-

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00

A Treasure House of Bayer. 32 Articles and Forecasts with George Bayer

1 × $6.00 -

×

Create Your Own ETF Hedge Fund: A Do-It-Yourself ETF Strategy for Private Wealth Management with David Fry

1 × $6.00

Create Your Own ETF Hedge Fund: A Do-It-Yourself ETF Strategy for Private Wealth Management with David Fry

1 × $6.00 -

×

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00 -

×

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00

Financial Freedom Mastery Course with Freedom Team Trading

1 × $31.00 -

×

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00

A Conservative Plan to Make $3K Monthly on $25K with Dan Sheridan – Sheridan Options Mentoring

1 × $23.00 -

×

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

RSI Basic with Andrew Cardwell

1 × $54.00

RSI Basic with Andrew Cardwell

1 × $54.00 -

×

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00

Traders: Risks, Decisions, and Management in Financial Markets - Mark Fenton-O’Creevy, Nigel Nicholson, Emma Soane & Paul Willman

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Capital with Charles D.Ellis

1 × $6.00

Capital with Charles D.Ellis

1 × $6.00 -

×

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

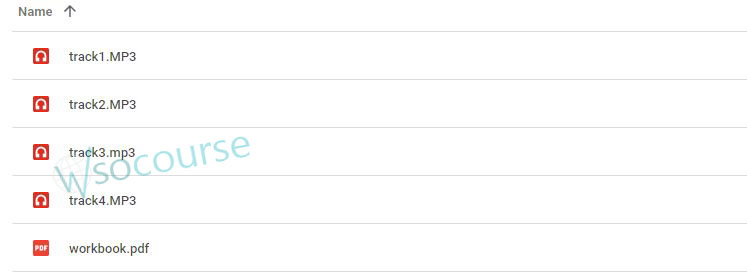

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00 -

×

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00 -

×

The Hedge Fund Edge. Maximum Profit, Minimum Risk. Global Trading Trend Strategies - Mark Boucher

1 × $6.00

The Hedge Fund Edge. Maximum Profit, Minimum Risk. Global Trading Trend Strategies - Mark Boucher

1 × $6.00 -

×

The Box Strategy with Blue Capital Academy

1 × $23.00

The Box Strategy with Blue Capital Academy

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Lee Gettess’s Package

1 × $6.00

Lee Gettess’s Package

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The Python for Traders Masterclass with Mr James

1 × $10.00

The Python for Traders Masterclass with Mr James

1 × $10.00 -

×

NASDAQ Level II Trading Strategies

1 × $6.00

NASDAQ Level II Trading Strategies

1 × $6.00 -

×

7 Steps to Success Trading Options Online with Larry Spears

1 × $4.00

7 Steps to Success Trading Options Online with Larry Spears

1 × $4.00 -

×

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00 -

×

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00 -

×

How To Flip All Those “Hard To Flip” Deals

1 × $6.00

How To Flip All Those “Hard To Flip” Deals

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

The Janus Factor with Gary Anderson

1 × $6.00

The Janus Factor with Gary Anderson

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Dynamic Time Cycles with Peter Eliades

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Dynamic Time Cycles with Peter Eliades” below:

Dynamic Time Cycles with Peter Eliades

Introduction

In the intricate world of financial markets, timing is everything. Peter Eliades, a renowned expert in market analysis, has developed a profound methodology for predicting market movements through dynamic time cycles. Let’s explore how these cycles work and how they can be a game-changer for traders.

What Are Dynamic Time Cycles?

Dynamic time cycles are a method of forecasting market trends by analyzing the rhythmic patterns in market data. These cycles help predict when significant market movements are likely to occur.

The Theory Behind Time Cycles

The foundation of dynamic time cycles lies in the belief that market movements are not random but are influenced by recurring time patterns.

Key Components of Time Cycles

- Duration: The length of time between significant market events.

- Amplitude: The strength of market movements within these cycles.

The Significance of Market Timing

Understanding the timing of market cycles can dramatically enhance trading strategies by identifying optimal times to enter or exit the market.

Benefits of Accurate Market Timing

- Risk Reduction: Minimizing exposure during predicted downturns.

- Profit Maximization: Capitalizing on the upswings.

Peter Eliades’ Contributions to Cycle Theory

Peter Eliades has been instrumental in refining cycle theory and making it accessible to modern traders through innovative tools and techniques.

Tools and Techniques

- Cycle Analysis Software: Programs that help identify and predict cycle lengths and endpoints.

- Charting Methodologies: Visual representations of cycles for easier interpretation.

Applying Dynamic Time Cycles in Trading

To effectively use dynamic time cycles in trading, one must understand how to integrate this data into their trading plan.

Steps for Application

- Cycle Identification: Determine the current cycle phase.

- Strategic Planning: Align trading strategies with cycle predictions.

Case Studies and Success Stories

Real-world examples of successful trades based on dynamic time cycles illustrate the practical benefits of this approach.

Analyzing Market Reactions

Examining past market reactions to similar cycle phases can provide valuable insights into future behaviors.

Challenges in Cycle Analysis

Despite its benefits, analyzing dynamic time cycles comes with challenges, primarily due to the complexity of market dynamics.

Overcoming Analytical Challenges

- Continuous Education: Keeping updated with the latest research and methodologies.

- Utilizing Advanced Tools: Employing sophisticated analytical software to improve accuracy.

Future of Dynamic Time Cycles

The future looks promising for dynamic time cycles with ongoing advancements in analytical technology and greater acceptance among the trading community.

Innovations and Trends

- Artificial Intelligence Integration: Leveraging AI to enhance cycle prediction accuracy.

- Global Market Applications: Expanding the use of time cycles across different market types and regions.

Conclusion

Dynamic time cycles offer a unique perspective on market timing that can lead to more informed and potentially profitable trading decisions. With the insights provided by Peter Eliades, traders can look forward to navigating the markets with greater confidence and precision.

FAQs

- What are dynamic time cycles?

- Dynamic time cycles are methods used to predict market movements based on recurring time patterns.

- How do dynamic time cycles reduce trading risk?

- By forecasting potential market downturns, allowing traders to adjust their strategies accordingly.

- What tools does Peter Eliades recommend for cycle analysis?

- He advocates using cycle analysis software and advanced charting methodologies.

- Can dynamic time cycles predict exact market movements?

- While not exact, they provide a probabilistic assessment of when significant movements are likely.

- Are dynamic time cycles applicable to all markets?

- Yes, they can be adapted to different market environments, enhancing their versatility.

Be the first to review “Dynamic Time Cycles with Peter Eliades” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.