-

×

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00 -

×

Renko Profits Accelerator

1 × $15.00

Renko Profits Accelerator

1 × $15.00 -

×

Pablo Order Flow Education with Pablo

1 × $6.00

Pablo Order Flow Education with Pablo

1 × $6.00 -

×

Simple Forex Profits with Rayy Bannzz

1 × $31.00

Simple Forex Profits with Rayy Bannzz

1 × $31.00 -

×

Japenese Candlesticks Charting, Analysis & Trading with Irwin Porter

1 × $6.00

Japenese Candlesticks Charting, Analysis & Trading with Irwin Porter

1 × $6.00 -

×

News FX Strategy with Zain Agha

1 × $6.00

News FX Strategy with Zain Agha

1 × $6.00 -

×

Option Greeks Class with Don Kaufman

1 × $6.00

Option Greeks Class with Don Kaufman

1 × $6.00 -

×

Secret $100k Meeting with Russell Brunson

1 × $6.00

Secret $100k Meeting with Russell Brunson

1 × $6.00 -

×

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00 -

×

How to Trade Better with Larry Williams

1 × $6.00

How to Trade Better with Larry Williams

1 × $6.00 -

×

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00 -

×

Short Swing Trading v6.0 with David Smith

1 × $6.00

Short Swing Trading v6.0 with David Smith

1 × $6.00 -

×

Forex Avenger Trading System with David Curran

1 × $6.00

Forex Avenger Trading System with David Curran

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

HectorTrader.com – Forex Trading Course with Hector DeVille

1 × $6.00

HectorTrader.com – Forex Trading Course with Hector DeVille

1 × $6.00 -

×

Module II - Signature Trades with FX MindShift

1 × $6.00

Module II - Signature Trades with FX MindShift

1 × $6.00 -

×

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00

Professional Level Trading (IPLT) Online Video Series with Anton Kreil

1 × $6.00 -

×

Getting New Insights from Old Indicators with Martin Pring

1 × $6.00

Getting New Insights from Old Indicators with Martin Pring

1 × $6.00 -

×

Learn To Trade with Tori Trades

1 × $8.00

Learn To Trade with Tori Trades

1 × $8.00 -

×

OFA - Intensive Boot Camp 5 Day Course

1 × $6.00

OFA - Intensive Boot Camp 5 Day Course

1 × $6.00 -

×

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00 -

×

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00 -

×

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00

Finding Astrocycles with an Ephemeris - Hans Hannula

1 × $6.00 -

×

Wyckoff Analytics Courses Collection

1 × $27.00

Wyckoff Analytics Courses Collection

1 × $27.00 -

×

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00 -

×

7 Things You MUST Know about Forex Candlesticks

1 × $4.00

7 Things You MUST Know about Forex Candlesticks

1 × $4.00 -

×

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00 -

×

Trade Your Way to Wealth with Bill Kraft

1 × $6.00

Trade Your Way to Wealth with Bill Kraft

1 × $6.00 -

×

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00 -

×

MTI - Trend Trader Course (Feb 2014)

1 × $23.00

MTI - Trend Trader Course (Feb 2014)

1 × $23.00 -

×

Market Maker Strategy Video Course with Fractal Flow Pro

1 × $6.00

Market Maker Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00 -

×

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00 -

×

Activedaytrader - Mastering Technicals

1 × $15.00

Activedaytrader - Mastering Technicals

1 × $15.00 -

×

Wealth Management with Dimitris Chorafas

1 × $6.00

Wealth Management with Dimitris Chorafas

1 × $6.00 -

×

Pattern Picking with Charles Drummond

1 × $6.00

Pattern Picking with Charles Drummond

1 × $6.00 -

×

Market Analysis Companion for Metastock with Martin Pring

1 × $6.00

Market Analysis Companion for Metastock with Martin Pring

1 × $6.00 -

×

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00 -

×

Futures & Options Course with Talkin Options

1 × $15.00

Futures & Options Course with Talkin Options

1 × $15.00 -

×

Market Structure Matters with Haim Bodek

1 × $62.00

Market Structure Matters with Haim Bodek

1 × $62.00 -

×

Stocks & Commodities Magazine S&C on DVD 11.26 (1982-2008)

1 × $6.00

Stocks & Commodities Magazine S&C on DVD 11.26 (1982-2008)

1 × $6.00 -

×

Masterclass 3.0 with RockzFX Academy

1 × $6.00

Masterclass 3.0 with RockzFX Academy

1 × $6.00 -

×

Practical Approach to Trend Following By Rajandran R

1 × $15.00

Practical Approach to Trend Following By Rajandran R

1 × $15.00 -

×

SnD SMC Course

1 × $10.00

SnD SMC Course

1 × $10.00 -

×

High Probability Option Trading - Covered Calls and Credit Spreads

1 × $6.00

High Probability Option Trading - Covered Calls and Credit Spreads

1 × $6.00 -

×

Investment Blunders with John Nofsinger

1 × $6.00

Investment Blunders with John Nofsinger

1 × $6.00 -

×

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00 -

×

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00 -

×

Patterns of Speculation with Bertrand M.Roehner

1 × $6.00

Patterns of Speculation with Bertrand M.Roehner

1 × $6.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

Profit Generating System with Brian Williams

1 × $6.00

Profit Generating System with Brian Williams

1 × $6.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

Examination Book Morning Section (1999)

1 × $6.00

Examination Book Morning Section (1999)

1 × $6.00 -

×

Mind Over Markets

1 × $6.00

Mind Over Markets

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00 -

×

Sell & Sell Short with Alexander Elder

1 × $6.00

Sell & Sell Short with Alexander Elder

1 × $6.00 -

×

War Room Psychology Vol.3 with Trick Trades

1 × $23.00

War Room Psychology Vol.3 with Trick Trades

1 × $23.00 -

×

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00 -

×

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00 -

×

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00 -

×

Tape Reading Big Caps 1 on 1 with Jtrader

1 × $6.00

Tape Reading Big Caps 1 on 1 with Jtrader

1 × $6.00 -

×

Master Forex Fundamentals

1 × $15.00

Master Forex Fundamentals

1 × $15.00 -

×

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00 -

×

Pristine Seminar - Guerrilla Trading Tactics with Oliver Velez

1 × $6.00

Pristine Seminar - Guerrilla Trading Tactics with Oliver Velez

1 × $6.00 -

×

Launchpad Trading

1 × $23.00

Launchpad Trading

1 × $23.00 -

×

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00

Quantitative Trading Systems (1st Edition) with Howard Bandy

1 × $6.00 -

×

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00 -

×

Selected Articles by the Late by George Lindsay

1 × $6.00

Selected Articles by the Late by George Lindsay

1 × $6.00 -

×

Master Trader with InvestingSimple

1 × $15.00

Master Trader with InvestingSimple

1 × $15.00 -

×

Freak Forex Technicals with Ken FX Freak

1 × $6.00

Freak Forex Technicals with Ken FX Freak

1 × $6.00 -

×

Profit Before Work System with John Piper

1 × $6.00

Profit Before Work System with John Piper

1 × $6.00 -

×

Portfolio Management in Practice with Christine Brentani

1 × $6.00

Portfolio Management in Practice with Christine Brentani

1 × $6.00 -

×

Original Curriculum with Home Options Trading Course

1 × $6.00

Original Curriculum with Home Options Trading Course

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00

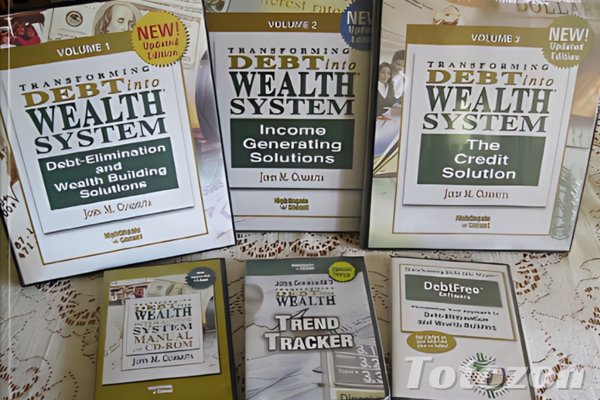

Transforming Debt into Wealth System with John Cummuta

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Transforming Debt into Wealth System with John Cummuta” below:

Transforming Debt into Wealth System with John Cummuta

Debt can feel like an insurmountable obstacle, but John Cummuta’s “Transforming Debt into Wealth” system offers a roadmap to financial freedom. In this article, we will explore the key principles and strategies of this system, designed to help you eliminate debt and build wealth effectively.

Introduction to John Cummuta’s System

Who is John Cummuta?

John Cummuta is a financial expert renowned for his innovative approach to personal finance. His system focuses on transforming debt into wealth through disciplined financial strategies.

What is the Transforming Debt into Wealth System?

This system is a comprehensive program that guides individuals on how to pay off debts rapidly and start building wealth. It emphasizes budgeting, smart spending, and strategic investing.

Core Principles of the System

The Power of Budgeting

Budgeting is the cornerstone of Cummuta’s system. By tracking income and expenses, you can identify areas to cut costs and allocate more funds towards debt repayment.

Debt Snowball Method

The debt snowball method involves paying off the smallest debts first while making minimum payments on larger ones. This approach builds momentum and encourages continued progress.

Living Below Your Means

Adopting a frugal lifestyle helps free up additional resources to tackle debt and save for the future. This involves making conscious spending choices and avoiding unnecessary purchases.

Steps to Transform Debt into Wealth

1. Assess Your Financial Situation

Begin by taking a comprehensive look at your current financial status. List all debts, income sources, and monthly expenses.

2. Create a Detailed Budget

Develop a realistic budget that includes all your income and expenses. Ensure you allocate funds for debt repayment and savings.

3. Prioritize Debts

Rank your debts from smallest to largest and focus on paying off the smallest debt first. This method boosts motivation as you see quick results.

4. Cut Unnecessary Expenses

Identify and eliminate non-essential expenses. Redirect these funds towards paying off debts and building an emergency fund.

5. Increase Your Income

Look for opportunities to boost your income, such as part-time jobs, freelance work, or selling unused items.

6. Pay Off Debts Aggressively

Use any extra income to pay down your debts faster. The quicker you eliminate debt, the sooner you can start saving and investing.

Building Wealth After Debt

Establish an Emergency Fund

Once debts are cleared, focus on building an emergency fund. Aim for three to six months’ worth of living expenses.

Invest Wisely

Start investing in assets that generate passive income. Consider stocks, bonds, real estate, or retirement accounts.

Automate Savings

Set up automatic transfers to your savings and investment accounts. This ensures consistent contributions and reduces the temptation to spend.

Common Pitfalls and How to Avoid Them

Ignoring the Budget

Sticking to a budget is crucial. Regularly review and adjust your budget to stay on track with your financial goals.

Accumulating More Debt

Avoid taking on new debt while paying off existing debts. Focus on living within your means and saving for purchases instead.

Lack of Emergency Fund

Not having an emergency fund can derail your financial progress. Prioritize building this fund to cover unexpected expenses.

Benefits of the Transforming Debt into Wealth System

Financial Freedom

Eliminating debt provides a sense of financial freedom and reduces stress. You can focus on building wealth and achieving long-term goals.

Increased Savings

With no debt payments, you can allocate more money towards savings and investments, accelerating your path to wealth.

Improved Financial Habits

Following this system helps develop disciplined financial habits that benefit you in the long run.

Conclusion

John Cummuta’s “Transforming Debt into Wealth” system offers a practical and effective approach to achieving financial independence. By following the steps outlined in this article, you can take control of your finances, eliminate debt, and start building wealth.

FAQs

1. How does the debt snowball method work?

The debt snowball method focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation to tackle larger debts.

2. What should be included in a budget?

A budget should include all sources of income and all expenses, both fixed and variable. It should also allocate funds for debt repayment and savings.

3. Why is an emergency fund important?

An emergency fund provides financial security by covering unexpected expenses, preventing the need to take on new debt.

4. How can I increase my income to pay off debt faster?

Consider part-time jobs, freelance work, or selling unused items to generate extra income that can be used for debt repayment.

5. What are some smart investment options after paying off debt?

Consider investing in stocks, bonds, real estate, or retirement accounts to build wealth and generate passive income.

Be the first to review “Transforming Debt into Wealth System with John Cummuta” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.