-

×

Equities with Peter Martin

1 × $6.00

Equities with Peter Martin

1 × $6.00 -

×

FasTrack Premium with Note Conference

1 × $78.00

FasTrack Premium with Note Conference

1 × $78.00 -

×

The Unified Theory of Markets with Earik Beann

1 × $79.00

The Unified Theory of Markets with Earik Beann

1 × $79.00 -

×

Spartan Renko 2.0 Workshop 2017

1 × $23.00

Spartan Renko 2.0 Workshop 2017

1 × $23.00 -

×

AbleTrend with John Wang & Grace Wang

1 × $6.00

AbleTrend with John Wang & Grace Wang

1 × $6.00 -

×

Forex Candlestick System. High Profit Forex Trading with B.M.Davis

1 × $6.00

Forex Candlestick System. High Profit Forex Trading with B.M.Davis

1 × $6.00 -

×

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00 -

×

An Introduction to Market Risk Measurement with Kevin Dowd

1 × $6.00

An Introduction to Market Risk Measurement with Kevin Dowd

1 × $6.00 -

×

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00 -

×

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00 -

×

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00 -

×

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00 -

×

The Litle Book of Bulletproof Investing

1 × $6.00

The Litle Book of Bulletproof Investing

1 × $6.00 -

×

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00 -

×

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00 -

×

Candlestick Charts with Clive Lambert

1 × $6.00

Candlestick Charts with Clive Lambert

1 × $6.00 -

×

CBOT Seminar on Market Profile (101 & 102) with Alex Benjamin

1 × $6.00

CBOT Seminar on Market Profile (101 & 102) with Alex Benjamin

1 × $6.00 -

×

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00 -

×

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00 -

×

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00 -

×

CFA Level 3- Examination Morning Session – Essay (2004)

1 × $6.00

CFA Level 3- Examination Morning Session – Essay (2004)

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Smart Money Trading Course with Prosperity Academy

1 × $5.00

Smart Money Trading Course with Prosperity Academy

1 × $5.00 -

×

3 Volatility Strategies with Quantified Strategies

1 × $23.00

3 Volatility Strategies with Quantified Strategies

1 × $23.00 -

×

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00 -

×

ProfileTraders - 5 course bundle

1 × $23.00

ProfileTraders - 5 course bundle

1 × $23.00 -

×

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00

3 Short Selling Strategies - Trading Strategy Bundles – Quantified Strategies

1 × $39.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00 -

×

Forex Education Trading System (Video 469 MB)

1 × $23.00

Forex Education Trading System (Video 469 MB)

1 × $23.00 -

×

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00 -

×

Profitable Strategies with Gemify Academy

1 × $10.00

Profitable Strategies with Gemify Academy

1 × $10.00 -

×

Day Trader Course

1 × $6.00

Day Trader Course

1 × $6.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

Master The Markets 2.0 with French Trader

1 × $6.00

Master The Markets 2.0 with French Trader

1 × $6.00 -

×

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Technical Analysis for Long-Term Investors with Clay Allen

1 × $6.00

Technical Analysis for Long-Term Investors with Clay Allen

1 × $6.00 -

×

How to Lose Money Profitably with Mark D.Cook

1 × $6.00

How to Lose Money Profitably with Mark D.Cook

1 × $6.00 -

×

TradeWithChris - TWC Forex Trading Course

1 × $6.00

TradeWithChris - TWC Forex Trading Course

1 × $6.00 -

×

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00 -

×

Hedge Fund Market Wizards: How Winning Traders Win with Jack Schwager

1 × $6.00

Hedge Fund Market Wizards: How Winning Traders Win with Jack Schwager

1 × $6.00 -

×

Forecast 2012 Report with Larry Williams

1 × $6.00

Forecast 2012 Report with Larry Williams

1 × $6.00 -

×

TraderSumo Academy Course

1 × $13.00

TraderSumo Academy Course

1 × $13.00 -

×

Forex Retracement Theory with CopperChips

1 × $6.00

Forex Retracement Theory with CopperChips

1 × $6.00 -

×

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00

Technical Analysis 101: A Comprehensive Guide to Becoming a Better Trader Class with Jeff Bierman

1 × $6.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00 -

×

The Delphi Scalper 4 (delphiscalper.com) with Jason Fielder

1 × $6.00

The Delphi Scalper 4 (delphiscalper.com) with Jason Fielder

1 × $6.00 -

×

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00 -

×

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00 -

×

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00 -

×

The Correlation Code with Jason Fielder

1 × $6.00

The Correlation Code with Jason Fielder

1 × $6.00 -

×

Secrets of the Darvas Trading System

1 × $6.00

Secrets of the Darvas Trading System

1 × $6.00 -

×

Indicator Companion for Metastock with Martin Pring

1 × $6.00

Indicator Companion for Metastock with Martin Pring

1 × $6.00 -

×

The Option Pit VIX Primer

1 × $31.00

The Option Pit VIX Primer

1 × $31.00 -

×

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00 -

×

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00 -

×

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00 -

×

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00 -

×

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00 -

×

A+ Setups Big Caps Options with Jtrader

1 × $6.00

A+ Setups Big Caps Options with Jtrader

1 × $6.00 -

×

ENG Renko Mastery with International Scalpers

1 × $10.00

ENG Renko Mastery with International Scalpers

1 × $10.00 -

×

Sure Fire Forex Trading with Mark McRae

1 × $6.00

Sure Fire Forex Trading with Mark McRae

1 × $6.00 -

×

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00 -

×

Active Trading Course Notes with Alan Hull

1 × $6.00

Active Trading Course Notes with Alan Hull

1 × $6.00 -

×

Technical Analysis for Short-Term Traders

1 × $6.00

Technical Analysis for Short-Term Traders

1 × $6.00 -

×

GANNacci Code Elite + Training Course

1 × $31.00

GANNacci Code Elite + Training Course

1 × $31.00 -

×

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00 -

×

Forex Master Method Evolution with Russ Horn

1 × $6.00

Forex Master Method Evolution with Russ Horn

1 × $6.00 -

×

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00 -

×

Researching your Trade

1 × $6.00

Researching your Trade

1 × $6.00 -

×

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00 -

×

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00 -

×

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

Million Dollar Stock Market Idea with Larry Williams

1 × $6.00

Million Dollar Stock Market Idea with Larry Williams

1 × $6.00 -

×

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00

Fibonnacci Trader WorkShop (Video 2.38 GB) with Dennis Bolze, Thom Hartle

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00

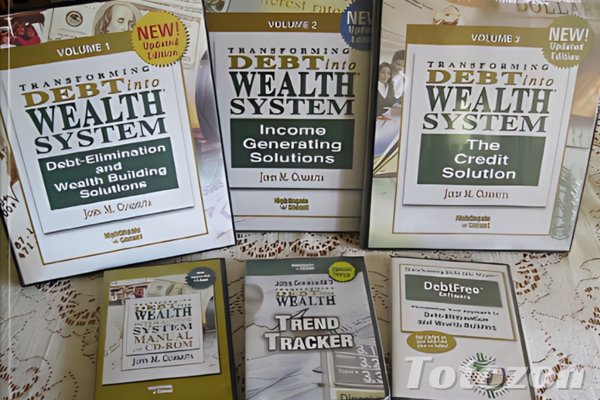

Transforming Debt into Wealth System with John Cummuta

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Transforming Debt into Wealth System with John Cummuta” below:

Transforming Debt into Wealth System with John Cummuta

Debt can feel like an insurmountable obstacle, but John Cummuta’s “Transforming Debt into Wealth” system offers a roadmap to financial freedom. In this article, we will explore the key principles and strategies of this system, designed to help you eliminate debt and build wealth effectively.

Introduction to John Cummuta’s System

Who is John Cummuta?

John Cummuta is a financial expert renowned for his innovative approach to personal finance. His system focuses on transforming debt into wealth through disciplined financial strategies.

What is the Transforming Debt into Wealth System?

This system is a comprehensive program that guides individuals on how to pay off debts rapidly and start building wealth. It emphasizes budgeting, smart spending, and strategic investing.

Core Principles of the System

The Power of Budgeting

Budgeting is the cornerstone of Cummuta’s system. By tracking income and expenses, you can identify areas to cut costs and allocate more funds towards debt repayment.

Debt Snowball Method

The debt snowball method involves paying off the smallest debts first while making minimum payments on larger ones. This approach builds momentum and encourages continued progress.

Living Below Your Means

Adopting a frugal lifestyle helps free up additional resources to tackle debt and save for the future. This involves making conscious spending choices and avoiding unnecessary purchases.

Steps to Transform Debt into Wealth

1. Assess Your Financial Situation

Begin by taking a comprehensive look at your current financial status. List all debts, income sources, and monthly expenses.

2. Create a Detailed Budget

Develop a realistic budget that includes all your income and expenses. Ensure you allocate funds for debt repayment and savings.

3. Prioritize Debts

Rank your debts from smallest to largest and focus on paying off the smallest debt first. This method boosts motivation as you see quick results.

4. Cut Unnecessary Expenses

Identify and eliminate non-essential expenses. Redirect these funds towards paying off debts and building an emergency fund.

5. Increase Your Income

Look for opportunities to boost your income, such as part-time jobs, freelance work, or selling unused items.

6. Pay Off Debts Aggressively

Use any extra income to pay down your debts faster. The quicker you eliminate debt, the sooner you can start saving and investing.

Building Wealth After Debt

Establish an Emergency Fund

Once debts are cleared, focus on building an emergency fund. Aim for three to six months’ worth of living expenses.

Invest Wisely

Start investing in assets that generate passive income. Consider stocks, bonds, real estate, or retirement accounts.

Automate Savings

Set up automatic transfers to your savings and investment accounts. This ensures consistent contributions and reduces the temptation to spend.

Common Pitfalls and How to Avoid Them

Ignoring the Budget

Sticking to a budget is crucial. Regularly review and adjust your budget to stay on track with your financial goals.

Accumulating More Debt

Avoid taking on new debt while paying off existing debts. Focus on living within your means and saving for purchases instead.

Lack of Emergency Fund

Not having an emergency fund can derail your financial progress. Prioritize building this fund to cover unexpected expenses.

Benefits of the Transforming Debt into Wealth System

Financial Freedom

Eliminating debt provides a sense of financial freedom and reduces stress. You can focus on building wealth and achieving long-term goals.

Increased Savings

With no debt payments, you can allocate more money towards savings and investments, accelerating your path to wealth.

Improved Financial Habits

Following this system helps develop disciplined financial habits that benefit you in the long run.

Conclusion

John Cummuta’s “Transforming Debt into Wealth” system offers a practical and effective approach to achieving financial independence. By following the steps outlined in this article, you can take control of your finances, eliminate debt, and start building wealth.

FAQs

1. How does the debt snowball method work?

The debt snowball method focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation to tackle larger debts.

2. What should be included in a budget?

A budget should include all sources of income and all expenses, both fixed and variable. It should also allocate funds for debt repayment and savings.

3. Why is an emergency fund important?

An emergency fund provides financial security by covering unexpected expenses, preventing the need to take on new debt.

4. How can I increase my income to pay off debt faster?

Consider part-time jobs, freelance work, or selling unused items to generate extra income that can be used for debt repayment.

5. What are some smart investment options after paying off debt?

Consider investing in stocks, bonds, real estate, or retirement accounts to build wealth and generate passive income.

Be the first to review “Transforming Debt into Wealth System with John Cummuta” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.