-

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The Complete FTMO Challenge Course with Petko Aleksandrov - EA Trading Academy

1 × $5.00

The Complete FTMO Challenge Course with Petko Aleksandrov - EA Trading Academy

1 × $5.00 -

×

Tutorials in Applied Technical Analysis with Daryl Guppy

1 × $4.00

Tutorials in Applied Technical Analysis with Daryl Guppy

1 × $4.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

NQ Full Order Flow Course with Scott Pulcini Trader

1 × $8.00

NQ Full Order Flow Course with Scott Pulcini Trader

1 × $8.00 -

×

Trading Framework with Retail Capital

1 × $24.00

Trading Framework with Retail Capital

1 × $24.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00 -

×

The Forex Legacy

1 × $6.00

The Forex Legacy

1 × $6.00 -

×

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Ultimate Breakout

1 × $54.00

Ultimate Breakout

1 × $54.00 -

×

Insider Signal Exclusive Forex Course with Andy X

1 × $7.00

Insider Signal Exclusive Forex Course with Andy X

1 × $7.00 -

×

Tunnel Through the Air (1994 Conference of Astro-Timing Techniques) with Bonnie Lee Hill

1 × $4.00

Tunnel Through the Air (1994 Conference of Astro-Timing Techniques) with Bonnie Lee Hill

1 × $4.00 -

×

The Conscious Investor: Profiting from the Timeless Value Approach with John Price

1 × $6.00

The Conscious Investor: Profiting from the Timeless Value Approach with John Price

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Forex Trading Course: A Self-Study Guide To Becoming a Successful Currency Trader with Abe Cofnas

1 × $6.00

The Forex Trading Course: A Self-Study Guide To Becoming a Successful Currency Trader with Abe Cofnas

1 × $6.00 -

×

Trading Pro System

1 × $31.00

Trading Pro System

1 × $31.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Stock Investing Course For Beginners with Matt Dodge

1 × $5.00

The Stock Investing Course For Beginners with Matt Dodge

1 × $5.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Credit Spread Plan to Generate 5% Weekly

1 × $31.00

Credit Spread Plan to Generate 5% Weekly

1 × $31.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Secret to Extraordinary Wealth in the Options Market - 4 DVDs

1 × $31.00

The Secret to Extraordinary Wealth in the Options Market - 4 DVDs

1 × $31.00 -

×

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00 -

×

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00 -

×

Trampoline Trading with Claytrader

1 × $6.00

Trampoline Trading with Claytrader

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

BETT Strategy (Breakout Entry Two Target Strategy)

1 × $62.00

BETT Strategy (Breakout Entry Two Target Strategy)

1 × $62.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Ultimate Professional Trader Plus CD Library

1 × $31.00

The Ultimate Professional Trader Plus CD Library

1 × $31.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Porsche Dots For NinjaTrader

1 × $31.00

Porsche Dots For NinjaTrader

1 × $31.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

The 4 Horsemen CD with David Elliott

$6.00

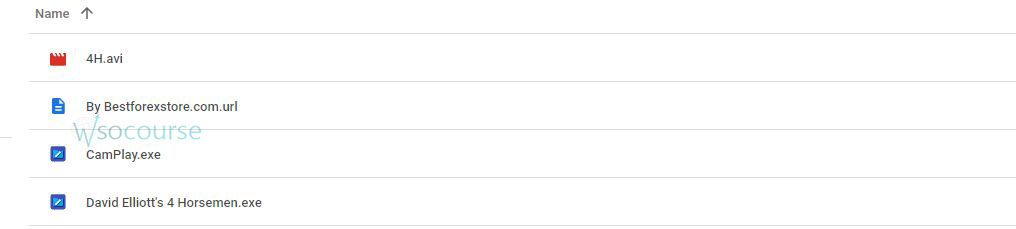

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “ The 4 Horsemen CD with David Elliott” below:

The 4 Horsemen CD with David Elliott

Introduction

David Elliott’s “The 4 Horsemen CD” is a profound exploration of market cycles and trading strategies. In this article, we will delve into the key concepts and insights offered by Elliott, providing you with a comprehensive understanding of his approach to trading and market analysis.

Understanding The 4 Horsemen Concept

The 4 Horsemen is a metaphor used by Elliott to describe four critical market indicators that, when combined, can predict market movements with remarkable accuracy.

What are The 4 Horsemen?

- Market Breadth: Measures the number of stocks advancing versus declining.

- Volume: Analyzes trading volume to confirm price movements.

- Momentum: Tracks the speed of price changes.

- Volatility: Assesses market volatility to gauge investor sentiment.

Market Breadth

Market breadth is an indicator of overall market strength, showing the proportion of stocks that are moving higher versus those that are declining.

Volume

Volume is a crucial indicator as it confirms the strength of price movements. High volume on a price increase suggests strong buying interest, while low volume on a price increase might indicate a weak move.

The Importance of Combining Indicators

Elliott emphasizes the importance of not relying on a single indicator but rather combining them to get a clearer picture of market conditions.

Why Combine Indicators?

- Accuracy: Increases the reliability of predictions.

- Confirmation: Ensures that signals are supported by multiple sources.

- Comprehensive View: Provides a holistic view of the market.

Case Study: Using The 4 Horsemen

A trader combines market breadth, volume, momentum, and volatility indicators to make informed trading decisions. This multi-indicator approach leads to more accurate predictions and better trading outcomes.

David Elliott’s Approach to Trading

Elliott’s trading strategy is built on a foundation of thorough market analysis, disciplined execution, and continuous learning.

Market Analysis

Analyzing the market involves understanding the underlying trends and identifying potential turning points.

Technical Analysis Tools

- Moving Averages: Help identify trends and potential reversal points.

- Relative Strength Index (RSI): Measures momentum and identifies overbought or oversold conditions.

- Bollinger Bands: Assess volatility and potential price breakouts.

Disciplined Execution

Following a trading plan with discipline is crucial to success.

Components of a Trading Plan

- Entry and Exit Points: Clear criteria for when to enter and exit trades.

- Risk Management: Strategies to protect capital and manage losses.

- Performance Evaluation: Regular assessment of trading performance.

Continuous Learning

The market is always evolving, and so should your trading strategies.

Learning Resources

- Books and Courses: Enhance knowledge and skills.

- Webinars and Workshops: Participate in live sessions for real-time insights.

- Trading Communities: Engage with other traders to share ideas and strategies.

Practical Applications of The 4 Horsemen

Using The 4 Horsemen in your trading can provide significant advantages.

Identifying Trends

Combine indicators to identify strong trends and potential reversals.

Trend Analysis

- Uptrend: High market breadth, strong volume, positive momentum, and low volatility.

- Downtrend: Low market breadth, weak volume, negative momentum, and high volatility.

Making Informed Decisions

Informed decisions are based on comprehensive market analysis.

Decision-Making Process

- Analyze Indicators: Review market breadth, volume, momentum, and volatility.

- Confirm Signals: Ensure multiple indicators support the trading signal.

- Execute Trades: Enter or exit trades based on confirmed signals.

Managing Risk

Effective risk management protects your trading capital and ensures long-term success.

Risk Management Techniques

- Stop-Loss Orders: Automatically close trades at a predetermined loss level.

- Position Sizing: Adjust trade size based on risk tolerance.

- Diversification: Spread risk by trading multiple instruments.

Advanced Trading Strategies

Elliott’s methods also include advanced strategies for experienced traders.

Swing Trading

Swing trading involves holding positions for several days to capture short- to medium-term gains.

Swing Trading Techniques

- Identify Swings: Use The 4 Horsemen to identify potential swing points.

- Enter and Exit: Enter trades at the beginning of a swing and exit at the end.

Scalping

Scalping is a high-frequency trading strategy aimed at making small profits from numerous trades.

Scalping Techniques

- Quick Entries and Exits: Use The 4 Horsemen to time entries and exits precisely.

- High Volume: Focus on high-volume trades to ensure liquidity.

Conclusion

David Elliott’s “The 4 Horsemen CD” provides a comprehensive framework for understanding and predicting market movements. By combining market breadth, volume, momentum, and volatility, traders can gain a clearer and more accurate view of the market. Elliott’s approach emphasizes disciplined execution, continuous learning, and effective risk management, making it a valuable resource for traders of all levels.

FAQs

1. What are The 4 Horsemen in David Elliott’s strategy?

The 4 Horsemen refer to market breadth, volume, momentum, and volatility indicators used to predict market movements.

2. Why is it important to combine multiple indicators in trading?

Combining multiple indicators increases the accuracy of predictions, confirms signals, and provides a comprehensive view of the market.

3. How can The 4 Horsemen help in trend analysis?

The 4 Horsemen help identify strong trends and potential reversals by analyzing market breadth, volume, momentum, and volatility.

4. What are the key components of a trading plan according to David Elliott?

A trading plan should include clear entry and exit points, risk management strategies, and regular performance evaluation.

5. How does David Elliott’s approach to trading emphasize continuous learning?

Elliott’s approach encourages traders to continually enhance their knowledge and adapt to market changes through books, courses, webinars, and community engagement.

Be the first to review “The 4 Horsemen CD with David Elliott” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.