-

×

Option Strategies with Courtney Smith

1 × $6.00

Option Strategies with Courtney Smith

1 × $6.00 -

×

Risk Management Toolkit with Peter Bain

1 × $6.00

Risk Management Toolkit with Peter Bain

1 × $6.00 -

×

Divergence Super BluePrint with Bill Poulos

1 × $6.00

Divergence Super BluePrint with Bill Poulos

1 × $6.00 -

×

STREAM ALERTS

1 × $6.00

STREAM ALERTS

1 × $6.00 -

×

Fisher Investments on Telecom with Dan Sinton, Andrew S.Teufel

1 × $6.00

Fisher Investments on Telecom with Dan Sinton, Andrew S.Teufel

1 × $6.00 -

×

Investing Classroom 2022 with Danny Devan

1 × $15.00

Investing Classroom 2022 with Danny Devan

1 × $15.00 -

×

FasTrack Premium with Note Conference

1 × $78.00

FasTrack Premium with Note Conference

1 × $78.00 -

×

Options Bootcamp with Sid Woolfolk

1 × $6.00

Options Bootcamp with Sid Woolfolk

1 × $6.00 -

×

Spotting Solid Short-Term Opportunities

1 × $6.00

Spotting Solid Short-Term Opportunities

1 × $6.00 -

×

Dynamic Trading Indicators with Mark W.Helweg, David C.Stendahl

1 × $6.00

Dynamic Trading Indicators with Mark W.Helweg, David C.Stendahl

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00 -

×

The PPS Trading System with Curtis Arnold

1 × $6.00

The PPS Trading System with Curtis Arnold

1 × $6.00 -

×

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Advanced Trading Strategies with Larry Connors

1 × $6.00

Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

EZ2 Trade Charting Collection eSignal (ez2tradesoftware.com) - Raghee Horner

1 × $6.00

EZ2 Trade Charting Collection eSignal (ez2tradesoftware.com) - Raghee Horner

1 × $6.00 -

×

Growth Traders Toolbox Course with Julian Komar

1 × $5.00

Growth Traders Toolbox Course with Julian Komar

1 × $5.00 -

×

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00 -

×

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00 -

×

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00

Spread Trading E-Trading Stagionale (Italian) with Joe Ross

1 × $6.00 -

×

Hedge Funds for Dummies

1 × $6.00

Hedge Funds for Dummies

1 × $6.00 -

×

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00

Steve Jobs. The Greatest Second Act in the History of Business with Young Simon

1 × $6.00 -

×

Path to Profits By Scott Redler - T3 Live

1 × $6.00

Path to Profits By Scott Redler - T3 Live

1 × $6.00 -

×

Emini Bonds

1 × $23.00

Emini Bonds

1 × $23.00 -

×

Physicists on Wall Street and Other Essays on Science and Society with Jeremy Bernstein

1 × $6.00

Physicists on Wall Street and Other Essays on Science and Society with Jeremy Bernstein

1 × $6.00 -

×

JeaFx 2023 with James Allen

1 × $5.00

JeaFx 2023 with James Allen

1 × $5.00 -

×

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00 -

×

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00 -

×

EURUSD Trading System with CopperChips

1 × $6.00

EURUSD Trading System with CopperChips

1 × $6.00 -

×

A-Z Course with InvestiTrade Academy

1 × $5.00

A-Z Course with InvestiTrade Academy

1 × $5.00 -

×

Commodity Trading Video Course with Bob Buran

1 × $6.00

Commodity Trading Video Course with Bob Buran

1 × $6.00 -

×

Survive and Thrive in Extreme Volatility Class with Don Kaufman

1 × $6.00

Survive and Thrive in Extreme Volatility Class with Don Kaufman

1 × $6.00 -

×

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00 -

×

FX Capital Online

1 × $5.00

FX Capital Online

1 × $5.00 -

×

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00 -

×

Staying Out of Trouble Trading Currency with Channels - Barbara Rockefeller

1 × $6.00

Staying Out of Trouble Trading Currency with Channels - Barbara Rockefeller

1 × $6.00 -

×

Profit.ly - Bitcoin Basics

1 × $6.00

Profit.ly - Bitcoin Basics

1 × $6.00 -

×

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00 -

×

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00 -

×

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00 -

×

Indicator Effectiveness Testing & System Creation with David Vomund

1 × $6.00

Indicator Effectiveness Testing & System Creation with David Vomund

1 × $6.00 -

×

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00 -

×

Selective Forex Trading with Don Snellgrove

1 × $6.00

Selective Forex Trading with Don Snellgrove

1 × $6.00 -

×

IBD Home Study Course Package with Investor's Business Daily

1 × $17.00

IBD Home Study Course Package with Investor's Business Daily

1 × $17.00 -

×

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00 -

×

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00 -

×

Intra-day Trading Strategies. Proven Steps to Trading Profits

1 × $6.00

Intra-day Trading Strategies. Proven Steps to Trading Profits

1 × $6.00 -

×

The Geography of Money with Benjamin J.Cohen

1 × $6.00

The Geography of Money with Benjamin J.Cohen

1 × $6.00 -

×

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00 -

×

Candlesticks Explained with Martin Pring

1 × $6.00

Candlesticks Explained with Martin Pring

1 × $6.00 -

×

Drewize Banks Course

1 × $5.00

Drewize Banks Course

1 × $5.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

The Vital Few vs. the Trivial Many: Invest with the Insiders, Not the Masses with George Muzea

1 × $6.00

The Vital Few vs. the Trivial Many: Invest with the Insiders, Not the Masses with George Muzea

1 × $6.00 -

×

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00 -

×

Pyrapoint with D.E.Hall

1 × $6.00

Pyrapoint with D.E.Hall

1 × $6.00 -

×

Diary of an Internet Trader with Alpesh Patel

1 × $6.00

Diary of an Internet Trader with Alpesh Patel

1 × $6.00 -

×

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00 -

×

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

Smashing False Breakouts with Better System Trader

1 × $5.00

Smashing False Breakouts with Better System Trader

1 × $5.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

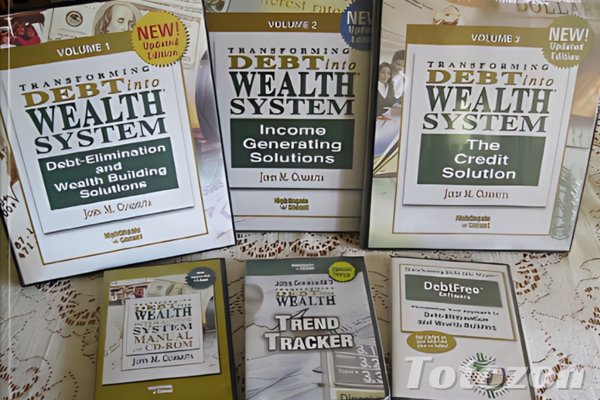

Transforming Debt into Wealth System with John Cummuta

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Transforming Debt into Wealth System with John Cummuta” below:

Transforming Debt into Wealth System with John Cummuta

Debt can feel like an insurmountable obstacle, but John Cummuta’s “Transforming Debt into Wealth” system offers a roadmap to financial freedom. In this article, we will explore the key principles and strategies of this system, designed to help you eliminate debt and build wealth effectively.

Introduction to John Cummuta’s System

Who is John Cummuta?

John Cummuta is a financial expert renowned for his innovative approach to personal finance. His system focuses on transforming debt into wealth through disciplined financial strategies.

What is the Transforming Debt into Wealth System?

This system is a comprehensive program that guides individuals on how to pay off debts rapidly and start building wealth. It emphasizes budgeting, smart spending, and strategic investing.

Core Principles of the System

The Power of Budgeting

Budgeting is the cornerstone of Cummuta’s system. By tracking income and expenses, you can identify areas to cut costs and allocate more funds towards debt repayment.

Debt Snowball Method

The debt snowball method involves paying off the smallest debts first while making minimum payments on larger ones. This approach builds momentum and encourages continued progress.

Living Below Your Means

Adopting a frugal lifestyle helps free up additional resources to tackle debt and save for the future. This involves making conscious spending choices and avoiding unnecessary purchases.

Steps to Transform Debt into Wealth

1. Assess Your Financial Situation

Begin by taking a comprehensive look at your current financial status. List all debts, income sources, and monthly expenses.

2. Create a Detailed Budget

Develop a realistic budget that includes all your income and expenses. Ensure you allocate funds for debt repayment and savings.

3. Prioritize Debts

Rank your debts from smallest to largest and focus on paying off the smallest debt first. This method boosts motivation as you see quick results.

4. Cut Unnecessary Expenses

Identify and eliminate non-essential expenses. Redirect these funds towards paying off debts and building an emergency fund.

5. Increase Your Income

Look for opportunities to boost your income, such as part-time jobs, freelance work, or selling unused items.

6. Pay Off Debts Aggressively

Use any extra income to pay down your debts faster. The quicker you eliminate debt, the sooner you can start saving and investing.

Building Wealth After Debt

Establish an Emergency Fund

Once debts are cleared, focus on building an emergency fund. Aim for three to six months’ worth of living expenses.

Invest Wisely

Start investing in assets that generate passive income. Consider stocks, bonds, real estate, or retirement accounts.

Automate Savings

Set up automatic transfers to your savings and investment accounts. This ensures consistent contributions and reduces the temptation to spend.

Common Pitfalls and How to Avoid Them

Ignoring the Budget

Sticking to a budget is crucial. Regularly review and adjust your budget to stay on track with your financial goals.

Accumulating More Debt

Avoid taking on new debt while paying off existing debts. Focus on living within your means and saving for purchases instead.

Lack of Emergency Fund

Not having an emergency fund can derail your financial progress. Prioritize building this fund to cover unexpected expenses.

Benefits of the Transforming Debt into Wealth System

Financial Freedom

Eliminating debt provides a sense of financial freedom and reduces stress. You can focus on building wealth and achieving long-term goals.

Increased Savings

With no debt payments, you can allocate more money towards savings and investments, accelerating your path to wealth.

Improved Financial Habits

Following this system helps develop disciplined financial habits that benefit you in the long run.

Conclusion

John Cummuta’s “Transforming Debt into Wealth” system offers a practical and effective approach to achieving financial independence. By following the steps outlined in this article, you can take control of your finances, eliminate debt, and start building wealth.

FAQs

1. How does the debt snowball method work?

The debt snowball method focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation to tackle larger debts.

2. What should be included in a budget?

A budget should include all sources of income and all expenses, both fixed and variable. It should also allocate funds for debt repayment and savings.

3. Why is an emergency fund important?

An emergency fund provides financial security by covering unexpected expenses, preventing the need to take on new debt.

4. How can I increase my income to pay off debt faster?

Consider part-time jobs, freelance work, or selling unused items to generate extra income that can be used for debt repayment.

5. What are some smart investment options after paying off debt?

Consider investing in stocks, bonds, real estate, or retirement accounts to build wealth and generate passive income.

Be the first to review “Transforming Debt into Wealth System with John Cummuta” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.