-

×

Daily Price Action

1 × $23.00

Daily Price Action

1 × $23.00 -

×

501 Stock Market Tips & Guidelines with Arshad Khan

1 × $6.00

501 Stock Market Tips & Guidelines with Arshad Khan

1 × $6.00 -

×

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00 -

×

QuickBooks 2003 Official Guide

1 × $6.00

QuickBooks 2003 Official Guide

1 × $6.00 -

×

Patterns of Speculation with Bertrand M.Roehner

1 × $6.00

Patterns of Speculation with Bertrand M.Roehner

1 × $6.00 -

×

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00 -

×

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00 -

×

ICT Mentorship – 2019

1 × $13.00

ICT Mentorship – 2019

1 × $13.00 -

×

Futures Trading (German)

1 × $6.00

Futures Trading (German)

1 × $6.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

Evolution Course with Kevin Trades

1 × $15.00

Evolution Course with Kevin Trades

1 × $15.00 -

×

Exploring MetaStock Basic with Martin Pring

1 × $6.00

Exploring MetaStock Basic with Martin Pring

1 × $6.00 -

×

VXX Made Easy By Option Pit

1 × $62.00

VXX Made Easy By Option Pit

1 × $62.00 -

×

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00 -

×

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00 -

×

BWT Precision 7.0.2.3 (bluewavetrading.com)

1 × $31.00

BWT Precision 7.0.2.3 (bluewavetrading.com)

1 × $31.00 -

×

New Generation Market Profile (May 2014)

1 × $15.00

New Generation Market Profile (May 2014)

1 × $15.00 -

×

Stock Trader`s Almanac 2012 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00

Stock Trader`s Almanac 2012 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00 -

×

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00 -

×

Handbook on the Knowledge Economy with David Rooney

1 × $6.00

Handbook on the Knowledge Economy with David Rooney

1 × $6.00 -

×

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00 -

×

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00 -

×

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Gillen Predicts with Jack Gillen

1 × $6.00

Gillen Predicts with Jack Gillen

1 × $6.00 -

×

Yes You Can Time the Market! with Ben Stein

1 × $6.00

Yes You Can Time the Market! with Ben Stein

1 × $6.00 -

×

Forecast 2012 Report with Larry Williams

1 × $6.00

Forecast 2012 Report with Larry Williams

1 × $6.00 -

×

Manage By The Greeks 2016 with Sheridan

1 × $6.00

Manage By The Greeks 2016 with Sheridan

1 × $6.00 -

×

Advanced Management Strategies - Home Study with Pristine Capital

1 × $27.00

Advanced Management Strategies - Home Study with Pristine Capital

1 × $27.00 -

×

Trading Non-Farm Payroll Report

1 × $6.00

Trading Non-Farm Payroll Report

1 × $6.00 -

×

Confidence to Hypnotize

1 × $6.00

Confidence to Hypnotize

1 × $6.00 -

×

The Bare Essentials Of Investing: Teaching The Horse To Talk with Harold Bierman

1 × $6.00

The Bare Essentials Of Investing: Teaching The Horse To Talk with Harold Bierman

1 × $6.00 -

×

Investment Philosophies

1 × $6.00

Investment Philosophies

1 × $6.00 -

×

Lee Gettess’s Package

1 × $6.00

Lee Gettess’s Package

1 × $6.00 -

×

ICT Trading Models with The Prop Trader

1 × $5.00

ICT Trading Models with The Prop Trader

1 × $5.00 -

×

Elite Trader Package

1 × $31.00

Elite Trader Package

1 × $31.00 -

×

Forex Mentor 2007 with Peter Bain

1 × $6.00

Forex Mentor 2007 with Peter Bain

1 × $6.00 -

×

Latent Curve Models with Kenneth Bollen

1 × $6.00

Latent Curve Models with Kenneth Bollen

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Forex Time Machine with Bill Poulos

1 × $6.00

Forex Time Machine with Bill Poulos

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00

Planting Landmines for Explosive Profits with Dave Slingshot

1 × $6.00 -

×

Fibonacci Swing Trader 2.0 with Frank Paul - Forexmentor

1 × $6.00

Fibonacci Swing Trader 2.0 with Frank Paul - Forexmentor

1 × $6.00 -

×

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00 -

×

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00 -

×

Pentagonal Time Cycle Theory

1 × $6.00

Pentagonal Time Cycle Theory

1 × $6.00 -

×

Market Neutral Strategies with Bruce I.Jacobs & Kenneth N.Levy

1 × $6.00

Market Neutral Strategies with Bruce I.Jacobs & Kenneth N.Levy

1 × $6.00 -

×

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00 -

×

Access All Areas with Marwood Research

1 × $54.00

Access All Areas with Marwood Research

1 × $54.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00 -

×

Trading Floor Training

1 × $6.00

Trading Floor Training

1 × $6.00 -

×

TenfoldFX Academy Course with Kenneth John

1 × $17.00

TenfoldFX Academy Course with Kenneth John

1 × $17.00 -

×

Volatility Position Risk Management with Cynthia Kase

1 × $6.00

Volatility Position Risk Management with Cynthia Kase

1 × $6.00 -

×

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00 -

×

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00 -

×

Forex & Fibonacci Day Trading Seminar - $695

1 × $6.00

Forex & Fibonacci Day Trading Seminar - $695

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00

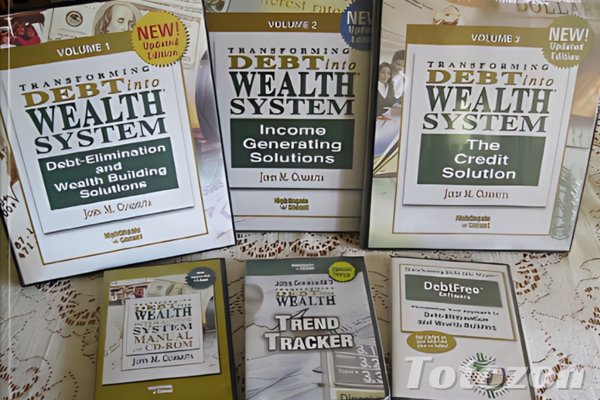

Transforming Debt into Wealth System with John Cummuta

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Transforming Debt into Wealth System with John Cummuta” below:

Transforming Debt into Wealth System with John Cummuta

Debt can feel like an insurmountable obstacle, but John Cummuta’s “Transforming Debt into Wealth” system offers a roadmap to financial freedom. In this article, we will explore the key principles and strategies of this system, designed to help you eliminate debt and build wealth effectively.

Introduction to John Cummuta’s System

Who is John Cummuta?

John Cummuta is a financial expert renowned for his innovative approach to personal finance. His system focuses on transforming debt into wealth through disciplined financial strategies.

What is the Transforming Debt into Wealth System?

This system is a comprehensive program that guides individuals on how to pay off debts rapidly and start building wealth. It emphasizes budgeting, smart spending, and strategic investing.

Core Principles of the System

The Power of Budgeting

Budgeting is the cornerstone of Cummuta’s system. By tracking income and expenses, you can identify areas to cut costs and allocate more funds towards debt repayment.

Debt Snowball Method

The debt snowball method involves paying off the smallest debts first while making minimum payments on larger ones. This approach builds momentum and encourages continued progress.

Living Below Your Means

Adopting a frugal lifestyle helps free up additional resources to tackle debt and save for the future. This involves making conscious spending choices and avoiding unnecessary purchases.

Steps to Transform Debt into Wealth

1. Assess Your Financial Situation

Begin by taking a comprehensive look at your current financial status. List all debts, income sources, and monthly expenses.

2. Create a Detailed Budget

Develop a realistic budget that includes all your income and expenses. Ensure you allocate funds for debt repayment and savings.

3. Prioritize Debts

Rank your debts from smallest to largest and focus on paying off the smallest debt first. This method boosts motivation as you see quick results.

4. Cut Unnecessary Expenses

Identify and eliminate non-essential expenses. Redirect these funds towards paying off debts and building an emergency fund.

5. Increase Your Income

Look for opportunities to boost your income, such as part-time jobs, freelance work, or selling unused items.

6. Pay Off Debts Aggressively

Use any extra income to pay down your debts faster. The quicker you eliminate debt, the sooner you can start saving and investing.

Building Wealth After Debt

Establish an Emergency Fund

Once debts are cleared, focus on building an emergency fund. Aim for three to six months’ worth of living expenses.

Invest Wisely

Start investing in assets that generate passive income. Consider stocks, bonds, real estate, or retirement accounts.

Automate Savings

Set up automatic transfers to your savings and investment accounts. This ensures consistent contributions and reduces the temptation to spend.

Common Pitfalls and How to Avoid Them

Ignoring the Budget

Sticking to a budget is crucial. Regularly review and adjust your budget to stay on track with your financial goals.

Accumulating More Debt

Avoid taking on new debt while paying off existing debts. Focus on living within your means and saving for purchases instead.

Lack of Emergency Fund

Not having an emergency fund can derail your financial progress. Prioritize building this fund to cover unexpected expenses.

Benefits of the Transforming Debt into Wealth System

Financial Freedom

Eliminating debt provides a sense of financial freedom and reduces stress. You can focus on building wealth and achieving long-term goals.

Increased Savings

With no debt payments, you can allocate more money towards savings and investments, accelerating your path to wealth.

Improved Financial Habits

Following this system helps develop disciplined financial habits that benefit you in the long run.

Conclusion

John Cummuta’s “Transforming Debt into Wealth” system offers a practical and effective approach to achieving financial independence. By following the steps outlined in this article, you can take control of your finances, eliminate debt, and start building wealth.

FAQs

1. How does the debt snowball method work?

The debt snowball method focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation to tackle larger debts.

2. What should be included in a budget?

A budget should include all sources of income and all expenses, both fixed and variable. It should also allocate funds for debt repayment and savings.

3. Why is an emergency fund important?

An emergency fund provides financial security by covering unexpected expenses, preventing the need to take on new debt.

4. How can I increase my income to pay off debt faster?

Consider part-time jobs, freelance work, or selling unused items to generate extra income that can be used for debt repayment.

5. What are some smart investment options after paying off debt?

Consider investing in stocks, bonds, real estate, or retirement accounts to build wealth and generate passive income.

Be the first to review “Transforming Debt into Wealth System with John Cummuta” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.