-

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

90 Minute Cycle withThe Algo Trader

1 × $5.00

90 Minute Cycle withThe Algo Trader

1 × $5.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

6 Dynamic Trader Real Time and End Of Day

1 × $39.00

6 Dynamic Trader Real Time and End Of Day

1 × $39.00 -

×

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00 -

×

A Day Trading Guide

1 × $54.00

A Day Trading Guide

1 × $54.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

AstroFibonacci 7.3722 magisociety

1 × $6.00

AstroFibonacci 7.3722 magisociety

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Trading as a Business with Alexander Elder

1 × $6.00

Trading as a Business with Alexander Elder

1 × $6.00 -

×

Bond Markets, Analysis and Strategies with Frank Fabozzi

1 × $6.00

Bond Markets, Analysis and Strategies with Frank Fabozzi

1 × $6.00 -

×

Alexander Elder Package ( Discount 28% )

1 × $31.00

Alexander Elder Package ( Discount 28% )

1 × $31.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

BCFX 2,0 and 2,5 with Brandon Carter

1 × $5.00

BCFX 2,0 and 2,5 with Brandon Carter

1 × $5.00 -

×

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00 -

×

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00 -

×

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00 -

×

Trading to Win with Ari Kiev

1 × $6.00

Trading to Win with Ari Kiev

1 × $6.00 -

×

Chart Analysis Boot Camp Course Webinar with Mike Albright

1 × $6.00

Chart Analysis Boot Camp Course Webinar with Mike Albright

1 × $6.00 -

×

Advanced Trading Strategies

1 × $31.00

Advanced Trading Strategies

1 × $31.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Trading Double Diagonals in 2019 with Dan Sheridan – Sheridan Options Mentoring

$297.00 Original price was: $297.00.$5.00Current price is: $5.00.

File Size: 2.11 GB

Delivery Time: 1–12 hours

Media Type: Online Course

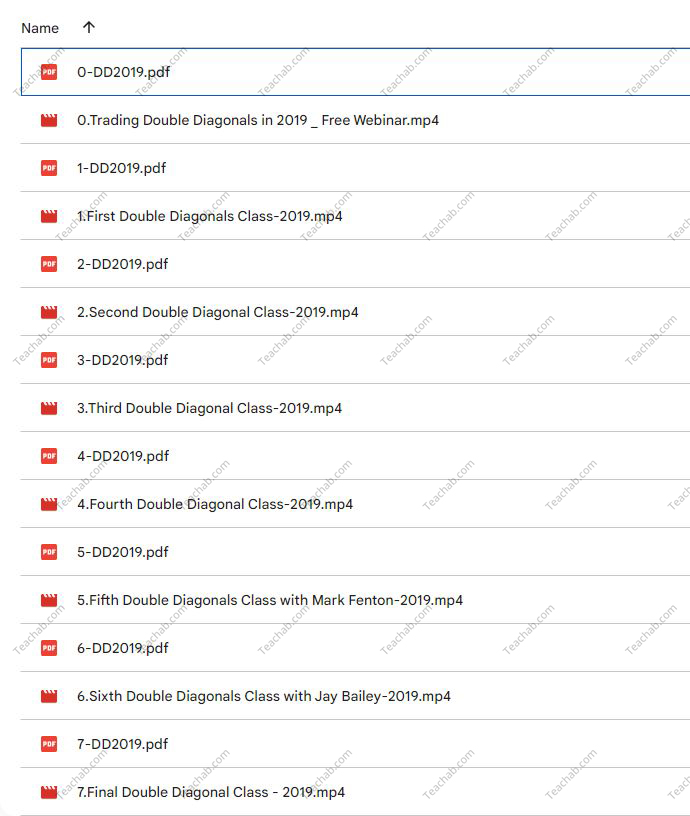

Content Proof: Watch Here!

You may check content proof of “Trading Double Diagonals in 2019 with Dan Sheridan – Sheridan Options Mentoring” below:

Mastering Double Diagonals: A 2019 Guide with Dan Sheridan – Sheridan Options Mentoring

Introduction to Double Diagonal Trading

In 2019, the options trading landscape saw numerous strategies rise in popularity, but few offered the flexibility and potential of double diagonals. Dan Sheridan of Sheridan Options Mentoring expertly demystified this approach, providing traders with a comprehensive guide to mastering this advanced strategy.

Who is Dan Sheridan?

Dan Sheridan is a veteran options trader and respected educator in the field. With decades of experience on the CBOE floor, Dan now dedicates his time to mentoring aspiring traders through his comprehensive training programs.

What is Sheridan Options Mentoring?

Sheridan Options Mentoring is a leading educational platform that specializes in teaching sophisticated options trading techniques in a clear and practical manner.

Understanding Double Diagonals

The Basics of Double Diagonals

Double diagonals are an advanced options strategy that involves two diagonal spreads, typically combining both calls and puts to leverage different strike prices and expiration dates.

Why Use Double Diagonals?

This strategy is particularly favored for its ability to capitalize on low-volatility markets while managing risks effectively.

Key Components of a Double Diagonal

Learn about the essential elements that make up a successful double diagonal trade, including strike selection and the importance of expiration timing.

Setting Up a Double Diagonal

Choosing the Right Markets

Insights into selecting the most suitable markets for applying double diagonals, focusing on liquidity and underlying stability.

Timing Your Entry

Strategies for timing your market entry to maximize the effectiveness of double diagonals.

Managing the Greeks

Understanding how ‘the Greeks’ (Delta, Gamma, Theta, Vega) influence double diagonal setups and adjustments.

Risk Management Strategies

Assessing Risk Properly

Techniques to assess and manage the inherent risks associated with double diagonal trading.

Adjustment Techniques

Learn various adjustment strategies to stay profitable under different market conditions.

Exit Strategies

Knowing when to exit is as crucial as entry. Explore practical exit strategies to maximize gains or minimize losses.

Tools and Resources for Double Diagonal Trading

Software Tools

Review of the best software tools for analyzing and setting up double diagonal trades effectively.

Educational Resources from Dan Sheridan

Explore the wealth of educational content Dan Sheridan provides, including webinars, live sessions, and workshops focused on double diagonals.

Real-Time Trading Simulations

The benefits of using real-time trading simulations to practice double diagonal strategies without financial risk.

Integration with Other Trading Strategies

Complementing Your Trading Portfolio

How double diagonals can complement other trading strategies in your portfolio, providing diversification and balance.

Leveraging Market Trends

Tips on leveraging broader market trends to enhance the performance of your double diagonal trades.

Continuous Learning and Adaptation

The importance of ongoing education and how to stay adaptive with evolving market conditions.

Success Stories and Testimonials

Feedback from Traders

Read about how other traders have successfully implemented double diagonal strategies in their trading activities.

Case Studies

Detailed case studies that showcase the real-world application and results of double diagonal trading.

Conclusion

Double diagonal trading, as taught by Dan Sheridan in 2019, remains a relevant and powerful options strategy. Through Dan’s expert guidance and the resources available at Sheridan Options Mentoring, traders can gain the knowledge needed to execute this strategy effectively and confidently.

FAQs

- What exactly is a double diagonal in options trading?

- A double diagonal is an advanced options strategy involving two diagonal spreads with different strike prices and expiration dates.

- Is double diagonal trading suitable for beginners?

- Due to its complexity, double diagonal trading is better suited for traders with some experience in options.

- How important is market volatility for double diagonals?

- Double diagonals generally perform best in low to moderate volatility environments.

- Can double diagonal strategies be automated?

- While certain aspects can be automated, successful double diagonal trading often requires active management and adjustment.

- Where can I learn more about advanced options strategies?

- Sheridan Options Mentoring offers extensive courses and resources on various advanced options strategies, including double diagonals.

Be the first to review “Trading Double Diagonals in 2019 with Dan Sheridan – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.