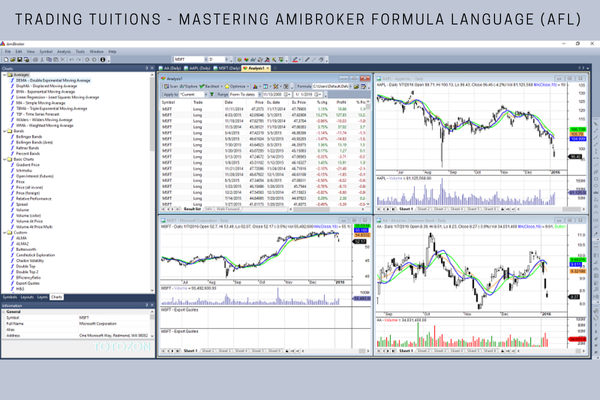

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00 -

×

Shawn Sharma Mentorship Program

1 × $34.00

Shawn Sharma Mentorship Program

1 × $34.00 -

×

Common Sense Commodities with David Duty

1 × $6.00

Common Sense Commodities with David Duty

1 × $6.00 -

×

Marber on Markets – How to Make Money from Charts with Brian Marber

1 × $6.00

Marber on Markets – How to Make Money from Charts with Brian Marber

1 × $6.00 -

×

Forex Trading Advice & Intro to The Natural Flow

1 × $6.00

Forex Trading Advice & Intro to The Natural Flow

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

6 (The Proper BackGround)

1 × $6.00

6 (The Proper BackGround)

1 × $6.00 -

×

Fractal Market Analysis with Edgar Peters

1 × $6.00

Fractal Market Analysis with Edgar Peters

1 × $6.00 -

×

Buy, Sell or Hold Manage Your Portfolio for Maximum Gain with Michaal Thomsett

1 × $6.00

Buy, Sell or Hold Manage Your Portfolio for Maximum Gain with Michaal Thomsett

1 × $6.00 -

×

Volatility Position Risk Management with Cynthia Kase

1 × $6.00

Volatility Position Risk Management with Cynthia Kase

1 × $6.00 -

×

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00 -

×

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00 -

×

AG Trading Journal with Ace Gazette

1 × $6.00

AG Trading Journal with Ace Gazette

1 × $6.00 -

×

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00 -

×

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00 -

×

Predicting Market Trends with Alan S.Farley

1 × $6.00

Predicting Market Trends with Alan S.Farley

1 × $6.00 -

×

Complete Set of Members Area Files

1 × $6.00

Complete Set of Members Area Files

1 × $6.00 -

×

Qualitative - Financial Statement Analysis with Sandesh Banger

1 × $5.00

Qualitative - Financial Statement Analysis with Sandesh Banger

1 × $5.00 -

×

Complete 32+ Hour Video Training Course 2008

1 × $23.00

Complete 32+ Hour Video Training Course 2008

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Access All Areas with Marwood Research

1 × $54.00

Access All Areas with Marwood Research

1 × $54.00 -

×

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00 -

×

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00 -

×

The Taylor Trading Technique with G.Douglas Taylor

1 × $6.00

The Taylor Trading Technique with G.Douglas Taylor

1 × $6.00 -

×

Evidence Based Technical Analysis with David Aronson

1 × $6.00

Evidence Based Technical Analysis with David Aronson

1 × $6.00 -

×

Traders Positioning System with Lee Gettess

1 × $4.00

Traders Positioning System with Lee Gettess

1 × $4.00 -

×

Trading the Moves - Consistent Gains in All Markets with Ed Downs

1 × $6.00

Trading the Moves - Consistent Gains in All Markets with Ed Downs

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

VWAP Trading course with Trade With Trend

1 × $6.00

VWAP Trading course with Trade With Trend

1 × $6.00 -

×

Swing Trading College IX 2010 with Larry Connors

1 × $15.00

Swing Trading College IX 2010 with Larry Connors

1 × $15.00 -

×

Option Income Stream System 2004

1 × $6.00

Option Income Stream System 2004

1 × $6.00 -

×

Candlestick Trading Forum Trading Seminar with Stephen W.Bigalow

1 × $4.00

Candlestick Trading Forum Trading Seminar with Stephen W.Bigalow

1 × $4.00 -

×

How to Trade Options 101 2021 with The Travel Trader

1 × $54.00

How to Trade Options 101 2021 with The Travel Trader

1 × $54.00 -

×

Mastering High Probability Chart Reading Methods with John Murphy

1 × $6.00

Mastering High Probability Chart Reading Methods with John Murphy

1 × $6.00 -

×

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00 -

×

Active Trading Course Notes with Alan Hull

1 × $6.00

Active Trading Course Notes with Alan Hull

1 × $6.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

The Binary Trigger (Video, Books) with John Piper

1 × $6.00

The Binary Trigger (Video, Books) with John Piper

1 × $6.00 -

×

Dynamite TNT Forex System with Clarence Chee

1 × $6.00

Dynamite TNT Forex System with Clarence Chee

1 × $6.00 -

×

Catching the Bounce

1 × $6.00

Catching the Bounce

1 × $6.00 -

×

A Convicted Stock Manipulators Guide to Investing with Marino Specogna

1 × $6.00

A Convicted Stock Manipulators Guide to Investing with Marino Specogna

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00 -

×

Forex Trading Course with Mike Norman

1 × $17.00

Forex Trading Course with Mike Norman

1 × $17.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Earnings Engine with Sami Abusaad - T3 Live

1 × $6.00

Earnings Engine with Sami Abusaad - T3 Live

1 × $6.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

Superstructure Trading - 5 DVDs + Manual + 1 BONUS DVD 2010 Live Trading Webinars with Ken Chow

1 × $6.00

Superstructure Trading - 5 DVDs + Manual + 1 BONUS DVD 2010 Live Trading Webinars with Ken Chow

1 × $6.00 -

×

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00 -

×

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

Duxinator: High Odds Penny Trading Presented with Steven Dux

1 × $6.00

Duxinator: High Odds Penny Trading Presented with Steven Dux

1 × $6.00 -

×

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00 -

×

Simple Smart Forex Renko Program with Nikos Mermigas

1 × $10.00

Simple Smart Forex Renko Program with Nikos Mermigas

1 × $10.00 -

×

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00

A Mathematician Plays The Stock Market with John Allen Paulos

1 × $6.00 -

×

Acclimation Course with Base Camp Trading

1 × $10.00

Acclimation Course with Base Camp Trading

1 × $10.00 -

×

Advanced Forex Mastery Course with Alpha Forex Global

1 × $5.00

Advanced Forex Mastery Course with Alpha Forex Global

1 × $5.00 -

×

TraderSumo Academy Course

1 × $13.00

TraderSumo Academy Course

1 × $13.00 -

×

Investing Classroom 2022 with Danny Devan

1 × $15.00

Investing Classroom 2022 with Danny Devan

1 × $15.00 -

×

Valuation of Internet & Technology Stocks with Brian Kettell

1 × $6.00

Valuation of Internet & Technology Stocks with Brian Kettell

1 × $6.00 -

×

The Hedge Bundle - SpotGamma Academy with Imran Lakha

1 × $8.00

The Hedge Bundle - SpotGamma Academy with Imran Lakha

1 × $8.00 -

×

Advanced Option Trading with Broken Wing Butterflys with Greg Loehr

1 × $9.00

Advanced Option Trading with Broken Wing Butterflys with Greg Loehr

1 × $9.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Bond Book (2nd Ed.) with Annette Thau

1 × $6.00

The Bond Book (2nd Ed.) with Annette Thau

1 × $6.00 -

×

Trading Trainer - 6 Percent Protocol

1 × $39.00

Trading Trainer - 6 Percent Protocol

1 × $39.00 -

×

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00 -

×

Square The Range Trading System with Michael Jenkins

1 × $6.00

Square The Range Trading System with Michael Jenkins

1 × $6.00 -

×

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00 -

×

Advanced Calculus with Applications in Statistics

1 × $6.00

Advanced Calculus with Applications in Statistics

1 × $6.00 -

×

Build a Professional Trading System using Amibroker with Trading Tuitions - Marwood Research

1 × $23.00

Build a Professional Trading System using Amibroker with Trading Tuitions - Marwood Research

1 × $23.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

Cycle Hunter Support with Brian James Sklenka

1 × $6.00

Cycle Hunter Support with Brian James Sklenka

1 × $6.00 -

×

Markets In Motion with Ned Davis

1 × $6.00

Markets In Motion with Ned Davis

1 × $6.00 -

×

TradingMind Course with Jack Bernstein

1 × $6.00

TradingMind Course with Jack Bernstein

1 × $6.00 -

×

Basic of Market Astrophisics with Hans Hannula

1 × $6.00

Basic of Market Astrophisics with Hans Hannula

1 × $6.00 -

×

Quantifiable Edges - 3 Course Bundle

1 × $31.00

Quantifiable Edges - 3 Course Bundle

1 × $31.00 -

×

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00 -

×

Price Action Trading Volume 1 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 1 with Fractal Flow Pro

1 × $6.00 -

×

Trading Masterclass POTM + PFTM + PTMI with Anton Kreil

1 × $6.00

Trading Masterclass POTM + PFTM + PTMI with Anton Kreil

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00

Delta Neutral Funding with Bitcoin Trading Practice

$500.00 Original price was: $500.00.$6.00Current price is: $6.00.

File Size: 4.51 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Delta Neutral Funding with Bitcoin Trading Practice” below:

Delta Neutral Funding with Bitcoin Trading Practice

Introduction

In the ever-evolving world of cryptocurrency trading, Delta Neutral funding strategies have become a cornerstone for traders looking to minimize risk while capitalizing on the volatile Bitcoin market. This approach is particularly compelling for those seeking to benefit from market inefficiencies without exposing themselves to the wild price swings typical of cryptocurrencies.

Understanding Delta Neutral Funding

What is Delta Neutral?

Delta Neutral is a strategy used in trading to create options portfolios that are not sensitive to changes in the price of the underlying asset. The goal is to balance positive and negative deltas so that the overall delta of the assets in question totals zero.

Applying Delta Neutral to Bitcoin

In the context of Bitcoin, Delta Neutral strategies involve combining futures and options to hedge against price movements, aiming to profit from volatility or time decay instead of price changes.

Benefits of Delta Neutral Trading

Reduced Risk

- Market Volatility: Shields investors from significant impacts due to market volatility.

- Price Swings: Neutralizes the effect of major price swings on investment.

Enhanced Opportunities

- Arbitrage: Exploits discrepancies between market prices for profit.

- Efficiency: Improves the efficiency of trading and investment strategies.

Getting Started with Delta Neutral

Essential Tools and Platforms

Choosing the right tools and platforms is critical for implementing effective Delta Neutral strategies in Bitcoin trading.

Key Considerations

- Risk Assessment: Understand the risks associated with options and futures trading.

- Capital Requirements: Evaluate the amount of capital needed to effectively engage in Delta Neutral trading.

Implementing Delta Neutral in Bitcoin Trading

Step-by-Step Guide

- Identify Opportunities: Look for price inefficiencies across different markets.

- Set Up Trades: Establish positions in futures and options that balance each other out.

- Monitor and Adjust: Continuously monitor the market and adjust positions to maintain balance.

Practical Examples

- Case Study: Detailed analysis of a successful Delta Neutral trade in the Bitcoin market.

Advanced Techniques

Integrating Quantitative Analysis

Utilizing quantitative methods can enhance the precision of Delta Neutral strategies, making adjustments based on mathematical models.

Algorithmic Trading

- Automation: Use algorithmic trading systems to automate the process of adjusting Delta Neutral positions.

Challenges and Solutions

Market Dynamics

Understanding the unique challenges of the Bitcoin market is essential for successfully implementing Delta Neutral strategies.

Mitigation Strategies

- Continuous Learning: Stay updated with market trends and potential regulatory changes.

- Expert Advice: Seek advice from seasoned traders who specialize in Delta Neutral strategies.

The Future of Delta Neutral Trading

Trends and Predictions

Exploring how Delta Neutral strategies might evolve with advancements in technology and changes in market conditions.

Adapting to Market Changes

How traders can adapt their Delta Neutral strategies to remain effective in the dynamic cryptocurrency market.

Conclusion

Delta Neutral funding provides a robust framework for traders aiming to exploit the inherent volatility of the Bitcoin market while mitigating risk. By balancing the deltas of various trading instruments, traders can maintain a neutral exposure to price movements, focusing instead on other profit-generating strategies such as volatility and time decay.

Frequently Asked Questions

- What is the primary benefit of using a Delta Neutral strategy in Bitcoin trading?

- It allows traders to reduce exposure to price fluctuations and focus on profiting from volatility and time decay.

- How much capital is required to start using Delta Neutral strategies?

- The capital requirement can vary widely depending on the scale and specific approaches used in trading.

- Can Delta Neutral strategies be automated?

- Yes, many traders use algorithmic trading systems to automate their Delta Neutral strategies, enhancing efficiency and precision.

- What are the main challenges of Delta Neutral trading?

- Key challenges include maintaining the balance of deltas in rapidly changing markets and understanding complex financial instruments.

- Where can I learn more about Delta Neutral strategies?

- Many online trading platforms and financial education websites offer courses and resources on Delta Neutral trading.

Be the first to review “Delta Neutral Funding with Bitcoin Trading Practice” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.