-

×

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00 -

×

Simpler Options - Weekly Butterflies for Income

1 × $6.00

Simpler Options - Weekly Butterflies for Income

1 × $6.00 -

×

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (3rd Ed.) with Michael Sheimo

1 × $6.00 -

×

Selected Articles by the Late by George Lindsay

1 × $6.00

Selected Articles by the Late by George Lindsay

1 × $6.00 -

×

I Segreti Del Trading Di Breve Termine (Italian) with Larry Williams

1 × $6.00

I Segreti Del Trading Di Breve Termine (Italian) with Larry Williams

1 × $6.00 -

×

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00 -

×

The Any Hour Trading System with Markets Mastered

1 × $6.00

The Any Hour Trading System with Markets Mastered

1 × $6.00 -

×

The Great Depression with David Burg

1 × $6.00

The Great Depression with David Burg

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Self-Mastery Course with Steven Cruz

1 × $62.00

Self-Mastery Course with Steven Cruz

1 × $62.00 -

×

Math Trading Course 2023

1 × $34.00

Math Trading Course 2023

1 × $34.00 -

×

NXT Level FX with Investors Domain

1 × $5.00

NXT Level FX with Investors Domain

1 × $5.00 -

×

Advance Gap Trading with Master Trader

1 × $39.00

Advance Gap Trading with Master Trader

1 × $39.00 -

×

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00 -

×

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00 -

×

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00

Swing Trading (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00 -

×

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00 -

×

Complete Series

1 × $31.00

Complete Series

1 × $31.00 -

×

Active Trading Course Notes with Alan Hull

1 × $6.00

Active Trading Course Notes with Alan Hull

1 × $6.00 -

×

Investment Illusions with Martin S.Fridson

1 × $6.00

Investment Illusions with Martin S.Fridson

1 × $6.00 -

×

Emini Bonds

1 × $23.00

Emini Bonds

1 × $23.00 -

×

Intro To Trading - 3 Module Bundle

1 × $23.00

Intro To Trading - 3 Module Bundle

1 × $23.00 -

×

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00

Super Conference 2020 - Premier Coaching Package with Vince Vora

1 × $109.00 -

×

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00 -

×

The Mathematics of Money Management. Risk Analysis Techniques for Traders

1 × $6.00

The Mathematics of Money Management. Risk Analysis Techniques for Traders

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Cracking The Forex Code with Kevin Adams

1 × $6.00

Cracking The Forex Code with Kevin Adams

1 × $6.00 -

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

Dynamic Time Cycles with Peter Eliades

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

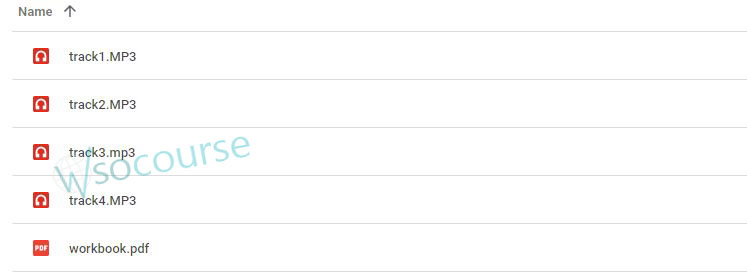

Content Proof: Watch Here!

You may check content proof of “Dynamic Time Cycles with Peter Eliades” below:

Dynamic Time Cycles with Peter Eliades

Introduction

In the intricate world of financial markets, timing is everything. Peter Eliades, a renowned expert in market analysis, has developed a profound methodology for predicting market movements through dynamic time cycles. Let’s explore how these cycles work and how they can be a game-changer for traders.

What Are Dynamic Time Cycles?

Dynamic time cycles are a method of forecasting market trends by analyzing the rhythmic patterns in market data. These cycles help predict when significant market movements are likely to occur.

The Theory Behind Time Cycles

The foundation of dynamic time cycles lies in the belief that market movements are not random but are influenced by recurring time patterns.

Key Components of Time Cycles

- Duration: The length of time between significant market events.

- Amplitude: The strength of market movements within these cycles.

The Significance of Market Timing

Understanding the timing of market cycles can dramatically enhance trading strategies by identifying optimal times to enter or exit the market.

Benefits of Accurate Market Timing

- Risk Reduction: Minimizing exposure during predicted downturns.

- Profit Maximization: Capitalizing on the upswings.

Peter Eliades’ Contributions to Cycle Theory

Peter Eliades has been instrumental in refining cycle theory and making it accessible to modern traders through innovative tools and techniques.

Tools and Techniques

- Cycle Analysis Software: Programs that help identify and predict cycle lengths and endpoints.

- Charting Methodologies: Visual representations of cycles for easier interpretation.

Applying Dynamic Time Cycles in Trading

To effectively use dynamic time cycles in trading, one must understand how to integrate this data into their trading plan.

Steps for Application

- Cycle Identification: Determine the current cycle phase.

- Strategic Planning: Align trading strategies with cycle predictions.

Case Studies and Success Stories

Real-world examples of successful trades based on dynamic time cycles illustrate the practical benefits of this approach.

Analyzing Market Reactions

Examining past market reactions to similar cycle phases can provide valuable insights into future behaviors.

Challenges in Cycle Analysis

Despite its benefits, analyzing dynamic time cycles comes with challenges, primarily due to the complexity of market dynamics.

Overcoming Analytical Challenges

- Continuous Education: Keeping updated with the latest research and methodologies.

- Utilizing Advanced Tools: Employing sophisticated analytical software to improve accuracy.

Future of Dynamic Time Cycles

The future looks promising for dynamic time cycles with ongoing advancements in analytical technology and greater acceptance among the trading community.

Innovations and Trends

- Artificial Intelligence Integration: Leveraging AI to enhance cycle prediction accuracy.

- Global Market Applications: Expanding the use of time cycles across different market types and regions.

Conclusion

Dynamic time cycles offer a unique perspective on market timing that can lead to more informed and potentially profitable trading decisions. With the insights provided by Peter Eliades, traders can look forward to navigating the markets with greater confidence and precision.

FAQs

- What are dynamic time cycles?

- Dynamic time cycles are methods used to predict market movements based on recurring time patterns.

- How do dynamic time cycles reduce trading risk?

- By forecasting potential market downturns, allowing traders to adjust their strategies accordingly.

- What tools does Peter Eliades recommend for cycle analysis?

- He advocates using cycle analysis software and advanced charting methodologies.

- Can dynamic time cycles predict exact market movements?

- While not exact, they provide a probabilistic assessment of when significant movements are likely.

- Are dynamic time cycles applicable to all markets?

- Yes, they can be adapted to different market environments, enhancing their versatility.

Be the first to review “Dynamic Time Cycles with Peter Eliades” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.