-

×

Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett

1 × $6.00

Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett

1 × $6.00 -

×

Fish Forex Robot 4G

1 × $6.00

Fish Forex Robot 4G

1 × $6.00 -

×

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00 -

×

Option Profits Success System

1 × $54.00

Option Profits Success System

1 × $54.00 -

×

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00 -

×

One Shot One Kill Trading with John Netto

1 × $6.00

One Shot One Kill Trading with John Netto

1 × $6.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00 -

×

Advanced Trading System 2020

1 × $179.00

Advanced Trading System 2020

1 × $179.00 -

×

The Stock Market, Credit & Capital Formation with Fritz Machlup

1 × $6.00

The Stock Market, Credit & Capital Formation with Fritz Machlup

1 × $6.00 -

×

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00 -

×

B.O.S.S. Carbon with Pat Mitchell – Trick Trades

1 × $8.00

B.O.S.S. Carbon with Pat Mitchell – Trick Trades

1 × $8.00 -

×

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00 -

×

FOREX GENERATION MASTER COURSE

1 × $6.00

FOREX GENERATION MASTER COURSE

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Pristine Seminar - Guerrilla Trading Tactics with Oliver Velez

1 × $6.00

Pristine Seminar - Guerrilla Trading Tactics with Oliver Velez

1 × $6.00 -

×

Winning With The Market with Douglas R.Sease

1 × $6.00

Winning With The Market with Douglas R.Sease

1 × $6.00 -

×

Intra-day Solar Trader with George Harrison

1 × $17.00

Intra-day Solar Trader with George Harrison

1 × $17.00 -

×

Commodities and Commodity Derivatives: Modeling and Pricing for Agriculturals, Metals and Energy - Helyette Geman

1 × $6.00

Commodities and Commodity Derivatives: Modeling and Pricing for Agriculturals, Metals and Energy - Helyette Geman

1 × $6.00 -

×

Weekly Options Windfall and Bonus with James Preston

1 × $54.00

Weekly Options Windfall and Bonus with James Preston

1 × $54.00 -

×

Mastermind Bootcamp + Core Concepts Mastery with DreamsFX

1 × $6.00

Mastermind Bootcamp + Core Concepts Mastery with DreamsFX

1 × $6.00 -

×

Newsbeat Master Class Recording

1 × $39.00

Newsbeat Master Class Recording

1 × $39.00 -

×

Amazing Day Trading Ninjatrader Indicator Perfect For Stocks, Futures And Forex

1 × $15.00

Amazing Day Trading Ninjatrader Indicator Perfect For Stocks, Futures And Forex

1 × $15.00 -

×

The Holy Grail Forex Strategy - 7 Setups To Conquer The Kingdom with Justin Whitebread-Lanaro - 1 Minute Master

1 × $15.00

The Holy Grail Forex Strategy - 7 Setups To Conquer The Kingdom with Justin Whitebread-Lanaro - 1 Minute Master

1 × $15.00 -

×

Deflaction with A.Gary Shilling

1 × $6.00

Deflaction with A.Gary Shilling

1 × $6.00 -

×

Currency Trading and Intermarket Analysis

1 × $6.00

Currency Trading and Intermarket Analysis

1 × $6.00 -

×

Price Action Prophet

1 × $54.00

Price Action Prophet

1 × $54.00 -

×

Mastering the Orderbook with Rowan Crawford

1 × $6.00

Mastering the Orderbook with Rowan Crawford

1 × $6.00 -

×

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00 -

×

Forex Options Trading

1 × $6.00

Forex Options Trading

1 × $6.00 -

×

Capital Flows and Crises with Barry Eichengreen

1 × $6.00

Capital Flows and Crises with Barry Eichengreen

1 × $6.00 -

×

7 Days Options Masters Course with John Carter

1 × $54.00

7 Days Options Masters Course with John Carter

1 × $54.00 -

×

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00 -

×

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00

Volatile Markets Made Easy: Trading Stocks and Options for Increased Profits with Guy Cohen

1 × $6.00 -

×

Chart Reading Course with TraderSumo

1 × $5.00

Chart Reading Course with TraderSumo

1 × $5.00 -

×

Catching the Big Moves with Jack Bernstein

1 × $6.00

Catching the Big Moves with Jack Bernstein

1 × $6.00 -

×

ePass Platinum

1 × $31.00

ePass Platinum

1 × $31.00 -

×

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00 -

×

Becoming a Disciplined Trader: Techniques for Achieving Peak Trading Performance with Ari Kiev

1 × $6.00

Becoming a Disciplined Trader: Techniques for Achieving Peak Trading Performance with Ari Kiev

1 × $6.00 -

×

Trading Order Power Strategies

1 × $6.00

Trading Order Power Strategies

1 × $6.00 -

×

Spike 35 Traders Manual with J.D.Hamon

1 × $6.00

Spike 35 Traders Manual with J.D.Hamon

1 × $6.00 -

×

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00 -

×

Self-Managed Trading with Stochastics By George Lane

1 × $4.00

Self-Managed Trading with Stochastics By George Lane

1 × $4.00 -

×

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

1 × $6.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

1 × $6.00 -

×

Activedaytrader - 3 Important Ways to Manage Your Options Position

1 × $15.00

Activedaytrader - 3 Important Ways to Manage Your Options Position

1 × $15.00 -

×

Trading MasterMind Course

1 × $23.00

Trading MasterMind Course

1 × $23.00 -

×

Confessions of a Pit Trader 2003 with Rick Burgess

1 × $6.00

Confessions of a Pit Trader 2003 with Rick Burgess

1 × $6.00 -

×

How You Can Identify Turning Points Using Fibonacci

1 × $6.00

How You Can Identify Turning Points Using Fibonacci

1 × $6.00 -

×

Using Robert’s Indicators with Rob Hoffman

1 × $6.00

Using Robert’s Indicators with Rob Hoffman

1 × $6.00 -

×

ZR Trading Complete Program (Arabic + French)

1 × $10.00

ZR Trading Complete Program (Arabic + French)

1 × $10.00 -

×

The EAP Training Program (Apr 2019)

1 × $6.00

The EAP Training Program (Apr 2019)

1 × $6.00 -

×

Getting Started in Options with Michael Thomsett

1 × $6.00

Getting Started in Options with Michael Thomsett

1 × $6.00 -

×

Classic Indicators Back to the Future with Linda Raschke

1 × $4.00

Classic Indicators Back to the Future with Linda Raschke

1 × $4.00 -

×

Options University - 3rd Anual Forex Superconference

1 × $3.00

Options University - 3rd Anual Forex Superconference

1 × $3.00 -

×

Stock Trading Simplified - 3 DVD + PDF Workbook with John Person

1 × $6.00

Stock Trading Simplified - 3 DVD + PDF Workbook with John Person

1 × $6.00 -

×

FX Capital Online

1 × $5.00

FX Capital Online

1 × $5.00 -

×

Greatest Trading Tools with Michael Parsons

1 × $6.00

Greatest Trading Tools with Michael Parsons

1 × $6.00 -

×

Online Course - Why Wave Analysis Belongs in Every Trader's Toolbox with Jeffrey Kennedy - Elliott Wave

1 × $15.00

Online Course - Why Wave Analysis Belongs in Every Trader's Toolbox with Jeffrey Kennedy - Elliott Wave

1 × $15.00 -

×

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00 -

×

Technical & Fundamental Courses with Diamant Capital

1 × $5.00

Technical & Fundamental Courses with Diamant Capital

1 × $5.00 -

×

Patterns of Speculation with Bertrand M.Roehner

1 × $6.00

Patterns of Speculation with Bertrand M.Roehner

1 × $6.00 -

×

Inside the Minds Leading Wall Street Investors with Aspatore Books

1 × $6.00

Inside the Minds Leading Wall Street Investors with Aspatore Books

1 × $6.00 -

×

Bitcoin Mastery: The Ultimate Program To A 6 Figure Cryptocurrency Income with Ryan Hildreth

1 × $23.00

Bitcoin Mastery: The Ultimate Program To A 6 Figure Cryptocurrency Income with Ryan Hildreth

1 × $23.00 -

×

The Future of Technology with Tom Standage

1 × $4.00

The Future of Technology with Tom Standage

1 × $4.00 -

×

Zap Seminar - David Stendahl – Day Trading the E-Minis

1 × $6.00

Zap Seminar - David Stendahl – Day Trading the E-Minis

1 × $6.00 -

×

Gann Masters II with Hallikers Inc

1 × $6.00

Gann Masters II with Hallikers Inc

1 × $6.00 -

×

Cycles: What they are, what they mean, how to profit by them - Dick Stoken

1 × $6.00

Cycles: What they are, what they mean, how to profit by them - Dick Stoken

1 × $6.00 -

×

Professional Trader Course

1 × $5.00

Professional Trader Course

1 × $5.00 -

×

Forex Nitty Gritty Course with Bill & Greg Poulos

1 × $6.00

Forex Nitty Gritty Course with Bill & Greg Poulos

1 × $6.00 -

×

Marder Videos Reports 2019 with Kevin Marder

1 × $34.00

Marder Videos Reports 2019 with Kevin Marder

1 × $34.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

SOAP. Served On A Platter CD with David Elliott

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

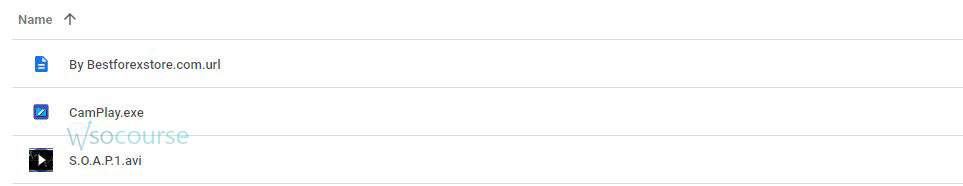

Content Proof: Watch Here!

You may check content proof of “ SOAP. Served On A Platter CD with David Elliott” below:

SOAP. Served On A Platter CD with David Elliott

Introduction

In the complex world of trading, understanding and mastering reliable strategies is crucial. David Elliott’s “SOAP. Served On A Platter CD” provides traders with actionable insights and techniques to enhance their trading performance. This article explores Elliott’s unique approach, offering a comprehensive guide to implementing his strategies effectively.

Understanding SOAP: An Overview

What is SOAP?

SOAP stands for Stock Opportunity Analysis Plan. It’s a systematic approach designed to identify and capitalize on trading opportunities.

Why SOAP?

- Clarity: Simplifies the decision-making process.

- Structure: Provides a clear framework for analysis.

- Effectiveness: Enhances the probability of successful trades.

Components of SOAP

Stock Selection

Selecting the right stocks is the first crucial step in the SOAP method.

Criteria for Stock Selection

- Volume: High trading volume indicates liquidity.

- Volatility: Stocks with significant price movements offer more trading opportunities.

- Trend: Identify stocks with clear upward or downward trends.

Opportunity Identification

Recognizing potential trading opportunities is essential for success.

Technical Indicators

- Moving Averages: Identify the direction of the trend.

- Relative Strength Index (RSI): Measure momentum and identify overbought or oversold conditions.

- Bollinger Bands: Assess volatility and potential price breakouts.

Analysis

Thorough analysis ensures that you make informed trading decisions.

Fundamental Analysis

- Earnings Reports: Evaluate a company’s profitability.

- News and Events: Stay updated with relevant news that could impact stock prices.

- Financial Ratios: Analyze ratios like P/E, ROI, and debt-to-equity.

Plan Execution

Having a solid execution plan is crucial to capitalize on identified opportunities.

Setting Entry and Exit Points

- Entry Points: Define criteria for when to enter a trade.

- Exit Points: Set rules for when to close a position to secure profits or minimize losses.

Implementing SOAP in Your Trading Routine

Step-by-Step Guide

- Identify Potential Stocks: Use criteria such as volume, volatility, and trend.

- Analyze Using Indicators: Apply technical indicators to assess trading opportunities.

- Perform Fundamental Analysis: Check earnings, news, and financial ratios.

- Set Up Your Trading Plan: Establish entry and exit points.

- Execute the Plan: Follow your strategy with discipline.

Practical Example

A trader uses SOAP to identify a high-volume stock with strong upward momentum. By applying moving averages and RSI, they confirm the trend and enter the trade at a strategic point. Regular monitoring and analysis lead to timely exits, securing profits.

Benefits of Using SOAP

Improved Decision-Making

SOAP provides a structured approach, reducing emotional decision-making and enhancing rational analysis.

Key Advantages

- Consistency: Ensures a systematic approach to trading.

- Confidence: Increases confidence in trading decisions.

- Risk Management: Incorporates risk management techniques to protect capital.

Enhanced Trading Performance

By following SOAP, traders can potentially improve their trading performance and achieve more consistent results.

Performance Metrics

- Win Rate: Track the percentage of successful trades.

- Average Return: Measure the average return per trade.

- Drawdown: Monitor the maximum loss from peak to trough.

Common Pitfalls to Avoid

Overtrading

Trading too frequently can lead to increased costs and potential losses.

How to Avoid Overtrading

- Stick to the Plan: Only trade when criteria are met.

- Set Limits: Limit the number of trades per day or week.

Ignoring Risk Management

Neglecting risk management can result in significant financial losses.

Implement Risk Management Strategies

- Use Stop-Loss Orders: Set automatic exit points to limit losses.

- Diversify: Spread risk by trading multiple instruments.

Emotional Trading

Allowing emotions to drive trading decisions can be detrimental.

Stay Disciplined

- Follow the Strategy: Adhere to your trading plan.

- Take Breaks: Step away from the screen to maintain a clear mindset.

Advanced Strategies in SOAP

Swing Trading

Swing trading involves holding positions for several days to capture short- to medium-term gains.

Swing Trading Techniques

- Identify Swings: Use technical indicators to pinpoint swing points.

- Enter and Exit: Strategically enter at the beginning of a swing and exit at the end.

Scalping

Scalping is a high-frequency trading strategy aimed at making small profits from numerous trades.

Scalping Techniques

- Quick Entries and Exits: Use SOAP to time entries and exits precisely.

- High Volume: Focus on high-volume trades to ensure liquidity.

Conclusion

David Elliott’s “SOAP. Served On A Platter CD” offers a comprehensive framework for identifying and capitalizing on trading opportunities. By integrating stock selection, opportunity identification, thorough analysis, and disciplined execution, traders can enhance their decision-making and trading performance. Implementing SOAP in your trading routine can lead to more consistent and profitable outcomes.

FAQs

1. What is SOAP in trading?

SOAP stands for Stock Opportunity Analysis Plan, a structured approach to identifying and capitalizing on trading opportunities.

2. How does SOAP improve trading decisions?

SOAP provides a clear framework for analysis and decision-making, reducing emotional biases and enhancing rational decisions.

3. What are the key components of SOAP?

The key components include stock selection, opportunity identification, analysis, and plan execution.

4. How can I avoid overtrading?

Avoid overtrading by sticking to your trading plan, setting limits, and trading only when criteria are met.

5. What advanced strategies can be implemented with SOAP?

Advanced strategies include swing trading and scalping, which use SOAP for precise entries and exits.

Be the first to review “SOAP. Served On A Platter CD with David Elliott” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.