-

×

Speculating with Futures and Traditional Commodities with Liverpool Group

1 × $6.00

Speculating with Futures and Traditional Commodities with Liverpool Group

1 × $6.00 -

×

IBD Advanced Buying Strategies Home Study Program

1 × $10.00

IBD Advanced Buying Strategies Home Study Program

1 × $10.00 -

×

Foreign Exchange Option Pricing: A Practitioner's Guide with Iain Clark

1 × $6.00

Foreign Exchange Option Pricing: A Practitioner's Guide with Iain Clark

1 × $6.00 -

×

FOREX STRATEGY #1 with Steven Primo

1 × $39.00

FOREX STRATEGY #1 with Steven Primo

1 × $39.00 -

×

VWAP Trading course with Trade With Trend

1 × $6.00

VWAP Trading course with Trade With Trend

1 × $6.00 -

×

Options Trading with Adam Grimes - MarketLife

1 × $5.00

Options Trading with Adam Grimes - MarketLife

1 × $5.00 -

×

How to Trade in Stocks

1 × $6.00

How to Trade in Stocks

1 × $6.00 -

×

Robotic trading interactive

1 × $31.00

Robotic trading interactive

1 × $31.00 -

×

Lepus Proprietary Trading with Richard Jackson

1 × $6.00

Lepus Proprietary Trading with Richard Jackson

1 × $6.00 -

×

Gann Wheel 1.2.15 (globalviewtech.com)

1 × $6.00

Gann Wheel 1.2.15 (globalviewtech.com)

1 × $6.00 -

×

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00 -

×

Smart Money Concepts with JordyBanks

1 × $6.00

Smart Money Concepts with JordyBanks

1 × $6.00 -

×

NQ Price Action Mastery with Trade Smart

1 × $15.00

NQ Price Action Mastery with Trade Smart

1 × $15.00 -

×

RDCC – Over 150 Hours Risk Doctor Group Coaching Clinics with Charles Cottle

1 × $6.00

RDCC – Over 150 Hours Risk Doctor Group Coaching Clinics with Charles Cottle

1 × $6.00 -

×

The Apple Way with Jeffrey Cruikshank

1 × $6.00

The Apple Way with Jeffrey Cruikshank

1 × $6.00 -

×

How I Trade Major First-Hour Reversals For Rapid Gains with Kevin Haggerty

1 × $6.00

How I Trade Major First-Hour Reversals For Rapid Gains with Kevin Haggerty

1 × $6.00 -

×

Steve Nison Member Files

1 × $6.00

Steve Nison Member Files

1 × $6.00 -

×

TechnicalGodsFX Advanced Forex Education

1 × $7.00

TechnicalGodsFX Advanced Forex Education

1 × $7.00 -

×

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00

Trading Natural Resources in a Volatile Market with Kevin Kerr

1 × $6.00 -

×

Strategic Swing Trader with Sami Abusaad

1 × $6.00

Strategic Swing Trader with Sami Abusaad

1 × $6.00 -

×

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00

Gann Trade Real Time with Larry B.Jacobs

1 × $6.00 -

×

James Dalton Mind Over Markets Expanded Intensive Series 2018

1 × $6.00

James Dalton Mind Over Markets Expanded Intensive Series 2018

1 × $6.00 -

×

HunterFX Video Course with HunterFX

1 × $6.00

HunterFX Video Course with HunterFX

1 × $6.00 -

×

Wall Street Stories with Edwin Lefevre

1 × $6.00

Wall Street Stories with Edwin Lefevre

1 × $6.00 -

×

USDX Trading Course with Jared Martinez - MTI

1 × $6.00

USDX Trading Course with Jared Martinez - MTI

1 × $6.00 -

×

Supply and Demand Video Course with JamesFXS

1 × $13.00

Supply and Demand Video Course with JamesFXS

1 × $13.00 -

×

Practical Astro with Ruth Miller & Iam Williams

1 × $6.00

Practical Astro with Ruth Miller & Iam Williams

1 × $6.00 -

×

Forex Power Strategy Course with Jason Steele

1 × $6.00

Forex Power Strategy Course with Jason Steele

1 × $6.00 -

×

Options Trading Accelerator with Base Camp Trading

1 × $23.00

Options Trading Accelerator with Base Camp Trading

1 × $23.00 -

×

SOT Intermediate Course (May 2014)

1 × $23.00

SOT Intermediate Course (May 2014)

1 × $23.00 -

×

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Advent Forex Course with Cecil Robles

1 × $6.00

Advent Forex Course with Cecil Robles

1 × $6.00 -

×

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00

Trading Volatility - The Ultimate Course with Master Trader

1 × $69.00 -

×

A New Look at Exit Strategies with Charles LeBeau

1 × $6.00

A New Look at Exit Strategies with Charles LeBeau

1 × $6.00 -

×

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00 -

×

Naked Trading Part 1 with Base Camp Trading

1 × $6.00

Naked Trading Part 1 with Base Camp Trading

1 × $6.00 -

×

Marder Videos Reports 2019 with Kevin Marder

1 × $34.00

Marder Videos Reports 2019 with Kevin Marder

1 × $34.00 -

×

Multi Asset Class Investment Strategy with Guy Fraser-Sampson

1 × $6.00

Multi Asset Class Investment Strategy with Guy Fraser-Sampson

1 × $6.00 -

×

Portfolio Investing with Ron Bertino

1 × $54.00

Portfolio Investing with Ron Bertino

1 × $54.00 -

×

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Complete Options Trading Course (New 2019) with Wealthy Education

1 × $6.00

The Complete Options Trading Course (New 2019) with Wealthy Education

1 × $6.00 -

×

Mastering Candlestick Charts I with Greg Capra

1 × $6.00

Mastering Candlestick Charts I with Greg Capra

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Order Flow Analysis

1 × $15.00

Order Flow Analysis

1 × $15.00 -

×

Metastock Online Traders Summit

1 × $5.00

Metastock Online Traders Summit

1 × $5.00 -

×

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00 -

×

Scalping the Forex

1 × $6.00

Scalping the Forex

1 × $6.00 -

×

Option Income Stream System 2004

1 × $6.00

Option Income Stream System 2004

1 × $6.00 -

×

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00 -

×

Most Woke Trading Methods with Hunter FX

1 × $5.00

Most Woke Trading Methods with Hunter FX

1 × $5.00 -

×

Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray

1 × $6.00

Streetsmart Guide To Valuing a Stock (2nd Ed.) with Gary Gray

1 × $6.00 -

×

War Room Psychology Package (Volume 1-4) with Pat Mitchell – Trick Trades

1 × $112.00

War Room Psychology Package (Volume 1-4) with Pat Mitchell – Trick Trades

1 × $112.00 -

×

Ichimoku Cloud Triple Confirmation Indicator and Scan with AlphaShark

1 × $31.00

Ichimoku Cloud Triple Confirmation Indicator and Scan with AlphaShark

1 × $31.00 -

×

![ACD Method [Video (6 MP4s)] with Mark Fisher](https://www.totozon.com/wp-content/uploads/2024/05/ACD-Method-Video-6-MP4s-with-Mark-Fisher.jpg) ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00

ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00 -

×

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00 -

×

In Jeremy's Stock Market Brain

1 × $62.00

In Jeremy's Stock Market Brain

1 × $62.00 -

×

Forex Commander Package by Amin Sadak

1 × $6.00

Forex Commander Package by Amin Sadak

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Wyckoff Analytics Courses Collection

1 × $27.00

Wyckoff Analytics Courses Collection

1 × $27.00

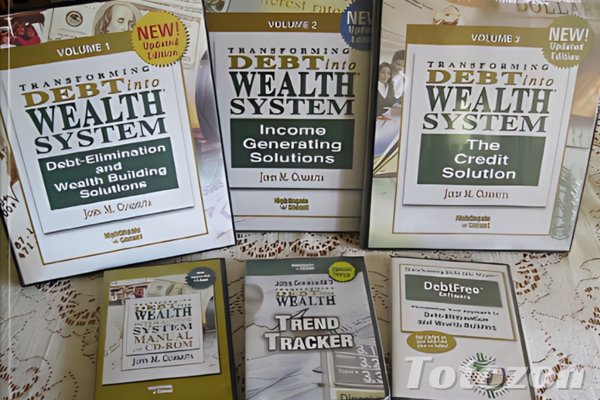

Transforming Debt into Wealth System with John Cummuta

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Transforming Debt into Wealth System with John Cummuta” below:

Transforming Debt into Wealth System with John Cummuta

Debt can feel like an insurmountable obstacle, but John Cummuta’s “Transforming Debt into Wealth” system offers a roadmap to financial freedom. In this article, we will explore the key principles and strategies of this system, designed to help you eliminate debt and build wealth effectively.

Introduction to John Cummuta’s System

Who is John Cummuta?

John Cummuta is a financial expert renowned for his innovative approach to personal finance. His system focuses on transforming debt into wealth through disciplined financial strategies.

What is the Transforming Debt into Wealth System?

This system is a comprehensive program that guides individuals on how to pay off debts rapidly and start building wealth. It emphasizes budgeting, smart spending, and strategic investing.

Core Principles of the System

The Power of Budgeting

Budgeting is the cornerstone of Cummuta’s system. By tracking income and expenses, you can identify areas to cut costs and allocate more funds towards debt repayment.

Debt Snowball Method

The debt snowball method involves paying off the smallest debts first while making minimum payments on larger ones. This approach builds momentum and encourages continued progress.

Living Below Your Means

Adopting a frugal lifestyle helps free up additional resources to tackle debt and save for the future. This involves making conscious spending choices and avoiding unnecessary purchases.

Steps to Transform Debt into Wealth

1. Assess Your Financial Situation

Begin by taking a comprehensive look at your current financial status. List all debts, income sources, and monthly expenses.

2. Create a Detailed Budget

Develop a realistic budget that includes all your income and expenses. Ensure you allocate funds for debt repayment and savings.

3. Prioritize Debts

Rank your debts from smallest to largest and focus on paying off the smallest debt first. This method boosts motivation as you see quick results.

4. Cut Unnecessary Expenses

Identify and eliminate non-essential expenses. Redirect these funds towards paying off debts and building an emergency fund.

5. Increase Your Income

Look for opportunities to boost your income, such as part-time jobs, freelance work, or selling unused items.

6. Pay Off Debts Aggressively

Use any extra income to pay down your debts faster. The quicker you eliminate debt, the sooner you can start saving and investing.

Building Wealth After Debt

Establish an Emergency Fund

Once debts are cleared, focus on building an emergency fund. Aim for three to six months’ worth of living expenses.

Invest Wisely

Start investing in assets that generate passive income. Consider stocks, bonds, real estate, or retirement accounts.

Automate Savings

Set up automatic transfers to your savings and investment accounts. This ensures consistent contributions and reduces the temptation to spend.

Common Pitfalls and How to Avoid Them

Ignoring the Budget

Sticking to a budget is crucial. Regularly review and adjust your budget to stay on track with your financial goals.

Accumulating More Debt

Avoid taking on new debt while paying off existing debts. Focus on living within your means and saving for purchases instead.

Lack of Emergency Fund

Not having an emergency fund can derail your financial progress. Prioritize building this fund to cover unexpected expenses.

Benefits of the Transforming Debt into Wealth System

Financial Freedom

Eliminating debt provides a sense of financial freedom and reduces stress. You can focus on building wealth and achieving long-term goals.

Increased Savings

With no debt payments, you can allocate more money towards savings and investments, accelerating your path to wealth.

Improved Financial Habits

Following this system helps develop disciplined financial habits that benefit you in the long run.

Conclusion

John Cummuta’s “Transforming Debt into Wealth” system offers a practical and effective approach to achieving financial independence. By following the steps outlined in this article, you can take control of your finances, eliminate debt, and start building wealth.

FAQs

1. How does the debt snowball method work?

The debt snowball method focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation to tackle larger debts.

2. What should be included in a budget?

A budget should include all sources of income and all expenses, both fixed and variable. It should also allocate funds for debt repayment and savings.

3. Why is an emergency fund important?

An emergency fund provides financial security by covering unexpected expenses, preventing the need to take on new debt.

4. How can I increase my income to pay off debt faster?

Consider part-time jobs, freelance work, or selling unused items to generate extra income that can be used for debt repayment.

5. What are some smart investment options after paying off debt?

Consider investing in stocks, bonds, real estate, or retirement accounts to build wealth and generate passive income.

Be the first to review “Transforming Debt into Wealth System with John Cummuta” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.