Daytraders Bulletin – Recurrent Structures for Profit with Charles Holt

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

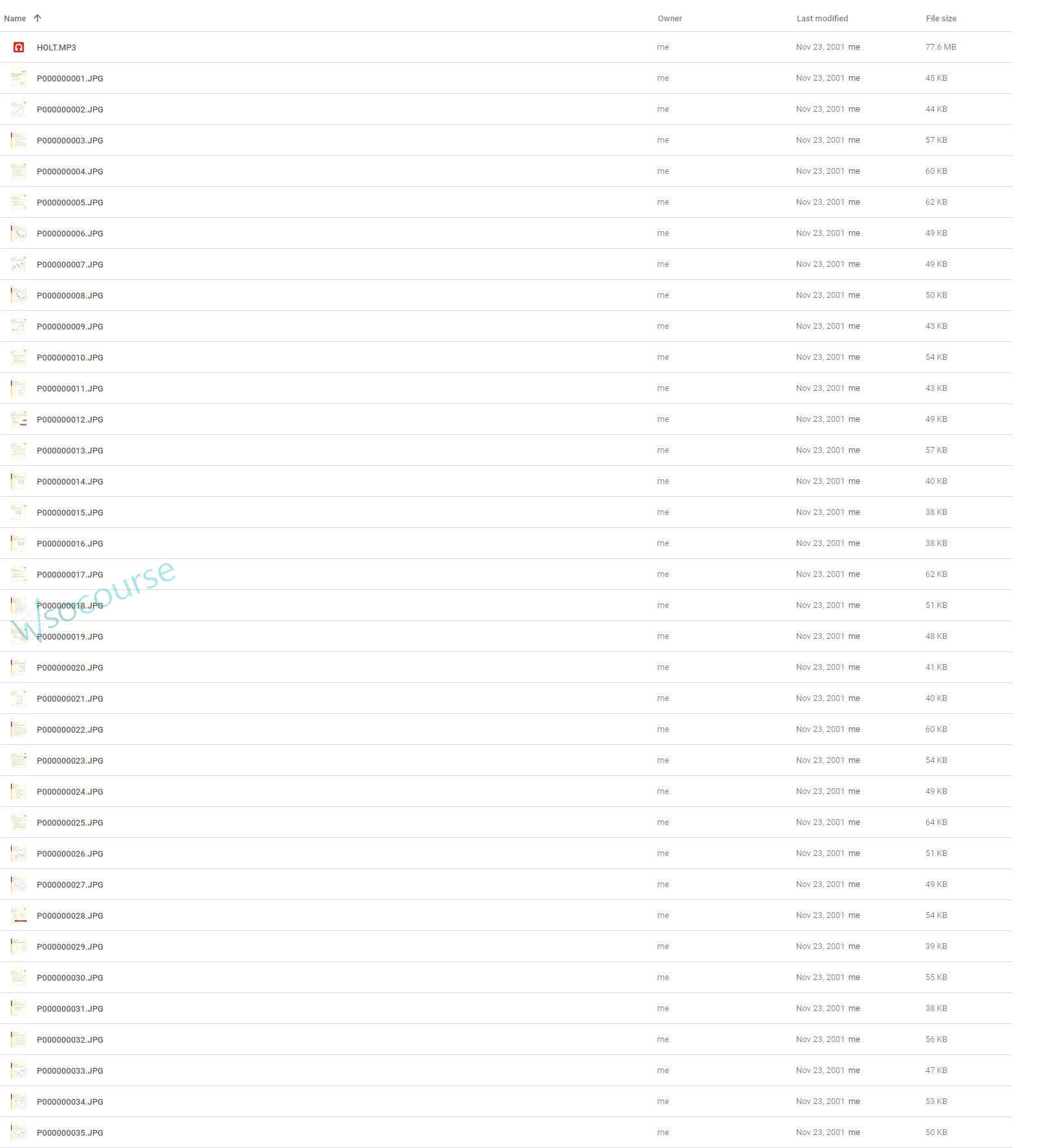

Content Proof: Watch Here!

You may check content proof of “Daytraders Bulletin – Recurrent Structures for Profit with Charles Holt” below:

Daytraders Bulletin – Recurrent Structures for Profit by Charles Holt

Introduction

In the fast-paced world of day trading, having an edge can make all the difference. Charles Holt’s approach in “Daytraders Bulletin – Recurrent Structures for Profit” offers just that. This groundbreaking method emphasizes the identification and utilization of recurrent patterns in market data to enhance trading strategies. Let’s delve into how this approach can be a game-changer for day traders.

Understanding Recurrent Structures

What Are Recurrent Structures?

Recurrent structures are patterns or sequences that occur repeatedly within market price data. These can be price levels, specific chart formations, or even time intervals that show a higher probability of a predictable outcome.

The Importance of Recognizing Patterns

Identifying these structures allows traders to anticipate potential market movements with greater accuracy. This knowledge is pivotal in reducing risk and enhancing the potential for profit.

Holt’s Strategy for Identifying Patterns

Daily Analysis

Every trading day, Holt suggests conducting a thorough analysis of the market. This involves looking for specific patterns that have historically led to profitable opportunities.

The Role of Software Tools

Holt advocates the use of analytical software to detect these patterns more efficiently. These tools can help highlight recurring structures that might be overlooked by the human eye.

Implementing the Strategy

Timing the Trades

Once a pattern is recognized, timing the entry and exit points becomes crucial. Holt provides detailed guidelines on the best times to enter and exit the market based on these structures.

Risk Management Techniques

Implementing strict risk management rules is essential. Holt emphasizes the need to set stop-loss orders to protect against unforeseen market reversals.

Advanced Techniques

Integrating Technical Indicators

To enhance the effectiveness of this strategy, Holt recommends integrating other technical indicators such as moving averages and RSI to confirm the signals provided by the recurrent structures.

Statistical Analysis

Applying statistical methods to analyze the frequency and reliability of the identified patterns can further refine the strategy, leading to more robust trading decisions.

Common Mistakes to Avoid

Overreliance on Patterns

While recurrent structures can be highly indicative of future movements, traders must avoid the pitfall of relying solely on these patterns without considering other market factors.

Ignoring Market Context

The current market environment can greatly influence the effectiveness of recurrent structures. Traders should always consider the broader market context before making trading decisions.

Conclusion

Charles Holt’s “Daytraders Bulletin – Recurrent Structures for Profit” provides a structured approach to day trading that leverages the power of recurrent patterns. By meticulously analyzing and implementing these structures, traders can enhance their trading precision and profitability.

FAQs

- What exactly are recurrent structures in trading?

Recurrent structures refer to patterns or sequences that consistently appear in market data, indicating potential predictable outcomes. - How can I identify these structures effectively?

Utilizing specialized software tools for pattern recognition and integrating them with manual analysis can enhance the identification process. - What are the common risks associated with this strategy?

Overreliance on patterns and ignoring broader market conditions are significant risks that can affect the strategy’s effectiveness. - Can this strategy be applied to all markets?

While primarily used in stock and forex markets, the principles can be adapted to other financial markets with careful consideration of market specifics. - How important is risk management in this strategy?

Extremely important. Setting strict stop-loss orders and adhering to a predefined risk management protocol is crucial to protect against losses.

Be the first to review “Daytraders Bulletin – Recurrent Structures for Profit with Charles Holt” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.