-

×

Trading Hub 4.0 with Mr. Khan

1 × $27.00

Trading Hub 4.0 with Mr. Khan

1 × $27.00 -

×

The Mathematics of Money Management. Risk Analysis Techniques for Traders

1 × $6.00

The Mathematics of Money Management. Risk Analysis Techniques for Traders

1 × $6.00 -

×

An Introduction to Option Trading Success with James Bittman

1 × $6.00

An Introduction to Option Trading Success with James Bittman

1 × $6.00 -

×

Beat the Market with Edward O.Thorp

1 × $6.00

Beat the Market with Edward O.Thorp

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Seasonal Stock Market Trends: The Definitive Guide to Calendar‐Based Stock Market Trading with Jay Kaeppel

1 × $6.00

Seasonal Stock Market Trends: The Definitive Guide to Calendar‐Based Stock Market Trading with Jay Kaeppel

1 × $6.00 -

×

The Quarters Theory with Ilian Yotov

1 × $6.00

The Quarters Theory with Ilian Yotov

1 × $6.00 -

×

Precision Timing Your Options Trades Using Fibonacci with Trading Analysis

1 × $15.00

Precision Timing Your Options Trades Using Fibonacci with Trading Analysis

1 × $15.00 -

×

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00

Profinacci Complete Course with Stephen A.Pierce

1 × $6.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00 -

×

The Dynamic Trading Master Course with Robert Miner

1 × $54.00

The Dynamic Trading Master Course with Robert Miner

1 × $54.00 -

×

Advanced Pattern Recognition with John Cameron

1 × $23.00

Advanced Pattern Recognition with John Cameron

1 × $23.00 -

×

Self-Mastery Course with Steven Cruz

1 × $62.00

Self-Mastery Course with Steven Cruz

1 × $62.00 -

×

TradingMind Course with Jack Bernstein

1 × $6.00

TradingMind Course with Jack Bernstein

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

All About High-Frequency Trading with Michael Durbin

1 × $6.00

All About High-Frequency Trading with Michael Durbin

1 × $6.00 -

×

Masterclass 2.0 with Dave Teaches

1 × $31.00

Masterclass 2.0 with Dave Teaches

1 × $31.00 -

×

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00 -

×

Simulating Continuous Fuzzy Systems with James Buckley & Leonard Jowers

1 × $6.00

Simulating Continuous Fuzzy Systems with James Buckley & Leonard Jowers

1 × $6.00 -

×

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00 -

×

Trading 3SMA System with Hector DeVille

1 × $6.00

Trading 3SMA System with Hector DeVille

1 × $6.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

Full Members Area (Icludes 2006 Seminar & Webinars) with Tom Yeomans

1 × $6.00

Full Members Area (Icludes 2006 Seminar & Webinars) with Tom Yeomans

1 × $6.00 -

×

How To Be a Profitable Forex Trader with Corey Halliday

1 × $6.00

How To Be a Profitable Forex Trader with Corey Halliday

1 × $6.00 -

×

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00 -

×

Channels & Cycles. A Tribute to J.M.Hurst with Brian J.Millard

1 × $6.00

Channels & Cycles. A Tribute to J.M.Hurst with Brian J.Millard

1 × $6.00 -

×

The Raptor 10 Momentum Methodology Course

1 × $6.00

The Raptor 10 Momentum Methodology Course

1 × $6.00 -

×

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Trading Against the Crowd with John Summa

1 × $6.00

Trading Against the Crowd with John Summa

1 × $6.00 -

×

Day Trade Futures Online with Larry Williams

1 × $6.00

Day Trade Futures Online with Larry Williams

1 × $6.00 -

×

Traders Edge with Steven Dux

1 × $5.00

Traders Edge with Steven Dux

1 × $5.00 -

×

9-Pack of TOS Indicators

1 × $6.00

9-Pack of TOS Indicators

1 × $6.00 -

×

Value, Price & Profit with Karl Marx

1 × $6.00

Value, Price & Profit with Karl Marx

1 × $6.00 -

×

Day Trading Options Guide PDF with Matt Diamond

1 × $23.00

Day Trading Options Guide PDF with Matt Diamond

1 × $23.00 -

×

The Candlestick Training Series with Timon Weller

1 × $6.00

The Candlestick Training Series with Timon Weller

1 × $6.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

Behavioral Trading with Woody Dorsey

1 × $6.00

Behavioral Trading with Woody Dorsey

1 × $6.00 -

×

The Internet Trading Course with Alpesh Patel

1 × $6.00

The Internet Trading Course with Alpesh Patel

1 × $6.00 -

×

Advanced Course with Jtrader

1 × $6.00

Advanced Course with Jtrader

1 × $6.00 -

×

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00 -

×

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00 -

×

Advance Gap Trading with Master Trader

1 × $39.00

Advance Gap Trading with Master Trader

1 × $39.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Advanced Trader with Nikos Trading Academy

1 × $5.00

Advanced Trader with Nikos Trading Academy

1 × $5.00 -

×

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00

Forex in Five Full Time Strategies for Part Time Traders (fxstreet.com) - Raghee Horner

1 × $6.00 -

×

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

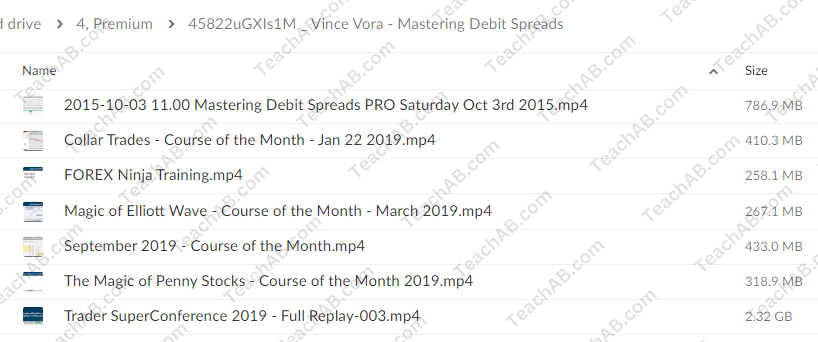

Mastering Debit Spreads with Vince Vora

$297.00 Original price was: $297.00.$15.00Current price is: $15.00.

File Size: 4.74 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here

You may check content proof of “Mastering Debit Spreads with Vince Vora” below:

Mastering Debit Spreads with Vince Vora

Introduction

Welcome to our in-depth guide on Mastering Debit Spreads with Vince Vora. Debit spreads are a powerful options trading strategy that can help you maximize profits while controlling risk. In this article, we will explore the fundamentals of debit spreads, their benefits, and how to implement them effectively with insights from Vince Vora, a renowned trading expert.

Who is Vince Vora?

Background and Expertise

Vince Vora is a seasoned trader and educator known for his expertise in options trading. With years of experience in the financial markets, Vora has developed a range of effective trading strategies, including debit spreads, to help traders achieve consistent success.

Trading Philosophy

Vora’s philosophy emphasizes the importance of risk management and strategic planning. He believes in using well-defined trading strategies to navigate the complexities of the market and maximize returns.

What are Debit Spreads?

Definition

A debit spread involves buying and selling options of the same type (either calls or puts) with different strike prices. The goal is to create a position that benefits from the movement of the underlying asset while limiting risk.

Importance

- Risk Management: Debit spreads help limit potential losses.

- Cost Efficiency: They are more cost-effective compared to outright options purchases.

- Profit Potential: Offer significant profit potential with controlled risk.

Core Concepts of Debit Spreads

1. Bull Call Spread

Setup

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price with the same expiration date.

When to Use

This strategy is used when you expect a moderate rise in the price of the underlying asset.

2. Bear Put Spread

Setup

A bear put spread involves buying a put option at a higher strike price and selling another put option at a lower strike price with the same expiration date.

When to Use

This strategy is used when you expect a moderate decline in the price of the underlying asset.

Benefits of Debit Spreads

Limited Risk

Debit spreads cap potential losses to the initial net premium paid, providing a clear risk-reward profile.

Reduced Cost

By selling an option, the premium received offsets part of the cost of the purchased option, making debit spreads more cost-effective.

Flexibility

Debit spreads can be used in various market conditions, allowing traders to adapt their strategies to different scenarios.

Implementing Debit Spreads

Step-by-Step Guide

- Select the Underlying Asset: Choose a stock or ETF that you believe will move in a specific direction.

- Determine Strike Prices: Select appropriate strike prices for the options based on your market outlook.

- Choose Expiration Date: Pick an expiration date that aligns with your trading horizon.

- Buy and Sell Options: Execute the trade by buying one option and selling another at different strike prices.

- Monitor the Trade: Keep track of the trade’s performance and make adjustments as necessary.

Example Strategy

Bull Call Spread Example

- Stock Price: $100

- Buy Call Option: Strike price $95, premium $6

- Sell Call Option: Strike price $105, premium $2

- Net Debit: $4 ($6 – $2)

- Max Profit: $6 ($10 spread – $4 net debit)

- Max Loss: $4 (net debit paid)

Risks and Considerations

Limited Profit Potential

While debit spreads limit risk, they also cap the maximum profit potential, which may not be suitable for traders seeking unlimited gains.

Time Decay

Options lose value as they approach expiration. It’s crucial to consider the impact of time decay on the trade’s profitability.

Market Movement

Debit spreads require the underlying asset to move in the anticipated direction. If the market moves against your position, losses will occur.

Tools and Resources for Trading Debit Spreads

Trading Platforms

Select a trading platform that supports options trading and provides robust tools for analyzing and executing debit spreads.

Educational Resources

Utilize books, webinars, and online courses to deepen your understanding of debit spreads and options trading.

Common Mistakes to Avoid

Ignoring Market Analysis

Conduct thorough market analysis before implementing debit spreads to ensure your strategy aligns with market conditions.

Overlooking Risk Management

Always use risk management techniques, such as stop-loss orders and position sizing, to protect your capital.

Failing to Monitor Trades

Regularly monitor your trades to make necessary adjustments and avoid unexpected losses.

Success Stories with Vince Vora

Trader A’s Journey

Trader A significantly improved their trading accuracy and consistency by applying Vince Vora’s debit spread strategies, achieving steady profits and reduced risks.

Trader B’s Experience

Trader B found the insights from Vince Vora invaluable for understanding the nuances of debit spreads, leading to enhanced trading performance and better risk management.

Conclusion

Mastering Debit Spreads with Vince Vora offers a structured approach to using debit spreads effectively in options trading. By understanding the fundamentals, benefits, and risks, you can integrate this powerful strategy into your trading routine. Remember to stay disciplined, continuously educate yourself, and adapt to changing market conditions for consistent success.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Mastering Debit Spreads with Vince Vora” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.