-

×

How I Trade for a Living with Gary Smith

1 × $6.00

How I Trade for a Living with Gary Smith

1 × $6.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

T3 Live - The Simple Art of Trading

1 × $31.00

T3 Live - The Simple Art of Trading

1 × $31.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00 -

×

Investment Philosophies

1 × $6.00

Investment Philosophies

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Gannline. Total School Package

1 × $6.00

Gannline. Total School Package

1 × $6.00 -

×

The Profit Magic of Stock Transaction Timing with J.M.Hurst

1 × $6.00

The Profit Magic of Stock Transaction Timing with J.M.Hurst

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00

From Wall Street to the Great Wall with Jonathan Worrall

1 × $6.00 -

×

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00 -

×

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00 -

×

Study Guide for Technical Analysis Explained (1st Edition) with Martin Pring

1 × $6.00

Study Guide for Technical Analysis Explained (1st Edition) with Martin Pring

1 × $6.00 -

×

Profitable Strategies with Gemify Academy

1 × $10.00

Profitable Strategies with Gemify Academy

1 × $10.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Technical Analysis 201: From Chart Setups to Trading Execution Methodology Class with Jeff Bierman

1 × $6.00

Technical Analysis 201: From Chart Setups to Trading Execution Methodology Class with Jeff Bierman

1 × $6.00 -

×

Power FX Xtreme BuySell EA

1 × $23.00

Power FX Xtreme BuySell EA

1 × $23.00 -

×

Simpler Options - Weekly Butterflies for Income

1 × $6.00

Simpler Options - Weekly Butterflies for Income

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00

Accelerated Learning Techniques in Action with Colin Rose, Jayne Nicholl & Malcolm Nicholl

1 × $6.00 -

×

Forex Project Advanced Course with Tyler Crowell

1 × $5.00

Forex Project Advanced Course with Tyler Crowell

1 × $5.00 -

×

Dow Theory for the 21st Century: Technical Indicators for Improving Your Investment Results with Jack Schannep

1 × $6.00

Dow Theory for the 21st Century: Technical Indicators for Improving Your Investment Results with Jack Schannep

1 × $6.00 -

×

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00 -

×

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00

The Deadly 7 Sins of Investing with Maury Fertig

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00

Dynamic Time and Price Analysis of Market Trends with Bruce Gilmore

1 × $6.00 -

×

Advanced Price Action Techniques with Andrew Jeken

1 × $6.00

Advanced Price Action Techniques with Andrew Jeken

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00 -

×

Financial Astrology Course with Brian James Sklenka

1 × $6.00

Financial Astrology Course with Brian James Sklenka

1 × $6.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00 -

×

Cotton Trading Manual with Terry Townsend

1 × $6.00

Cotton Trading Manual with Terry Townsend

1 × $6.00 -

×

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00

Options 101 - The Basics and Beyond Class A 5-Part Course with Don Kaufman

1 × $6.00 -

×

Master Trader Course

1 × $23.00

Master Trader Course

1 × $23.00 -

×

Futures Trading Secrets Home Study Course 2008 with Bill McCready

1 × $6.00

Futures Trading Secrets Home Study Course 2008 with Bill McCready

1 × $6.00 -

×

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00 -

×

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00 -

×

Pocketing Premium Master Class (Basic) with Henrry Gambell

1 × $31.00

Pocketing Premium Master Class (Basic) with Henrry Gambell

1 × $31.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00 -

×

Sixpart Study Guide to Market Profile

1 × $6.00

Sixpart Study Guide to Market Profile

1 × $6.00 -

×

RSD - Alex’s Natural Instinct Method Manifesto

1 × $6.00

RSD - Alex’s Natural Instinct Method Manifesto

1 × $6.00 -

×

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00

Generative AI for Asset Managers Workshop Recording with Ernest Chan

1 × $55.00 -

×

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00

Fundamentals 101: A Comprehensive Guide to Macroeconomic, Industry, and Financial Statement Analysis Class with Jeff Bierman

1 × $6.00 -

×

Blueprint to Extreme Reversals with Aiman Almansoori - Trading Terminal

1 × $8.00

Blueprint to Extreme Reversals with Aiman Almansoori - Trading Terminal

1 × $8.00 -

×

What Products to Watch and Why Class with Don Kaufman

1 × $6.00

What Products to Watch and Why Class with Don Kaufman

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

SOAP. Served On A Platter CD with David Elliott

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

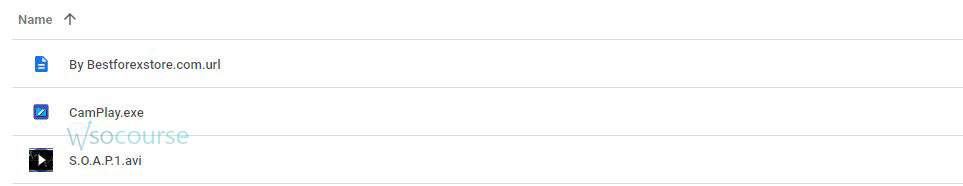

Content Proof: Watch Here!

You may check content proof of “ SOAP. Served On A Platter CD with David Elliott” below:

SOAP. Served On A Platter CD with David Elliott

Introduction

In the complex world of trading, understanding and mastering reliable strategies is crucial. David Elliott’s “SOAP. Served On A Platter CD” provides traders with actionable insights and techniques to enhance their trading performance. This article explores Elliott’s unique approach, offering a comprehensive guide to implementing his strategies effectively.

Understanding SOAP: An Overview

What is SOAP?

SOAP stands for Stock Opportunity Analysis Plan. It’s a systematic approach designed to identify and capitalize on trading opportunities.

Why SOAP?

- Clarity: Simplifies the decision-making process.

- Structure: Provides a clear framework for analysis.

- Effectiveness: Enhances the probability of successful trades.

Components of SOAP

Stock Selection

Selecting the right stocks is the first crucial step in the SOAP method.

Criteria for Stock Selection

- Volume: High trading volume indicates liquidity.

- Volatility: Stocks with significant price movements offer more trading opportunities.

- Trend: Identify stocks with clear upward or downward trends.

Opportunity Identification

Recognizing potential trading opportunities is essential for success.

Technical Indicators

- Moving Averages: Identify the direction of the trend.

- Relative Strength Index (RSI): Measure momentum and identify overbought or oversold conditions.

- Bollinger Bands: Assess volatility and potential price breakouts.

Analysis

Thorough analysis ensures that you make informed trading decisions.

Fundamental Analysis

- Earnings Reports: Evaluate a company’s profitability.

- News and Events: Stay updated with relevant news that could impact stock prices.

- Financial Ratios: Analyze ratios like P/E, ROI, and debt-to-equity.

Plan Execution

Having a solid execution plan is crucial to capitalize on identified opportunities.

Setting Entry and Exit Points

- Entry Points: Define criteria for when to enter a trade.

- Exit Points: Set rules for when to close a position to secure profits or minimize losses.

Implementing SOAP in Your Trading Routine

Step-by-Step Guide

- Identify Potential Stocks: Use criteria such as volume, volatility, and trend.

- Analyze Using Indicators: Apply technical indicators to assess trading opportunities.

- Perform Fundamental Analysis: Check earnings, news, and financial ratios.

- Set Up Your Trading Plan: Establish entry and exit points.

- Execute the Plan: Follow your strategy with discipline.

Practical Example

A trader uses SOAP to identify a high-volume stock with strong upward momentum. By applying moving averages and RSI, they confirm the trend and enter the trade at a strategic point. Regular monitoring and analysis lead to timely exits, securing profits.

Benefits of Using SOAP

Improved Decision-Making

SOAP provides a structured approach, reducing emotional decision-making and enhancing rational analysis.

Key Advantages

- Consistency: Ensures a systematic approach to trading.

- Confidence: Increases confidence in trading decisions.

- Risk Management: Incorporates risk management techniques to protect capital.

Enhanced Trading Performance

By following SOAP, traders can potentially improve their trading performance and achieve more consistent results.

Performance Metrics

- Win Rate: Track the percentage of successful trades.

- Average Return: Measure the average return per trade.

- Drawdown: Monitor the maximum loss from peak to trough.

Common Pitfalls to Avoid

Overtrading

Trading too frequently can lead to increased costs and potential losses.

How to Avoid Overtrading

- Stick to the Plan: Only trade when criteria are met.

- Set Limits: Limit the number of trades per day or week.

Ignoring Risk Management

Neglecting risk management can result in significant financial losses.

Implement Risk Management Strategies

- Use Stop-Loss Orders: Set automatic exit points to limit losses.

- Diversify: Spread risk by trading multiple instruments.

Emotional Trading

Allowing emotions to drive trading decisions can be detrimental.

Stay Disciplined

- Follow the Strategy: Adhere to your trading plan.

- Take Breaks: Step away from the screen to maintain a clear mindset.

Advanced Strategies in SOAP

Swing Trading

Swing trading involves holding positions for several days to capture short- to medium-term gains.

Swing Trading Techniques

- Identify Swings: Use technical indicators to pinpoint swing points.

- Enter and Exit: Strategically enter at the beginning of a swing and exit at the end.

Scalping

Scalping is a high-frequency trading strategy aimed at making small profits from numerous trades.

Scalping Techniques

- Quick Entries and Exits: Use SOAP to time entries and exits precisely.

- High Volume: Focus on high-volume trades to ensure liquidity.

Conclusion

David Elliott’s “SOAP. Served On A Platter CD” offers a comprehensive framework for identifying and capitalizing on trading opportunities. By integrating stock selection, opportunity identification, thorough analysis, and disciplined execution, traders can enhance their decision-making and trading performance. Implementing SOAP in your trading routine can lead to more consistent and profitable outcomes.

FAQs

1. What is SOAP in trading?

SOAP stands for Stock Opportunity Analysis Plan, a structured approach to identifying and capitalizing on trading opportunities.

2. How does SOAP improve trading decisions?

SOAP provides a clear framework for analysis and decision-making, reducing emotional biases and enhancing rational decisions.

3. What are the key components of SOAP?

The key components include stock selection, opportunity identification, analysis, and plan execution.

4. How can I avoid overtrading?

Avoid overtrading by sticking to your trading plan, setting limits, and trading only when criteria are met.

5. What advanced strategies can be implemented with SOAP?

Advanced strategies include swing trading and scalping, which use SOAP for precise entries and exits.

Be the first to review “SOAP. Served On A Platter CD with David Elliott” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.