-

×

Mastering Technical Analysis with Investi Share

1 × $23.00

Mastering Technical Analysis with Investi Share

1 × $23.00 -

×

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00 -

×

Profit Generating System with Brian Williams

1 × $6.00

Profit Generating System with Brian Williams

1 × $6.00 -

×

Forex Mentor 2007 with Peter Bain

1 × $6.00

Forex Mentor 2007 with Peter Bain

1 × $6.00 -

×

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00

Forex Trading For Beginners with John Jagerson - Investopedia Academy

1 × $6.00 -

×

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00 -

×

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00 -

×

Peter Borish Online Trader Program

1 × $15.00

Peter Borish Online Trader Program

1 × $15.00 -

×

Letal Forex System with Alex Seeni

1 × $6.00

Letal Forex System with Alex Seeni

1 × $6.00 -

×

New Market Mavericks with Geoff Cutmore

1 × $6.00

New Market Mavericks with Geoff Cutmore

1 × $6.00 -

×

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00 -

×

Mentfx Paid Mentoship (2021)

1 × $5.00

Mentfx Paid Mentoship (2021)

1 × $5.00 -

×

Essential Skills for Consistency in Trading Class with Don Kaufman

1 × $6.00

Essential Skills for Consistency in Trading Class with Don Kaufman

1 × $6.00 -

×

Investing Smart. How to Pick Stocks with Investors Business Daily By Dhun H.Sethna

1 × $4.00

Investing Smart. How to Pick Stocks with Investors Business Daily By Dhun H.Sethna

1 × $4.00 -

×

Gold Trading Academy Video Course

1 × $23.00

Gold Trading Academy Video Course

1 × $23.00 -

×

Options On Futures Class By Mark Fenton - Sheridan Options Mentoring

1 × $6.00

Options On Futures Class By Mark Fenton - Sheridan Options Mentoring

1 × $6.00 -

×

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00

Ezaih Academy 2024 Mentorship with Ezaih

1 × $54.00 -

×

ICT Mastery with Casper SMC

1 × $14.00

ICT Mastery with Casper SMC

1 × $14.00 -

×

Smashing False Breakouts with Better System Trader

1 × $5.00

Smashing False Breakouts with Better System Trader

1 × $5.00 -

×

Smart Money Concepts with JordyBanks

1 × $6.00

Smart Money Concepts with JordyBanks

1 × $6.00 -

×

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00 -

×

Options Trading with Nick & Gareth - Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $31.00

Options Trading with Nick & Gareth - Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $31.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Market Expectations & Option Prices with Martin Mandler

1 × $6.00

Market Expectations & Option Prices with Martin Mandler

1 × $6.00 -

×

Activedaytrader - Workshop: Unusual Options

1 × $6.00

Activedaytrader - Workshop: Unusual Options

1 × $6.00 -

×

SO FX Educational Course with SO FX

1 × $5.00

SO FX Educational Course with SO FX

1 × $5.00 -

×

Commodity Trading Video Course with Bob Buran

1 × $6.00

Commodity Trading Video Course with Bob Buran

1 × $6.00 -

×

Forex Trading Course. Turn $1,260 Into $12,300 In 30 Days with David Arena

1 × $6.00

Forex Trading Course. Turn $1,260 Into $12,300 In 30 Days with David Arena

1 × $6.00 -

×

Real-Time Course with Rich Swannell

1 × $6.00

Real-Time Course with Rich Swannell

1 × $6.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00 -

×

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00 -

×

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00 -

×

ETF Trading Strategies Revealed with David Vomund

1 × $6.00

ETF Trading Strategies Revealed with David Vomund

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00

Introduction to the Elliot Wave Principle Seminar - Robert Prechter

1 × $6.00 -

×

Quantitative Business Valuation with Jay Abrams

1 × $6.00

Quantitative Business Valuation with Jay Abrams

1 × $6.00 -

×

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00 -

×

Bar Ipro v9.1 for MT4 11XX

1 × $23.00

Bar Ipro v9.1 for MT4 11XX

1 × $23.00 -

×

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00

Market Stalkers Level 1 - Swing trading school (2020)

1 × $8.00 -

×

FOREX UNLIMITED WEALTH EA

1 × $6.00

FOREX UNLIMITED WEALTH EA

1 × $6.00 -

×

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00 -

×

Options Academy Elevate with Simon Ree - Tao of Trading

1 × $109.00

Options Academy Elevate with Simon Ree - Tao of Trading

1 × $109.00 -

×

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00

Practical Portfolio Performance Measurement and Attribution (2nd Ed.) with Carl Bacon

1 × $6.00 -

×

RSI Unleashed: Building a Comprehensive Trading Framework By Doc Severson

1 × $6.00

RSI Unleashed: Building a Comprehensive Trading Framework By Doc Severson

1 × $6.00 -

×

Investing Online for Dummies (5th Edition) with Kathleen Sindell

1 × $6.00

Investing Online for Dummies (5th Edition) with Kathleen Sindell

1 × $6.00 -

×

Freedom Challenge Course with Steven Dux

1 × $5.00

Freedom Challenge Course with Steven Dux

1 × $5.00 -

×

Advanced Calculus with Applications in Statistics

1 × $6.00

Advanced Calculus with Applications in Statistics

1 × $6.00 -

×

7 Figures Forex Course

1 × $15.00

7 Figures Forex Course

1 × $15.00 -

×

Profit Power Seminar

1 × $23.00

Profit Power Seminar

1 × $23.00 -

×

Live Online Masterclass with XSPY Trader

1 × $5.00

Live Online Masterclass with XSPY Trader

1 × $5.00 -

×

6 (The Proper BackGround)

1 × $6.00

6 (The Proper BackGround)

1 × $6.00 -

×

Stock Option Trading 3 – Easy Advanced Profits and Success with Scott Paton

1 × $6.00

Stock Option Trading 3 – Easy Advanced Profits and Success with Scott Paton

1 × $6.00 -

×

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00

Learn To Day-Trade the E-Mini S&P 500. Simple-as-123 with Marshall Jones

1 × $6.00 -

×

Support and Resistance Trading with Rob Booker

1 × $6.00

Support and Resistance Trading with Rob Booker

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Zap Seminar - David Stendahl – Day Trading the E-Minis

1 × $6.00

Zap Seminar - David Stendahl – Day Trading the E-Minis

1 × $6.00 -

×

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00 -

×

Study Guide for Technical Analysis Explained (1st Edition) with Martin Pring

1 × $6.00

Study Guide for Technical Analysis Explained (1st Edition) with Martin Pring

1 × $6.00 -

×

Stable Adaptive Control for Nonlinear Systems with Jeffrey Spooner

1 × $6.00

Stable Adaptive Control for Nonlinear Systems with Jeffrey Spooner

1 × $6.00 -

×

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00 -

×

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00 -

×

Equities with Peter Martin

1 × $6.00

Equities with Peter Martin

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

AstroScan Regulus 4.1E newastro.net

1 × $6.00

AstroScan Regulus 4.1E newastro.net

1 × $6.00 -

×

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00 -

×

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00 -

×

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00 -

×

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00

Forex Trading Secrets. Trading Strategies for the Forex Market

1 × $6.00 -

×

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00 -

×

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00 -

×

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00 -

×

AG Trading Journal with Ace Gazette

1 × $6.00

AG Trading Journal with Ace Gazette

1 × $6.00 -

×

Active Investing courses notes with Alan Hull

1 × $6.00

Active Investing courses notes with Alan Hull

1 × $6.00 -

×

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00 -

×

3 Hour Calendar Class With Bonus 3 Months Daily Analysis!

1 × $23.00

3 Hour Calendar Class With Bonus 3 Months Daily Analysis!

1 × $23.00 -

×

3 Day WorkShop with HYDRA

1 × $13.00

3 Day WorkShop with HYDRA

1 × $13.00 -

×

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Hedge Funds for Dummies

1 × $6.00

Hedge Funds for Dummies

1 × $6.00 -

×

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00 -

×

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00

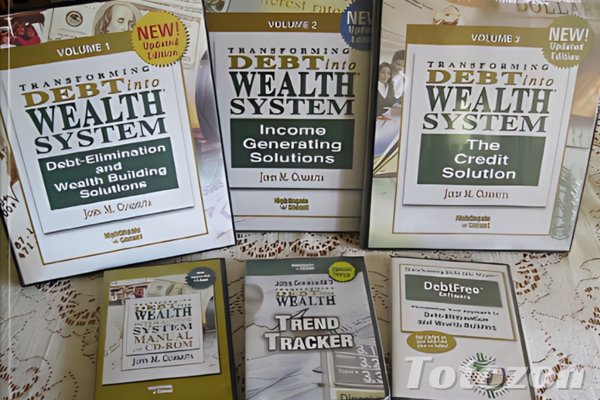

Transforming Debt into Wealth System with John Cummuta

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Transforming Debt into Wealth System with John Cummuta” below:

Transforming Debt into Wealth System with John Cummuta

Debt can feel like an insurmountable obstacle, but John Cummuta’s “Transforming Debt into Wealth” system offers a roadmap to financial freedom. In this article, we will explore the key principles and strategies of this system, designed to help you eliminate debt and build wealth effectively.

Introduction to John Cummuta’s System

Who is John Cummuta?

John Cummuta is a financial expert renowned for his innovative approach to personal finance. His system focuses on transforming debt into wealth through disciplined financial strategies.

What is the Transforming Debt into Wealth System?

This system is a comprehensive program that guides individuals on how to pay off debts rapidly and start building wealth. It emphasizes budgeting, smart spending, and strategic investing.

Core Principles of the System

The Power of Budgeting

Budgeting is the cornerstone of Cummuta’s system. By tracking income and expenses, you can identify areas to cut costs and allocate more funds towards debt repayment.

Debt Snowball Method

The debt snowball method involves paying off the smallest debts first while making minimum payments on larger ones. This approach builds momentum and encourages continued progress.

Living Below Your Means

Adopting a frugal lifestyle helps free up additional resources to tackle debt and save for the future. This involves making conscious spending choices and avoiding unnecessary purchases.

Steps to Transform Debt into Wealth

1. Assess Your Financial Situation

Begin by taking a comprehensive look at your current financial status. List all debts, income sources, and monthly expenses.

2. Create a Detailed Budget

Develop a realistic budget that includes all your income and expenses. Ensure you allocate funds for debt repayment and savings.

3. Prioritize Debts

Rank your debts from smallest to largest and focus on paying off the smallest debt first. This method boosts motivation as you see quick results.

4. Cut Unnecessary Expenses

Identify and eliminate non-essential expenses. Redirect these funds towards paying off debts and building an emergency fund.

5. Increase Your Income

Look for opportunities to boost your income, such as part-time jobs, freelance work, or selling unused items.

6. Pay Off Debts Aggressively

Use any extra income to pay down your debts faster. The quicker you eliminate debt, the sooner you can start saving and investing.

Building Wealth After Debt

Establish an Emergency Fund

Once debts are cleared, focus on building an emergency fund. Aim for three to six months’ worth of living expenses.

Invest Wisely

Start investing in assets that generate passive income. Consider stocks, bonds, real estate, or retirement accounts.

Automate Savings

Set up automatic transfers to your savings and investment accounts. This ensures consistent contributions and reduces the temptation to spend.

Common Pitfalls and How to Avoid Them

Ignoring the Budget

Sticking to a budget is crucial. Regularly review and adjust your budget to stay on track with your financial goals.

Accumulating More Debt

Avoid taking on new debt while paying off existing debts. Focus on living within your means and saving for purchases instead.

Lack of Emergency Fund

Not having an emergency fund can derail your financial progress. Prioritize building this fund to cover unexpected expenses.

Benefits of the Transforming Debt into Wealth System

Financial Freedom

Eliminating debt provides a sense of financial freedom and reduces stress. You can focus on building wealth and achieving long-term goals.

Increased Savings

With no debt payments, you can allocate more money towards savings and investments, accelerating your path to wealth.

Improved Financial Habits

Following this system helps develop disciplined financial habits that benefit you in the long run.

Conclusion

John Cummuta’s “Transforming Debt into Wealth” system offers a practical and effective approach to achieving financial independence. By following the steps outlined in this article, you can take control of your finances, eliminate debt, and start building wealth.

FAQs

1. How does the debt snowball method work?

The debt snowball method focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation to tackle larger debts.

2. What should be included in a budget?

A budget should include all sources of income and all expenses, both fixed and variable. It should also allocate funds for debt repayment and savings.

3. Why is an emergency fund important?

An emergency fund provides financial security by covering unexpected expenses, preventing the need to take on new debt.

4. How can I increase my income to pay off debt faster?

Consider part-time jobs, freelance work, or selling unused items to generate extra income that can be used for debt repayment.

5. What are some smart investment options after paying off debt?

Consider investing in stocks, bonds, real estate, or retirement accounts to build wealth and generate passive income.

Be the first to review “Transforming Debt into Wealth System with John Cummuta” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.