-

×

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00

Electronic Day Traders' Secrets: Learn From the Best of the Best DayTraders with Burton Friedfertig

1 × $6.00 -

×

Capital Asset Investment with Anthony F.Herbst

1 × $6.00

Capital Asset Investment with Anthony F.Herbst

1 × $6.00 -

×

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Candlesticks Explained with Martin Pring

1 × $6.00

Candlesticks Explained with Martin Pring

1 × $6.00 -

×

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00 -

×

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00 -

×

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00 -

×

The New Science of Asset Allocation with Thomas Schneeweis

1 × $6.00

The New Science of Asset Allocation with Thomas Schneeweis

1 × $6.00 -

×

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00 -

×

Cotton Trading Manual with Terry Townsend

1 × $6.00

Cotton Trading Manual with Terry Townsend

1 × $6.00 -

×

WealthFRX Trading Mastery Course 2.0

1 × $5.00

WealthFRX Trading Mastery Course 2.0

1 × $5.00 -

×

Master Strategies of Super Achievers By Steven Scott

1 × $23.00

Master Strategies of Super Achievers By Steven Scott

1 × $23.00 -

×

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00 -

×

Design for Six Sigma with Subir Chowdhury

1 × $6.00

Design for Six Sigma with Subir Chowdhury

1 × $6.00 -

×

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00 -

×

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Kicker Signals with Stephen W.Bigalow

1 × $6.00

Kicker Signals with Stephen W.Bigalow

1 × $6.00 -

×

Ambush Trading Method on Wheat & Corn with Marco Mayer

1 × $4.00

Ambush Trading Method on Wheat & Corn with Marco Mayer

1 × $4.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00 -

×

Trading Economic Data System with CopperChips

1 × $6.00

Trading Economic Data System with CopperChips

1 × $6.00 -

×

Path to Profits By Scott Redler - T3 Live

1 × $6.00

Path to Profits By Scott Redler - T3 Live

1 × $6.00 -

×

Advanced Course with Jtrader

1 × $6.00

Advanced Course with Jtrader

1 × $6.00 -

×

The Psychology of Risk (Audio) with Ari Kiev

1 × $6.00

The Psychology of Risk (Audio) with Ari Kiev

1 × $6.00 -

×

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00 -

×

![ACD Method [Video (6 MP4s)] with Mark Fisher](https://www.totozon.com/wp-content/uploads/2024/05/ACD-Method-Video-6-MP4s-with-Mark-Fisher.jpg) ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00

ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00 -

×

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00 -

×

An Introduction to Option Trading Success with James Bittman

1 × $6.00

An Introduction to Option Trading Success with James Bittman

1 × $6.00 -

×

Pattern Cycles with Alan Farley

1 × $6.00

Pattern Cycles with Alan Farley

1 × $6.00 -

×

The Art And Science Of Trading with Adam Grimes

1 × $6.00

The Art And Science Of Trading with Adam Grimes

1 × $6.00 -

×

Currency Trading for Dummies with Mark Galant

1 × $6.00

Currency Trading for Dummies with Mark Galant

1 × $6.00 -

×

Advanced Price Action Course with Chris Capre

1 × $7.00

Advanced Price Action Course with Chris Capre

1 × $7.00 -

×

Trading From Your Gut with Curtis Faith

1 × $6.00

Trading From Your Gut with Curtis Faith

1 × $6.00 -

×

9-Pack of TOS Indicators

1 × $6.00

9-Pack of TOS Indicators

1 × $6.00 -

×

8 Strategies for Day Trading

1 × $31.00

8 Strategies for Day Trading

1 × $31.00 -

×

Complete Series

1 × $31.00

Complete Series

1 × $31.00 -

×

Hidden Cash Flow Fortunes

1 × $54.00

Hidden Cash Flow Fortunes

1 × $54.00 -

×

The Michanics of Futures Trading - Roy Habben

1 × $6.00

The Michanics of Futures Trading - Roy Habben

1 × $6.00 -

×

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00

ADR Pro For Metatrader 4.0 with Compass FX

1 × $15.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

TenfoldFX Academy Course with Kenneth John

1 × $17.00

TenfoldFX Academy Course with Kenneth John

1 × $17.00 -

×

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00 -

×

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00

CAT 2007 Seminar with Stephen W.Bigalow

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00

Investment Intelligence from Insider Trading with H.N.Seyhun

1 × $6.00 -

×

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00 -

×

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00 -

×

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00 -

×

Tharp Think Essentials Video Workshop with Van Tharp

1 × $5.00

Tharp Think Essentials Video Workshop with Van Tharp

1 × $5.00 -

×

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00 -

×

Emini, Forex, Stock Course COMPLETE Series Recorded Seminar 2009 - 49 Modules in 3 DVDs (SpecialistTrading.com)

1 × $78.00

Emini, Forex, Stock Course COMPLETE Series Recorded Seminar 2009 - 49 Modules in 3 DVDs (SpecialistTrading.com)

1 × $78.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

1 × $4.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

A Working Man's Forex Position Trading System 2010 with Alan Benefield

1 × $6.00

A Working Man's Forex Position Trading System 2010 with Alan Benefield

1 × $6.00 -

×

Virtual Intensive Trader Training

1 × $31.00

Virtual Intensive Trader Training

1 × $31.00 -

×

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

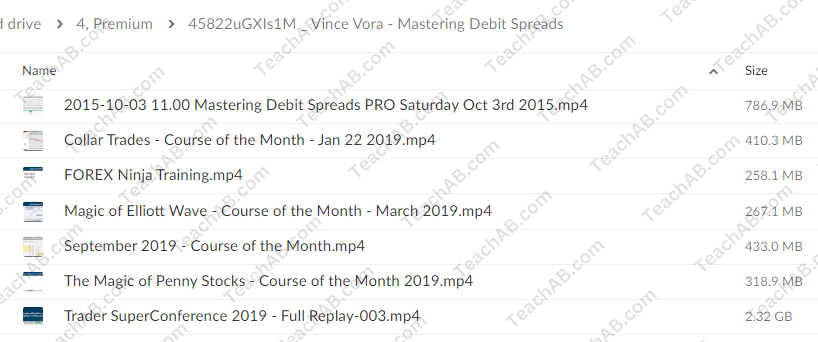

Mastering Debit Spreads with Vince Vora

$297.00 Original price was: $297.00.$15.00Current price is: $15.00.

File Size: 4.74 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here

You may check content proof of “Mastering Debit Spreads with Vince Vora” below:

Mastering Debit Spreads with Vince Vora

Introduction

Welcome to our in-depth guide on Mastering Debit Spreads with Vince Vora. Debit spreads are a powerful options trading strategy that can help you maximize profits while controlling risk. In this article, we will explore the fundamentals of debit spreads, their benefits, and how to implement them effectively with insights from Vince Vora, a renowned trading expert.

Who is Vince Vora?

Background and Expertise

Vince Vora is a seasoned trader and educator known for his expertise in options trading. With years of experience in the financial markets, Vora has developed a range of effective trading strategies, including debit spreads, to help traders achieve consistent success.

Trading Philosophy

Vora’s philosophy emphasizes the importance of risk management and strategic planning. He believes in using well-defined trading strategies to navigate the complexities of the market and maximize returns.

What are Debit Spreads?

Definition

A debit spread involves buying and selling options of the same type (either calls or puts) with different strike prices. The goal is to create a position that benefits from the movement of the underlying asset while limiting risk.

Importance

- Risk Management: Debit spreads help limit potential losses.

- Cost Efficiency: They are more cost-effective compared to outright options purchases.

- Profit Potential: Offer significant profit potential with controlled risk.

Core Concepts of Debit Spreads

1. Bull Call Spread

Setup

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price with the same expiration date.

When to Use

This strategy is used when you expect a moderate rise in the price of the underlying asset.

2. Bear Put Spread

Setup

A bear put spread involves buying a put option at a higher strike price and selling another put option at a lower strike price with the same expiration date.

When to Use

This strategy is used when you expect a moderate decline in the price of the underlying asset.

Benefits of Debit Spreads

Limited Risk

Debit spreads cap potential losses to the initial net premium paid, providing a clear risk-reward profile.

Reduced Cost

By selling an option, the premium received offsets part of the cost of the purchased option, making debit spreads more cost-effective.

Flexibility

Debit spreads can be used in various market conditions, allowing traders to adapt their strategies to different scenarios.

Implementing Debit Spreads

Step-by-Step Guide

- Select the Underlying Asset: Choose a stock or ETF that you believe will move in a specific direction.

- Determine Strike Prices: Select appropriate strike prices for the options based on your market outlook.

- Choose Expiration Date: Pick an expiration date that aligns with your trading horizon.

- Buy and Sell Options: Execute the trade by buying one option and selling another at different strike prices.

- Monitor the Trade: Keep track of the trade’s performance and make adjustments as necessary.

Example Strategy

Bull Call Spread Example

- Stock Price: $100

- Buy Call Option: Strike price $95, premium $6

- Sell Call Option: Strike price $105, premium $2

- Net Debit: $4 ($6 – $2)

- Max Profit: $6 ($10 spread – $4 net debit)

- Max Loss: $4 (net debit paid)

Risks and Considerations

Limited Profit Potential

While debit spreads limit risk, they also cap the maximum profit potential, which may not be suitable for traders seeking unlimited gains.

Time Decay

Options lose value as they approach expiration. It’s crucial to consider the impact of time decay on the trade’s profitability.

Market Movement

Debit spreads require the underlying asset to move in the anticipated direction. If the market moves against your position, losses will occur.

Tools and Resources for Trading Debit Spreads

Trading Platforms

Select a trading platform that supports options trading and provides robust tools for analyzing and executing debit spreads.

Educational Resources

Utilize books, webinars, and online courses to deepen your understanding of debit spreads and options trading.

Common Mistakes to Avoid

Ignoring Market Analysis

Conduct thorough market analysis before implementing debit spreads to ensure your strategy aligns with market conditions.

Overlooking Risk Management

Always use risk management techniques, such as stop-loss orders and position sizing, to protect your capital.

Failing to Monitor Trades

Regularly monitor your trades to make necessary adjustments and avoid unexpected losses.

Success Stories with Vince Vora

Trader A’s Journey

Trader A significantly improved their trading accuracy and consistency by applying Vince Vora’s debit spread strategies, achieving steady profits and reduced risks.

Trader B’s Experience

Trader B found the insights from Vince Vora invaluable for understanding the nuances of debit spreads, leading to enhanced trading performance and better risk management.

Conclusion

Mastering Debit Spreads with Vince Vora offers a structured approach to using debit spreads effectively in options trading. By understanding the fundamentals, benefits, and risks, you can integrate this powerful strategy into your trading routine. Remember to stay disciplined, continuously educate yourself, and adapt to changing market conditions for consistent success.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Mastering Debit Spreads with Vince Vora” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.