-

×

Electronic AGS Trading Workshop with John Carter & Hunert Senters

1 × $6.00

Electronic AGS Trading Workshop with John Carter & Hunert Senters

1 × $6.00 -

×

Trading Using Ocean Theory with Pat Raffolovich

1 × $4.00

Trading Using Ocean Theory with Pat Raffolovich

1 × $4.00 -

×

Raghee Horner - Submarket Sonar - Live Trading + Indicator

1 × $39.00

Raghee Horner - Submarket Sonar - Live Trading + Indicator

1 × $39.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Phantom Trading Course 2.0

1 × $7.00

Phantom Trading Course 2.0

1 × $7.00 -

×

Technical Analysis Package with Martin Pring

1 × $4.00

Technical Analysis Package with Martin Pring

1 × $4.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Little Black Book of Scripts

1 × $6.00

Little Black Book of Scripts

1 × $6.00 -

×

Intra-Day Trading Techniques CD with Greg Capra

1 × $6.00

Intra-Day Trading Techniques CD with Greg Capra

1 × $6.00 -

×

CFA Level 1 – PassMaster 2004 CD with Stalla

1 × $6.00

CFA Level 1 – PassMaster 2004 CD with Stalla

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00 -

×

Options Course - 4 CD Course + PDF Workbook with VectorVest

1 × $54.00

Options Course - 4 CD Course + PDF Workbook with VectorVest

1 × $54.00 -

×

Short-Term Trading Course with Mark Boucher

1 × $6.00

Short-Term Trading Course with Mark Boucher

1 × $6.00 -

×

Millard on Channel Analysis: The key to Share Price Prediction (2nd Ed.) with Brian Millard

1 × $6.00

Millard on Channel Analysis: The key to Share Price Prediction (2nd Ed.) with Brian Millard

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

MATS Market Auction Trading System with Ryan Watts

1 × $6.00

MATS Market Auction Trading System with Ryan Watts

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

JJ Dream Team Workshop Training Full Course

1 × $55.00

JJ Dream Team Workshop Training Full Course

1 × $55.00 -

×

Derivates with Philip McBride Johnson

1 × $6.00

Derivates with Philip McBride Johnson

1 × $6.00 -

×

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00 -

×

MarketSharks Forex Training

1 × $31.00

MarketSharks Forex Training

1 × $31.00 -

×

Power Income FUTURES Day Trading Course with Trade Out Loud

1 × $31.00

Power Income FUTURES Day Trading Course with Trade Out Loud

1 × $31.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Price Action Forex Trading Strategies Training Course & Members Videos with Nial Fuller

1 × $28.00

Price Action Forex Trading Strategies Training Course & Members Videos with Nial Fuller

1 × $28.00 -

×

Donchian’s 20 Guides to Trading Commodities with Barbara S.Dixon

1 × $4.00

Donchian’s 20 Guides to Trading Commodities with Barbara S.Dixon

1 × $4.00 -

×

Order Flow Edge – Extreme Edge

1 × $15.00

Order Flow Edge – Extreme Edge

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Mesa & Trading Market Cycles (1st Edition) with John Ehlers & Perry Kaufman

1 × $6.00

Mesa & Trading Market Cycles (1st Edition) with John Ehlers & Perry Kaufman

1 × $6.00 -

×

ITPM - The Emergency Trading Room Portfolio Repair from Covid 19

1 × $15.00

ITPM - The Emergency Trading Room Portfolio Repair from Covid 19

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

FX SpeedRunner

1 × $5.00

FX SpeedRunner

1 × $5.00 -

×

Philadelphia Seminar Replay & PDF Study Guide with ASFX Day Trading

1 × $31.00

Philadelphia Seminar Replay & PDF Study Guide with ASFX Day Trading

1 × $31.00 -

×

Market Gems Manual with Barbara J.Simon

1 × $6.00

Market Gems Manual with Barbara J.Simon

1 × $6.00 -

×

HandBook of Parametric and Nonparametric Statistical Procedures with David J.Sheskin

1 × $6.00

HandBook of Parametric and Nonparametric Statistical Procedures with David J.Sheskin

1 × $6.00 -

×

Introduction to Probability with Charles M.Grinstead, J.Laurie Snell

1 × $6.00

Introduction to Probability with Charles M.Grinstead, J.Laurie Snell

1 × $6.00 -

×

Woodies Collection and AutoTrader 7.0.1.6

1 × $31.00

Woodies Collection and AutoTrader 7.0.1.6

1 × $31.00 -

×

Market Controller Course with Controller FX

1 × $5.00

Market Controller Course with Controller FX

1 × $5.00 -

×

Management Consultancy & Banking in a Era of Globalization

1 × $6.00

Management Consultancy & Banking in a Era of Globalization

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The A.M. Trader with MarketGauge

1 × $31.00

The A.M. Trader with MarketGauge

1 × $31.00 -

×

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00

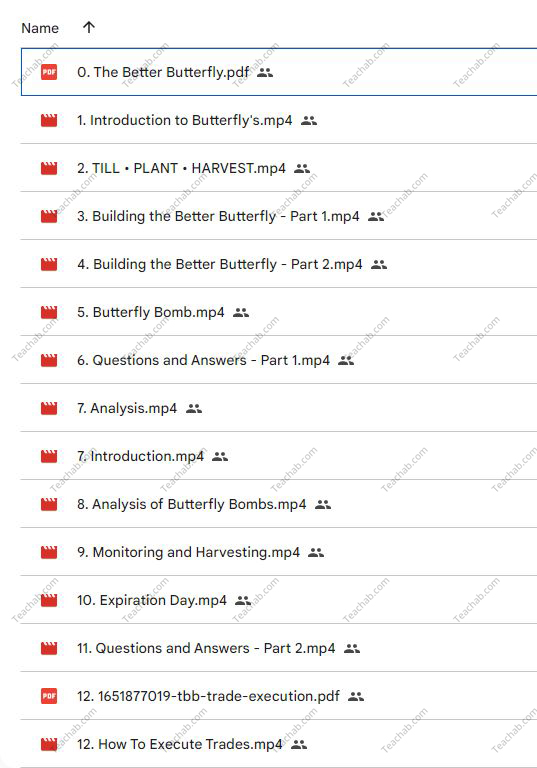

The Better Butterfly Course with David Vallieres – Tradingology

$497.00 Original price was: $497.00.$39.00Current price is: $39.00.

File Size: 2.01 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “The Better Butterfly Course with David Vallieres – Tradingology” below:

Mastering Market Strategy: The Better Butterfly Course with David Vallieres – Tradingology

Introduction to Advanced Trading Strategies

In the intricate world of options trading, the butterfly spread stands out for its unique potential to harness market conditions where minimal price movement is expected. David Vallieres’ “The Better Butterfly Course” from Tradingology is designed to deepen traders’ understanding of this complex strategy and refine it for better performance and higher profitability.

Who is David Vallieres?

David Vallieres is a veteran trader and the founder of Tradingology, a platform dedicated to teaching advanced trading strategies that go beyond conventional methods. His expertise has helped countless traders achieve a deeper understanding of the markets.

Overview of Tradingology

Tradingology is a premier educational platform that provides in-depth training programs focusing on advanced options trading techniques and strategies.

Exploring The Better Butterfly Strategy

Understanding the Butterfly Spread

A butterfly spread is a risk-defined options strategy combining bull and bear spreads to create a profit zone with limited risk. This section will explore the mechanics behind its construction.

Advantages of the Butterfly Spread

Delve into why the butterfly spread is a favorite among veteran traders, especially in terms of risk management and potential returns.

Enhancements in The Better Butterfly

Learn about the enhancements and tweaks made by David Vallieres to optimize this classic strategy for today’s market conditions.

Components of The Better Butterfly Course

Video Training Modules

Extensive video modules that walk you through the intricacies of setting up, managing, and closing butterfly trades effectively.

Real-World Examples

David Vallieres provides numerous examples from real trading scenarios to demonstrate the practical application of the butterfly strategy.

Interactive Learning Tools

Engage with interactive tools and simulations that reinforce learning and allow you to practice the strategies in a virtual trading environment.

Integration with Technical Analysis

Using Technical Indicators

Understand how to use technical indicators to enhance the timing and selection of your butterfly spreads.

Chart Patterns and Butterfly Setups

Explore how various chart patterns can signal optimal setups for implementing butterfly spreads.

Market Conditions for Butterfly Trades

Identify the market conditions that are most favorable for the Better Butterfly strategy and learn how to recognize them.

Risk Management Techniques

Position Sizing in Butterfly Spreads

Position sizing is crucial in managing risk. Learn how to determine the appropriate size for your butterfly spreads to balance potential profit against risk.

Adjustments and Hedging

Effective methods for adjusting butterfly positions to manage risk and strategies for hedging undesirable market moves.

Exit Strategies for Butterfly Trades

Comprehensive guidelines on when and how to exit butterfly positions to maximize gains or minimize losses.

Advanced Trading Concepts

The Role of Volatility in Butterfly Spreads

Volatility can make or break a butterfly spread. This section covers how to leverage volatility to your advantage.

Time Decay and Option Pricing

Understand the effects of time decay on butterfly spreads and how to turn it into an advantage through precise timing.

Psychological Aspects of Trading Complex Strategies

Trading complex strategies like the Better Butterfly requires mental sharpness and emotional control—learn tips and practices to maintain both.

Educational Resources and Support

Supplemental Reading and Resources

A curated list of books, articles, and other resources to complement your learning from the Better Butterfly course.

Community and Forum Access

Gain access to an exclusive community of fellow traders and enthusiasts where you can discuss strategies, share insights, and seek advice.

Continuous Learning and Mentorship

Details on how to continue your education with David Vallieres and Tradingology, including advanced courses and personal mentorship options.

Conclusion

“The Better Butterfly Course” by David Vallieres offers a comprehensive approach to mastering one of the most sophisticated strategies in options trading. Through this course, traders can expect to not only understand but also effectively implement and profit from butterfly spreads with enhanced confidence and control.

FAQs

- What is a butterfly spread in options trading?

- A butterfly spread is an options strategy combining both bull and bear spreads to create a position with defined maximum gain and limited risk.

- Who can benefit from The Better Butterfly Course?

- Both intermediate and experienced options traders looking to enhance their strategy repertoire and refine their trading skills.

- How long does it take to complete The Better Butterfly Course?

- The course duration varies, but typically it can be completed in a few weeks, depending on the learner’s pace and prior experience.

- Can the strategies from The Better Butterfly Course be applied in all market conditions?

- While particularly effective in low-volatility environments, the course teaches how to adapt the strategies to different market conditions.

- Where can I sign up for The Better Butterfly Course?

- You can enroll in the course through the Tradingology website, where you will also find additional information about upcoming sessions and pricing.

Be the first to review “The Better Butterfly Course with David Vallieres – Tradingology” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.