-

×

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00 -

×

Infectious Greed with John Nofsinger & Kenneth Kim

1 × $6.00

Infectious Greed with John Nofsinger & Kenneth Kim

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Learn To Trade Markets with Karl Richards

1 × $6.00

Learn To Trade Markets with Karl Richards

1 × $6.00 -

×

Generate Weekly Income by Trend-Trading Stocks Intraday Class with Corey Rosenbloom

1 × $6.00

Generate Weekly Income by Trend-Trading Stocks Intraday Class with Corey Rosenbloom

1 × $6.00 -

×

Advanced Options Trading with Lucas Downey

1 × $15.00

Advanced Options Trading with Lucas Downey

1 × $15.00 -

×

Professional Chart Reading Bootcamp - 2 CDs

1 × $6.00

Professional Chart Reading Bootcamp - 2 CDs

1 × $6.00 -

×

Video On Demand Pathway with Trade With Profile

1 × $5.00

Video On Demand Pathway with Trade With Profile

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Real Options Analysis: Tools and Techniques for Valuing Strategic Investments and Decisions - Johnathan Mun

1 × $6.00

Real Options Analysis: Tools and Techniques for Valuing Strategic Investments and Decisions - Johnathan Mun

1 × $6.00 -

×

SJG Trading - Butterflies Class with Steve Ganz

1 × $31.00

SJG Trading - Butterflies Class with Steve Ganz

1 × $31.00 -

×

How to Capture Big Profits from Explosive Markets with Glen Ring

1 × $6.00

How to Capture Big Profits from Explosive Markets with Glen Ring

1 × $6.00 -

×

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00 -

×

Forex Profit Formula System with Jason Fielder

1 × $6.00

Forex Profit Formula System with Jason Fielder

1 × $6.00 -

×

Bulletproof Butterflies 2.0 2022 (PREMIUM) with Bruce Marshall

1 × $23.00

Bulletproof Butterflies 2.0 2022 (PREMIUM) with Bruce Marshall

1 × $23.00 -

×

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00 -

×

Options Trading Training. The Blend SF with Charles Cottle

1 × $6.00

Options Trading Training. The Blend SF with Charles Cottle

1 × $6.00 -

×

Ez-Forex Trading System 4.2 with Beau Diamond

1 × $6.00

Ez-Forex Trading System 4.2 with Beau Diamond

1 × $6.00 -

×

Pro Indicator Pack with Trade Confident

1 × $15.00

Pro Indicator Pack with Trade Confident

1 × $15.00 -

×

Charles Cottle Package ( Discount 50% )

1 × $23.00

Charles Cottle Package ( Discount 50% )

1 × $23.00 -

×

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

Commodity Trading Video Course with Bob Buran

1 × $6.00

Commodity Trading Video Course with Bob Buran

1 × $6.00 -

×

The Day Trader: From the Pit to the PC with Lewis Borsellino

1 × $6.00

The Day Trader: From the Pit to the PC with Lewis Borsellino

1 × $6.00 -

×

A Complete Guide to the Futures Markets: Fundamental Analysis, Technical Analysis, Trading, Spreads, and Options (1st Edition) - Jack Schwager

1 × $6.00

A Complete Guide to the Futures Markets: Fundamental Analysis, Technical Analysis, Trading, Spreads, and Options (1st Edition) - Jack Schwager

1 × $6.00 -

×

Hot Commodities: How Anyone Can Invest Profitably in the World's Best Market with Jim Rogers

1 × $6.00

Hot Commodities: How Anyone Can Invest Profitably in the World's Best Market with Jim Rogers

1 × $6.00 -

×

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00

Construct & Trade a High Probability Trading System with John L.Person

1 × $6.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

Elite Core Advance Course with Urban Forex

1 × $5.00

Elite Core Advance Course with Urban Forex

1 × $5.00 -

×

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00 -

×

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00

Advanced Cycles with Nick Santiago - InTheMoneyStocks

1 × $171.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Trading Calendar Spreads with Option Pit

1 × $39.00

Trading Calendar Spreads with Option Pit

1 × $39.00 -

×

Mechanical Timing Systems. The Key to Consistent Profits & Sharper Trading with Nelson Freeburg

1 × $6.00

Mechanical Timing Systems. The Key to Consistent Profits & Sharper Trading with Nelson Freeburg

1 × $6.00 -

×

SE ELITE COURSE with SE TRADINGX

1 × $5.00

SE ELITE COURSE with SE TRADINGX

1 × $5.00 -

×

Forex Patterns and Probabilities: Trading Strategies for Trending and Range-Bound Markets with Ed Ponsi

1 × $6.00

Forex Patterns and Probabilities: Trading Strategies for Trending and Range-Bound Markets with Ed Ponsi

1 × $6.00 -

×

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00 -

×

Falcon FX Pro

1 × $31.00

Falcon FX Pro

1 × $31.00 -

×

Selected Articles by the Late by George Lindsay

1 × $6.00

Selected Articles by the Late by George Lindsay

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00 -

×

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00 -

×

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00 -

×

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00 -

×

Trading as a Business with Alexander Elder

1 × $6.00

Trading as a Business with Alexander Elder

1 × $6.00 -

×

Trading For a Living By Thomas Carr (Dr. Stoxx)

1 × $34.00

Trading For a Living By Thomas Carr (Dr. Stoxx)

1 × $34.00 -

×

NXT Level FX with Investors Domain

1 × $5.00

NXT Level FX with Investors Domain

1 × $5.00 -

×

EZ2 Trade Charting Collection eSignal (ez2tradesoftware.com) - Raghee Horner

1 × $6.00

EZ2 Trade Charting Collection eSignal (ez2tradesoftware.com) - Raghee Horner

1 × $6.00 -

×

Sharp Edge Institutional Trading Program 2022 (No indicators) with CompassFX

1 × $139.00

Sharp Edge Institutional Trading Program 2022 (No indicators) with CompassFX

1 × $139.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

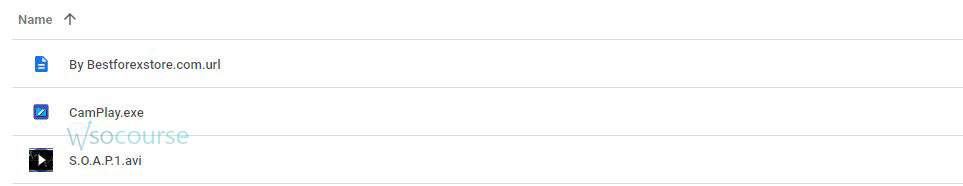

SOAP. Served On A Platter CD with David Elliott

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “ SOAP. Served On A Platter CD with David Elliott” below:

SOAP. Served On A Platter CD with David Elliott

Introduction

In the complex world of trading, understanding and mastering reliable strategies is crucial. David Elliott’s “SOAP. Served On A Platter CD” provides traders with actionable insights and techniques to enhance their trading performance. This article explores Elliott’s unique approach, offering a comprehensive guide to implementing his strategies effectively.

Understanding SOAP: An Overview

What is SOAP?

SOAP stands for Stock Opportunity Analysis Plan. It’s a systematic approach designed to identify and capitalize on trading opportunities.

Why SOAP?

- Clarity: Simplifies the decision-making process.

- Structure: Provides a clear framework for analysis.

- Effectiveness: Enhances the probability of successful trades.

Components of SOAP

Stock Selection

Selecting the right stocks is the first crucial step in the SOAP method.

Criteria for Stock Selection

- Volume: High trading volume indicates liquidity.

- Volatility: Stocks with significant price movements offer more trading opportunities.

- Trend: Identify stocks with clear upward or downward trends.

Opportunity Identification

Recognizing potential trading opportunities is essential for success.

Technical Indicators

- Moving Averages: Identify the direction of the trend.

- Relative Strength Index (RSI): Measure momentum and identify overbought or oversold conditions.

- Bollinger Bands: Assess volatility and potential price breakouts.

Analysis

Thorough analysis ensures that you make informed trading decisions.

Fundamental Analysis

- Earnings Reports: Evaluate a company’s profitability.

- News and Events: Stay updated with relevant news that could impact stock prices.

- Financial Ratios: Analyze ratios like P/E, ROI, and debt-to-equity.

Plan Execution

Having a solid execution plan is crucial to capitalize on identified opportunities.

Setting Entry and Exit Points

- Entry Points: Define criteria for when to enter a trade.

- Exit Points: Set rules for when to close a position to secure profits or minimize losses.

Implementing SOAP in Your Trading Routine

Step-by-Step Guide

- Identify Potential Stocks: Use criteria such as volume, volatility, and trend.

- Analyze Using Indicators: Apply technical indicators to assess trading opportunities.

- Perform Fundamental Analysis: Check earnings, news, and financial ratios.

- Set Up Your Trading Plan: Establish entry and exit points.

- Execute the Plan: Follow your strategy with discipline.

Practical Example

A trader uses SOAP to identify a high-volume stock with strong upward momentum. By applying moving averages and RSI, they confirm the trend and enter the trade at a strategic point. Regular monitoring and analysis lead to timely exits, securing profits.

Benefits of Using SOAP

Improved Decision-Making

SOAP provides a structured approach, reducing emotional decision-making and enhancing rational analysis.

Key Advantages

- Consistency: Ensures a systematic approach to trading.

- Confidence: Increases confidence in trading decisions.

- Risk Management: Incorporates risk management techniques to protect capital.

Enhanced Trading Performance

By following SOAP, traders can potentially improve their trading performance and achieve more consistent results.

Performance Metrics

- Win Rate: Track the percentage of successful trades.

- Average Return: Measure the average return per trade.

- Drawdown: Monitor the maximum loss from peak to trough.

Common Pitfalls to Avoid

Overtrading

Trading too frequently can lead to increased costs and potential losses.

How to Avoid Overtrading

- Stick to the Plan: Only trade when criteria are met.

- Set Limits: Limit the number of trades per day or week.

Ignoring Risk Management

Neglecting risk management can result in significant financial losses.

Implement Risk Management Strategies

- Use Stop-Loss Orders: Set automatic exit points to limit losses.

- Diversify: Spread risk by trading multiple instruments.

Emotional Trading

Allowing emotions to drive trading decisions can be detrimental.

Stay Disciplined

- Follow the Strategy: Adhere to your trading plan.

- Take Breaks: Step away from the screen to maintain a clear mindset.

Advanced Strategies in SOAP

Swing Trading

Swing trading involves holding positions for several days to capture short- to medium-term gains.

Swing Trading Techniques

- Identify Swings: Use technical indicators to pinpoint swing points.

- Enter and Exit: Strategically enter at the beginning of a swing and exit at the end.

Scalping

Scalping is a high-frequency trading strategy aimed at making small profits from numerous trades.

Scalping Techniques

- Quick Entries and Exits: Use SOAP to time entries and exits precisely.

- High Volume: Focus on high-volume trades to ensure liquidity.

Conclusion

David Elliott’s “SOAP. Served On A Platter CD” offers a comprehensive framework for identifying and capitalizing on trading opportunities. By integrating stock selection, opportunity identification, thorough analysis, and disciplined execution, traders can enhance their decision-making and trading performance. Implementing SOAP in your trading routine can lead to more consistent and profitable outcomes.

FAQs

1. What is SOAP in trading?

SOAP stands for Stock Opportunity Analysis Plan, a structured approach to identifying and capitalizing on trading opportunities.

2. How does SOAP improve trading decisions?

SOAP provides a clear framework for analysis and decision-making, reducing emotional biases and enhancing rational decisions.

3. What are the key components of SOAP?

The key components include stock selection, opportunity identification, analysis, and plan execution.

4. How can I avoid overtrading?

Avoid overtrading by sticking to your trading plan, setting limits, and trading only when criteria are met.

5. What advanced strategies can be implemented with SOAP?

Advanced strategies include swing trading and scalping, which use SOAP for precise entries and exits.

Be the first to review “SOAP. Served On A Platter CD with David Elliott” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.