-

×

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00 -

×

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00

8 Year Presidential Election Pattern (Article) with Adam White

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00 -

×

Elite Mentorship Home Study - 3T Live with Sami Abusaad

1 × $5.00

Elite Mentorship Home Study - 3T Live with Sami Abusaad

1 × $5.00 -

×

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00

Traders Secret Success Package. Symmetry Wave Trading with Michael Gur Dillon

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00 -

×

An Introduction to Option Trading Success with James Bittman

1 × $6.00

An Introduction to Option Trading Success with James Bittman

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00 -

×

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

3 Day WorkShop with HYDRA

1 × $13.00

3 Day WorkShop with HYDRA

1 × $13.00 -

×

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

Investment Science with David G.Luenberger

1 × $6.00

Investment Science with David G.Luenberger

1 × $6.00 -

×

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00 -

×

Capital Asset Investment with Anthony F.Herbst

1 × $6.00

Capital Asset Investment with Anthony F.Herbst

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Strategy Factory Workshop with Kevin Davey - KJ Trading Systems

1 × $5.00

Strategy Factory Workshop with Kevin Davey - KJ Trading Systems

1 × $5.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00

3-Day Day Trading Seminar Online CD with John Carter & Hubert Senters

1 × $6.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Volatility Trading with Fractal Flow Pro

1 × $15.00

Volatility Trading with Fractal Flow Pro

1 × $15.00 -

×

Trading With an Edge with Bruce Gilmore

1 × $6.00

Trading With an Edge with Bruce Gilmore

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00 -

×

The Trading Masterclass with Chris Capre

1 × $23.00

The Trading Masterclass with Chris Capre

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Cash Flow Investing Course

1 × $20.00

Cash Flow Investing Course

1 × $20.00 -

×

The Adventures of the Cycle Hunter. The Cyclist with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Cyclist with Craig Bttlc

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00

Who is Afraid of Word Trade Organization with Kent Jones

1 × $6.00 -

×

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Candlestick Charts with Clive Lambert

1 × $6.00

Candlestick Charts with Clive Lambert

1 × $6.00 -

×

7 Figures Forex Course

1 × $15.00

7 Figures Forex Course

1 × $15.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00 -

×

Follow the Leader Trading System with Anthony Gibson

1 × $6.00

Follow the Leader Trading System with Anthony Gibson

1 × $6.00 -

×

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00 -

×

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00 -

×

Candlestick Charting Explained with Greg Morris

1 × $8.00

Candlestick Charting Explained with Greg Morris

1 × $8.00 -

×

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

All About High-Frequency Trading with Michael Durbin

1 × $6.00

All About High-Frequency Trading with Michael Durbin

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00 -

×

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00 -

×

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00 -

×

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00 -

×

Market Tide indicator with Alphashark

1 × $54.00

Market Tide indicator with Alphashark

1 × $54.00 -

×

FX Prosperity Academy with Leonard Williams Jr

1 × $5.00

FX Prosperity Academy with Leonard Williams Jr

1 × $5.00 -

×

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00 -

×

Advent Forex Course with Cecil Robles

1 × $6.00

Advent Forex Course with Cecil Robles

1 × $6.00 -

×

3 Hour Calendar Class With Bonus 3 Months Daily Analysis!

1 × $23.00

3 Hour Calendar Class With Bonus 3 Months Daily Analysis!

1 × $23.00 -

×

Advanced Course with Jtrader

1 × $6.00

Advanced Course with Jtrader

1 × $6.00 -

×

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Day Trader Course

1 × $6.00

Day Trader Course

1 × $6.00

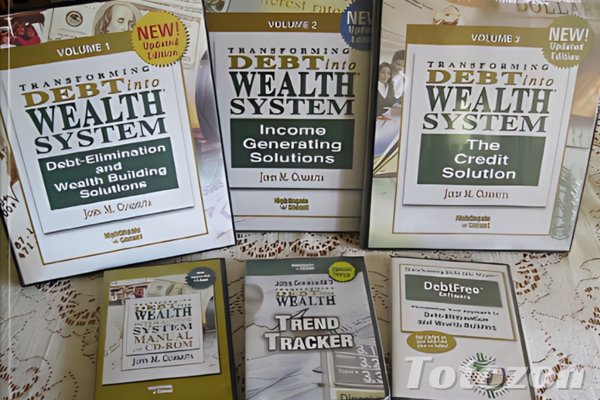

Transforming Debt into Wealth System with John Cummuta

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Transforming Debt into Wealth System with John Cummuta” below:

Transforming Debt into Wealth System with John Cummuta

Debt can feel like an insurmountable obstacle, but John Cummuta’s “Transforming Debt into Wealth” system offers a roadmap to financial freedom. In this article, we will explore the key principles and strategies of this system, designed to help you eliminate debt and build wealth effectively.

Introduction to John Cummuta’s System

Who is John Cummuta?

John Cummuta is a financial expert renowned for his innovative approach to personal finance. His system focuses on transforming debt into wealth through disciplined financial strategies.

What is the Transforming Debt into Wealth System?

This system is a comprehensive program that guides individuals on how to pay off debts rapidly and start building wealth. It emphasizes budgeting, smart spending, and strategic investing.

Core Principles of the System

The Power of Budgeting

Budgeting is the cornerstone of Cummuta’s system. By tracking income and expenses, you can identify areas to cut costs and allocate more funds towards debt repayment.

Debt Snowball Method

The debt snowball method involves paying off the smallest debts first while making minimum payments on larger ones. This approach builds momentum and encourages continued progress.

Living Below Your Means

Adopting a frugal lifestyle helps free up additional resources to tackle debt and save for the future. This involves making conscious spending choices and avoiding unnecessary purchases.

Steps to Transform Debt into Wealth

1. Assess Your Financial Situation

Begin by taking a comprehensive look at your current financial status. List all debts, income sources, and monthly expenses.

2. Create a Detailed Budget

Develop a realistic budget that includes all your income and expenses. Ensure you allocate funds for debt repayment and savings.

3. Prioritize Debts

Rank your debts from smallest to largest and focus on paying off the smallest debt first. This method boosts motivation as you see quick results.

4. Cut Unnecessary Expenses

Identify and eliminate non-essential expenses. Redirect these funds towards paying off debts and building an emergency fund.

5. Increase Your Income

Look for opportunities to boost your income, such as part-time jobs, freelance work, or selling unused items.

6. Pay Off Debts Aggressively

Use any extra income to pay down your debts faster. The quicker you eliminate debt, the sooner you can start saving and investing.

Building Wealth After Debt

Establish an Emergency Fund

Once debts are cleared, focus on building an emergency fund. Aim for three to six months’ worth of living expenses.

Invest Wisely

Start investing in assets that generate passive income. Consider stocks, bonds, real estate, or retirement accounts.

Automate Savings

Set up automatic transfers to your savings and investment accounts. This ensures consistent contributions and reduces the temptation to spend.

Common Pitfalls and How to Avoid Them

Ignoring the Budget

Sticking to a budget is crucial. Regularly review and adjust your budget to stay on track with your financial goals.

Accumulating More Debt

Avoid taking on new debt while paying off existing debts. Focus on living within your means and saving for purchases instead.

Lack of Emergency Fund

Not having an emergency fund can derail your financial progress. Prioritize building this fund to cover unexpected expenses.

Benefits of the Transforming Debt into Wealth System

Financial Freedom

Eliminating debt provides a sense of financial freedom and reduces stress. You can focus on building wealth and achieving long-term goals.

Increased Savings

With no debt payments, you can allocate more money towards savings and investments, accelerating your path to wealth.

Improved Financial Habits

Following this system helps develop disciplined financial habits that benefit you in the long run.

Conclusion

John Cummuta’s “Transforming Debt into Wealth” system offers a practical and effective approach to achieving financial independence. By following the steps outlined in this article, you can take control of your finances, eliminate debt, and start building wealth.

FAQs

1. How does the debt snowball method work?

The debt snowball method focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation to tackle larger debts.

2. What should be included in a budget?

A budget should include all sources of income and all expenses, both fixed and variable. It should also allocate funds for debt repayment and savings.

3. Why is an emergency fund important?

An emergency fund provides financial security by covering unexpected expenses, preventing the need to take on new debt.

4. How can I increase my income to pay off debt faster?

Consider part-time jobs, freelance work, or selling unused items to generate extra income that can be used for debt repayment.

5. What are some smart investment options after paying off debt?

Consider investing in stocks, bonds, real estate, or retirement accounts to build wealth and generate passive income.

Be the first to review “Transforming Debt into Wealth System with John Cummuta” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.