-

×

Volatility Position Risk Management with Cynthia Kase

1 × $6.00

Volatility Position Risk Management with Cynthia Kase

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00

China & the World Trading System with Deborah Cass, Brett Williams & George Barker

1 × $6.00 -

×

Commodities for Dummies with Amine Bouchentouf

1 × $6.00

Commodities for Dummies with Amine Bouchentouf

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00 -

×

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00 -

×

Diary of an Internet Trader with Alpesh Patel

1 × $6.00

Diary of an Internet Trader with Alpesh Patel

1 × $6.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

ePass Platinum

1 × $31.00

ePass Platinum

1 × $31.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

Complete Times Course with Afshin Taghechian

1 × $6.00

Complete Times Course with Afshin Taghechian

1 × $6.00 -

×

Get to know the VIX Index (aka The Fear Index)

1 × $15.00

Get to know the VIX Index (aka The Fear Index)

1 × $15.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Traders Winning Edge (Presentation) with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge (Presentation) with Adrienne Laris Toghraie

1 × $6.00 -

×

Quarterly Theory with Trader Daye

1 × $20.00

Quarterly Theory with Trader Daye

1 × $20.00 -

×

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00 -

×

Future DayTrading (German)

1 × $6.00

Future DayTrading (German)

1 × $6.00 -

×

The Master Trader Bundle with Gareth Soloway

1 × $39.00

The Master Trader Bundle with Gareth Soloway

1 × $39.00 -

×

Empirical Market Microstructure

1 × $6.00

Empirical Market Microstructure

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Trading Masterclass with Chris Capre

1 × $23.00

The Trading Masterclass with Chris Capre

1 × $23.00 -

×

The Complete Short Course on Ripple Cryptocurrency with Saad Hameed

1 × $5.00

The Complete Short Course on Ripple Cryptocurrency with Saad Hameed

1 × $5.00 -

×

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00 -

×

Confessions of a Street Addict with James Cramer

1 × $6.00

Confessions of a Street Addict with James Cramer

1 × $6.00 -

×

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00

Core Strategy Program + Extended Learning Track with Ota Courses

1 × $124.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

The Internet Trading Course with Alpesh Patel

1 × $6.00

The Internet Trading Course with Alpesh Patel

1 × $6.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

Foundations of Forex Trading with TradeSmart University

1 × $6.00

Foundations of Forex Trading with TradeSmart University

1 × $6.00 -

×

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00

5 Day Program with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00 -

×

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00

Financial Markets Online – VIP Membership with James Bentley

1 × $6.00 -

×

TradeWithChris - TWC Forex Trading Course

1 × $6.00

TradeWithChris - TWC Forex Trading Course

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00 -

×

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00 -

×

How to Avoid Tax on Your Stock Market Profits with Lee Hadnum

1 × $6.00

How to Avoid Tax on Your Stock Market Profits with Lee Hadnum

1 × $6.00 -

×

Hawkeye Indicators for eSignal + Manual (janarps.com)

1 × $6.00

Hawkeye Indicators for eSignal + Manual (janarps.com)

1 × $6.00 -

×

VWAP Trading course with Trade With Trend

1 × $6.00

VWAP Trading course with Trade With Trend

1 × $6.00 -

×

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00 -

×

The Art And Science Of Trading with Adam Grimes

1 × $6.00

The Art And Science Of Trading with Adam Grimes

1 × $6.00 -

×

The Psychology of Investing with John Nofsinger

1 × $6.00

The Psychology of Investing with John Nofsinger

1 × $6.00 -

×

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00 -

×

The Correlation Code with Jason Fielder

1 × $6.00

The Correlation Code with Jason Fielder

1 × $6.00 -

×

Day Trading Insight with Al Brooks

1 × $10.00

Day Trading Insight with Al Brooks

1 × $10.00 -

×

Defending Options with Simpler Options

1 × $6.00

Defending Options with Simpler Options

1 × $6.00 -

×

Emini, Forex, Stock Course COMPLETE Series Recorded Seminar 2009 - 49 Modules in 3 DVDs (SpecialistTrading.com)

1 × $78.00

Emini, Forex, Stock Course COMPLETE Series Recorded Seminar 2009 - 49 Modules in 3 DVDs (SpecialistTrading.com)

1 × $78.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Complete Day Trading Course with The Trading Floor

1 × $13.00

Complete Day Trading Course with The Trading Floor

1 × $13.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00 -

×

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00 -

×

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00

Equity Valuation for Analysts and Investors: A Unique Stock Valuation Tool for Financial Statement Analysis and Model-Building with James Kelleher

1 × $6.00 -

×

Forex Education Trading System (Video 469 MB)

1 × $23.00

Forex Education Trading System (Video 469 MB)

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Freedom Challenge Course with Steven Dux

1 × $5.00

Freedom Challenge Course with Steven Dux

1 × $5.00 -

×

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00 -

×

How To Be a Profitable Forex Trader with Corey Halliday

1 × $6.00

How To Be a Profitable Forex Trader with Corey Halliday

1 × $6.00 -

×

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Trading Options Effectively with Paul Forchione

1 × $4.00

Trading Options Effectively with Paul Forchione

1 × $4.00 -

×

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00 -

×

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00

Street-Smart Chart Reading – Volume 2 – Digging Deeper with Donald G.Worden

1 × $6.00 -

×

The Blockchain Bootcamp 2.0 with Gregory (Dapp University)

1 × $15.00

The Blockchain Bootcamp 2.0 with Gregory (Dapp University)

1 × $15.00 -

×

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00 -

×

Advanced Get 12.0.3485 x86 (August 2014) (+ open code efs, dll's) for Any eSignal Account

1 × $23.00

Advanced Get 12.0.3485 x86 (August 2014) (+ open code efs, dll's) for Any eSignal Account

1 × $23.00 -

×

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00

Stock Market Wizards Interviews with America’s Top Stock Traders - Jack Schwager

1 × $6.00 -

×

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00

Secrets of the Trading Pros with Jack Bouroudjan & Terrence Duffy

1 × $6.00 -

×

Equities with Peter Martin

1 × $6.00

Equities with Peter Martin

1 × $6.00 -

×

The Psychology Of Trading with Brett N.Steenbarger

1 × $6.00

The Psychology Of Trading with Brett N.Steenbarger

1 × $6.00 -

×

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

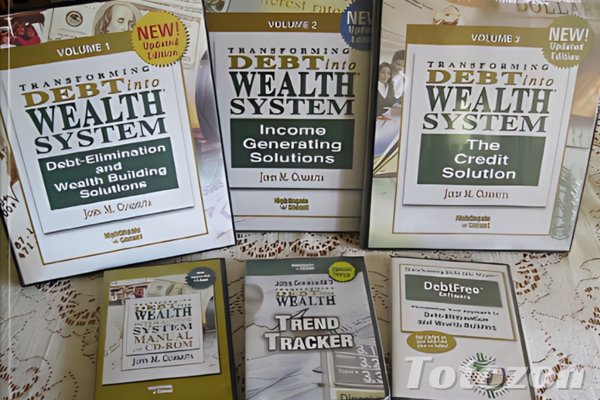

Transforming Debt into Wealth System with John Cummuta

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Transforming Debt into Wealth System with John Cummuta” below:

Transforming Debt into Wealth System with John Cummuta

Debt can feel like an insurmountable obstacle, but John Cummuta’s “Transforming Debt into Wealth” system offers a roadmap to financial freedom. In this article, we will explore the key principles and strategies of this system, designed to help you eliminate debt and build wealth effectively.

Introduction to John Cummuta’s System

Who is John Cummuta?

John Cummuta is a financial expert renowned for his innovative approach to personal finance. His system focuses on transforming debt into wealth through disciplined financial strategies.

What is the Transforming Debt into Wealth System?

This system is a comprehensive program that guides individuals on how to pay off debts rapidly and start building wealth. It emphasizes budgeting, smart spending, and strategic investing.

Core Principles of the System

The Power of Budgeting

Budgeting is the cornerstone of Cummuta’s system. By tracking income and expenses, you can identify areas to cut costs and allocate more funds towards debt repayment.

Debt Snowball Method

The debt snowball method involves paying off the smallest debts first while making minimum payments on larger ones. This approach builds momentum and encourages continued progress.

Living Below Your Means

Adopting a frugal lifestyle helps free up additional resources to tackle debt and save for the future. This involves making conscious spending choices and avoiding unnecessary purchases.

Steps to Transform Debt into Wealth

1. Assess Your Financial Situation

Begin by taking a comprehensive look at your current financial status. List all debts, income sources, and monthly expenses.

2. Create a Detailed Budget

Develop a realistic budget that includes all your income and expenses. Ensure you allocate funds for debt repayment and savings.

3. Prioritize Debts

Rank your debts from smallest to largest and focus on paying off the smallest debt first. This method boosts motivation as you see quick results.

4. Cut Unnecessary Expenses

Identify and eliminate non-essential expenses. Redirect these funds towards paying off debts and building an emergency fund.

5. Increase Your Income

Look for opportunities to boost your income, such as part-time jobs, freelance work, or selling unused items.

6. Pay Off Debts Aggressively

Use any extra income to pay down your debts faster. The quicker you eliminate debt, the sooner you can start saving and investing.

Building Wealth After Debt

Establish an Emergency Fund

Once debts are cleared, focus on building an emergency fund. Aim for three to six months’ worth of living expenses.

Invest Wisely

Start investing in assets that generate passive income. Consider stocks, bonds, real estate, or retirement accounts.

Automate Savings

Set up automatic transfers to your savings and investment accounts. This ensures consistent contributions and reduces the temptation to spend.

Common Pitfalls and How to Avoid Them

Ignoring the Budget

Sticking to a budget is crucial. Regularly review and adjust your budget to stay on track with your financial goals.

Accumulating More Debt

Avoid taking on new debt while paying off existing debts. Focus on living within your means and saving for purchases instead.

Lack of Emergency Fund

Not having an emergency fund can derail your financial progress. Prioritize building this fund to cover unexpected expenses.

Benefits of the Transforming Debt into Wealth System

Financial Freedom

Eliminating debt provides a sense of financial freedom and reduces stress. You can focus on building wealth and achieving long-term goals.

Increased Savings

With no debt payments, you can allocate more money towards savings and investments, accelerating your path to wealth.

Improved Financial Habits

Following this system helps develop disciplined financial habits that benefit you in the long run.

Conclusion

John Cummuta’s “Transforming Debt into Wealth” system offers a practical and effective approach to achieving financial independence. By following the steps outlined in this article, you can take control of your finances, eliminate debt, and start building wealth.

FAQs

1. How does the debt snowball method work?

The debt snowball method focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation to tackle larger debts.

2. What should be included in a budget?

A budget should include all sources of income and all expenses, both fixed and variable. It should also allocate funds for debt repayment and savings.

3. Why is an emergency fund important?

An emergency fund provides financial security by covering unexpected expenses, preventing the need to take on new debt.

4. How can I increase my income to pay off debt faster?

Consider part-time jobs, freelance work, or selling unused items to generate extra income that can be used for debt repayment.

5. What are some smart investment options after paying off debt?

Consider investing in stocks, bonds, real estate, or retirement accounts to build wealth and generate passive income.

Be the first to review “Transforming Debt into Wealth System with John Cummuta” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.