-

×

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00

Advanced Trading System - How To 10x Your Trading Skillsets & Results with The Trade Academy

1 × $6.00 -

×

The Illustrated Guide to Technical Analysis Signals and Phrases with Constance Brown

1 × $6.00

The Illustrated Guide to Technical Analysis Signals and Phrases with Constance Brown

1 × $6.00 -

×

RSD - Alex’s Natural Instinct Method Manifesto

1 × $6.00

RSD - Alex’s Natural Instinct Method Manifesto

1 × $6.00 -

×

Simple Forex Profits with Rayy Bannzz

1 × $31.00

Simple Forex Profits with Rayy Bannzz

1 × $31.00 -

×

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Options, Futures & Other Derivatives (5th Ed.)

1 × $6.00

Options, Futures & Other Derivatives (5th Ed.)

1 × $6.00 -

×

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Hidden Cash Flow Fortunes

1 × $54.00

Hidden Cash Flow Fortunes

1 × $54.00 -

×

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00

Advanced Scalping Techniques Home Study Course with Sami Abusaad - T3Live

1 × $31.00 -

×

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00

Money Attraction Bootcamp - Video + Audio + Workbook by Greg Habstritt

1 × $6.00 -

×

Gann Masters II with Hallikers Inc

1 × $6.00

Gann Masters II with Hallikers Inc

1 × $6.00 -

×

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00 -

×

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00 -

×

Pattern Picking with Charles Drummond

1 × $6.00

Pattern Picking with Charles Drummond

1 × $6.00 -

×

The Art of the Trade: What I Learned (and Lost) Trading the Chicago Futures Markets - Jason Alan Jankovsky

1 × $6.00

The Art of the Trade: What I Learned (and Lost) Trading the Chicago Futures Markets - Jason Alan Jankovsky

1 × $6.00 -

×

The Telecoms Trade War with Mark Naftel

1 × $6.00

The Telecoms Trade War with Mark Naftel

1 × $6.00 -

×

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00 -

×

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00

Practical Elliott Wave Trading Strategies with Robert Miner

1 × $6.00 -

×

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00 -

×

An Introduction to Market Risk Measurement with Kevin Dowd

1 × $6.00

An Introduction to Market Risk Measurement with Kevin Dowd

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Technical Analysis for the Trading Professional with Constance Brown

1 × $6.00

Technical Analysis for the Trading Professional with Constance Brown

1 × $6.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

EZ2 Trade Charting Collection eSignal (ez2tradesoftware.com) - Raghee Horner

1 × $6.00

EZ2 Trade Charting Collection eSignal (ez2tradesoftware.com) - Raghee Horner

1 × $6.00 -

×

Mastering Candlestick Charts II with Greg Capra

1 × $6.00

Mastering Candlestick Charts II with Greg Capra

1 × $6.00 -

×

Fantastic 4 Trading Strategies

1 × $15.00

Fantastic 4 Trading Strategies

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00

Natural Language Processing in Trading with Dr. Terry Benzschawel

1 × $31.00 -

×

Transparent FX Course

1 × $6.00

Transparent FX Course

1 × $6.00 -

×

Advanced Trader with Nikos Trading Academy

1 × $5.00

Advanced Trader with Nikos Trading Academy

1 × $5.00 -

×

Empirical Market Microstructure

1 × $6.00

Empirical Market Microstructure

1 × $6.00 -

×

Buy, Sell or Hold Manage Your Portfolio for Maximum Gain with Michaal Thomsett

1 × $6.00

Buy, Sell or Hold Manage Your Portfolio for Maximum Gain with Michaal Thomsett

1 × $6.00 -

×

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00 -

×

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00

CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan

$39.00 Original price was: $39.00.$6.00Current price is: $6.00.

File Size: 571 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan” below:

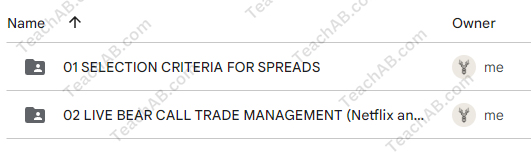

Credit Spread Surgery: Mastering Bear Call and Bull Put Spreads with Hari Swaminathan

Dive deep into the world of options trading with “Credit Spread Surgery,” a specialized course designed by renowned options educator Hari Swaminathan. This course focuses on mastering bear call spreads and bull put spreads, two essential strategies for traders looking to enhance their profitability while managing risk effectively.

Introduction to Credit Spread Surgery

Credit spreads are a cornerstone of conservative options trading, providing a balance between risk and return. With Hari Swaminathan’s expert guidance, traders of all levels can learn to implement these strategies to capitalize on market movements while protecting their investment.

Who is Hari Swaminathan?

Background and Expertise

Hari Swaminathan is a respected figure in the options trading community, known for his ability to simplify complex trading concepts and strategies.

Philosophy on Options Trading

Hari’s trading philosophy revolves around risk management and the strategic use of options spreads to achieve consistent returns.

Understanding Credit Spreads

What are Credit Spreads?

A basic overview of credit spreads, including their structure and how they are used in trading.

Benefits of Trading Credit Spreads

Explore the advantages of using credit spreads, such as reduced risk and improved probability of profit.

Bear Call Spreads Explained

Setting Up a Bear Call Spread

Step-by-step guidance on how to establish a bear call spread, including selecting strike prices and expiration dates.

Risk Management with Bear Call Spreads

Techniques for managing risk when utilizing bear call spreads in various market conditions.

Bull Put Spreads Demystified

Constructing a Bull Put Spread

Detailed instructions on building a bull put spread to maximize your earnings potential.

Advantages of Bull Put Spreads

Discussion on why bull put spreads can be a lucrative strategy for bullish or neutral market scenarios.

Analyzing Market Conditions

Identifying Ideal Conditions for Credit Spreads

Learn how to analyze market conditions to determine the best times to employ bear call or bull put spreads.

Adjustments and Exit Strategies

How to make necessary adjustments to your spreads to protect profits or minimize losses.

Tools and Indicators

Essential Tools for Credit Spread Traders

Overview of the tools and indicators that are most effective for traders specializing in credit spreads.

Using Technical Analysis to Enhance Decisions

How to integrate technical analysis to improve decision-making in credit spread trading.

Trade Management

Monitoring and Adjusting Open Positions

Tips on how to monitor and adjust open credit spread positions effectively.

Dealing with Assignment Risk

Guidance on managing the risk of option assignment, a common concern with credit spreads.

Advanced Techniques

Utilizing Greeks in Credit Spread Trading

Understanding how options ‘Greeks’ can influence your credit spread strategies and decision-making process.

Combining Multiple Spreads

Strategies for combining multiple credit spreads to increase potential returns and diversify risk.

Learning from Mistakes

Common Pitfalls in Credit Spread Trading

Identify and learn how to avoid the most common mistakes made by credit spread traders.

Case Studies and Real-World Examples

Analyzing real-world examples to illustrate successful and unsuccessful credit spread trades.

Joining the Trading Community

Benefits of Community Learning

The advantages of joining a trading community, including shared knowledge and emotional support.

Ongoing Support and Education

Information on continuing education and support available through Hari Swaminathan’s training programs.

Conclusion

“CREDIT SPREAD SURGERY” with Hari Swaminathan provides a comprehensive roadmap to mastering bear call and bull put spreads. This course is an invaluable resource for anyone looking to enhance their options trading skills through structured, strategic approaches that prioritize risk management.

FAQs

1. How long does it take to complete the Credit Spread Surgery course?

- Typically, the course can be completed within a few weeks, depending on the learner’s pace.

2. Is prior experience in options trading necessary?

- Basic knowledge of options is recommended, but beginners can also benefit as the course starts with foundational concepts.

3. What additional resources does Hari Swaminathan offer?

- Hari provides additional webinars, live trading sessions, and one-on-one coaching for deeper learning.

4. Can these strategies be applied in any market environment?

- Yes, bear call and bull put spreads are versatile strategies that can be adapted to various market conditions.

5. How can I sign up for the course?

- Visit the Simpler Trading website to enroll in the “Credit Spread Surgery” course and start your journey to options mastery.

Be the first to review “CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.