-

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00 -

×

WyseTrade Trading Masterclass Course

1 × $5.00

WyseTrade Trading Masterclass Course

1 × $5.00 -

×

Elite Trend Trader with Frank Bunn

1 × $23.00

Elite Trend Trader with Frank Bunn

1 × $23.00 -

×

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00

Enhancing Technical Analysis with Planetary Price & Price Factors

1 × $6.00 -

×

Inner Circle Trader

1 × $6.00

Inner Circle Trader

1 × $6.00 -

×

No BS Day Trading Basic Course

1 × $6.00

No BS Day Trading Basic Course

1 × $6.00 -

×

Online Course: Forex Trading By Fxtc.co

1 × $5.00

Online Course: Forex Trading By Fxtc.co

1 × $5.00 -

×

Sports Trading Journey with Jack Birkhead

1 × $23.00

Sports Trading Journey with Jack Birkhead

1 × $23.00 -

×

Breakthroughs in Commodity Technical Analysis with J.D.Hamon

1 × $6.00

Breakthroughs in Commodity Technical Analysis with J.D.Hamon

1 × $6.00 -

×

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00

Linda Raschke Short Term Trading Strategies with David Vomund

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Short-Term Trading Course with Mark Boucher

1 × $6.00

Short-Term Trading Course with Mark Boucher

1 × $6.00 -

×

Techical Analysis with Charles D.Kirkpatrick

1 × $6.00

Techical Analysis with Charles D.Kirkpatrick

1 × $6.00 -

×

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00 -

×

The Future of Technology with Tom Standage

1 × $4.00

The Future of Technology with Tom Standage

1 × $4.00 -

×

Trading Blox Builder 4.3.2.1

1 × $31.00

Trading Blox Builder 4.3.2.1

1 × $31.00 -

×

Chart Mastery Course 2024 with Quantum

1 × $24.00

Chart Mastery Course 2024 with Quantum

1 × $24.00 -

×

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00

Options for Long Term Trading & Hedging with Option Pit

1 × $39.00 -

×

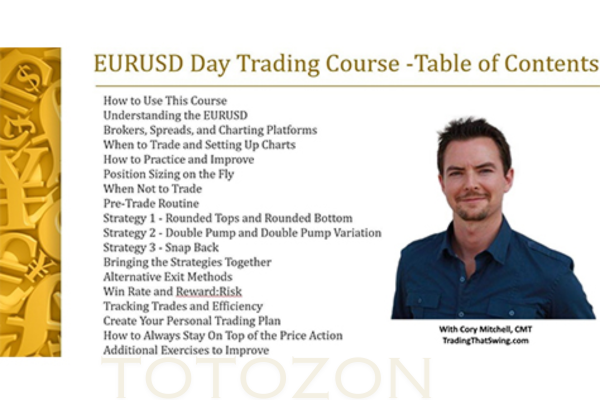

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Beginners Guide to Trading Intraday Futures Class with Doc Severson

1 × $6.00

Beginners Guide to Trading Intraday Futures Class with Doc Severson

1 × $6.00 -

×

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00 -

×

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00 -

×

Tunnel Trading Course (No Software) with Joshua Martinez

1 × $101.00

Tunnel Trading Course (No Software) with Joshua Martinez

1 × $101.00 -

×

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00

BOSSPack Course with Pat Mitchell – Trick Trades

1 × $69.00 -

×

The Trading Avantage with Joseph Duffy

1 × $6.00

The Trading Avantage with Joseph Duffy

1 × $6.00 -

×

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00

C'MON MAN SHEEEIIIITTT PACKAGE with King Khang

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00

Trading High-Momentum Stocks with Landry Persistent Pullbacks

1 × $15.00 -

×

MIC JUMPSTART ACCELERATOR with My Investing Club

1 × $54.00

MIC JUMPSTART ACCELERATOR with My Investing Club

1 × $54.00 -

×

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00

Successful Algorithmic Trading with Mike Halls-Moore

1 × $8.00 -

×

Using the Techniques of Andrews & Babson

1 × $6.00

Using the Techniques of Andrews & Babson

1 × $6.00 -

×

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00 -

×

Bootcamp and eBook with Jjwurldin

1 × $24.00

Bootcamp and eBook with Jjwurldin

1 × $24.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00 -

×

Wolfe Waves

1 × $15.00

Wolfe Waves

1 × $15.00 -

×

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00 -

×

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00 -

×

Strategy Spotlight Series

1 × $15.00

Strategy Spotlight Series

1 × $15.00 -

×

Accumulation & Distribution with Larry Williams

1 × $4.00

Accumulation & Distribution with Larry Williams

1 × $4.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

The Day Trader’s Course with Lewis Borsellino

1 × $6.00

The Day Trader’s Course with Lewis Borsellino

1 × $6.00 -

×

Key to Speculation on the New York Stock Exchange

1 × $6.00

Key to Speculation on the New York Stock Exchange

1 × $6.00 -

×

The Double Thurst Stock Trading System

1 × $15.00

The Double Thurst Stock Trading System

1 × $15.00 -

×

Basic Astrotech

1 × $6.00

Basic Astrotech

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Market Trading Tactics: Beating the Odds Through Technical Analysis and Money Management with Daryl Guppy

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Market Trading Tactics with Daryl Guppy

Introduction

In the competitive world of market trading, mastering technical analysis and money management is crucial. Daryl Guppy, a seasoned trader and author, offers invaluable insights in his book “Market Trading Tactics: Beating the Odds Through Technical Analysis and Money Management.” This article delves into the key concepts and strategies from Guppy’s book, providing a comprehensive guide to improving your trading performance.

Who is Daryl Guppy?

Background and Expertise

Daryl Guppy is an internationally recognized trader and author known for his expertise in technical analysis. With years of experience in trading and financial education, Guppy has developed several innovative trading tools and strategies.

Key Contributions

- Guppy Multiple Moving Averages (GMMA): A unique indicator that helps traders identify market trends.

- Educational Resources: Author of several books and a regular contributor to financial news platforms.

Understanding Market Trading Tactics

What are Market Trading Tactics?

Market trading tactics involve strategies and techniques used to navigate the financial markets successfully. These tactics are designed to help traders make informed decisions, manage risks, and maximize profits.

Importance of Technical Analysis

Technical analysis is the study of past market data, primarily price and volume, to forecast future market behavior. It is a fundamental tool for traders to identify trends, patterns, and potential entry and exit points.

Key Concepts in Guppy’s Book

Technical Analysis

Chart Patterns

Guppy emphasizes the importance of understanding chart patterns to predict market movements.

- Head and Shoulders: Indicates a potential reversal.

- Double Tops and Bottoms: Suggests a trend change.

Technical Indicators

Using technical indicators can provide additional confirmation for trading decisions.

- Moving Averages: Helps smooth out price data to identify trends.

- Relative Strength Index (RSI): Measures market momentum.

Money Management

Risk Management

Effective risk management is crucial for long-term trading success.

- Position Sizing: Adjusting the size of your trades based on risk tolerance.

- Stop-Loss Orders: Setting predefined levels to limit potential losses.

Capital Allocation

Proper allocation of trading capital helps mitigate risks and maximize returns.

- Diversification: Spreading investments across different assets to reduce risk.

- Reinvestment Strategies: Using profits to increase trading capital.

Guppy Multiple Moving Averages (GMMA)

What is GMMA?

The GMMA consists of two sets of moving averages: short-term and long-term. This indicator helps traders identify the strength and direction of a trend.

How to Use GMMA

Identifying Trends

- Bullish Trend: When short-term averages are above long-term averages.

- Bearish Trend: When short-term averages are below long-term averages.

Trend Reversals

Watching for convergence or divergence between the two sets of moving averages can signal potential trend reversals.

Developing a Trading Plan

Components of a Trading Plan

A well-defined trading plan includes your trading goals, strategies, risk management rules, and performance evaluation criteria.

Setting Goals

Define clear, achievable trading goals to guide your efforts.

Choosing Strategies

Select trading strategies that align with your goals and risk tolerance.

Implementing Risk Management

Incorporate risk management techniques to protect your capital.

Case Studies

Successful Trades Using GMMA

Analyzing real-world examples can provide insights into how to apply Guppy’s strategies effectively.

Example 1: Bullish Trend

A trader identifies a bullish trend using GMMA and enters a long position, resulting in significant profits as the trend continues.

Example 2: Trend Reversal

A trader spots a trend reversal using GMMA, exits a long position, and avoids potential losses as the market shifts.

Practical Tips for Traders

Continuous Learning

Stay updated with market trends and continuously improve your trading skills.

Discipline and Patience

Maintain discipline in following your trading plan and be patient for the right opportunities.

Keeping Emotions in Check

Avoid letting emotions drive your trading decisions.

Tools and Resources

Trading Platforms

Choose a reliable trading platform that offers robust charting tools and technical indicators.

Educational Materials

Leverage books, online courses, and seminars to enhance your trading knowledge.

Common Pitfalls to Avoid

Overtrading

Avoid making too many trades, which can increase costs and reduce profits.

Ignoring Risk Management

Never neglect risk management practices, as they are crucial for preserving your capital.

Chasing Losses

Avoid the temptation to make impulsive trades to recover losses.

Conclusion

Daryl Guppy’s “Market Trading Tactics: Beating the Odds Through Technical Analysis and Money Management” offers a wealth of knowledge for traders looking to enhance their performance. By understanding and applying his strategies, traders can improve their market analysis, manage risks effectively, and achieve consistent success.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Market Trading Tactics: Beating the Odds Through Technical Analysis and Money Management with Daryl Guppy” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.