-

×

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Timing Solution Terra Incognita Edition Build 24 (timingsolution.com)

1 × $6.00

Timing Solution Terra Incognita Edition Build 24 (timingsolution.com)

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Sector Rotation & Market Timing with Frank Barbera

1 × $6.00

Sector Rotation & Market Timing with Frank Barbera

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00 -

×

CFA Level 2 - Sample Item Sets 2003

1 × $6.00

CFA Level 2 - Sample Item Sets 2003

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Rob’s 6 Day 21 Set-up Course with Rob Hoffman

1 × $85.00

Rob’s 6 Day 21 Set-up Course with Rob Hoffman

1 × $85.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Ultimate Options with Andy Tanner & Corey Halliday - The Cashflow Academy

1 × $139.00

Ultimate Options with Andy Tanner & Corey Halliday - The Cashflow Academy

1 × $139.00 -

×

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00 -

×

Researching your Trade

1 × $6.00

Researching your Trade

1 × $6.00 -

×

Options, Futures, and Other Derivative Securities

1 × $6.00

Options, Futures, and Other Derivative Securities

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00

TRADE THE BANKS TRAINING PACKAGE

1 × $15.00 -

×

IBD Advanced Buying Strategies Home Study Program

1 × $10.00

IBD Advanced Buying Strategies Home Study Program

1 × $10.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Trader University Course

1 × $5.00

Trader University Course

1 × $5.00 -

×

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00 -

×

Wave Trading Masterclass: Elliott's Wave Theory/Fibonacci Principles with Wave Trader

1 × $116.00

Wave Trading Masterclass: Elliott's Wave Theory/Fibonacci Principles with Wave Trader

1 × $116.00 -

×

Pro Indicator Pack with Trade Confident

1 × $15.00

Pro Indicator Pack with Trade Confident

1 × $15.00 -

×

Becoming a Disciplined Trader: Techniques for Achieving Peak Trading Performance with Ari Kiev

1 × $6.00

Becoming a Disciplined Trader: Techniques for Achieving Peak Trading Performance with Ari Kiev

1 × $6.00 -

×

NetPicks - Universal Market Trader Course

1 × $6.00

NetPicks - Universal Market Trader Course

1 × $6.00 -

×

Advanced Trading Course with Edney Pinheiro

1 × $5.00

Advanced Trading Course with Edney Pinheiro

1 × $5.00 -

×

QuickBooks 2003 Official Guide

1 × $6.00

QuickBooks 2003 Official Guide

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00 -

×

How To Create Your Own Trading Strategy with Simon Klein - Trade Smart

1 × $5.00

How To Create Your Own Trading Strategy with Simon Klein - Trade Smart

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

CFA Level 2 - Examination Book Afternoon Section (1999)

1 × $6.00

CFA Level 2 - Examination Book Afternoon Section (1999)

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Options Wizardry from A to Z (Video 2.80 GB) with Don Fishback

1 × $6.00

Options Wizardry from A to Z (Video 2.80 GB) with Don Fishback

1 × $6.00 -

×

ETF Trading Strategies Revealed with David Vomund

1 × $6.00

ETF Trading Strategies Revealed with David Vomund

1 × $6.00 -

×

Four Books with J.L.Lord

1 × $23.00

Four Books with J.L.Lord

1 × $23.00 -

×

Trading Masterclass XVII with Wysetrade

1 × $6.00

Trading Masterclass XVII with Wysetrade

1 × $6.00 -

×

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00 -

×

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00 -

×

Using the Techniques of Andrews & Babson

1 × $6.00

Using the Techniques of Andrews & Babson

1 × $6.00 -

×

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00 -

×

Mastering Candlestick Charts II with Greg Capra

1 × $6.00

Mastering Candlestick Charts II with Greg Capra

1 × $6.00 -

×

Forex Strategy Master with Russ Horn

1 × $6.00

Forex Strategy Master with Russ Horn

1 × $6.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

Fed Balance Sheet 201 with Joseph Wang - Central Banking 101

1 × $10.00

Fed Balance Sheet 201 with Joseph Wang - Central Banking 101

1 × $10.00 -

×

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Wyckoff Analysis Series. Module 1. Wyckoff Volume Analysis

1 × $6.00

Wyckoff Analysis Series. Module 1. Wyckoff Volume Analysis

1 × $6.00 -

×

What Products to Watch and Why Class with Don Kaufman

1 × $6.00

What Products to Watch and Why Class with Don Kaufman

1 × $6.00 -

×

Tom Busby – DAX Supplement Trading Course 2007 with DTI

1 × $6.00

Tom Busby – DAX Supplement Trading Course 2007 with DTI

1 × $6.00 -

×

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

War Room Psychology Vol. 4 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 4 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Wyckoff Analytics Courses Collection

1 × $27.00

Wyckoff Analytics Courses Collection

1 × $27.00 -

×

Strategy Week: Using High Probability Options Strategies with Don Kaufman

1 × $6.00

Strategy Week: Using High Probability Options Strategies with Don Kaufman

1 × $6.00 -

×

Crypto Strategies From Swing Trading To Intraday with Alessio Rutigliano & Roman Bogomazov

1 × $17.00

Crypto Strategies From Swing Trading To Intraday with Alessio Rutigliano & Roman Bogomazov

1 × $17.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

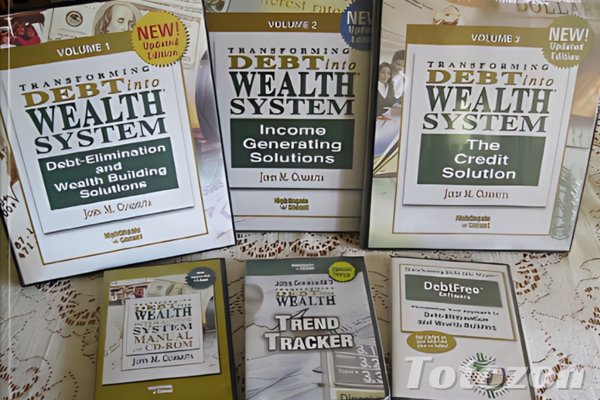

Transforming Debt into Wealth System with John Cummuta

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Transforming Debt into Wealth System with John Cummuta” below:

Transforming Debt into Wealth System with John Cummuta

Debt can feel like an insurmountable obstacle, but John Cummuta’s “Transforming Debt into Wealth” system offers a roadmap to financial freedom. In this article, we will explore the key principles and strategies of this system, designed to help you eliminate debt and build wealth effectively.

Introduction to John Cummuta’s System

Who is John Cummuta?

John Cummuta is a financial expert renowned for his innovative approach to personal finance. His system focuses on transforming debt into wealth through disciplined financial strategies.

What is the Transforming Debt into Wealth System?

This system is a comprehensive program that guides individuals on how to pay off debts rapidly and start building wealth. It emphasizes budgeting, smart spending, and strategic investing.

Core Principles of the System

The Power of Budgeting

Budgeting is the cornerstone of Cummuta’s system. By tracking income and expenses, you can identify areas to cut costs and allocate more funds towards debt repayment.

Debt Snowball Method

The debt snowball method involves paying off the smallest debts first while making minimum payments on larger ones. This approach builds momentum and encourages continued progress.

Living Below Your Means

Adopting a frugal lifestyle helps free up additional resources to tackle debt and save for the future. This involves making conscious spending choices and avoiding unnecessary purchases.

Steps to Transform Debt into Wealth

1. Assess Your Financial Situation

Begin by taking a comprehensive look at your current financial status. List all debts, income sources, and monthly expenses.

2. Create a Detailed Budget

Develop a realistic budget that includes all your income and expenses. Ensure you allocate funds for debt repayment and savings.

3. Prioritize Debts

Rank your debts from smallest to largest and focus on paying off the smallest debt first. This method boosts motivation as you see quick results.

4. Cut Unnecessary Expenses

Identify and eliminate non-essential expenses. Redirect these funds towards paying off debts and building an emergency fund.

5. Increase Your Income

Look for opportunities to boost your income, such as part-time jobs, freelance work, or selling unused items.

6. Pay Off Debts Aggressively

Use any extra income to pay down your debts faster. The quicker you eliminate debt, the sooner you can start saving and investing.

Building Wealth After Debt

Establish an Emergency Fund

Once debts are cleared, focus on building an emergency fund. Aim for three to six months’ worth of living expenses.

Invest Wisely

Start investing in assets that generate passive income. Consider stocks, bonds, real estate, or retirement accounts.

Automate Savings

Set up automatic transfers to your savings and investment accounts. This ensures consistent contributions and reduces the temptation to spend.

Common Pitfalls and How to Avoid Them

Ignoring the Budget

Sticking to a budget is crucial. Regularly review and adjust your budget to stay on track with your financial goals.

Accumulating More Debt

Avoid taking on new debt while paying off existing debts. Focus on living within your means and saving for purchases instead.

Lack of Emergency Fund

Not having an emergency fund can derail your financial progress. Prioritize building this fund to cover unexpected expenses.

Benefits of the Transforming Debt into Wealth System

Financial Freedom

Eliminating debt provides a sense of financial freedom and reduces stress. You can focus on building wealth and achieving long-term goals.

Increased Savings

With no debt payments, you can allocate more money towards savings and investments, accelerating your path to wealth.

Improved Financial Habits

Following this system helps develop disciplined financial habits that benefit you in the long run.

Conclusion

John Cummuta’s “Transforming Debt into Wealth” system offers a practical and effective approach to achieving financial independence. By following the steps outlined in this article, you can take control of your finances, eliminate debt, and start building wealth.

FAQs

1. How does the debt snowball method work?

The debt snowball method focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation to tackle larger debts.

2. What should be included in a budget?

A budget should include all sources of income and all expenses, both fixed and variable. It should also allocate funds for debt repayment and savings.

3. Why is an emergency fund important?

An emergency fund provides financial security by covering unexpected expenses, preventing the need to take on new debt.

4. How can I increase my income to pay off debt faster?

Consider part-time jobs, freelance work, or selling unused items to generate extra income that can be used for debt repayment.

5. What are some smart investment options after paying off debt?

Consider investing in stocks, bonds, real estate, or retirement accounts to build wealth and generate passive income.

Be the first to review “Transforming Debt into Wealth System with John Cummuta” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.