-

×

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

SO FX Educational Course with SO FX

1 × $5.00

SO FX Educational Course with SO FX

1 × $5.00 -

×

How I Trade for a Living with Gary Smith

1 × $6.00

How I Trade for a Living with Gary Smith

1 × $6.00 -

×

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00 -

×

Evolved Traders with Riley Coleman

1 × $5.00

Evolved Traders with Riley Coleman

1 × $5.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Startup Trading Masterclass with Jack Gleason

1 × $93.00

Startup Trading Masterclass with Jack Gleason

1 × $93.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

Mastering Technical Analysis with Investi Share

1 × $23.00

Mastering Technical Analysis with Investi Share

1 × $23.00 -

×

How I Day Trade Course with Traderade

1 × $15.00

How I Day Trade Course with Traderade

1 × $15.00 -

×

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00 -

×

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00 -

×

Fast Track Course with Tradelikerocket

1 × $233.00

Fast Track Course with Tradelikerocket

1 × $233.00 -

×

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00 -

×

Equity Trader 101 Course with KeyStone Trading

1 × $6.00

Equity Trader 101 Course with KeyStone Trading

1 × $6.00 -

×

The Apple Way with Jeffrey Cruikshank

1 × $6.00

The Apple Way with Jeffrey Cruikshank

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Bear Market Success Workshop with Base Camp Trading

1 × $15.00

Bear Market Success Workshop with Base Camp Trading

1 × $15.00 -

×

Futures 101: An Introduction to Futures Contracts Class with Don Kaufman

1 × $6.00

Futures 101: An Introduction to Futures Contracts Class with Don Kaufman

1 × $6.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00 -

×

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Mastering Candlestick Charts II with Greg Capra

1 × $6.00

Mastering Candlestick Charts II with Greg Capra

1 × $6.00 -

×

The Art And Science Of Trading with Adam Grimes

1 × $6.00

The Art And Science Of Trading with Adam Grimes

1 × $6.00 -

×

MAP. Moving Average Patterns CD with David Elliott

1 × $6.00

MAP. Moving Average Patterns CD with David Elliott

1 × $6.00 -

×

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00 -

×

7 Days Options Masters Course with John Carter

1 × $54.00

7 Days Options Masters Course with John Carter

1 × $54.00 -

×

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

No Bull Investing with Jack Bernstein

1 × $6.00

No Bull Investing with Jack Bernstein

1 × $6.00 -

×

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00

Price Action Manual (2nd Ed.) with Bruce Gilmore

1 × $6.00 -

×

Smart Money Trading Course with Prosperity Academy

1 × $5.00

Smart Money Trading Course with Prosperity Academy

1 × $5.00 -

×

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00 -

×

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00

5-Step-Trading Stocks I and II with Lex Van Dam

1 × $4.00 -

×

Freedom Challenge Course with Steven Dux

1 × $5.00

Freedom Challenge Course with Steven Dux

1 × $5.00 -

×

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00

Traders Winning Edge with Adrienne Laris Toghraie

1 × $6.00 -

×

Forex EURUSD Trader Live Training (2012)

1 × $6.00

Forex EURUSD Trader Live Training (2012)

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Day One Trader with John Sussex

1 × $6.00

Day One Trader with John Sussex

1 × $6.00 -

×

How I Trade the QQQs with Don Miller

1 × $6.00

How I Trade the QQQs with Don Miller

1 × $6.00 -

×

CarterFX Membership with Duran Carter

1 × $23.00

CarterFX Membership with Duran Carter

1 × $23.00 -

×

The M21 Strategy

1 × $15.00

The M21 Strategy

1 × $15.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00

The Aggressive Investor. Case Studies with Colin Nicholson

1 × $6.00 -

×

Hedge Funds for Dummies

1 × $6.00

Hedge Funds for Dummies

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

NoBSFX Trading Workshop with Jaime Johnson

1 × $23.00

NoBSFX Trading Workshop with Jaime Johnson

1 × $23.00 -

×

Adx Mastery Complete Course

1 × $6.00

Adx Mastery Complete Course

1 × $6.00 -

×

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

The All Put Flat Butterfly with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00 -

×

The Loyalty Effect with Frederick Reichheld

1 × $6.00

The Loyalty Effect with Frederick Reichheld

1 × $6.00 -

×

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00 -

×

Art & Science of Trend Trading Class with Jeff Bierman

1 × $6.00

Art & Science of Trend Trading Class with Jeff Bierman

1 × $6.00 -

×

Pricing of Bond Options with Detlef Repplinger

1 × $6.00

Pricing of Bond Options with Detlef Repplinger

1 × $6.00 -

×

The Candlestick Training Series with Timon Weller

1 × $6.00

The Candlestick Training Series with Timon Weller

1 × $6.00 -

×

Mao, Marx & the Market: Capitalist Adventures in Russia and China with Dean LeBaro

1 × $6.00

Mao, Marx & the Market: Capitalist Adventures in Russia and China with Dean LeBaro

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Trade the OEX with Arthur Darack

1 × $6.00

Trade the OEX with Arthur Darack

1 × $6.00 -

×

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00

CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan

$39.00 Original price was: $39.00.$6.00Current price is: $6.00.

File Size: 571 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

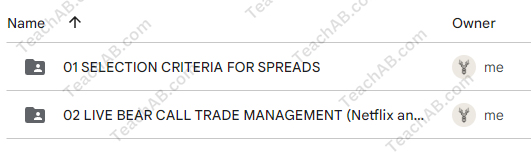

You may check content proof of “CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan” below:

Credit Spread Surgery: Mastering Bear Call and Bull Put Spreads with Hari Swaminathan

Dive deep into the world of options trading with “Credit Spread Surgery,” a specialized course designed by renowned options educator Hari Swaminathan. This course focuses on mastering bear call spreads and bull put spreads, two essential strategies for traders looking to enhance their profitability while managing risk effectively.

Introduction to Credit Spread Surgery

Credit spreads are a cornerstone of conservative options trading, providing a balance between risk and return. With Hari Swaminathan’s expert guidance, traders of all levels can learn to implement these strategies to capitalize on market movements while protecting their investment.

Who is Hari Swaminathan?

Background and Expertise

Hari Swaminathan is a respected figure in the options trading community, known for his ability to simplify complex trading concepts and strategies.

Philosophy on Options Trading

Hari’s trading philosophy revolves around risk management and the strategic use of options spreads to achieve consistent returns.

Understanding Credit Spreads

What are Credit Spreads?

A basic overview of credit spreads, including their structure and how they are used in trading.

Benefits of Trading Credit Spreads

Explore the advantages of using credit spreads, such as reduced risk and improved probability of profit.

Bear Call Spreads Explained

Setting Up a Bear Call Spread

Step-by-step guidance on how to establish a bear call spread, including selecting strike prices and expiration dates.

Risk Management with Bear Call Spreads

Techniques for managing risk when utilizing bear call spreads in various market conditions.

Bull Put Spreads Demystified

Constructing a Bull Put Spread

Detailed instructions on building a bull put spread to maximize your earnings potential.

Advantages of Bull Put Spreads

Discussion on why bull put spreads can be a lucrative strategy for bullish or neutral market scenarios.

Analyzing Market Conditions

Identifying Ideal Conditions for Credit Spreads

Learn how to analyze market conditions to determine the best times to employ bear call or bull put spreads.

Adjustments and Exit Strategies

How to make necessary adjustments to your spreads to protect profits or minimize losses.

Tools and Indicators

Essential Tools for Credit Spread Traders

Overview of the tools and indicators that are most effective for traders specializing in credit spreads.

Using Technical Analysis to Enhance Decisions

How to integrate technical analysis to improve decision-making in credit spread trading.

Trade Management

Monitoring and Adjusting Open Positions

Tips on how to monitor and adjust open credit spread positions effectively.

Dealing with Assignment Risk

Guidance on managing the risk of option assignment, a common concern with credit spreads.

Advanced Techniques

Utilizing Greeks in Credit Spread Trading

Understanding how options ‘Greeks’ can influence your credit spread strategies and decision-making process.

Combining Multiple Spreads

Strategies for combining multiple credit spreads to increase potential returns and diversify risk.

Learning from Mistakes

Common Pitfalls in Credit Spread Trading

Identify and learn how to avoid the most common mistakes made by credit spread traders.

Case Studies and Real-World Examples

Analyzing real-world examples to illustrate successful and unsuccessful credit spread trades.

Joining the Trading Community

Benefits of Community Learning

The advantages of joining a trading community, including shared knowledge and emotional support.

Ongoing Support and Education

Information on continuing education and support available through Hari Swaminathan’s training programs.

Conclusion

“CREDIT SPREAD SURGERY” with Hari Swaminathan provides a comprehensive roadmap to mastering bear call and bull put spreads. This course is an invaluable resource for anyone looking to enhance their options trading skills through structured, strategic approaches that prioritize risk management.

FAQs

1. How long does it take to complete the Credit Spread Surgery course?

- Typically, the course can be completed within a few weeks, depending on the learner’s pace.

2. Is prior experience in options trading necessary?

- Basic knowledge of options is recommended, but beginners can also benefit as the course starts with foundational concepts.

3. What additional resources does Hari Swaminathan offer?

- Hari provides additional webinars, live trading sessions, and one-on-one coaching for deeper learning.

4. Can these strategies be applied in any market environment?

- Yes, bear call and bull put spreads are versatile strategies that can be adapted to various market conditions.

5. How can I sign up for the course?

- Visit the Simpler Trading website to enroll in the “Credit Spread Surgery” course and start your journey to options mastery.

Be the first to review “CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.