-

×

MTA Master Trader Academy with Junior Charles

1 × $5.00

MTA Master Trader Academy with Junior Charles

1 × $5.00 -

×

Rockwell Day Trading - Starter Package

1 × $6.00

Rockwell Day Trading - Starter Package

1 × $6.00 -

×

Main Online Course with Cue Banks

1 × $90.00

Main Online Course with Cue Banks

1 × $90.00 -

×

Video Bundle - 4d & "Into The Abyss" with Blackrabbitfx

1 × $6.00

Video Bundle - 4d & "Into The Abyss" with Blackrabbitfx

1 × $6.00 -

×

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00 -

×

The Age of Turbulence with Alan Greenspan

1 × $6.00

The Age of Turbulence with Alan Greenspan

1 × $6.00 -

×

Exclusive Footprint and Market Profile with Adam Set

1 × $5.00

Exclusive Footprint and Market Profile with Adam Set

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Mutual Funds for Dummies (6th edition) with Eric Tyson

1 × $6.00

Mutual Funds for Dummies (6th edition) with Eric Tyson

1 × $6.00 -

×

Tradingriot Bootcamp + Blueprint 3.0

1 × $6.00

Tradingriot Bootcamp + Blueprint 3.0

1 × $6.00 -

×

Random Walk Trading Options Professional

1 × $31.00

Random Walk Trading Options Professional

1 × $31.00 -

×

Real Trade Examples Volume 1 with Steve Burns

1 × $15.00

Real Trade Examples Volume 1 with Steve Burns

1 × $15.00 -

×

Patterns to Profits with Ryan Mallory - Share Planner

1 × $6.00

Patterns to Profits with Ryan Mallory - Share Planner

1 × $6.00 -

×

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00 -

×

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00 -

×

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00 -

×

Forex Education Trading System (Video 469 MB)

1 × $23.00

Forex Education Trading System (Video 469 MB)

1 × $23.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00 -

×

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00 -

×

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00 -

×

Out of the Pits with Caitlin Zaloom

1 × $6.00

Out of the Pits with Caitlin Zaloom

1 × $6.00 -

×

Secret Day - Swing Trading Strategy For Stock, Forex, Crypto with Value Stocks

1 × $5.00

Secret Day - Swing Trading Strategy For Stock, Forex, Crypto with Value Stocks

1 × $5.00 -

×

Price Action Trading Volume 1 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 1 with Fractal Flow Pro

1 × $6.00 -

×

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00 -

×

Rapid Results Method with Russ Horn

1 × $6.00

Rapid Results Method with Russ Horn

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Imperial FX Academy

1 × $5.00

Imperial FX Academy

1 × $5.00 -

×

How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge

1 × $6.00

How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge

1 × $6.00 -

×

Pristine - Trading the Pristine Method 2

1 × $6.00

Pristine - Trading the Pristine Method 2

1 × $6.00 -

×

Spyglass LSS Day Trading Workshop

1 × $15.00

Spyglass LSS Day Trading Workshop

1 × $15.00 -

×

QuickBooks 2003 Official Guide

1 × $6.00

QuickBooks 2003 Official Guide

1 × $6.00 -

×

Scalping the Forex

1 × $6.00

Scalping the Forex

1 × $6.00 -

×

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00 -

×

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00 -

×

New York Institute of Finance – Futures. A Personal Seminar

1 × $6.00

New York Institute of Finance – Futures. A Personal Seminar

1 × $6.00 -

×

From Zero to Trading e-Book with Jermaine McGruder

1 × $15.00

From Zero to Trading e-Book with Jermaine McGruder

1 × $15.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Activedaytrader - Bond Trading Bootcamp

1 × $8.00

Activedaytrader - Bond Trading Bootcamp

1 × $8.00 -

×

Surplus Trader Secrets Masterclass Coaching Program

1 × $6.00

Surplus Trader Secrets Masterclass Coaching Program

1 × $6.00 -

×

Hedge Fund Alpha with John Longo - World Scientific

1 × $6.00

Hedge Fund Alpha with John Longo - World Scientific

1 × $6.00 -

×

Options Made Easy: Learn to Trade Stock Options

1 × $6.00

Options Made Easy: Learn to Trade Stock Options

1 × $6.00 -

×

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00 -

×

How to Trade in Stocks

1 × $6.00

How to Trade in Stocks

1 × $6.00 -

×

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00 -

×

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00 -

×

Seven Trading Systems for The S&P Futures with David Bean

1 × $6.00

Seven Trading Systems for The S&P Futures with David Bean

1 × $6.00 -

×

Long Term Investing Strategies for Maximizing Returns with Lerone Bleasdille

1 × $5.00

Long Term Investing Strategies for Maximizing Returns with Lerone Bleasdille

1 × $5.00 -

×

Harmonic Vibrations with Larry Pesavento

1 × $6.00

Harmonic Vibrations with Larry Pesavento

1 × $6.00 -

×

Pips&Profit Trading Course

1 × $13.00

Pips&Profit Trading Course

1 × $13.00 -

×

Investment Madness with John Nofsinger

1 × $6.00

Investment Madness with John Nofsinger

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Trading for a Living with Alexander Elder

1 × $6.00

Trading for a Living with Alexander Elder

1 × $6.00 -

×

OTC Oracle Course - PENNY WHALE with Simple Trade

1 × $31.00

OTC Oracle Course - PENNY WHALE with Simple Trade

1 × $31.00 -

×

High Probability Patterns and Rule Based Trading with Jake Bernstein

1 × $6.00

High Probability Patterns and Rule Based Trading with Jake Bernstein

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Trading as a Business with Alexander Elder

1 × $6.00

Trading as a Business with Alexander Elder

1 × $6.00 -

×

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00 -

×

Oportunities in Forex Calendar Trading Patterns with Anduril Analytics

1 × $6.00

Oportunities in Forex Calendar Trading Patterns with Anduril Analytics

1 × $6.00 -

×

FruitFly For Consistent Income with Matt Williamson

1 × $6.00

FruitFly For Consistent Income with Matt Williamson

1 × $6.00 -

×

Pit Bull with Martin Schwartz

1 × $6.00

Pit Bull with Martin Schwartz

1 × $6.00 -

×

Market Making Scalping Manual with Gary Norden - Jigsaw Trading

1 × $69.00

Market Making Scalping Manual with Gary Norden - Jigsaw Trading

1 × $69.00 -

×

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00 -

×

Latent Curve Models with Kenneth Bollen

1 × $6.00

Latent Curve Models with Kenneth Bollen

1 × $6.00 -

×

Activedaytrader - Workshop: Practical Money Management

1 × $23.00

Activedaytrader - Workshop: Practical Money Management

1 × $23.00 -

×

Elite Trader Package

1 × $31.00

Elite Trader Package

1 × $31.00 -

×

Forex Millionaire Course with Willis University

1 × $6.00

Forex Millionaire Course with Willis University

1 × $6.00 -

×

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00 -

×

AM Trader - Strategy Training Course

1 × $23.00

AM Trader - Strategy Training Course

1 × $23.00 -

×

Mastering Momentum Gaps with Toni Hansen

1 × $6.00

Mastering Momentum Gaps with Toni Hansen

1 × $6.00 -

×

Iconic Trader Program with Urban Forex

1 × $5.00

Iconic Trader Program with Urban Forex

1 × $5.00 -

×

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00 -

×

Get More Leads Quickly with Brittany Lynch

1 × $6.00

Get More Leads Quickly with Brittany Lynch

1 × $6.00 -

×

The New Reality Of Wall Street with Donald Coxe

1 × $6.00

The New Reality Of Wall Street with Donald Coxe

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00

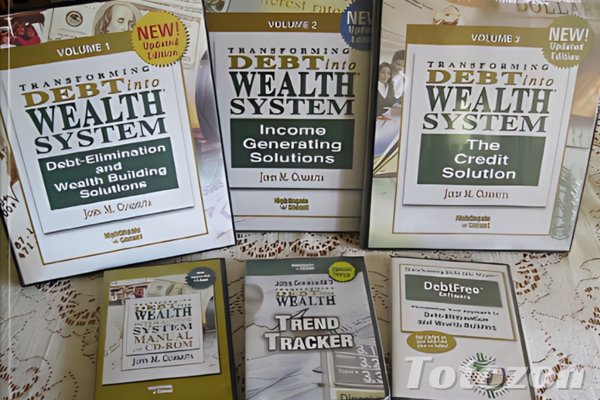

Transforming Debt into Wealth System with John Cummuta

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Transforming Debt into Wealth System with John Cummuta” below:

Transforming Debt into Wealth System with John Cummuta

Debt can feel like an insurmountable obstacle, but John Cummuta’s “Transforming Debt into Wealth” system offers a roadmap to financial freedom. In this article, we will explore the key principles and strategies of this system, designed to help you eliminate debt and build wealth effectively.

Introduction to John Cummuta’s System

Who is John Cummuta?

John Cummuta is a financial expert renowned for his innovative approach to personal finance. His system focuses on transforming debt into wealth through disciplined financial strategies.

What is the Transforming Debt into Wealth System?

This system is a comprehensive program that guides individuals on how to pay off debts rapidly and start building wealth. It emphasizes budgeting, smart spending, and strategic investing.

Core Principles of the System

The Power of Budgeting

Budgeting is the cornerstone of Cummuta’s system. By tracking income and expenses, you can identify areas to cut costs and allocate more funds towards debt repayment.

Debt Snowball Method

The debt snowball method involves paying off the smallest debts first while making minimum payments on larger ones. This approach builds momentum and encourages continued progress.

Living Below Your Means

Adopting a frugal lifestyle helps free up additional resources to tackle debt and save for the future. This involves making conscious spending choices and avoiding unnecessary purchases.

Steps to Transform Debt into Wealth

1. Assess Your Financial Situation

Begin by taking a comprehensive look at your current financial status. List all debts, income sources, and monthly expenses.

2. Create a Detailed Budget

Develop a realistic budget that includes all your income and expenses. Ensure you allocate funds for debt repayment and savings.

3. Prioritize Debts

Rank your debts from smallest to largest and focus on paying off the smallest debt first. This method boosts motivation as you see quick results.

4. Cut Unnecessary Expenses

Identify and eliminate non-essential expenses. Redirect these funds towards paying off debts and building an emergency fund.

5. Increase Your Income

Look for opportunities to boost your income, such as part-time jobs, freelance work, or selling unused items.

6. Pay Off Debts Aggressively

Use any extra income to pay down your debts faster. The quicker you eliminate debt, the sooner you can start saving and investing.

Building Wealth After Debt

Establish an Emergency Fund

Once debts are cleared, focus on building an emergency fund. Aim for three to six months’ worth of living expenses.

Invest Wisely

Start investing in assets that generate passive income. Consider stocks, bonds, real estate, or retirement accounts.

Automate Savings

Set up automatic transfers to your savings and investment accounts. This ensures consistent contributions and reduces the temptation to spend.

Common Pitfalls and How to Avoid Them

Ignoring the Budget

Sticking to a budget is crucial. Regularly review and adjust your budget to stay on track with your financial goals.

Accumulating More Debt

Avoid taking on new debt while paying off existing debts. Focus on living within your means and saving for purchases instead.

Lack of Emergency Fund

Not having an emergency fund can derail your financial progress. Prioritize building this fund to cover unexpected expenses.

Benefits of the Transforming Debt into Wealth System

Financial Freedom

Eliminating debt provides a sense of financial freedom and reduces stress. You can focus on building wealth and achieving long-term goals.

Increased Savings

With no debt payments, you can allocate more money towards savings and investments, accelerating your path to wealth.

Improved Financial Habits

Following this system helps develop disciplined financial habits that benefit you in the long run.

Conclusion

John Cummuta’s “Transforming Debt into Wealth” system offers a practical and effective approach to achieving financial independence. By following the steps outlined in this article, you can take control of your finances, eliminate debt, and start building wealth.

FAQs

1. How does the debt snowball method work?

The debt snowball method focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation to tackle larger debts.

2. What should be included in a budget?

A budget should include all sources of income and all expenses, both fixed and variable. It should also allocate funds for debt repayment and savings.

3. Why is an emergency fund important?

An emergency fund provides financial security by covering unexpected expenses, preventing the need to take on new debt.

4. How can I increase my income to pay off debt faster?

Consider part-time jobs, freelance work, or selling unused items to generate extra income that can be used for debt repayment.

5. What are some smart investment options after paying off debt?

Consider investing in stocks, bonds, real estate, or retirement accounts to build wealth and generate passive income.

Be the first to review “Transforming Debt into Wealth System with John Cummuta” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.