-

×

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Black Edge FX – Professional Forex Trader

1 × $31.00

Black Edge FX – Professional Forex Trader

1 × $31.00 -

×

ART Trading - Fine Tuning Your Money Management Skills & Controlling Your Trade Risk

1 × $15.00

ART Trading - Fine Tuning Your Money Management Skills & Controlling Your Trade Risk

1 × $15.00 -

×

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00 -

×

The Spiral Calendar and Its Effect on Financial Markets and Human Events with Christopher Carolan

1 × $6.00

The Spiral Calendar and Its Effect on Financial Markets and Human Events with Christopher Carolan

1 × $6.00 -

×

Forex Trading Make Your First Trader Today with Corey Halliday

1 × $6.00

Forex Trading Make Your First Trader Today with Corey Halliday

1 × $6.00 -

×

Whats In Your Name – The Science of Letters and Numbers (1916)

1 × $6.00

Whats In Your Name – The Science of Letters and Numbers (1916)

1 × $6.00 -

×

CalendarMAX with Hari Swaminathan

1 × $15.00

CalendarMAX with Hari Swaminathan

1 × $15.00 -

×

Advanced Price Action Course with Chris Capre

1 × $7.00

Advanced Price Action Course with Chris Capre

1 × $7.00 -

×

Trends & Trendlines with Albert Yang

1 × $4.00

Trends & Trendlines with Albert Yang

1 × $4.00 -

×

Betfair Scalper Trading Course

1 × $15.00

Betfair Scalper Trading Course

1 × $15.00 -

×

The Complete Foundation Stock Trading Course

1 × $62.00

The Complete Foundation Stock Trading Course

1 × $62.00 -

×

FX Accelerator

1 × $31.00

FX Accelerator

1 × $31.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Insider’s Guide To Forex Trading Howard Gilmore

1 × $6.00

Insider’s Guide To Forex Trading Howard Gilmore

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00 -

×

The Banks Code with Smart Money Trader

1 × $34.00

The Banks Code with Smart Money Trader

1 × $34.00 -

×

TopTradeTools - Trend Breakout Levels

1 × $15.00

TopTradeTools - Trend Breakout Levels

1 × $15.00 -

×

Harmonic Patterns for ThinkorSwim Bat, Butterfly, Crab, and Gartley

1 × $6.00

Harmonic Patterns for ThinkorSwim Bat, Butterfly, Crab, and Gartley

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Credit Risk from Transaction to Portfolio Management with Andrew Kimber

1 × $6.00

Credit Risk from Transaction to Portfolio Management with Andrew Kimber

1 × $6.00 -

×

Forex & Fibonacci Day Trading Seminar - $695

1 × $6.00

Forex & Fibonacci Day Trading Seminar - $695

1 × $6.00 -

×

Management Consultancy & Banking in a Era of Globalization

1 × $6.00

Management Consultancy & Banking in a Era of Globalization

1 × $6.00 -

×

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00 -

×

Ichimokutrade - Fibonacci 101

1 × $15.00

Ichimokutrade - Fibonacci 101

1 × $15.00 -

×

Basecamptrading - Ichimoku Value Cloud Strategy

1 × $23.00

Basecamptrading - Ichimoku Value Cloud Strategy

1 × $23.00 -

×

Options Masterclass with WallStreet Trapper

1 × $13.00

Options Masterclass with WallStreet Trapper

1 × $13.00 -

×

Start Trading Stocks Using Technical Analysis with Corey Halliday

1 × $6.00

Start Trading Stocks Using Technical Analysis with Corey Halliday

1 × $6.00 -

×

The Haller Theory of Stock Market Trends

1 × $6.00

The Haller Theory of Stock Market Trends

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Essential Technical Analysis with Leigh Stevens

1 × $6.00

Essential Technical Analysis with Leigh Stevens

1 × $6.00 -

×

Options Mastery 32 DVDs

1 × $6.00

Options Mastery 32 DVDs

1 × $6.00 -

×

Iron Condor - Advanced

1 × $31.00

Iron Condor - Advanced

1 × $31.00 -

×

Anton Kreil - Professional Options Trading Masterclass

1 × $23.00

Anton Kreil - Professional Options Trading Masterclass

1 × $23.00 -

×

Technical Analysis Applications in the Global Currency Markets (2nd Ed.) with Cornelius Luca

1 × $6.00

Technical Analysis Applications in the Global Currency Markets (2nd Ed.) with Cornelius Luca

1 × $6.00 -

×

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00 -

×

Learning Track: Quantitative Approach in Options Trading

1 × $39.00

Learning Track: Quantitative Approach in Options Trading

1 × $39.00 -

×

TradeGuider VSA Plugin for MetaTrader 4

1 × $6.00

TradeGuider VSA Plugin for MetaTrader 4

1 × $6.00 -

×

Using Fundamental Analysis with Andrew Baxter

1 × $6.00

Using Fundamental Analysis with Andrew Baxter

1 × $6.00 -

×

Zap Seminar - David Stendahl – Day Trading the E-Minis

1 × $6.00

Zap Seminar - David Stendahl – Day Trading the E-Minis

1 × $6.00 -

×

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00 -

×

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00 -

×

Elite Mentorship Home Study - 3T Live with Sami Abusaad

1 × $5.00

Elite Mentorship Home Study - 3T Live with Sami Abusaad

1 × $5.00 -

×

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00 -

×

Momentum Explained. Vol.1

1 × $6.00

Momentum Explained. Vol.1

1 × $6.00 -

×

Wave Trading

1 × $23.00

Wave Trading

1 × $23.00 -

×

ICinDER V2 Cycle Analysis and TrendGuide Pack and Bloodhound Ultimate (May 2015)

1 × $31.00

ICinDER V2 Cycle Analysis and TrendGuide Pack and Bloodhound Ultimate (May 2015)

1 × $31.00 -

×

Trading Pivot Points with Andrew Peters

1 × $6.00

Trading Pivot Points with Andrew Peters

1 × $6.00 -

×

The Alvarez Factor

1 × $23.00

The Alvarez Factor

1 × $23.00 -

×

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

NYC REPLAYS 2018

1 × $6.00

NYC REPLAYS 2018

1 × $6.00 -

×

Classic Trading Tactics Theory and Practice with Linda Raschke

1 × $13.00

Classic Trading Tactics Theory and Practice with Linda Raschke

1 × $13.00 -

×

Butterflies For Monthly Income 2016 with Dan Sheridan

1 × $15.00

Butterflies For Monthly Income 2016 with Dan Sheridan

1 × $15.00 -

×

Volatility Trading with Fractal Flow Pro

1 × $15.00

Volatility Trading with Fractal Flow Pro

1 × $15.00 -

×

The Winning Watch-List with Ryan Mallory

1 × $31.00

The Winning Watch-List with Ryan Mallory

1 × $31.00 -

×

Austin Passamonte Package ( Discount 25 % )

1 × $15.00

Austin Passamonte Package ( Discount 25 % )

1 × $15.00 -

×

The Works (Full Educational Course) with Waves 618

1 × $39.00

The Works (Full Educational Course) with Waves 618

1 × $39.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Broker Robbery University Course with Billi Richy FX

1 × $5.00

Broker Robbery University Course with Billi Richy FX

1 × $5.00 -

×

Dan Sheridan 2011 Calendar Workshop

1 × $6.00

Dan Sheridan 2011 Calendar Workshop

1 × $6.00 -

×

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00 -

×

Module III - Peak Formation Trades with FX MindShift

1 × $6.00

Module III - Peak Formation Trades with FX MindShift

1 × $6.00 -

×

The Ultimate Systems Trader (UST) Advanced - Trading with Rayner

1 × $62.00

The Ultimate Systems Trader (UST) Advanced - Trading with Rayner

1 × $62.00 -

×

FX Prosperity Academy with Leonard Williams Jr

1 × $5.00

FX Prosperity Academy with Leonard Williams Jr

1 × $5.00 -

×

Atlas Edition Course with Apex Paragon Trading

1 × $6.00

Atlas Edition Course with Apex Paragon Trading

1 × $6.00 -

×

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00 -

×

B The Trader Trading Course

1 × $15.00

B The Trader Trading Course

1 × $15.00 -

×

Introduction To The STRAT Course with Rob Smith

1 × $8.00

Introduction To The STRAT Course with Rob Smith

1 × $8.00 -

×

Big Fish Trading Strategy with Dave Aquino

1 × $6.00

Big Fish Trading Strategy with Dave Aquino

1 × $6.00

SOAP. Served On A Platter CD with David Elliott

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

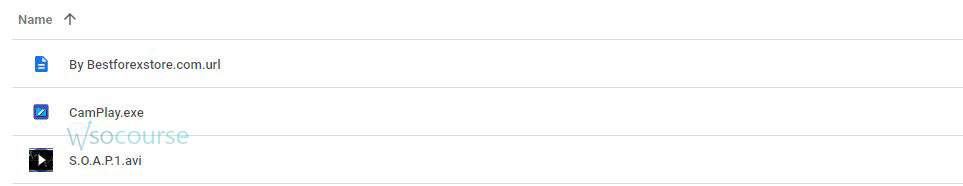

Content Proof: Watch Here!

You may check content proof of “ SOAP. Served On A Platter CD with David Elliott” below:

SOAP. Served On A Platter CD with David Elliott

Introduction

In the complex world of trading, understanding and mastering reliable strategies is crucial. David Elliott’s “SOAP. Served On A Platter CD” provides traders with actionable insights and techniques to enhance their trading performance. This article explores Elliott’s unique approach, offering a comprehensive guide to implementing his strategies effectively.

Understanding SOAP: An Overview

What is SOAP?

SOAP stands for Stock Opportunity Analysis Plan. It’s a systematic approach designed to identify and capitalize on trading opportunities.

Why SOAP?

- Clarity: Simplifies the decision-making process.

- Structure: Provides a clear framework for analysis.

- Effectiveness: Enhances the probability of successful trades.

Components of SOAP

Stock Selection

Selecting the right stocks is the first crucial step in the SOAP method.

Criteria for Stock Selection

- Volume: High trading volume indicates liquidity.

- Volatility: Stocks with significant price movements offer more trading opportunities.

- Trend: Identify stocks with clear upward or downward trends.

Opportunity Identification

Recognizing potential trading opportunities is essential for success.

Technical Indicators

- Moving Averages: Identify the direction of the trend.

- Relative Strength Index (RSI): Measure momentum and identify overbought or oversold conditions.

- Bollinger Bands: Assess volatility and potential price breakouts.

Analysis

Thorough analysis ensures that you make informed trading decisions.

Fundamental Analysis

- Earnings Reports: Evaluate a company’s profitability.

- News and Events: Stay updated with relevant news that could impact stock prices.

- Financial Ratios: Analyze ratios like P/E, ROI, and debt-to-equity.

Plan Execution

Having a solid execution plan is crucial to capitalize on identified opportunities.

Setting Entry and Exit Points

- Entry Points: Define criteria for when to enter a trade.

- Exit Points: Set rules for when to close a position to secure profits or minimize losses.

Implementing SOAP in Your Trading Routine

Step-by-Step Guide

- Identify Potential Stocks: Use criteria such as volume, volatility, and trend.

- Analyze Using Indicators: Apply technical indicators to assess trading opportunities.

- Perform Fundamental Analysis: Check earnings, news, and financial ratios.

- Set Up Your Trading Plan: Establish entry and exit points.

- Execute the Plan: Follow your strategy with discipline.

Practical Example

A trader uses SOAP to identify a high-volume stock with strong upward momentum. By applying moving averages and RSI, they confirm the trend and enter the trade at a strategic point. Regular monitoring and analysis lead to timely exits, securing profits.

Benefits of Using SOAP

Improved Decision-Making

SOAP provides a structured approach, reducing emotional decision-making and enhancing rational analysis.

Key Advantages

- Consistency: Ensures a systematic approach to trading.

- Confidence: Increases confidence in trading decisions.

- Risk Management: Incorporates risk management techniques to protect capital.

Enhanced Trading Performance

By following SOAP, traders can potentially improve their trading performance and achieve more consistent results.

Performance Metrics

- Win Rate: Track the percentage of successful trades.

- Average Return: Measure the average return per trade.

- Drawdown: Monitor the maximum loss from peak to trough.

Common Pitfalls to Avoid

Overtrading

Trading too frequently can lead to increased costs and potential losses.

How to Avoid Overtrading

- Stick to the Plan: Only trade when criteria are met.

- Set Limits: Limit the number of trades per day or week.

Ignoring Risk Management

Neglecting risk management can result in significant financial losses.

Implement Risk Management Strategies

- Use Stop-Loss Orders: Set automatic exit points to limit losses.

- Diversify: Spread risk by trading multiple instruments.

Emotional Trading

Allowing emotions to drive trading decisions can be detrimental.

Stay Disciplined

- Follow the Strategy: Adhere to your trading plan.

- Take Breaks: Step away from the screen to maintain a clear mindset.

Advanced Strategies in SOAP

Swing Trading

Swing trading involves holding positions for several days to capture short- to medium-term gains.

Swing Trading Techniques

- Identify Swings: Use technical indicators to pinpoint swing points.

- Enter and Exit: Strategically enter at the beginning of a swing and exit at the end.

Scalping

Scalping is a high-frequency trading strategy aimed at making small profits from numerous trades.

Scalping Techniques

- Quick Entries and Exits: Use SOAP to time entries and exits precisely.

- High Volume: Focus on high-volume trades to ensure liquidity.

Conclusion

David Elliott’s “SOAP. Served On A Platter CD” offers a comprehensive framework for identifying and capitalizing on trading opportunities. By integrating stock selection, opportunity identification, thorough analysis, and disciplined execution, traders can enhance their decision-making and trading performance. Implementing SOAP in your trading routine can lead to more consistent and profitable outcomes.

FAQs

1. What is SOAP in trading?

SOAP stands for Stock Opportunity Analysis Plan, a structured approach to identifying and capitalizing on trading opportunities.

2. How does SOAP improve trading decisions?

SOAP provides a clear framework for analysis and decision-making, reducing emotional biases and enhancing rational decisions.

3. What are the key components of SOAP?

The key components include stock selection, opportunity identification, analysis, and plan execution.

4. How can I avoid overtrading?

Avoid overtrading by sticking to your trading plan, setting limits, and trading only when criteria are met.

5. What advanced strategies can be implemented with SOAP?

Advanced strategies include swing trading and scalping, which use SOAP for precise entries and exits.

Be the first to review “SOAP. Served On A Platter CD with David Elliott” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Reviews

There are no reviews yet.