-

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Sacredscience - W.T.Foster – Sunspots and Weather

1 × $6.00

Sacredscience - W.T.Foster – Sunspots and Weather

1 × $6.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00

Stock Market Crash of 1929 with Aron Abrams

1 × $6.00 -

×

Trading Books with Michael Harris

1 × $6.00

Trading Books with Michael Harris

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

3 Volatility Strategies with Quantified Strategies

1 × $23.00

3 Volatility Strategies with Quantified Strategies

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Trading Masterclass with Chris Capre

1 × $23.00

The Trading Masterclass with Chris Capre

1 × $23.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Pattern Recognition: A Fundamental Introduction to Japanese Candlestick Charting Techniques Class with Jeff Bierman

1 × $6.00

Pattern Recognition: A Fundamental Introduction to Japanese Candlestick Charting Techniques Class with Jeff Bierman

1 × $6.00 -

×

Profit.ly - Bitcoin Basics

1 × $6.00

Profit.ly - Bitcoin Basics

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

How To Be a Profitable Forex Trader with Corey Halliday

1 × $6.00

How To Be a Profitable Forex Trader with Corey Halliday

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

”Trading With The Generals 2003-2004” Training Course with Kevin Haggerty

1 × $6.00

”Trading With The Generals 2003-2004” Training Course with Kevin Haggerty

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

12 Strategies for Picking Tops & Bottoms

1 × $23.00

12 Strategies for Picking Tops & Bottoms

1 × $23.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Technical Analysis 201: From Chart Setups to Trading Execution Methodology Class with Jeff Bierman

1 × $6.00

Technical Analysis 201: From Chart Setups to Trading Execution Methodology Class with Jeff Bierman

1 × $6.00 -

×

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00 -

×

Finserv Corp Complete Course

1 × $4.00

Finserv Corp Complete Course

1 × $4.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

7 Figures Forex Course

1 × $15.00

7 Figures Forex Course

1 × $15.00 -

×

Sensitivity Analysis in Practice

1 × $6.00

Sensitivity Analysis in Practice

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Quantum Stone Capital

1 × $15.00

Quantum Stone Capital

1 × $15.00 -

×

How I Trade the QQQs with Don Miller

1 × $6.00

How I Trade the QQQs with Don Miller

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00

Dynamic Time Cycles with Peter Eliades

$6.00

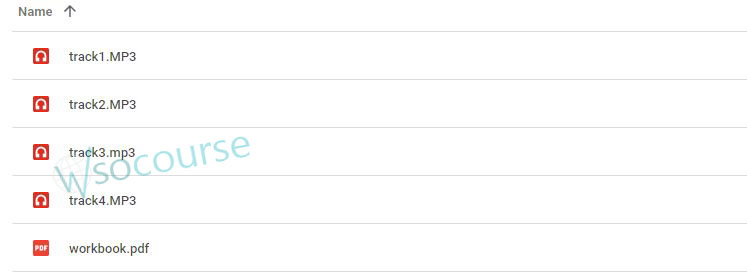

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Dynamic Time Cycles with Peter Eliades” below:

Dynamic Time Cycles with Peter Eliades

Introduction

In the intricate world of financial markets, timing is everything. Peter Eliades, a renowned expert in market analysis, has developed a profound methodology for predicting market movements through dynamic time cycles. Let’s explore how these cycles work and how they can be a game-changer for traders.

What Are Dynamic Time Cycles?

Dynamic time cycles are a method of forecasting market trends by analyzing the rhythmic patterns in market data. These cycles help predict when significant market movements are likely to occur.

The Theory Behind Time Cycles

The foundation of dynamic time cycles lies in the belief that market movements are not random but are influenced by recurring time patterns.

Key Components of Time Cycles

- Duration: The length of time between significant market events.

- Amplitude: The strength of market movements within these cycles.

The Significance of Market Timing

Understanding the timing of market cycles can dramatically enhance trading strategies by identifying optimal times to enter or exit the market.

Benefits of Accurate Market Timing

- Risk Reduction: Minimizing exposure during predicted downturns.

- Profit Maximization: Capitalizing on the upswings.

Peter Eliades’ Contributions to Cycle Theory

Peter Eliades has been instrumental in refining cycle theory and making it accessible to modern traders through innovative tools and techniques.

Tools and Techniques

- Cycle Analysis Software: Programs that help identify and predict cycle lengths and endpoints.

- Charting Methodologies: Visual representations of cycles for easier interpretation.

Applying Dynamic Time Cycles in Trading

To effectively use dynamic time cycles in trading, one must understand how to integrate this data into their trading plan.

Steps for Application

- Cycle Identification: Determine the current cycle phase.

- Strategic Planning: Align trading strategies with cycle predictions.

Case Studies and Success Stories

Real-world examples of successful trades based on dynamic time cycles illustrate the practical benefits of this approach.

Analyzing Market Reactions

Examining past market reactions to similar cycle phases can provide valuable insights into future behaviors.

Challenges in Cycle Analysis

Despite its benefits, analyzing dynamic time cycles comes with challenges, primarily due to the complexity of market dynamics.

Overcoming Analytical Challenges

- Continuous Education: Keeping updated with the latest research and methodologies.

- Utilizing Advanced Tools: Employing sophisticated analytical software to improve accuracy.

Future of Dynamic Time Cycles

The future looks promising for dynamic time cycles with ongoing advancements in analytical technology and greater acceptance among the trading community.

Innovations and Trends

- Artificial Intelligence Integration: Leveraging AI to enhance cycle prediction accuracy.

- Global Market Applications: Expanding the use of time cycles across different market types and regions.

Conclusion

Dynamic time cycles offer a unique perspective on market timing that can lead to more informed and potentially profitable trading decisions. With the insights provided by Peter Eliades, traders can look forward to navigating the markets with greater confidence and precision.

FAQs

- What are dynamic time cycles?

- Dynamic time cycles are methods used to predict market movements based on recurring time patterns.

- How do dynamic time cycles reduce trading risk?

- By forecasting potential market downturns, allowing traders to adjust their strategies accordingly.

- What tools does Peter Eliades recommend for cycle analysis?

- He advocates using cycle analysis software and advanced charting methodologies.

- Can dynamic time cycles predict exact market movements?

- While not exact, they provide a probabilistic assessment of when significant movements are likely.

- Are dynamic time cycles applicable to all markets?

- Yes, they can be adapted to different market environments, enhancing their versatility.

Be the first to review “Dynamic Time Cycles with Peter Eliades” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.