-

×

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Traders Guide to Emotional Management with Brian McAboy

1 × $4.00

Traders Guide to Emotional Management with Brian McAboy

1 × $4.00 -

×

7 Days Options Masters Course with John Carter

1 × $54.00

7 Days Options Masters Course with John Carter

1 × $54.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Spring 2023) - Roman Bogomazov & Alessio Rutigliano

1 × $209.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

AG Trading Journal with Ace Gazette

1 × $6.00

AG Trading Journal with Ace Gazette

1 × $6.00 -

×

An Introduction to Option Trading Success with James Bittman

1 × $6.00

An Introduction to Option Trading Success with James Bittman

1 × $6.00 -

×

4 Day Trading Bootcamp

1 × $31.00

4 Day Trading Bootcamp

1 × $31.00 -

×

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00 -

×

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00

Algo Trading Strategies 2017 with Autotrading Academy

1 × $6.00 -

×

Artificial Intelligence with Larry Pesavento

1 × $6.00

Artificial Intelligence with Larry Pesavento

1 × $6.00 -

×

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Beginner's Guide to Ratio Butterflys Class with Don Kaufman

1 × $6.00

Beginner's Guide to Ratio Butterflys Class with Don Kaufman

1 × $6.00 -

×

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00 -

×

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00 -

×

Three Tricks, Two Traps, One Truth Real Help for Traders and Investors with D.R.Barton

1 × $6.00

Three Tricks, Two Traps, One Truth Real Help for Traders and Investors with D.R.Barton

1 × $6.00 -

×

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00

Money Management Strategies for Serious Traders with David Stendahl

1 × $6.00 -

×

Charles Cottle Package ( Discount 50% )

1 × $23.00

Charles Cottle Package ( Discount 50% )

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

What Products to Watch and Why Class with Don Kaufman

1 × $6.00

What Products to Watch and Why Class with Don Kaufman

1 × $6.00 -

×

Advanced Fibonacci Trading with Neal Hughes

1 × $6.00

Advanced Fibonacci Trading with Neal Hughes

1 × $6.00 -

×

San Jose Options - Iron Condor & Butterfly Options Trading Videos

1 × $15.00

San Jose Options - Iron Condor & Butterfly Options Trading Videos

1 × $15.00 -

×

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00 -

×

Market Profile Video with FutexLive

1 × $6.00

Market Profile Video with FutexLive

1 × $6.00 -

×

How To Buy with Justin Mamis

1 × $6.00

How To Buy with Justin Mamis

1 × $6.00 -

×

Advanced Calculus with Applications in Statistics

1 × $6.00

Advanced Calculus with Applications in Statistics

1 × $6.00 -

×

![ACD Method [Video (6 MP4s)] with Mark Fisher](https://www.totozon.com/wp-content/uploads/2024/05/ACD-Method-Video-6-MP4s-with-Mark-Fisher.jpg) ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00

ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00 -

×

Advanced Get 12.0.3485 x86 (August 2014) (+ open code efs, dll's) for Any eSignal Account

1 × $23.00

Advanced Get 12.0.3485 x86 (August 2014) (+ open code efs, dll's) for Any eSignal Account

1 × $23.00 -

×

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00 -

×

Trader University with Matthew Kratter

1 × $6.00

Trader University with Matthew Kratter

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00 -

×

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00 -

×

7 Figures Forex Course

1 × $15.00

7 Figures Forex Course

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Elder-disk for TradeStation, enhanced with a MACD scanner

1 × $54.00

Elder-disk for TradeStation, enhanced with a MACD scanner

1 × $54.00 -

×

Volume Profile Video Course with Trader Dale

1 × $8.00

Volume Profile Video Course with Trader Dale

1 × $8.00 -

×

Physicists on Wall Street and Other Essays on Science and Society with Jeremy Bernstein

1 × $6.00

Physicists on Wall Street and Other Essays on Science and Society with Jeremy Bernstein

1 × $6.00 -

×

Annual Forecast Reports - Forecast 2023 with Larry Williams

1 × $8.00

Annual Forecast Reports - Forecast 2023 with Larry Williams

1 × $8.00 -

×

How To Flip All Those “Hard To Flip” Deals

1 × $6.00

How To Flip All Those “Hard To Flip” Deals

1 × $6.00 -

×

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00 -

×

Month 01 to 08 2018

1 × $62.00

Month 01 to 08 2018

1 × $62.00 -

×

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00

A Momentum Based Approach to Swing Trading with Dave Landry

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

Capital Asset Investment with Anthony F.Herbst

1 × $6.00

Capital Asset Investment with Anthony F.Herbst

1 × $6.00 -

×

Mind of a Trader with Alpesh Patel

1 × $6.00

Mind of a Trader with Alpesh Patel

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

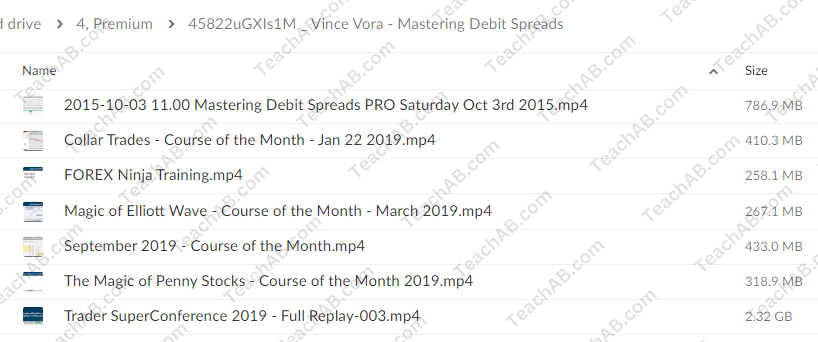

Mastering Debit Spreads with Vince Vora

$297.00 Original price was: $297.00.$15.00Current price is: $15.00.

File Size: 4.74 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here

You may check content proof of “Mastering Debit Spreads with Vince Vora” below:

Mastering Debit Spreads with Vince Vora

Introduction

Welcome to our in-depth guide on Mastering Debit Spreads with Vince Vora. Debit spreads are a powerful options trading strategy that can help you maximize profits while controlling risk. In this article, we will explore the fundamentals of debit spreads, their benefits, and how to implement them effectively with insights from Vince Vora, a renowned trading expert.

Who is Vince Vora?

Background and Expertise

Vince Vora is a seasoned trader and educator known for his expertise in options trading. With years of experience in the financial markets, Vora has developed a range of effective trading strategies, including debit spreads, to help traders achieve consistent success.

Trading Philosophy

Vora’s philosophy emphasizes the importance of risk management and strategic planning. He believes in using well-defined trading strategies to navigate the complexities of the market and maximize returns.

What are Debit Spreads?

Definition

A debit spread involves buying and selling options of the same type (either calls or puts) with different strike prices. The goal is to create a position that benefits from the movement of the underlying asset while limiting risk.

Importance

- Risk Management: Debit spreads help limit potential losses.

- Cost Efficiency: They are more cost-effective compared to outright options purchases.

- Profit Potential: Offer significant profit potential with controlled risk.

Core Concepts of Debit Spreads

1. Bull Call Spread

Setup

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price with the same expiration date.

When to Use

This strategy is used when you expect a moderate rise in the price of the underlying asset.

2. Bear Put Spread

Setup

A bear put spread involves buying a put option at a higher strike price and selling another put option at a lower strike price with the same expiration date.

When to Use

This strategy is used when you expect a moderate decline in the price of the underlying asset.

Benefits of Debit Spreads

Limited Risk

Debit spreads cap potential losses to the initial net premium paid, providing a clear risk-reward profile.

Reduced Cost

By selling an option, the premium received offsets part of the cost of the purchased option, making debit spreads more cost-effective.

Flexibility

Debit spreads can be used in various market conditions, allowing traders to adapt their strategies to different scenarios.

Implementing Debit Spreads

Step-by-Step Guide

- Select the Underlying Asset: Choose a stock or ETF that you believe will move in a specific direction.

- Determine Strike Prices: Select appropriate strike prices for the options based on your market outlook.

- Choose Expiration Date: Pick an expiration date that aligns with your trading horizon.

- Buy and Sell Options: Execute the trade by buying one option and selling another at different strike prices.

- Monitor the Trade: Keep track of the trade’s performance and make adjustments as necessary.

Example Strategy

Bull Call Spread Example

- Stock Price: $100

- Buy Call Option: Strike price $95, premium $6

- Sell Call Option: Strike price $105, premium $2

- Net Debit: $4 ($6 – $2)

- Max Profit: $6 ($10 spread – $4 net debit)

- Max Loss: $4 (net debit paid)

Risks and Considerations

Limited Profit Potential

While debit spreads limit risk, they also cap the maximum profit potential, which may not be suitable for traders seeking unlimited gains.

Time Decay

Options lose value as they approach expiration. It’s crucial to consider the impact of time decay on the trade’s profitability.

Market Movement

Debit spreads require the underlying asset to move in the anticipated direction. If the market moves against your position, losses will occur.

Tools and Resources for Trading Debit Spreads

Trading Platforms

Select a trading platform that supports options trading and provides robust tools for analyzing and executing debit spreads.

Educational Resources

Utilize books, webinars, and online courses to deepen your understanding of debit spreads and options trading.

Common Mistakes to Avoid

Ignoring Market Analysis

Conduct thorough market analysis before implementing debit spreads to ensure your strategy aligns with market conditions.

Overlooking Risk Management

Always use risk management techniques, such as stop-loss orders and position sizing, to protect your capital.

Failing to Monitor Trades

Regularly monitor your trades to make necessary adjustments and avoid unexpected losses.

Success Stories with Vince Vora

Trader A’s Journey

Trader A significantly improved their trading accuracy and consistency by applying Vince Vora’s debit spread strategies, achieving steady profits and reduced risks.

Trader B’s Experience

Trader B found the insights from Vince Vora invaluable for understanding the nuances of debit spreads, leading to enhanced trading performance and better risk management.

Conclusion

Mastering Debit Spreads with Vince Vora offers a structured approach to using debit spreads effectively in options trading. By understanding the fundamentals, benefits, and risks, you can integrate this powerful strategy into your trading routine. Remember to stay disciplined, continuously educate yourself, and adapt to changing market conditions for consistent success.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Mastering Debit Spreads with Vince Vora” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.