-

×

Yes You Can Time the Market! with Ben Stein

1 × $6.00

Yes You Can Time the Market! with Ben Stein

1 × $6.00 -

×

Trading Options at Expiration: Strategies and Models for Winning the Endgame with Jeff Augen

1 × $6.00

Trading Options at Expiration: Strategies and Models for Winning the Endgame with Jeff Augen

1 × $6.00 -

×

Trading a Living Thing (Article) with David Bowden

1 × $6.00

Trading a Living Thing (Article) with David Bowden

1 × $6.00 -

×

WealthFRX Trading Mastery Course 2.0

1 × $5.00

WealthFRX Trading Mastery Course 2.0

1 × $5.00 -

×

Sure Thing Stock Investing with Larry Williams

1 × $6.00

Sure Thing Stock Investing with Larry Williams

1 × $6.00 -

×

DNA Wealth Blueprint 3 (Complete)

1 × $54.00

DNA Wealth Blueprint 3 (Complete)

1 × $54.00 -

×

Read the Greed-Live! Course

1 × $15.00

Read the Greed-Live! Course

1 × $15.00 -

×

Professional Strategies For Trading The DAX

1 × $6.00

Professional Strategies For Trading The DAX

1 × $6.00 -

×

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00 -

×

The Japanese Money Tree with Andrew H.Shipley

1 × $6.00

The Japanese Money Tree with Andrew H.Shipley

1 × $6.00 -

×

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00 -

×

Master NFTs in 7 Days with Ben Yu

1 × $23.00

Master NFTs in 7 Days with Ben Yu

1 × $23.00 -

×

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Trading Calendar Spreads with Option Pit

1 × $39.00

Trading Calendar Spreads with Option Pit

1 × $39.00 -

×

The AB-CD Secret Pattern

1 × $4.00

The AB-CD Secret Pattern

1 × $4.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

MT4 High Probability Forex Trading Method

1 × $6.00

MT4 High Probability Forex Trading Method

1 × $6.00 -

×

Basic Day Trading Techniques with Michael Jenkins

1 × $6.00

Basic Day Trading Techniques with Michael Jenkins

1 × $6.00 -

×

Vaga Academy with VAGAFX

1 × $5.00

Vaga Academy with VAGAFX

1 × $5.00 -

×

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00 -

×

Sell Premium & Minimize Risk Class with Don Kaufman

1 × $6.00

Sell Premium & Minimize Risk Class with Don Kaufman

1 × $6.00 -

×

Fundamental & Technical Analysis Mini Course with Colin Nicholson

1 × $6.00

Fundamental & Technical Analysis Mini Course with Colin Nicholson

1 × $6.00 -

×

TheoTrade

1 × $31.00

TheoTrade

1 × $31.00 -

×

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00 -

×

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00 -

×

Market Structure Matters with Haim Bodek

1 × $62.00

Market Structure Matters with Haim Bodek

1 × $62.00 -

×

War Room Psychology Vol. 4 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 4 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

BWT Precision 7.0.2.3 (bluewavetrading.com)

1 × $31.00

BWT Precision 7.0.2.3 (bluewavetrading.com)

1 × $31.00 -

×

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

KojoForex Goat Strategy with Kojo Forex Academy

1 × $20.00

KojoForex Goat Strategy with Kojo Forex Academy

1 × $20.00 -

×

Foundation Options - Time Decay, Implied Volatility, Greeks

1 × $6.00

Foundation Options - Time Decay, Implied Volatility, Greeks

1 × $6.00 -

×

TIMfundamentals with Timothy Sykes

1 × $5.00

TIMfundamentals with Timothy Sykes

1 × $5.00 -

×

Frontline Forex Vol 1-3 with Steve Nison - Candle Charts

1 × $54.00

Frontline Forex Vol 1-3 with Steve Nison - Candle Charts

1 × $54.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Mastering the Orderbook with Rowan Crawford

1 × $6.00

Mastering the Orderbook with Rowan Crawford

1 × $6.00 -

×

London Super Conference 2018

1 × $54.00

London Super Conference 2018

1 × $54.00 -

×

How to Trade Choppy, Sideways Markets with Wayne Gorman - Elliott Wave International

1 × $6.00

How to Trade Choppy, Sideways Markets with Wayne Gorman - Elliott Wave International

1 × $6.00 -

×

Pristine - Oliver Velez – Swing Trading Tactics 2001

1 × $6.00

Pristine - Oliver Velez – Swing Trading Tactics 2001

1 × $6.00 -

×

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00 -

×

The Sellers Code Master Class with Flip2Freedom

1 × $31.00

The Sellers Code Master Class with Flip2Freedom

1 × $31.00 -

×

Daytraders Bulletin – Recurrent Structures for Profit with Charles Holt

1 × $6.00

Daytraders Bulletin – Recurrent Structures for Profit with Charles Holt

1 × $6.00 -

×

The Aime Workshop with Clay Marafiote

1 × $6.00

The Aime Workshop with Clay Marafiote

1 × $6.00 -

×

The Complete Guide To Futures & Commodities Trading with Stephen Jennings

1 × $6.00

The Complete Guide To Futures & Commodities Trading with Stephen Jennings

1 × $6.00 -

×

How to Make Money with Real State Options with Thomas Lucier

1 × $6.00

How to Make Money with Real State Options with Thomas Lucier

1 × $6.00 -

×

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00 -

×

Advanced Trading Strategies with Larry Connors

1 × $6.00

Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

Trading Psychology with Barry Burns

1 × $4.00

Trading Psychology with Barry Burns

1 × $4.00 -

×

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00 -

×

Secret Day - Swing Trading Strategy For Stock, Forex, Crypto with Value Stocks

1 × $5.00

Secret Day - Swing Trading Strategy For Stock, Forex, Crypto with Value Stocks

1 × $5.00 -

×

Market Timing & Technical Analysis with Alan Shaw

1 × $6.00

Market Timing & Technical Analysis with Alan Shaw

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00

CM APR (A Pivot Reverse) Trade Method with Austin Passamonte

1 × $6.00 -

×

Intra-Day Trading Nasdaq Futures Class with Tony Rago

1 × $6.00

Intra-Day Trading Nasdaq Futures Class with Tony Rago

1 × $6.00 -

×

Futures & Options Course with Talkin Options

1 × $15.00

Futures & Options Course with Talkin Options

1 × $15.00 -

×

Sample and Mock Exams 2008 with CFA Institute

1 × $6.00

Sample and Mock Exams 2008 with CFA Institute

1 × $6.00 -

×

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00 -

×

OTC Oracle Course - PENNY WHALE with Simple Trade

1 × $31.00

OTC Oracle Course - PENNY WHALE with Simple Trade

1 × $31.00 -

×

NORMAN HALLETT SIMPLE TRADING PLANS

1 × $31.00

NORMAN HALLETT SIMPLE TRADING PLANS

1 × $31.00 -

×

Whats In Your Name – The Science of Letters and Numbers (1916)

1 × $6.00

Whats In Your Name – The Science of Letters and Numbers (1916)

1 × $6.00 -

×

The Price Action Manual, 2nd Ed 2008 with Bryce Gilmore

1 × $4.00

The Price Action Manual, 2nd Ed 2008 with Bryce Gilmore

1 × $4.00 -

×

Volatility Trading with Euan Sinclair

1 × $6.00

Volatility Trading with Euan Sinclair

1 × $6.00 -

×

License to Steal with John Carlton

1 × $6.00

License to Steal with John Carlton

1 × $6.00 -

×

The Power of Beliefs in Trading with Gabriel Grammatidis - Van Tharp

1 × $13.00

The Power of Beliefs in Trading with Gabriel Grammatidis - Van Tharp

1 × $13.00 -

×

ETF Strategies & Tactics: Hedge Your Portfolio in a Changing Marke with Laurence Rosenberg

1 × $6.00

ETF Strategies & Tactics: Hedge Your Portfolio in a Changing Marke with Laurence Rosenberg

1 × $6.00 -

×

The Investor Accelerator Premium Membership

1 × $34.00

The Investor Accelerator Premium Membership

1 × $34.00 -

×

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00

Sun Tzu and the Art of War for Traders with Dean Lundell

1 × $6.00 -

×

Trading - Candlelight - Ryan Litchfield

1 × $6.00

Trading - Candlelight - Ryan Litchfield

1 × $6.00 -

×

Trading Analysis Crash Course

1 × $23.00

Trading Analysis Crash Course

1 × $23.00 -

×

The Key to Speculation for Greyhound Dog Racing with Jack Gillen

1 × $4.00

The Key to Speculation for Greyhound Dog Racing with Jack Gillen

1 × $4.00 -

×

FX Daniel Savage Bundle (2in1)

1 × $23.00

FX Daniel Savage Bundle (2in1)

1 × $23.00 -

×

The Vital Few vs. the Trivial Many: Invest with the Insiders, Not the Masses with George Muzea

1 × $6.00

The Vital Few vs. the Trivial Many: Invest with the Insiders, Not the Masses with George Muzea

1 × $6.00 -

×

Spike 35 Traders Manual with J.D.Hamon

1 × $6.00

Spike 35 Traders Manual with J.D.Hamon

1 × $6.00 -

×

Fixed-Income Securities: Valuation, Risk Management and Portfolio Strategies - Lionel Martellini, Philippe Priaulet & Stéphane Priaulet

1 × $6.00

Fixed-Income Securities: Valuation, Risk Management and Portfolio Strategies - Lionel Martellini, Philippe Priaulet & Stéphane Priaulet

1 × $6.00 -

×

Dan Sheridan 2011 Calendar Workshop

1 × $6.00

Dan Sheridan 2011 Calendar Workshop

1 × $6.00 -

×

Chart Reading Course with TraderSumo

1 × $5.00

Chart Reading Course with TraderSumo

1 × $5.00 -

×

How To Trade Like a Pro, Not a Hobby with Jason Bond

1 × $62.00

How To Trade Like a Pro, Not a Hobby with Jason Bond

1 × $62.00 -

×

Modeling Financial Markets. Using Visual Basic Net & Databases To Create Pricing Trading & Risk Management Models

1 × $6.00

Modeling Financial Markets. Using Visual Basic Net & Databases To Create Pricing Trading & Risk Management Models

1 × $6.00 -

×

The Basics of the Wave Principle with Wayne Gorman

1 × $15.00

The Basics of the Wave Principle with Wayne Gorman

1 × $15.00 -

×

The Insured Portfolio: Your Gateway to Stress-Free Global Investments with Erika Nolan, Marc-Andre Sola & Shannon Crouch

1 × $6.00

The Insured Portfolio: Your Gateway to Stress-Free Global Investments with Erika Nolan, Marc-Andre Sola & Shannon Crouch

1 × $6.00 -

×

The TradingKey Mastering Elliott Wave with Hubb Financial

1 × $6.00

The TradingKey Mastering Elliott Wave with Hubb Financial

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00 -

×

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00 -

×

Code 1 with Oil Trading Academy

1 × $31.00

Code 1 with Oil Trading Academy

1 × $31.00 -

×

Complete Gunner24 Trading & Forecasting Course

1 × $6.00

Complete Gunner24 Trading & Forecasting Course

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Futures & Options from A to Z with Russell Wassendorf

1 × $6.00

Futures & Options from A to Z with Russell Wassendorf

1 × $6.00 -

×

The Dynamic Trend Confirmation Indicator with Alphashark

1 × $54.00

The Dynamic Trend Confirmation Indicator with Alphashark

1 × $54.00 -

×

Play to Win with David La Piana & Michaela Hayes

1 × $6.00

Play to Win with David La Piana & Michaela Hayes

1 × $6.00 -

×

Volatility Master Class

1 × $62.00

Volatility Master Class

1 × $62.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The Complete 32 Plus Hour Video Course Bundle with Rob Hoffman - Become a Better Trader

1 × $6.00

The Complete 32 Plus Hour Video Course Bundle with Rob Hoffman - Become a Better Trader

1 × $6.00 -

×

Electronic Trading "TNT" I Gorilla Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" I Gorilla Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Trading Against the Crowd with John Summa

1 × $6.00

Trading Against the Crowd with John Summa

1 × $6.00 -

×

Classic Trading Tactics Theory and Practice with Linda Raschke

1 × $13.00

Classic Trading Tactics Theory and Practice with Linda Raschke

1 × $13.00 -

×

iMarketsLive Academy Course

1 × $5.00

iMarketsLive Academy Course

1 × $5.00 -

×

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00 -

×

The Next Great Bull Market with Matthew McCall

1 × $6.00

The Next Great Bull Market with Matthew McCall

1 × $6.00 -

×

Investment Titans: Investment Insights from the Minds that Move Wall Street with Jonathan Burton

1 × $6.00

Investment Titans: Investment Insights from the Minds that Move Wall Street with Jonathan Burton

1 × $6.00

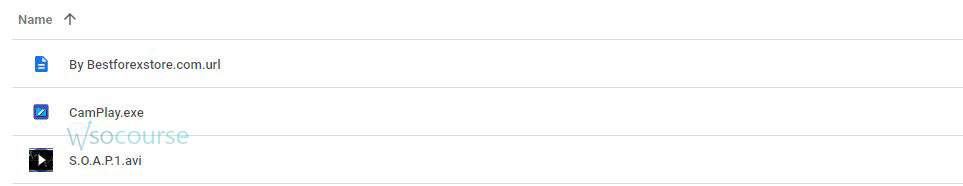

SOAP. Served On A Platter CD with David Elliott

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “ SOAP. Served On A Platter CD with David Elliott” below:

SOAP. Served On A Platter CD with David Elliott

Introduction

In the complex world of trading, understanding and mastering reliable strategies is crucial. David Elliott’s “SOAP. Served On A Platter CD” provides traders with actionable insights and techniques to enhance their trading performance. This article explores Elliott’s unique approach, offering a comprehensive guide to implementing his strategies effectively.

Understanding SOAP: An Overview

What is SOAP?

SOAP stands for Stock Opportunity Analysis Plan. It’s a systematic approach designed to identify and capitalize on trading opportunities.

Why SOAP?

- Clarity: Simplifies the decision-making process.

- Structure: Provides a clear framework for analysis.

- Effectiveness: Enhances the probability of successful trades.

Components of SOAP

Stock Selection

Selecting the right stocks is the first crucial step in the SOAP method.

Criteria for Stock Selection

- Volume: High trading volume indicates liquidity.

- Volatility: Stocks with significant price movements offer more trading opportunities.

- Trend: Identify stocks with clear upward or downward trends.

Opportunity Identification

Recognizing potential trading opportunities is essential for success.

Technical Indicators

- Moving Averages: Identify the direction of the trend.

- Relative Strength Index (RSI): Measure momentum and identify overbought or oversold conditions.

- Bollinger Bands: Assess volatility and potential price breakouts.

Analysis

Thorough analysis ensures that you make informed trading decisions.

Fundamental Analysis

- Earnings Reports: Evaluate a company’s profitability.

- News and Events: Stay updated with relevant news that could impact stock prices.

- Financial Ratios: Analyze ratios like P/E, ROI, and debt-to-equity.

Plan Execution

Having a solid execution plan is crucial to capitalize on identified opportunities.

Setting Entry and Exit Points

- Entry Points: Define criteria for when to enter a trade.

- Exit Points: Set rules for when to close a position to secure profits or minimize losses.

Implementing SOAP in Your Trading Routine

Step-by-Step Guide

- Identify Potential Stocks: Use criteria such as volume, volatility, and trend.

- Analyze Using Indicators: Apply technical indicators to assess trading opportunities.

- Perform Fundamental Analysis: Check earnings, news, and financial ratios.

- Set Up Your Trading Plan: Establish entry and exit points.

- Execute the Plan: Follow your strategy with discipline.

Practical Example

A trader uses SOAP to identify a high-volume stock with strong upward momentum. By applying moving averages and RSI, they confirm the trend and enter the trade at a strategic point. Regular monitoring and analysis lead to timely exits, securing profits.

Benefits of Using SOAP

Improved Decision-Making

SOAP provides a structured approach, reducing emotional decision-making and enhancing rational analysis.

Key Advantages

- Consistency: Ensures a systematic approach to trading.

- Confidence: Increases confidence in trading decisions.

- Risk Management: Incorporates risk management techniques to protect capital.

Enhanced Trading Performance

By following SOAP, traders can potentially improve their trading performance and achieve more consistent results.

Performance Metrics

- Win Rate: Track the percentage of successful trades.

- Average Return: Measure the average return per trade.

- Drawdown: Monitor the maximum loss from peak to trough.

Common Pitfalls to Avoid

Overtrading

Trading too frequently can lead to increased costs and potential losses.

How to Avoid Overtrading

- Stick to the Plan: Only trade when criteria are met.

- Set Limits: Limit the number of trades per day or week.

Ignoring Risk Management

Neglecting risk management can result in significant financial losses.

Implement Risk Management Strategies

- Use Stop-Loss Orders: Set automatic exit points to limit losses.

- Diversify: Spread risk by trading multiple instruments.

Emotional Trading

Allowing emotions to drive trading decisions can be detrimental.

Stay Disciplined

- Follow the Strategy: Adhere to your trading plan.

- Take Breaks: Step away from the screen to maintain a clear mindset.

Advanced Strategies in SOAP

Swing Trading

Swing trading involves holding positions for several days to capture short- to medium-term gains.

Swing Trading Techniques

- Identify Swings: Use technical indicators to pinpoint swing points.

- Enter and Exit: Strategically enter at the beginning of a swing and exit at the end.

Scalping

Scalping is a high-frequency trading strategy aimed at making small profits from numerous trades.

Scalping Techniques

- Quick Entries and Exits: Use SOAP to time entries and exits precisely.

- High Volume: Focus on high-volume trades to ensure liquidity.

Conclusion

David Elliott’s “SOAP. Served On A Platter CD” offers a comprehensive framework for identifying and capitalizing on trading opportunities. By integrating stock selection, opportunity identification, thorough analysis, and disciplined execution, traders can enhance their decision-making and trading performance. Implementing SOAP in your trading routine can lead to more consistent and profitable outcomes.

FAQs

1. What is SOAP in trading?

SOAP stands for Stock Opportunity Analysis Plan, a structured approach to identifying and capitalizing on trading opportunities.

2. How does SOAP improve trading decisions?

SOAP provides a clear framework for analysis and decision-making, reducing emotional biases and enhancing rational decisions.

3. What are the key components of SOAP?

The key components include stock selection, opportunity identification, analysis, and plan execution.

4. How can I avoid overtrading?

Avoid overtrading by sticking to your trading plan, setting limits, and trading only when criteria are met.

5. What advanced strategies can be implemented with SOAP?

Advanced strategies include swing trading and scalping, which use SOAP for precise entries and exits.

Be the first to review “SOAP. Served On A Platter CD with David Elliott” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.