-

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00 -

×

Big Profit Patterns Using Candlestick Signals & Gaps with Stephen W.Bigalow

1 × $6.00

Big Profit Patterns Using Candlestick Signals & Gaps with Stephen W.Bigalow

1 × $6.00 -

×

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00

Cecil Robles Advent Forex Course & Indicators with Adventforex

1 × $6.00 -

×

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00 -

×

A Complete Guide to the Futures Markets: Fundamental Analysis, Technical Analysis, Trading, Spreads, and Options (1st Edition) - Jack Schwager

1 × $6.00

A Complete Guide to the Futures Markets: Fundamental Analysis, Technical Analysis, Trading, Spreads, and Options (1st Edition) - Jack Schwager

1 × $6.00 -

×

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00 -

×

Getting Started in Stocks with Alvin D.Hall

1 × $6.00

Getting Started in Stocks with Alvin D.Hall

1 × $6.00 -

×

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00 -

×

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00 -

×

Daytraders Survival Guide with Christopher Farrell

1 × $6.00

Daytraders Survival Guide with Christopher Farrell

1 × $6.00 -

×

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00

Advanced Options Trading: Approaches, Tools, and Techniques for Professionals Traders with Kevin Kraus

1 × $6.00 -

×

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00 -

×

Stock Selection Course with Dave Landry

1 × $6.00

Stock Selection Course with Dave Landry

1 × $6.00 -

×

FestX Main Online video Course with Clint Fester

1 × $5.00

FestX Main Online video Course with Clint Fester

1 × $5.00 -

×

Trading Masterclass POTM + PFTM + PTMI with Anton Kreil

1 × $6.00

Trading Masterclass POTM + PFTM + PTMI with Anton Kreil

1 × $6.00 -

×

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00

Fundamentals of the Securities Industry with William A.Rini

1 × $6.00 -

×

Complete Cryptocurrency Trading 2021

1 × $5.00

Complete Cryptocurrency Trading 2021

1 × $5.00 -

×

Commodities for Dummies with Amine Bouchentouf

1 × $6.00

Commodities for Dummies with Amine Bouchentouf

1 × $6.00 -

×

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00

How to Analyze Multifamily Investment Opportunities with Symon He & Brandon Young

1 × $6.00 -

×

Building Your E-Mini Trading Strategy with Daniel Gramza

1 × $6.00

Building Your E-Mini Trading Strategy with Daniel Gramza

1 × $6.00 -

×

Mastering Candlestick Charts II with Greg Capra

1 × $6.00

Mastering Candlestick Charts II with Greg Capra

1 × $6.00 -

×

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Futures & Options 101 with Talkin Options

1 × $8.00

Futures & Options 101 with Talkin Options

1 × $8.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Cash Flow Investing Course

1 × $20.00

Cash Flow Investing Course

1 × $20.00 -

×

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00 -

×

Power FX Xtreme BuySell EA

1 × $23.00

Power FX Xtreme BuySell EA

1 × $23.00 -

×

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00 -

×

Forex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders - James Bickford

1 × $6.00

Forex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders - James Bickford

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan

$39.00 Original price was: $39.00.$6.00Current price is: $6.00.

File Size: 571 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

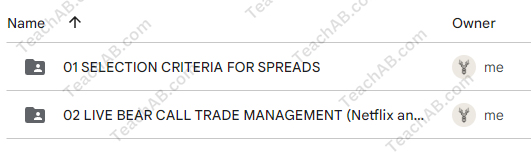

You may check content proof of “CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan” below:

Credit Spread Surgery: Mastering Bear Call and Bull Put Spreads with Hari Swaminathan

Dive deep into the world of options trading with “Credit Spread Surgery,” a specialized course designed by renowned options educator Hari Swaminathan. This course focuses on mastering bear call spreads and bull put spreads, two essential strategies for traders looking to enhance their profitability while managing risk effectively.

Introduction to Credit Spread Surgery

Credit spreads are a cornerstone of conservative options trading, providing a balance between risk and return. With Hari Swaminathan’s expert guidance, traders of all levels can learn to implement these strategies to capitalize on market movements while protecting their investment.

Who is Hari Swaminathan?

Background and Expertise

Hari Swaminathan is a respected figure in the options trading community, known for his ability to simplify complex trading concepts and strategies.

Philosophy on Options Trading

Hari’s trading philosophy revolves around risk management and the strategic use of options spreads to achieve consistent returns.

Understanding Credit Spreads

What are Credit Spreads?

A basic overview of credit spreads, including their structure and how they are used in trading.

Benefits of Trading Credit Spreads

Explore the advantages of using credit spreads, such as reduced risk and improved probability of profit.

Bear Call Spreads Explained

Setting Up a Bear Call Spread

Step-by-step guidance on how to establish a bear call spread, including selecting strike prices and expiration dates.

Risk Management with Bear Call Spreads

Techniques for managing risk when utilizing bear call spreads in various market conditions.

Bull Put Spreads Demystified

Constructing a Bull Put Spread

Detailed instructions on building a bull put spread to maximize your earnings potential.

Advantages of Bull Put Spreads

Discussion on why bull put spreads can be a lucrative strategy for bullish or neutral market scenarios.

Analyzing Market Conditions

Identifying Ideal Conditions for Credit Spreads

Learn how to analyze market conditions to determine the best times to employ bear call or bull put spreads.

Adjustments and Exit Strategies

How to make necessary adjustments to your spreads to protect profits or minimize losses.

Tools and Indicators

Essential Tools for Credit Spread Traders

Overview of the tools and indicators that are most effective for traders specializing in credit spreads.

Using Technical Analysis to Enhance Decisions

How to integrate technical analysis to improve decision-making in credit spread trading.

Trade Management

Monitoring and Adjusting Open Positions

Tips on how to monitor and adjust open credit spread positions effectively.

Dealing with Assignment Risk

Guidance on managing the risk of option assignment, a common concern with credit spreads.

Advanced Techniques

Utilizing Greeks in Credit Spread Trading

Understanding how options ‘Greeks’ can influence your credit spread strategies and decision-making process.

Combining Multiple Spreads

Strategies for combining multiple credit spreads to increase potential returns and diversify risk.

Learning from Mistakes

Common Pitfalls in Credit Spread Trading

Identify and learn how to avoid the most common mistakes made by credit spread traders.

Case Studies and Real-World Examples

Analyzing real-world examples to illustrate successful and unsuccessful credit spread trades.

Joining the Trading Community

Benefits of Community Learning

The advantages of joining a trading community, including shared knowledge and emotional support.

Ongoing Support and Education

Information on continuing education and support available through Hari Swaminathan’s training programs.

Conclusion

“CREDIT SPREAD SURGERY” with Hari Swaminathan provides a comprehensive roadmap to mastering bear call and bull put spreads. This course is an invaluable resource for anyone looking to enhance their options trading skills through structured, strategic approaches that prioritize risk management.

FAQs

1. How long does it take to complete the Credit Spread Surgery course?

- Typically, the course can be completed within a few weeks, depending on the learner’s pace.

2. Is prior experience in options trading necessary?

- Basic knowledge of options is recommended, but beginners can also benefit as the course starts with foundational concepts.

3. What additional resources does Hari Swaminathan offer?

- Hari provides additional webinars, live trading sessions, and one-on-one coaching for deeper learning.

4. Can these strategies be applied in any market environment?

- Yes, bear call and bull put spreads are versatile strategies that can be adapted to various market conditions.

5. How can I sign up for the course?

- Visit the Simpler Trading website to enroll in the “Credit Spread Surgery” course and start your journey to options mastery.

Be the first to review “CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.