-

×

Yes You Can Time the Market! with Ben Stein

1 × $6.00

Yes You Can Time the Market! with Ben Stein

1 × $6.00 -

×

Basecamptrading - Naked Trading Part 2

1 × $6.00

Basecamptrading - Naked Trading Part 2

1 × $6.00 -

×

Advanced Get 12.0.3485 x86 (August 2014) (+ open code efs, dll's) for Any eSignal Account

1 × $23.00

Advanced Get 12.0.3485 x86 (August 2014) (+ open code efs, dll's) for Any eSignal Account

1 × $23.00 -

×

VIP - One on One Coursework with Talkin Options

1 × $15.00

VIP - One on One Coursework with Talkin Options

1 × $15.00 -

×

Option Alpha Signals

1 × $15.00

Option Alpha Signals

1 × $15.00 -

×

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00 -

×

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00 -

×

Ichimoku Cloud Triple Confirmation Indicator and Scan with AlphaShark

1 × $31.00

Ichimoku Cloud Triple Confirmation Indicator and Scan with AlphaShark

1 × $31.00 -

×

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00 -

×

Deep Reinforcement Learning in Trading with Dr. Thomas Starke

1 × $62.00

Deep Reinforcement Learning in Trading with Dr. Thomas Starke

1 × $62.00 -

×

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00 -

×

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00 -

×

Active Trading Course Notes with Alan Hull

1 × $6.00

Active Trading Course Notes with Alan Hull

1 × $6.00 -

×

Investment Blunders with John Nofsinger

1 × $6.00

Investment Blunders with John Nofsinger

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Secret Mindset Academy 2023 with The Secret Mindset Academy

1 × $5.00

The Secret Mindset Academy 2023 with The Secret Mindset Academy

1 × $5.00 -

×

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00 -

×

Applied Portfolio Management with Catherine Shenoy

1 × $6.00

Applied Portfolio Management with Catherine Shenoy

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Candlestick Charts with Clive Lambert

1 × $6.00

Candlestick Charts with Clive Lambert

1 × $6.00 -

×

Dominate Stocks 2020 with J. Bravo

1 × $6.00

Dominate Stocks 2020 with J. Bravo

1 × $6.00 -

×

Dynamic Trader 6 Dynamic Trader Real Time and End Of Day

1 × $6.00

Dynamic Trader 6 Dynamic Trader Real Time and End Of Day

1 × $6.00 -

×

Trading - Candlelight - Ryan Litchfield

1 × $6.00

Trading - Candlelight - Ryan Litchfield

1 × $6.00 -

×

Contrarian Trading Class with Jeff Bierman

1 × $6.00

Contrarian Trading Class with Jeff Bierman

1 × $6.00 -

×

Code 1 with Oil Trading Academy

1 × $31.00

Code 1 with Oil Trading Academy

1 × $31.00 -

×

Tape Reading Big Caps 1 on 1 with Jtrader

1 × $6.00

Tape Reading Big Caps 1 on 1 with Jtrader

1 × $6.00 -

×

TickScalper Trading System

1 × $23.00

TickScalper Trading System

1 × $23.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Great Reflation with Anthony Boeckh

1 × $6.00

The Great Reflation with Anthony Boeckh

1 × $6.00 -

×

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00 -

×

Trend Harmony with Murray Ruggiero

1 × $15.00

Trend Harmony with Murray Ruggiero

1 × $15.00 -

×

The Precision Profit Float Indicator (TS Code & Setups) with Steve Woods

1 × $6.00

The Precision Profit Float Indicator (TS Code & Setups) with Steve Woods

1 × $6.00 -

×

W.D. Gann’s Secret Divergence Method with Hexatrade350

1 × $5.00

W.D. Gann’s Secret Divergence Method with Hexatrade350

1 × $5.00 -

×

The Cash Flow Bootcamp with John Macgregor

1 × $233.00

The Cash Flow Bootcamp with John Macgregor

1 × $233.00 -

×

The Tape Reader’s Bundle with The Price Action Room

1 × $62.00

The Tape Reader’s Bundle with The Price Action Room

1 × $62.00 -

×

The Tickmaster Indicator

1 × $54.00

The Tickmaster Indicator

1 × $54.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Complete Dividend Investing Course (Updated 2019) with Wealthy Education

1 × $6.00

The Complete Dividend Investing Course (Updated 2019) with Wealthy Education

1 × $6.00 -

×

Low Stress Options Trading with Low Stress Training

1 × $23.00

Low Stress Options Trading with Low Stress Training

1 × $23.00 -

×

Advanced Trading Course with John Person

1 × $6.00

Advanced Trading Course with John Person

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

Cracking The Forex Code with Kevin Adams

1 × $6.00

Cracking The Forex Code with Kevin Adams

1 × $6.00 -

×

The Market Matrix

1 × $6.00

The Market Matrix

1 × $6.00 -

×

The Hidden Order Within Stock Prices with Clay Allen

1 × $6.00

The Hidden Order Within Stock Prices with Clay Allen

1 × $6.00 -

×

Volatility Position Risk Management with Cynthia Kase

1 × $6.00

Volatility Position Risk Management with Cynthia Kase

1 × $6.00 -

×

Area 61 with BCFX

1 × $6.00

Area 61 with BCFX

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

The Complete Foundation Stock Trading Course

1 × $62.00

The Complete Foundation Stock Trading Course

1 × $62.00 -

×

Derivates Demystified

1 × $6.00

Derivates Demystified

1 × $6.00 -

×

AstroScan Regulus 4.1E newastro.net

1 × $6.00

AstroScan Regulus 4.1E newastro.net

1 × $6.00 -

×

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00

How to Make a Living Trading Foreign Exchange: A Guaranteed Income for Life with Courtney Smith

1 × $6.00 -

×

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00 -

×

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00 -

×

Advanced Trading Strategies with Larry Connors

1 × $6.00

Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

Day Trading Smart + David Nassar – Foundational Analysis. Selecting Winning Stock with David Nassar

1 × $6.00

Day Trading Smart + David Nassar – Foundational Analysis. Selecting Winning Stock with David Nassar

1 × $6.00 -

×

Emini Volume Break Out System

1 × $6.00

Emini Volume Break Out System

1 × $6.00 -

×

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00 -

×

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00 -

×

Penny Stock Mastery

1 × $31.00

Penny Stock Mastery

1 × $31.00 -

×

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00 -

×

Magical Forex Trading System

1 × $6.00

Magical Forex Trading System

1 × $6.00 -

×

The Complete Lot Flipper System

1 × $6.00

The Complete Lot Flipper System

1 × $6.00 -

×

The FX Swing Trading Blueprint with Swing FX

1 × $6.00

The FX Swing Trading Blueprint with Swing FX

1 × $6.00 -

×

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

David Landry On Swing Trading

1 × $6.00

David Landry On Swing Trading

1 × $6.00 -

×

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00 -

×

Change Happens. Do You Profit Or Does Someone Else (Traders Expo Las Vegas Dec 2005) by Tobin Smith

1 × $6.00

Change Happens. Do You Profit Or Does Someone Else (Traders Expo Las Vegas Dec 2005) by Tobin Smith

1 × $6.00 -

×

Support and Resistance Trading with Rob Booker

1 × $6.00

Support and Resistance Trading with Rob Booker

1 × $6.00 -

×

B.O.S.S. Swing with Pat Mitchell – Trick Trades

1 × $39.00

B.O.S.S. Swing with Pat Mitchell – Trick Trades

1 × $39.00 -

×

The Option Pit VIX Primer

1 × $31.00

The Option Pit VIX Primer

1 × $31.00 -

×

An Introduction to Market Risk Measurement with Kevin Dowd

1 × $6.00

An Introduction to Market Risk Measurement with Kevin Dowd

1 × $6.00 -

×

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00 -

×

ePass Platinum

1 × $31.00

ePass Platinum

1 × $31.00 -

×

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00 -

×

Trading Masterclass XVII with Wysetrade

1 × $6.00

Trading Masterclass XVII with Wysetrade

1 × $6.00 -

×

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00 -

×

The Three Secrets to Trading Momentum Indicators with David Penn

1 × $6.00

The Three Secrets to Trading Momentum Indicators with David Penn

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Commodities for Dummies with Amine Bouchentouf

1 × $6.00

Commodities for Dummies with Amine Bouchentouf

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Chart Pattern Profits

1 × $6.00

Chart Pattern Profits

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Behavioral Trading with Woody Dorsey

1 × $6.00

Behavioral Trading with Woody Dorsey

1 × $6.00 -

×

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00 -

×

Volume Profile Video Course with Trader Dale

1 × $8.00

Volume Profile Video Course with Trader Dale

1 × $8.00 -

×

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00 -

×

SMT FX Trading

1 × $5.00

SMT FX Trading

1 × $5.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Stock Market, Credit & Capital Formation with Fritz Machlup

1 × $6.00

The Stock Market, Credit & Capital Formation with Fritz Machlup

1 × $6.00 -

×

FMG Online Course with FMG Traders

1 × $6.00

FMG Online Course with FMG Traders

1 × $6.00 -

×

Trading Options at Expiration: Strategies and Models for Winning the Endgame with Jeff Augen

1 × $6.00

Trading Options at Expiration: Strategies and Models for Winning the Endgame with Jeff Augen

1 × $6.00 -

×

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00 -

×

Ichimoku Traders Academy with Tyler Espitia

1 × $31.00

Ichimoku Traders Academy with Tyler Espitia

1 × $31.00 -

×

Future DayTrading (German)

1 × $6.00

Future DayTrading (German)

1 × $6.00 -

×

Theo Trade - 128 Course Bundle

1 × $93.00

Theo Trade - 128 Course Bundle

1 × $93.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

eASCTrend Traning CD. Hybrid Trading Method with Ablesys

1 × $6.00

eASCTrend Traning CD. Hybrid Trading Method with Ablesys

1 × $6.00 -

×

What is Strategy with Michael E.Porter

1 × $6.00

What is Strategy with Michael E.Porter

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Forex Master Levels with Nicola Delic

1 × $15.00

Forex Master Levels with Nicola Delic

1 × $15.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00

David Landry On Swing Trading

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “David Landry On Swing Trading” below:

David Landry On Swing Trading

Swing trading is a popular trading strategy that aims to capture short-to-medium-term gains in a stock (or any financial instrument) over a period of a few days to several weeks. David Landry, a renowned trader and author, has been a significant influence in the world of swing trading. His insights and strategies have helped countless traders understand and succeed in swing trading. This article delves into Landry’s methodologies and how you can apply them to enhance your trading performance.

Introduction to Swing Trading

Swing trading involves holding positions for several days to weeks, aiming to profit from expected price moves. It sits between day trading and trend trading, offering flexibility and potential for substantial gains.

Why Choose Swing Trading?

- Time Flexibility: Requires less time compared to day trading.

- Potential for Profits: Captures significant price movements.

- Reduced Stress: Less pressure compared to day trading.

Who is David Landry?

David Landry is a seasoned trader, author, and educator known for his practical and straightforward approach to trading.

Author’s Credentials

- Experience: Over two decades in the trading industry.

- Education: Background in finance and market analysis.

- Publications: Numerous books and articles on trading strategies.

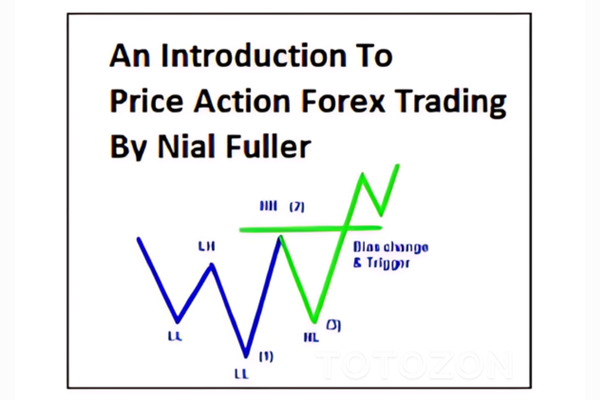

Core Concepts of Swing Trading

1. Identifying Trends

Understanding market trends is crucial for successful swing trading.

Uptrends

- Higher Highs and Higher Lows: Indicative of an uptrend.

- Bullish Signals: Look for buying opportunities.

Downtrends

- Lower Highs and Lower Lows: Indicative of a downtrend.

- Bearish Signals: Look for selling opportunities.

2. Using Technical Indicators

Technical indicators help in identifying entry and exit points.

Moving Averages

- Simple Moving Average (SMA): Useful for identifying trends.

- Exponential Moving Average (EMA): Responds more quickly to price changes.

Relative Strength Index (RSI)

- Overbought/Oversold Conditions: Indicates potential reversal points.

Bollinger Bands

- Volatility Measurement: Helps identify overbought or oversold conditions.

3. Chart Patterns

Recognizing chart patterns can provide insights into future price movements.

Head and Shoulders

- Reversal Pattern: Indicates a trend reversal.

Triangles

- Continuation Pattern: Suggests the continuation of the current trend.

4. Risk Management

Managing risk is essential to protect your capital.

Position Sizing

- Appropriate Size: Determines the number of shares to trade based on risk tolerance.

Stop-Loss Orders

- Limiting Losses: Protects against significant losses.

Implementing David Landry’s Swing Trading Strategies

Step-by-Step Guide

- Analyze Market Trends: Use technical indicators to identify market trends.

- Identify Entry Points: Look for signals from indicators and chart patterns.

- Place Trades: Enter trades based on identified signals.

- Set Stop-Loss Orders: Protect your capital by setting stop-loss orders.

- Monitor Trades: Adjust your strategy based on market movements.

Example Trade Setup

- Identify Trend: Spot an uptrend using moving averages.

- Find Entry Point: Use RSI to identify an oversold condition.

- Place Trade: Enter a long position.

- Set Stop-Loss: Place a stop-loss below the recent low.

- Monitor Trade: Adjust stop-loss and take profit levels as the trade progresses.

Advantages of Swing Trading

Time Efficiency

Swing trading does not require constant market monitoring, making it suitable for those with other commitments.

Potential for High Returns

Capturing significant price movements can lead to substantial gains.

Reduced Stress

Holding positions for days or weeks reduces the pressure of making quick decisions.

Challenges in Swing Trading

Market Volatility

Market fluctuations can impact trades, requiring careful analysis and strategy adjustment.

Risk Management

Effective risk management is crucial to protect against potential losses.

Practical Tips for Success

1. Continuous Learning

Stay updated with market trends and continuously refine your trading strategy.

2. Regular Practice

Use demo accounts to practice and fine-tune your swing trading techniques without financial risk.

3. Maintain Discipline

Stick to your trading plan and avoid emotional decision-making.

Conclusion

David Landry’s insights on swing trading provide a comprehensive guide to capturing short-to-medium-term gains in the market. By understanding market trends, using technical indicators, recognizing chart patterns, and managing risks, traders can enhance their swing trading strategies. Whether you’re a novice or an experienced trader, applying Landry’s techniques can help you achieve consistent trading success.

FAQs

1. What is swing trading?

Swing trading involves holding positions for several days to weeks to profit from expected price moves.

2. Who can benefit from swing trading?

Both novice and experienced traders can benefit from swing trading due to its time efficiency and potential for high returns.

3. How do technical indicators help in swing trading?

Technical indicators help identify entry and exit points, providing signals for buying and selling.

4. Why is risk management important in swing trading?

Risk management protects your capital and limits potential losses, ensuring long-term trading success.

5. How can I practice swing trading without financial risk?

Use demo accounts to practice and refine your swing trading techniques without risking real money.

Be the first to review “David Landry On Swing Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.