-

×

The Mango Butterfly Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

The Mango Butterfly Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Cracking The Forex Code with Kevin Adams

1 × $6.00

Cracking The Forex Code with Kevin Adams

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Activedaytrader - Mastering Technicals

1 × $15.00

Activedaytrader - Mastering Technicals

1 × $15.00 -

×

The Day Traders Fast Track Program

1 × $23.00

The Day Traders Fast Track Program

1 × $23.00 -

×

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00 -

×

A New Look at Exit Strategies with Charles LeBeau

1 × $6.00

A New Look at Exit Strategies with Charles LeBeau

1 × $6.00 -

×

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00 -

×

The Market Maker’s Edge with Josh Lukeman

1 × $6.00

The Market Maker’s Edge with Josh Lukeman

1 × $6.00 -

×

Trading by the Minute - Joe Ross

1 × $6.00

Trading by the Minute - Joe Ross

1 × $6.00 -

×

Forex Mastery with Willis University

1 × $6.00

Forex Mastery with Willis University

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00 -

×

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00 -

×

Adx Mastery Complete Course

1 × $6.00

Adx Mastery Complete Course

1 × $6.00 -

×

Elliott Wave Mastery Course with Todd Gordon

1 × $54.00

Elliott Wave Mastery Course with Todd Gordon

1 × $54.00 -

×

TRADINGWITHRAYNER - PRICE ACTION TRADING INSTITUTE

1 × $23.00

TRADINGWITHRAYNER - PRICE ACTION TRADING INSTITUTE

1 × $23.00 -

×

Fibonacci Trading & Dynamic Profit Targeting with Base Camp Trading

1 × $15.00

Fibonacci Trading & Dynamic Profit Targeting with Base Camp Trading

1 × $15.00 -

×

Technical Analysis 201: From Chart Setups to Trading Execution Methodology Class with Jeff Bierman

1 × $6.00

Technical Analysis 201: From Chart Setups to Trading Execution Methodology Class with Jeff Bierman

1 × $6.00 -

×

Trading With DiNapoli Levels

1 × $6.00

Trading With DiNapoli Levels

1 × $6.00 -

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00

Beginners Guide To Technical Analysis with Henry Gambell

1 × $15.00 -

×

Fibonacci Analysis with Constance Brown

1 × $6.00

Fibonacci Analysis with Constance Brown

1 × $6.00 -

×

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00 -

×

Donald Delves – Stock Options and the New Rules of Corporate Accountability

1 × $6.00

Donald Delves – Stock Options and the New Rules of Corporate Accountability

1 × $6.00 -

×

The Mathematics of Money Management. Risk Analysis Techniques for Traders

1 × $6.00

The Mathematics of Money Management. Risk Analysis Techniques for Traders

1 × $6.00 -

×

Million Dollar Bond Strategies Video with Paul Judd

1 × $6.00

Million Dollar Bond Strategies Video with Paul Judd

1 × $6.00 -

×

NFTMastermind with Charting Wizards

1 × $5.00

NFTMastermind with Charting Wizards

1 × $5.00 -

×

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00 -

×

Cheatcode Trend System with Dominique Woodson

1 × $15.00

Cheatcode Trend System with Dominique Woodson

1 × $15.00 -

×

WealthFRX Trading Mastery Course 2.0

1 × $5.00

WealthFRX Trading Mastery Course 2.0

1 × $5.00 -

×

Supply and Demand 2023 with Willy Jay

1 × $5.00

Supply and Demand 2023 with Willy Jay

1 × $5.00 -

×

The City Traders Course with Andrew Lockwood

1 × $10.00

The City Traders Course with Andrew Lockwood

1 × $10.00 -

×

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00 -

×

System Building Masterclass

1 × $31.00

System Building Masterclass

1 × $31.00 -

×

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00 -

×

Crash Profits Make Money When Stocks Sink and Soar with Martin D.Weiss

1 × $6.00

Crash Profits Make Money When Stocks Sink and Soar with Martin D.Weiss

1 × $6.00 -

×

Dominate Stocks (Swing Trading) 2023 with J. Bravo

1 × $5.00

Dominate Stocks (Swing Trading) 2023 with J. Bravo

1 × $5.00 -

×

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00

FOREX MASTER TRADING COURSE with BKFOREX

1 × $5.00 -

×

Trading by the Book (tradingeducators.com)

1 × $6.00

Trading by the Book (tradingeducators.com)

1 × $6.00 -

×

The Systematic Trader: Maximizing Trading Systems and Money Management with David Stendahl & John Boyer

1 × $6.00

The Systematic Trader: Maximizing Trading Systems and Money Management with David Stendahl & John Boyer

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Trading double Diagonals 2023 with Dan Sheridan - Sheridan Options Mentoring

1 × $39.00

Trading double Diagonals 2023 with Dan Sheridan - Sheridan Options Mentoring

1 × $39.00 -

×

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00 -

×

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00

Mastering Debit Spreads with Vince Vora

$297.00 Original price was: $297.00.$15.00Current price is: $15.00.

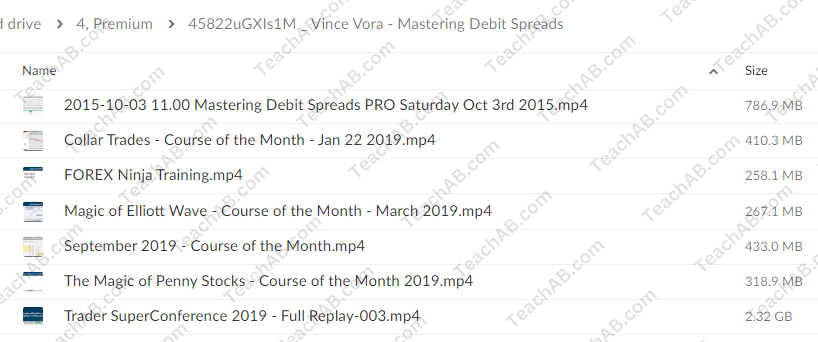

File Size: 4.74 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here

You may check content proof of “Mastering Debit Spreads with Vince Vora” below:

Mastering Debit Spreads with Vince Vora

Introduction

Welcome to our in-depth guide on Mastering Debit Spreads with Vince Vora. Debit spreads are a powerful options trading strategy that can help you maximize profits while controlling risk. In this article, we will explore the fundamentals of debit spreads, their benefits, and how to implement them effectively with insights from Vince Vora, a renowned trading expert.

Who is Vince Vora?

Background and Expertise

Vince Vora is a seasoned trader and educator known for his expertise in options trading. With years of experience in the financial markets, Vora has developed a range of effective trading strategies, including debit spreads, to help traders achieve consistent success.

Trading Philosophy

Vora’s philosophy emphasizes the importance of risk management and strategic planning. He believes in using well-defined trading strategies to navigate the complexities of the market and maximize returns.

What are Debit Spreads?

Definition

A debit spread involves buying and selling options of the same type (either calls or puts) with different strike prices. The goal is to create a position that benefits from the movement of the underlying asset while limiting risk.

Importance

- Risk Management: Debit spreads help limit potential losses.

- Cost Efficiency: They are more cost-effective compared to outright options purchases.

- Profit Potential: Offer significant profit potential with controlled risk.

Core Concepts of Debit Spreads

1. Bull Call Spread

Setup

A bull call spread involves buying a call option at a lower strike price and selling another call option at a higher strike price with the same expiration date.

When to Use

This strategy is used when you expect a moderate rise in the price of the underlying asset.

2. Bear Put Spread

Setup

A bear put spread involves buying a put option at a higher strike price and selling another put option at a lower strike price with the same expiration date.

When to Use

This strategy is used when you expect a moderate decline in the price of the underlying asset.

Benefits of Debit Spreads

Limited Risk

Debit spreads cap potential losses to the initial net premium paid, providing a clear risk-reward profile.

Reduced Cost

By selling an option, the premium received offsets part of the cost of the purchased option, making debit spreads more cost-effective.

Flexibility

Debit spreads can be used in various market conditions, allowing traders to adapt their strategies to different scenarios.

Implementing Debit Spreads

Step-by-Step Guide

- Select the Underlying Asset: Choose a stock or ETF that you believe will move in a specific direction.

- Determine Strike Prices: Select appropriate strike prices for the options based on your market outlook.

- Choose Expiration Date: Pick an expiration date that aligns with your trading horizon.

- Buy and Sell Options: Execute the trade by buying one option and selling another at different strike prices.

- Monitor the Trade: Keep track of the trade’s performance and make adjustments as necessary.

Example Strategy

Bull Call Spread Example

- Stock Price: $100

- Buy Call Option: Strike price $95, premium $6

- Sell Call Option: Strike price $105, premium $2

- Net Debit: $4 ($6 – $2)

- Max Profit: $6 ($10 spread – $4 net debit)

- Max Loss: $4 (net debit paid)

Risks and Considerations

Limited Profit Potential

While debit spreads limit risk, they also cap the maximum profit potential, which may not be suitable for traders seeking unlimited gains.

Time Decay

Options lose value as they approach expiration. It’s crucial to consider the impact of time decay on the trade’s profitability.

Market Movement

Debit spreads require the underlying asset to move in the anticipated direction. If the market moves against your position, losses will occur.

Tools and Resources for Trading Debit Spreads

Trading Platforms

Select a trading platform that supports options trading and provides robust tools for analyzing and executing debit spreads.

Educational Resources

Utilize books, webinars, and online courses to deepen your understanding of debit spreads and options trading.

Common Mistakes to Avoid

Ignoring Market Analysis

Conduct thorough market analysis before implementing debit spreads to ensure your strategy aligns with market conditions.

Overlooking Risk Management

Always use risk management techniques, such as stop-loss orders and position sizing, to protect your capital.

Failing to Monitor Trades

Regularly monitor your trades to make necessary adjustments and avoid unexpected losses.

Success Stories with Vince Vora

Trader A’s Journey

Trader A significantly improved their trading accuracy and consistency by applying Vince Vora’s debit spread strategies, achieving steady profits and reduced risks.

Trader B’s Experience

Trader B found the insights from Vince Vora invaluable for understanding the nuances of debit spreads, leading to enhanced trading performance and better risk management.

Conclusion

Mastering Debit Spreads with Vince Vora offers a structured approach to using debit spreads effectively in options trading. By understanding the fundamentals, benefits, and risks, you can integrate this powerful strategy into your trading routine. Remember to stay disciplined, continuously educate yourself, and adapt to changing market conditions for consistent success.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Mastering Debit Spreads with Vince Vora” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.