-

×

Acclimation Course with Base Camp Trading

1 × $10.00

Acclimation Course with Base Camp Trading

1 × $10.00 -

×

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

Pre-Previews. 23 Articles and Forecasts

1 × $6.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00

Sea Lanes & Pipelines with Bernard D.Cole

1 × $6.00 -

×

The 10%ers with Trader Mike

1 × $5.00

The 10%ers with Trader Mike

1 × $5.00 -

×

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00 -

×

The Art of the Trade: What I Learned (and Lost) Trading the Chicago Futures Markets - Jason Alan Jankovsky

1 × $6.00

The Art of the Trade: What I Learned (and Lost) Trading the Chicago Futures Markets - Jason Alan Jankovsky

1 × $6.00 -

×

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00 -

×

The Great Depression with David Burg

1 × $6.00

The Great Depression with David Burg

1 × $6.00 -

×

FOUS4 with Cameron Fous

1 × $5.00

FOUS4 with Cameron Fous

1 × $5.00 -

×

Forex Avenger Trading System with David Curran

1 × $6.00

Forex Avenger Trading System with David Curran

1 × $6.00 -

×

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00 -

×

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00

How to Pick Hot Reverse Merger Penny Stocks with John Lux

1 × $5.00 -

×

Simple Sector Trading Strategies with John Murphy

1 × $6.00

Simple Sector Trading Strategies with John Murphy

1 × $6.00 -

×

Forex 800k Workshop with Spartan Trader

1 × $23.00

Forex 800k Workshop with Spartan Trader

1 × $23.00 -

×

Square The Range Trading System with Michael Jenkins

1 × $6.00

Square The Range Trading System with Michael Jenkins

1 × $6.00 -

×

Mql4 Bundle: Basics, Scripts, Indicators, Experts with Jim Hodges

1 × $15.00

Mql4 Bundle: Basics, Scripts, Indicators, Experts with Jim Hodges

1 × $15.00 -

×

8 Strategies for Day Trading

1 × $31.00

8 Strategies for Day Trading

1 × $31.00 -

×

The Compleat Day Trader with Jake Bernstein

1 × $6.00

The Compleat Day Trader with Jake Bernstein

1 × $6.00 -

×

TOP Gamma Bundle with TopTrade Tools

1 × $69.00

TOP Gamma Bundle with TopTrade Tools

1 × $69.00 -

×

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00 -

×

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00 -

×

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00 -

×

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

Secrets of Swiss Banking with Hoyt Barber

1 × $6.00

Secrets of Swiss Banking with Hoyt Barber

1 × $6.00 -

×

The Greatest Trade Ever with Gregory Zuckerman

1 × $6.00

The Greatest Trade Ever with Gregory Zuckerman

1 × $6.00 -

×

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00

Road to consistent profits (Dec 2022) with Jarrod Goodwin - Trading Halls of Knowledge

1 × $31.00 -

×

The Art And Science Of Trading with Adam Grimes

1 × $6.00

The Art And Science Of Trading with Adam Grimes

1 × $6.00 -

×

Hit The Mark Trading - Boot Camp 2016 Courses

1 × $23.00

Hit The Mark Trading - Boot Camp 2016 Courses

1 × $23.00 -

×

Fundamental Analysis with CA Rachana Ranade

1 × $5.00

Fundamental Analysis with CA Rachana Ranade

1 × $5.00 -

×

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00 -

×

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00 -

×

We Fund Traders - The Whale Order

1 × $5.00

We Fund Traders - The Whale Order

1 × $5.00 -

×

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00 -

×

How I Trade for a Living with Gary Smith

1 × $6.00

How I Trade for a Living with Gary Smith

1 × $6.00 -

×

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Professional Trader Course

1 × $5.00

Professional Trader Course

1 × $5.00 -

×

Volume Profile Formula with Aaron Korbs

1 × $5.00

Volume Profile Formula with Aaron Korbs

1 × $5.00 -

×

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00 -

×

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00 -

×

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00 -

×

Master Trader with InvestingSimple

1 × $15.00

Master Trader with InvestingSimple

1 × $15.00 -

×

Trading with the Gods Fibonacci Series with Alan Oliver

1 × $6.00

Trading with the Gods Fibonacci Series with Alan Oliver

1 × $6.00 -

×

EasyLanguage Home Study Course PDF Book + CD

1 × $6.00

EasyLanguage Home Study Course PDF Book + CD

1 × $6.00 -

×

Investing in 401k Plans with Cliffsnotes

1 × $6.00

Investing in 401k Plans with Cliffsnotes

1 × $6.00 -

×

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00 -

×

The PPS Trading System with Curtis Arnold

1 × $6.00

The PPS Trading System with Curtis Arnold

1 × $6.00 -

×

The Practical Fractal with Bill Williams

1 × $6.00

The Practical Fractal with Bill Williams

1 × $6.00 -

×

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00 -

×

Secrets to Short Term Trading with Larry Williams

1 × $6.00

Secrets to Short Term Trading with Larry Williams

1 × $6.00 -

×

Signals

1 × $6.00

Signals

1 × $6.00 -

×

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Investing Strategies with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

The Age of Turbulence with Alan Greenspan

1 × $6.00

The Age of Turbulence with Alan Greenspan

1 × $6.00 -

×

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00 -

×

E75 Forex System with James de Wet

1 × $6.00

E75 Forex System with James de Wet

1 × $6.00 -

×

Sequence Trading Course with Kevin Haggerty

1 × $4.00

Sequence Trading Course with Kevin Haggerty

1 × $4.00 -

×

Traders Forge with Ryan Litchfield

1 × $6.00

Traders Forge with Ryan Litchfield

1 × $6.00 -

×

Confessions of a Street Addict with James Cramer

1 × $6.00

Confessions of a Street Addict with James Cramer

1 × $6.00 -

×

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00

Fibonacci – CCI Workshop Recording Series (2006 & 2008)

1 × $6.00 -

×

Activedaytrader - Workshop Options For Income

1 × $15.00

Activedaytrader - Workshop Options For Income

1 × $15.00 -

×

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00 -

×

The Psychology Of Trading with Brett N.Steenbarger

1 × $6.00

The Psychology Of Trading with Brett N.Steenbarger

1 × $6.00 -

×

Intra-day Solar Trader with George Harrison

1 × $17.00

Intra-day Solar Trader with George Harrison

1 × $17.00 -

×

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00 -

×

Sell & Sell Short with Alexander Elder

1 × $6.00

Sell & Sell Short with Alexander Elder

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Transforming Debt into Wealth System with John Cummuta

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

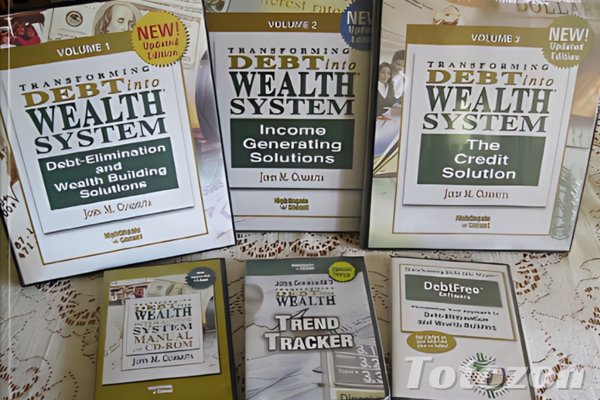

You may check content proof of “Transforming Debt into Wealth System with John Cummuta” below:

Transforming Debt into Wealth System with John Cummuta

Debt can feel like an insurmountable obstacle, but John Cummuta’s “Transforming Debt into Wealth” system offers a roadmap to financial freedom. In this article, we will explore the key principles and strategies of this system, designed to help you eliminate debt and build wealth effectively.

Introduction to John Cummuta’s System

Who is John Cummuta?

John Cummuta is a financial expert renowned for his innovative approach to personal finance. His system focuses on transforming debt into wealth through disciplined financial strategies.

What is the Transforming Debt into Wealth System?

This system is a comprehensive program that guides individuals on how to pay off debts rapidly and start building wealth. It emphasizes budgeting, smart spending, and strategic investing.

Core Principles of the System

The Power of Budgeting

Budgeting is the cornerstone of Cummuta’s system. By tracking income and expenses, you can identify areas to cut costs and allocate more funds towards debt repayment.

Debt Snowball Method

The debt snowball method involves paying off the smallest debts first while making minimum payments on larger ones. This approach builds momentum and encourages continued progress.

Living Below Your Means

Adopting a frugal lifestyle helps free up additional resources to tackle debt and save for the future. This involves making conscious spending choices and avoiding unnecessary purchases.

Steps to Transform Debt into Wealth

1. Assess Your Financial Situation

Begin by taking a comprehensive look at your current financial status. List all debts, income sources, and monthly expenses.

2. Create a Detailed Budget

Develop a realistic budget that includes all your income and expenses. Ensure you allocate funds for debt repayment and savings.

3. Prioritize Debts

Rank your debts from smallest to largest and focus on paying off the smallest debt first. This method boosts motivation as you see quick results.

4. Cut Unnecessary Expenses

Identify and eliminate non-essential expenses. Redirect these funds towards paying off debts and building an emergency fund.

5. Increase Your Income

Look for opportunities to boost your income, such as part-time jobs, freelance work, or selling unused items.

6. Pay Off Debts Aggressively

Use any extra income to pay down your debts faster. The quicker you eliminate debt, the sooner you can start saving and investing.

Building Wealth After Debt

Establish an Emergency Fund

Once debts are cleared, focus on building an emergency fund. Aim for three to six months’ worth of living expenses.

Invest Wisely

Start investing in assets that generate passive income. Consider stocks, bonds, real estate, or retirement accounts.

Automate Savings

Set up automatic transfers to your savings and investment accounts. This ensures consistent contributions and reduces the temptation to spend.

Common Pitfalls and How to Avoid Them

Ignoring the Budget

Sticking to a budget is crucial. Regularly review and adjust your budget to stay on track with your financial goals.

Accumulating More Debt

Avoid taking on new debt while paying off existing debts. Focus on living within your means and saving for purchases instead.

Lack of Emergency Fund

Not having an emergency fund can derail your financial progress. Prioritize building this fund to cover unexpected expenses.

Benefits of the Transforming Debt into Wealth System

Financial Freedom

Eliminating debt provides a sense of financial freedom and reduces stress. You can focus on building wealth and achieving long-term goals.

Increased Savings

With no debt payments, you can allocate more money towards savings and investments, accelerating your path to wealth.

Improved Financial Habits

Following this system helps develop disciplined financial habits that benefit you in the long run.

Conclusion

John Cummuta’s “Transforming Debt into Wealth” system offers a practical and effective approach to achieving financial independence. By following the steps outlined in this article, you can take control of your finances, eliminate debt, and start building wealth.

FAQs

1. How does the debt snowball method work?

The debt snowball method focuses on paying off the smallest debts first, creating a sense of accomplishment and motivation to tackle larger debts.

2. What should be included in a budget?

A budget should include all sources of income and all expenses, both fixed and variable. It should also allocate funds for debt repayment and savings.

3. Why is an emergency fund important?

An emergency fund provides financial security by covering unexpected expenses, preventing the need to take on new debt.

4. How can I increase my income to pay off debt faster?

Consider part-time jobs, freelance work, or selling unused items to generate extra income that can be used for debt repayment.

5. What are some smart investment options after paying off debt?

Consider investing in stocks, bonds, real estate, or retirement accounts to build wealth and generate passive income.

Be the first to review “Transforming Debt into Wealth System with John Cummuta” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.