-

×

JokerSZN Course with David

1 × $20.00

JokerSZN Course with David

1 × $20.00 -

×

Marus FX 2023

1 × $5.00

Marus FX 2023

1 × $5.00 -

×

Market Profile Video with FutexLive

1 × $6.00

Market Profile Video with FutexLive

1 × $6.00 -

×

New York Institute of Finance – Futures. A Personal Seminar

1 × $6.00

New York Institute of Finance – Futures. A Personal Seminar

1 × $6.00 -

×

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

Harmonic Vibrations with Larry Pesavento

1 × $6.00

Harmonic Vibrations with Larry Pesavento

1 × $6.00 -

×

Emini Bonds

1 × $23.00

Emini Bonds

1 × $23.00 -

×

Bird Watch in Lion Country 2010 Ed with Dirk Du Toit

1 × $6.00

Bird Watch in Lion Country 2010 Ed with Dirk Du Toit

1 × $6.00 -

×

MTI - Basics UTP

1 × $6.00

MTI - Basics UTP

1 × $6.00 -

×

Option Income Stream System 2004

1 × $6.00

Option Income Stream System 2004

1 × $6.00 -

×

Pyrapoint with D.E.Hall

1 × $6.00

Pyrapoint with D.E.Hall

1 × $6.00 -

×

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00 -

×

7 Steps to Success Trading Options Online with Larry Spears

1 × $4.00

7 Steps to Success Trading Options Online with Larry Spears

1 × $4.00 -

×

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00 -

×

Five Trading Trends of 2005 with Dan Denning

1 × $6.00

Five Trading Trends of 2005 with Dan Denning

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00 -

×

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00 -

×

Fractal Markets SFX with Tyson Bieniek

1 × $5.00

Fractal Markets SFX with Tyson Bieniek

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00 -

×

Market Structure Matters with Haim Bodek

1 × $62.00

Market Structure Matters with Haim Bodek

1 × $62.00 -

×

TenfoldFX Academy Course with Kenneth John

1 × $17.00

TenfoldFX Academy Course with Kenneth John

1 × $17.00 -

×

FOUS4 with Cameron Fous

1 × $5.00

FOUS4 with Cameron Fous

1 × $5.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

Foundations of Forex Trading with TradeSmart University

1 × $6.00

Foundations of Forex Trading with TradeSmart University

1 × $6.00 -

×

Zap Seminar - Ablesys

1 × $6.00

Zap Seminar - Ablesys

1 × $6.00 -

×

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00 -

×

European Members - March 2023 with Stockbee

1 × $5.00

European Members - March 2023 with Stockbee

1 × $5.00 -

×

Equities with Peter Martin

1 × $6.00

Equities with Peter Martin

1 × $6.00 -

×

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00 -

×

Optimize Funding Program 2023 with Solo Network Courses

1 × $13.00

Optimize Funding Program 2023 with Solo Network Courses

1 × $13.00 -

×

FruitFly For Consistent Income with Matt Williamson

1 × $6.00

FruitFly For Consistent Income with Matt Williamson

1 × $6.00 -

×

Matrix Options

1 × $6.00

Matrix Options

1 × $6.00 -

×

Online Investing Hacks with Bonnie Biafore

1 × $6.00

Online Investing Hacks with Bonnie Biafore

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00 -

×

How to Spot Trading Opportunities

1 × $6.00

How to Spot Trading Opportunities

1 × $6.00 -

×

Info Product Mastery - Ron Douglas & Alice Seba

1 × $6.00

Info Product Mastery - Ron Douglas & Alice Seba

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Drewize Banks Course

1 × $5.00

Drewize Banks Course

1 × $5.00 -

×

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00 -

×

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00 -

×

Synthetic and Structured Assets: A Practical Guide to Investment and Risk with Erik Banks

1 × $6.00

Synthetic and Structured Assets: A Practical Guide to Investment and Risk with Erik Banks

1 × $6.00 -

×

SOAP. Served On A Platter CD with David Elliott

1 × $6.00

SOAP. Served On A Platter CD with David Elliott

1 × $6.00 -

×

HST Mobile

1 × $31.00

HST Mobile

1 × $31.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Planetary Harmonics of Speculative Markets with Larry Pesavento

1 × $6.00

Planetary Harmonics of Speculative Markets with Larry Pesavento

1 × $6.00 -

×

Investing Online for Dummies (5th Edition) with Kathleen Sindell

1 × $6.00

Investing Online for Dummies (5th Edition) with Kathleen Sindell

1 × $6.00 -

×

AG Trading Journal with Ace Gazette

1 × $6.00

AG Trading Journal with Ace Gazette

1 × $6.00 -

×

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00 -

×

Profit Before Work System with John Piper

1 × $6.00

Profit Before Work System with John Piper

1 × $6.00 -

×

Smart Money Concepts with MFX Trading

1 × $13.00

Smart Money Concepts with MFX Trading

1 × $13.00 -

×

Investing In KLSE Stocks and Futures With Japanese Candlestick with Fred Tam

1 × $6.00

Investing In KLSE Stocks and Futures With Japanese Candlestick with Fred Tam

1 × $6.00 -

×

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00 -

×

Super CD Companion for Metastock with Martin Pring

1 × $6.00

Super CD Companion for Metastock with Martin Pring

1 × $6.00 -

×

Optionetics 2007 - Home Study Course, MP3

1 × $6.00

Optionetics 2007 - Home Study Course, MP3

1 × $6.00 -

×

Monthly Income with Short Strangles, Dan's Way - Dan Sheridan - Sheridan Options Mentoring

1 × $69.00

Monthly Income with Short Strangles, Dan's Way - Dan Sheridan - Sheridan Options Mentoring

1 × $69.00 -

×

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Any Hour Trading System with Markets Mastered

1 × $6.00

The Any Hour Trading System with Markets Mastered

1 × $6.00 -

×

Psycho-Paper 96 with Charles Drummond

1 × $6.00

Psycho-Paper 96 with Charles Drummond

1 × $6.00 -

×

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00 -

×

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00 -

×

ICT Mentorship – 2019

1 × $13.00

ICT Mentorship – 2019

1 × $13.00 -

×

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00 -

×

Small and Mighty Association with Ryan Lee

1 × $6.00

Small and Mighty Association with Ryan Lee

1 × $6.00 -

×

Investing with Exchange Traded Funds Made Easy with Marvin Appel

1 × $6.00

Investing with Exchange Traded Funds Made Easy with Marvin Appel

1 × $6.00 -

×

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00 -

×

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00

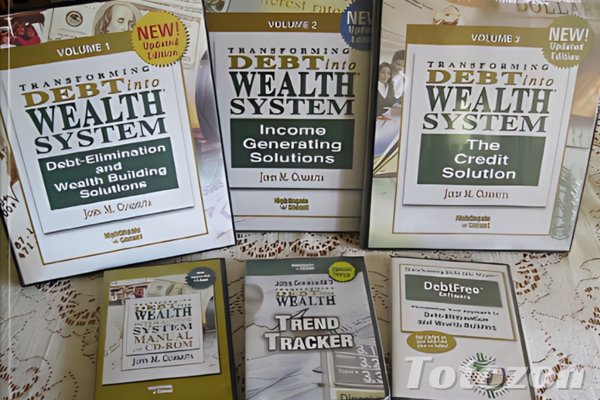

Transforming Debt into Wealth System with John Cummuta

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Transforming Debt into Wealth System with John Cummuta” below:

Transforming Debt into Wealth System with John Cummuta

Debt can feel like an insurmountable obstacle, but John Cummuta’s “Transforming Debt into Wealth” system offers a roadmap to financial freedom. In this article, we will explore the key principles and strategies of this system, designed to help you eliminate debt and build wealth effectively.

Introduction to John Cummuta’s System

Who is John Cummuta?

John Cummuta is a financial expert renowned for his innovative approach to personal finance. His system focuses on transforming debt into wealth through disciplined financial strategies.

What is the Transforming Debt into Wealth System?

This system is a comprehensive program that guides individuals on how to pay off debts rapidly and start building wealth. It emphasizes budgeting, smart spending, and strategic investing.

Core Principles of the System

The Power of Budgeting

Budgeting is the cornerstone of Cummuta’s system. By tracking income and expenses, you can identify areas to cut costs and allocate more funds towards debt repayment.

Debt Snowball Method

The debt snowball method involves paying off the smallest debts first while making minimum payments on larger ones. This approach builds momentum and encourages continued progress.

Living Below Your Means

Adopting a frugal lifestyle helps free up additional resources to tackle debt and save for the future. This involves making conscious spending choices and avoiding unnecessary purchases.

Steps to Transform Debt into Wealth

1. Assess Your Financial Situation

Begin by taking a comprehensive look at your current financial status. List all debts, income sources, and monthly expenses.

2. Create a Detailed Budget

Develop a realistic budget that includes all your income and expenses. Ensure you allocate funds for debt repayment and savings.

3. Prioritize Debts

Rank your debts from smallest to largest and focus on paying off the smallest debt first. This method boosts motivation as you see quick results.

4. Cut Unnecessary Expenses

Identify and eliminate non-essential expenses. Redirect these funds towards paying off debts and building an emergency fund.

5. Increase Your Income

Look for opportunities to boost your income, such as part-time jobs, freelance work, or selling unused items.

6. Pay Off Debts Aggressively

Use any extra income to pay down your debts faster. The quicker you eliminate debt, the sooner you can start saving and investing.

Building Wealth After Debt

Establish an Emergency Fund

Once debts are cleared, focus on building an emergency fund. Aim for three to six months’ worth of living expenses.

Invest Wisely

Start investing in assets that generate passive income. Consider stocks, bonds, real estate, or retirement accounts.

Automate Savings

Set up automatic transfers to your savings and investment accounts. This ensures consistent contributions and reduces the temptation to spend.

Common Pitfalls and How to Avoid Them

Ignoring the Budget

Sticking to a budget is crucial. Regularly review and adjust your budget to stay on track with your financial goals.

Accumulating More Debt

Avoid taking on new debt while paying off existing debts. Focus on living within your means and saving for purchases instead.

Lack of Emergency Fund

Not having an emergency fund can derail your financial progress. Prioritize building this fund to cover unexpected expenses.

Benefits of the Transforming Debt into Wealth System

Financial Freedom

Eliminating debt provides a sense of financial freedom and reduces stress. You can focus on building wealth and achieving long-term goals.

Increased Savings

With no debt payments, you can allocate more money towards savings and investments, accelerating your path to wealth.

Improved Financial Habits

Following this system helps develop disciplined financial habits that benefit you in the long run.

Conclusion

John Cummuta’s “Transforming Debt into Wealth” system offers a practical and effective approach to achieving financial independence. By following the steps outlined in this article, you can take control of your finances, eliminate debt, and start building wealth.

FAQs

1. How does the debt snowball method work?

The debt snowball method focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation to tackle larger debts.

2. What should be included in a budget?

A budget should include all sources of income and all expenses, both fixed and variable. It should also allocate funds for debt repayment and savings.

3. Why is an emergency fund important?

An emergency fund provides financial security by covering unexpected expenses, preventing the need to take on new debt.

4. How can I increase my income to pay off debt faster?

Consider part-time jobs, freelance work, or selling unused items to generate extra income that can be used for debt repayment.

5. What are some smart investment options after paying off debt?

Consider investing in stocks, bonds, real estate, or retirement accounts to build wealth and generate passive income.

Be the first to review “Transforming Debt into Wealth System with John Cummuta” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.