-

×

Precise Planetary Timing for Stock Trading

1 × $6.00

Precise Planetary Timing for Stock Trading

1 × $6.00 -

×

Volatility Position Risk Management with Cynthia Kase

1 × $6.00

Volatility Position Risk Management with Cynthia Kase

1 × $6.00 -

×

Active Trading Course Notes with Alan Hull

1 × $6.00

Active Trading Course Notes with Alan Hull

1 × $6.00 -

×

The Complete 32 Plus Hour Video Course Bundle with Rob Hoffman - Become a Better Trader

1 × $6.00

The Complete 32 Plus Hour Video Course Bundle with Rob Hoffman - Become a Better Trader

1 × $6.00 -

×

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00 -

×

My Forex League - The Course

1 × $5.00

My Forex League - The Course

1 × $5.00 -

×

CyberTrading University – Advanced Stock Course

1 × $31.00

CyberTrading University – Advanced Stock Course

1 × $31.00 -

×

Trading Masterclass XVII with Wysetrade

1 × $6.00

Trading Masterclass XVII with Wysetrade

1 × $6.00 -

×

Ultimate Options with Andy Tanner & Corey Halliday - The Cashflow Academy

1 × $139.00

Ultimate Options with Andy Tanner & Corey Halliday - The Cashflow Academy

1 × $139.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00

Power Cycle Trading The Ultimate Option Guide: When & How to Use Which Option Strategy For the Best Results - Powercycletrading

1 × $69.00 -

×

Activedaytrader - Workshop Options For Income

1 × $15.00

Activedaytrader - Workshop Options For Income

1 × $15.00 -

×

Activedaytrader - Mastering Technicals

1 × $15.00

Activedaytrader - Mastering Technicals

1 × $15.00 -

×

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

Sacredscience - W.T.Foster – Sunspots and Weather

1 × $6.00

Sacredscience - W.T.Foster – Sunspots and Weather

1 × $6.00 -

×

Option Greeks Class with Don Kaufman

1 × $6.00

Option Greeks Class with Don Kaufman

1 × $6.00 -

×

How to Find the Most Profitable Stocks with Mubarak Shah

1 × $6.00

How to Find the Most Profitable Stocks with Mubarak Shah

1 × $6.00 -

×

TOP Momentum Bundle with Top Trade Tools

1 × $62.00

TOP Momentum Bundle with Top Trade Tools

1 × $62.00 -

×

SNR Trader Course with Ariff T

1 × $6.00

SNR Trader Course with Ariff T

1 × $6.00 -

×

Rounded Bottom Breakout Multimedia Course

1 × $31.00

Rounded Bottom Breakout Multimedia Course

1 × $31.00 -

×

Trade Like a Pro in Currency Trading with Don Schellenberg

1 × $6.00

Trade Like a Pro in Currency Trading with Don Schellenberg

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00

Advanced Iron Condors, Trading Concepts with Todd Mitchell

1 × $31.00 -

×

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00 -

×

The Loyalty Effect with Frederick Reichheld

1 × $6.00

The Loyalty Effect with Frederick Reichheld

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Learn To Fish Part III - How To Swing Trade for Consistent Gains with Daniel

1 × $15.00

Learn To Fish Part III - How To Swing Trade for Consistent Gains with Daniel

1 × $15.00 -

×

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00 -

×

Self-Mastery Course with Steven Cruz

1 × $62.00

Self-Mastery Course with Steven Cruz

1 × $62.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Mastering Amibroker Formula Language

1 × $15.00

Mastering Amibroker Formula Language

1 × $15.00 -

×

Complete Series

1 × $31.00

Complete Series

1 × $31.00 -

×

Investment Madness with John Nofsinger

1 × $6.00

Investment Madness with John Nofsinger

1 × $6.00 -

×

How To Trade Forex Using Support & Resistance Levels with Vic Noble

1 × $6.00

How To Trade Forex Using Support & Resistance Levels with Vic Noble

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00 -

×

The Ticker Investment Digest Articles

1 × $6.00

The Ticker Investment Digest Articles

1 × $6.00 -

×

Discounted Cash Flow Valuation: Spot Undervalued Stocks Fast with Jari Roomer

1 × $6.00

Discounted Cash Flow Valuation: Spot Undervalued Stocks Fast with Jari Roomer

1 × $6.00 -

×

POS+ Hindi 30 Days Subscription with Surjeetkakkar

1 × $62.00

POS+ Hindi 30 Days Subscription with Surjeetkakkar

1 × $62.00 -

×

Precision Pattern Trading with Daryl Guppy

1 × $6.00

Precision Pattern Trading with Daryl Guppy

1 × $6.00 -

×

Secret Weapon to Trading Options on ETF's Class with Don Kaufman

1 × $6.00

Secret Weapon to Trading Options on ETF's Class with Don Kaufman

1 × $6.00 -

×

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00 -

×

Optimize Funding Program 2023 with Solo Network Courses

1 × $13.00

Optimize Funding Program 2023 with Solo Network Courses

1 × $13.00 -

×

TOP Gamma Bundle with TopTrade Tools

1 × $69.00

TOP Gamma Bundle with TopTrade Tools

1 × $69.00 -

×

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00 -

×

Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett

1 × $6.00

Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Market Tide indicator with Alphashark

1 × $54.00

Market Tide indicator with Alphashark

1 × $54.00 -

×

Cycles: What they are, what they mean, how to profit by them - Dick Stoken

1 × $6.00

Cycles: What they are, what they mean, how to profit by them - Dick Stoken

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00

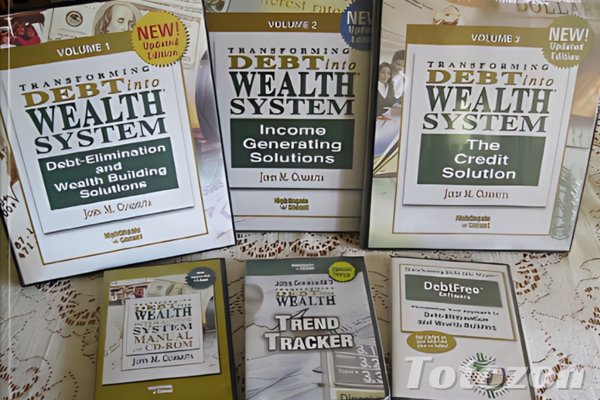

Transforming Debt into Wealth System with John Cummuta

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Transforming Debt into Wealth System with John Cummuta” below:

Transforming Debt into Wealth System with John Cummuta

Debt can feel like an insurmountable obstacle, but John Cummuta’s “Transforming Debt into Wealth” system offers a roadmap to financial freedom. In this article, we will explore the key principles and strategies of this system, designed to help you eliminate debt and build wealth effectively.

Introduction to John Cummuta’s System

Who is John Cummuta?

John Cummuta is a financial expert renowned for his innovative approach to personal finance. His system focuses on transforming debt into wealth through disciplined financial strategies.

What is the Transforming Debt into Wealth System?

This system is a comprehensive program that guides individuals on how to pay off debts rapidly and start building wealth. It emphasizes budgeting, smart spending, and strategic investing.

Core Principles of the System

The Power of Budgeting

Budgeting is the cornerstone of Cummuta’s system. By tracking income and expenses, you can identify areas to cut costs and allocate more funds towards debt repayment.

Debt Snowball Method

The debt snowball method involves paying off the smallest debts first while making minimum payments on larger ones. This approach builds momentum and encourages continued progress.

Living Below Your Means

Adopting a frugal lifestyle helps free up additional resources to tackle debt and save for the future. This involves making conscious spending choices and avoiding unnecessary purchases.

Steps to Transform Debt into Wealth

1. Assess Your Financial Situation

Begin by taking a comprehensive look at your current financial status. List all debts, income sources, and monthly expenses.

2. Create a Detailed Budget

Develop a realistic budget that includes all your income and expenses. Ensure you allocate funds for debt repayment and savings.

3. Prioritize Debts

Rank your debts from smallest to largest and focus on paying off the smallest debt first. This method boosts motivation as you see quick results.

4. Cut Unnecessary Expenses

Identify and eliminate non-essential expenses. Redirect these funds towards paying off debts and building an emergency fund.

5. Increase Your Income

Look for opportunities to boost your income, such as part-time jobs, freelance work, or selling unused items.

6. Pay Off Debts Aggressively

Use any extra income to pay down your debts faster. The quicker you eliminate debt, the sooner you can start saving and investing.

Building Wealth After Debt

Establish an Emergency Fund

Once debts are cleared, focus on building an emergency fund. Aim for three to six months’ worth of living expenses.

Invest Wisely

Start investing in assets that generate passive income. Consider stocks, bonds, real estate, or retirement accounts.

Automate Savings

Set up automatic transfers to your savings and investment accounts. This ensures consistent contributions and reduces the temptation to spend.

Common Pitfalls and How to Avoid Them

Ignoring the Budget

Sticking to a budget is crucial. Regularly review and adjust your budget to stay on track with your financial goals.

Accumulating More Debt

Avoid taking on new debt while paying off existing debts. Focus on living within your means and saving for purchases instead.

Lack of Emergency Fund

Not having an emergency fund can derail your financial progress. Prioritize building this fund to cover unexpected expenses.

Benefits of the Transforming Debt into Wealth System

Financial Freedom

Eliminating debt provides a sense of financial freedom and reduces stress. You can focus on building wealth and achieving long-term goals.

Increased Savings

With no debt payments, you can allocate more money towards savings and investments, accelerating your path to wealth.

Improved Financial Habits

Following this system helps develop disciplined financial habits that benefit you in the long run.

Conclusion

John Cummuta’s “Transforming Debt into Wealth” system offers a practical and effective approach to achieving financial independence. By following the steps outlined in this article, you can take control of your finances, eliminate debt, and start building wealth.

FAQs

1. How does the debt snowball method work?

The debt snowball method focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation to tackle larger debts.

2. What should be included in a budget?

A budget should include all sources of income and all expenses, both fixed and variable. It should also allocate funds for debt repayment and savings.

3. Why is an emergency fund important?

An emergency fund provides financial security by covering unexpected expenses, preventing the need to take on new debt.

4. How can I increase my income to pay off debt faster?

Consider part-time jobs, freelance work, or selling unused items to generate extra income that can be used for debt repayment.

5. What are some smart investment options after paying off debt?

Consider investing in stocks, bonds, real estate, or retirement accounts to build wealth and generate passive income.

Be the first to review “Transforming Debt into Wealth System with John Cummuta” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.