-

×

Currency Trading and Intermarket Analysis

1 × $6.00

Currency Trading and Intermarket Analysis

1 × $6.00 -

×

Forex Trading - Making A Living Online Trading Forex By Luciano Kelly & Learn Forex Mentor

1 × $6.00

Forex Trading - Making A Living Online Trading Forex By Luciano Kelly & Learn Forex Mentor

1 × $6.00 -

×

The Options Handbook with Bernie Schaeffer

1 × $6.00

The Options Handbook with Bernie Schaeffer

1 × $6.00 -

×

4D Bootcamp with Black Rabbit

1 × $10.00

4D Bootcamp with Black Rabbit

1 × $10.00 -

×

Getting Started in Options with Michael Thomsett

1 × $6.00

Getting Started in Options with Michael Thomsett

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

How To Successfully Trade The Haggerty 1,2,3 Strategy Home Study Trading Course with Kevin Haggerty

1 × $6.00

How To Successfully Trade The Haggerty 1,2,3 Strategy Home Study Trading Course with Kevin Haggerty

1 × $6.00 -

×

Cumulative and Comparative TICK (Option TradeStation)

1 × $23.00

Cumulative and Comparative TICK (Option TradeStation)

1 × $23.00 -

×

The Price Action Protocol - 2015 Edition

1 × $15.00

The Price Action Protocol - 2015 Edition

1 × $15.00 -

×

The Futures Edge with Joshua Martinez

1 × $155.00

The Futures Edge with Joshua Martinez

1 × $155.00 -

×

Schwager on Futures: Managed Trading with Jack Schwager

1 × $4.00

Schwager on Futures: Managed Trading with Jack Schwager

1 × $4.00 -

×

Forex Trading for Beginners 100 Must Know “What”&”How” Q&A

1 × $5.00

Forex Trading for Beginners 100 Must Know “What”&”How” Q&A

1 × $5.00 -

×

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00 -

×

Technical Analysis. The Basis with Glenn Ring

1 × $6.00

Technical Analysis. The Basis with Glenn Ring

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Mastering Level 2 with ClayTrader

1 × $197.00

Mastering Level 2 with ClayTrader

1 × $197.00 -

×

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00 -

×

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00 -

×

Leading Indicators

1 × $23.00

Leading Indicators

1 × $23.00 -

×

Advanced Elliott Wave Analysis : Complex Patterns, Intermarket Relationships, and Global Cash Flow Analysis

1 × $6.00

Advanced Elliott Wave Analysis : Complex Patterns, Intermarket Relationships, and Global Cash Flow Analysis

1 × $6.00 -

×

Speculator King 1967 with Jesse Livermore

1 × $6.00

Speculator King 1967 with Jesse Livermore

1 × $6.00 -

×

Introduction To The STRAT Course with Rob Smith

1 × $8.00

Introduction To The STRAT Course with Rob Smith

1 × $8.00 -

×

Rise Precision Latest Course

1 × $10.00

Rise Precision Latest Course

1 × $10.00 -

×

European Fixed Income Markets with Jonathan Batten

1 × $6.00

European Fixed Income Markets with Jonathan Batten

1 × $6.00 -

×

Pay me in Stock Options with Carol Curtis

1 × $6.00

Pay me in Stock Options with Carol Curtis

1 × $6.00 -

×

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00 -

×

Pattern Trader Pro with ForexStore

1 × $6.00

Pattern Trader Pro with ForexStore

1 × $6.00 -

×

The Online Investing Book with Harry Domash

1 × $6.00

The Online Investing Book with Harry Domash

1 × $6.00 -

×

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00 -

×

Intermarket Analysis with John Murphy

1 × $6.00

Intermarket Analysis with John Murphy

1 × $6.00 -

×

Manage By The Greeks 2016 with Dan Sheridan

1 × $23.00

Manage By The Greeks 2016 with Dan Sheridan

1 × $23.00 -

×

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00 -

×

Trading Mastery For Financial Freedom with Marv Eisen

1 × $10.00

Trading Mastery For Financial Freedom with Marv Eisen

1 × $10.00 -

×

Price Action Trader Training

1 × $6.00

Price Action Trader Training

1 × $6.00 -

×

Lit Trading Course

1 × $15.00

Lit Trading Course

1 × $15.00 -

×

Forex Trading MasterClass with Torero Traders School

1 × $5.00

Forex Trading MasterClass with Torero Traders School

1 × $5.00 -

×

Top 20 SP500 Trading Strategies Course with Larry Connors

1 × $23.00

Top 20 SP500 Trading Strategies Course with Larry Connors

1 × $23.00 -

×

Advanced Seminar

1 × $31.00

Advanced Seminar

1 × $31.00 -

×

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00 -

×

Trading Without Gambling with Marcel Link

1 × $6.00

Trading Without Gambling with Marcel Link

1 × $6.00 -

×

Forex Scalping Strategy Course with Vic Noble & Sarid Harper

1 × $6.00

Forex Scalping Strategy Course with Vic Noble & Sarid Harper

1 × $6.00 -

×

Investing With Giants: Tried and True Stocks That Have Sustained the Test of Time with Linda T.Mead

1 × $6.00

Investing With Giants: Tried and True Stocks That Have Sustained the Test of Time with Linda T.Mead

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Market Trader Forecasting Modeling Course

1 × $6.00

Market Trader Forecasting Modeling Course

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Professional Strategies For Trading The DAX

1 × $6.00

Professional Strategies For Trading The DAX

1 × $6.00 -

×

Forex Trading Strategies Modules 1-3 Complete Set with Blake Young - Shadow Trader

1 × $54.00

Forex Trading Strategies Modules 1-3 Complete Set with Blake Young - Shadow Trader

1 × $54.00 -

×

Big Money Little Effort with Mark Shipman

1 × $6.00

Big Money Little Effort with Mark Shipman

1 × $6.00 -

×

Total Fibonacci Trading with TradeSmart University

1 × $31.00

Total Fibonacci Trading with TradeSmart University

1 × $31.00 -

×

FluxOrion By Back To The Future Trading

1 × $6.00

FluxOrion By Back To The Future Trading

1 × $6.00 -

×

Price Action Forex Trading Strategies Training Course & Members Videos with Nial Fuller

1 × $28.00

Price Action Forex Trading Strategies Training Course & Members Videos with Nial Fuller

1 × $28.00 -

×

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00 -

×

Trading System Mastery with Brian McAboy

1 × $6.00

Trading System Mastery with Brian McAboy

1 × $6.00 -

×

The Haller Theory of Stock Market Trends

1 × $6.00

The Haller Theory of Stock Market Trends

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

SOAP. Served On A Platter CD with David Elliott

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

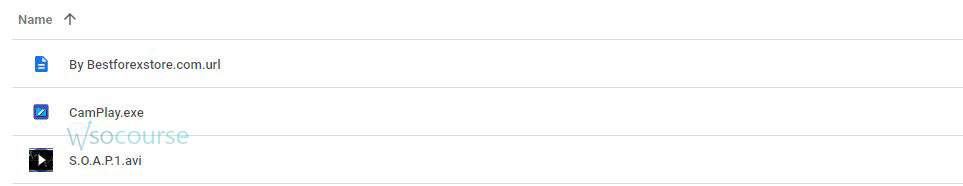

Content Proof: Watch Here!

You may check content proof of “ SOAP. Served On A Platter CD with David Elliott” below:

SOAP. Served On A Platter CD with David Elliott

Introduction

In the complex world of trading, understanding and mastering reliable strategies is crucial. David Elliott’s “SOAP. Served On A Platter CD” provides traders with actionable insights and techniques to enhance their trading performance. This article explores Elliott’s unique approach, offering a comprehensive guide to implementing his strategies effectively.

Understanding SOAP: An Overview

What is SOAP?

SOAP stands for Stock Opportunity Analysis Plan. It’s a systematic approach designed to identify and capitalize on trading opportunities.

Why SOAP?

- Clarity: Simplifies the decision-making process.

- Structure: Provides a clear framework for analysis.

- Effectiveness: Enhances the probability of successful trades.

Components of SOAP

Stock Selection

Selecting the right stocks is the first crucial step in the SOAP method.

Criteria for Stock Selection

- Volume: High trading volume indicates liquidity.

- Volatility: Stocks with significant price movements offer more trading opportunities.

- Trend: Identify stocks with clear upward or downward trends.

Opportunity Identification

Recognizing potential trading opportunities is essential for success.

Technical Indicators

- Moving Averages: Identify the direction of the trend.

- Relative Strength Index (RSI): Measure momentum and identify overbought or oversold conditions.

- Bollinger Bands: Assess volatility and potential price breakouts.

Analysis

Thorough analysis ensures that you make informed trading decisions.

Fundamental Analysis

- Earnings Reports: Evaluate a company’s profitability.

- News and Events: Stay updated with relevant news that could impact stock prices.

- Financial Ratios: Analyze ratios like P/E, ROI, and debt-to-equity.

Plan Execution

Having a solid execution plan is crucial to capitalize on identified opportunities.

Setting Entry and Exit Points

- Entry Points: Define criteria for when to enter a trade.

- Exit Points: Set rules for when to close a position to secure profits or minimize losses.

Implementing SOAP in Your Trading Routine

Step-by-Step Guide

- Identify Potential Stocks: Use criteria such as volume, volatility, and trend.

- Analyze Using Indicators: Apply technical indicators to assess trading opportunities.

- Perform Fundamental Analysis: Check earnings, news, and financial ratios.

- Set Up Your Trading Plan: Establish entry and exit points.

- Execute the Plan: Follow your strategy with discipline.

Practical Example

A trader uses SOAP to identify a high-volume stock with strong upward momentum. By applying moving averages and RSI, they confirm the trend and enter the trade at a strategic point. Regular monitoring and analysis lead to timely exits, securing profits.

Benefits of Using SOAP

Improved Decision-Making

SOAP provides a structured approach, reducing emotional decision-making and enhancing rational analysis.

Key Advantages

- Consistency: Ensures a systematic approach to trading.

- Confidence: Increases confidence in trading decisions.

- Risk Management: Incorporates risk management techniques to protect capital.

Enhanced Trading Performance

By following SOAP, traders can potentially improve their trading performance and achieve more consistent results.

Performance Metrics

- Win Rate: Track the percentage of successful trades.

- Average Return: Measure the average return per trade.

- Drawdown: Monitor the maximum loss from peak to trough.

Common Pitfalls to Avoid

Overtrading

Trading too frequently can lead to increased costs and potential losses.

How to Avoid Overtrading

- Stick to the Plan: Only trade when criteria are met.

- Set Limits: Limit the number of trades per day or week.

Ignoring Risk Management

Neglecting risk management can result in significant financial losses.

Implement Risk Management Strategies

- Use Stop-Loss Orders: Set automatic exit points to limit losses.

- Diversify: Spread risk by trading multiple instruments.

Emotional Trading

Allowing emotions to drive trading decisions can be detrimental.

Stay Disciplined

- Follow the Strategy: Adhere to your trading plan.

- Take Breaks: Step away from the screen to maintain a clear mindset.

Advanced Strategies in SOAP

Swing Trading

Swing trading involves holding positions for several days to capture short- to medium-term gains.

Swing Trading Techniques

- Identify Swings: Use technical indicators to pinpoint swing points.

- Enter and Exit: Strategically enter at the beginning of a swing and exit at the end.

Scalping

Scalping is a high-frequency trading strategy aimed at making small profits from numerous trades.

Scalping Techniques

- Quick Entries and Exits: Use SOAP to time entries and exits precisely.

- High Volume: Focus on high-volume trades to ensure liquidity.

Conclusion

David Elliott’s “SOAP. Served On A Platter CD” offers a comprehensive framework for identifying and capitalizing on trading opportunities. By integrating stock selection, opportunity identification, thorough analysis, and disciplined execution, traders can enhance their decision-making and trading performance. Implementing SOAP in your trading routine can lead to more consistent and profitable outcomes.

FAQs

1. What is SOAP in trading?

SOAP stands for Stock Opportunity Analysis Plan, a structured approach to identifying and capitalizing on trading opportunities.

2. How does SOAP improve trading decisions?

SOAP provides a clear framework for analysis and decision-making, reducing emotional biases and enhancing rational decisions.

3. What are the key components of SOAP?

The key components include stock selection, opportunity identification, analysis, and plan execution.

4. How can I avoid overtrading?

Avoid overtrading by sticking to your trading plan, setting limits, and trading only when criteria are met.

5. What advanced strategies can be implemented with SOAP?

Advanced strategies include swing trading and scalping, which use SOAP for precise entries and exits.

Be the first to review “SOAP. Served On A Platter CD with David Elliott” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.