-

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

ePass Platinum

1 × $31.00

ePass Platinum

1 × $31.00 -

×

All Access Online Trading Course with Steve Luke

1 × $6.00

All Access Online Trading Course with Steve Luke

1 × $6.00 -

×

Introduction to Stocks & Forex

1 × $15.00

Introduction to Stocks & Forex

1 × $15.00 -

×

The Dynamic Trading Master Course with Robert Miner

1 × $54.00

The Dynamic Trading Master Course with Robert Miner

1 × $54.00 -

×

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00 -

×

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00

Profits In PJs - Profitably Selling Stock Options for Passive Income with Cam Tucker

1 × $6.00 -

×

Fibonacci Analysis with Constance Brown

1 × $6.00

Fibonacci Analysis with Constance Brown

1 × $6.00 -

×

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00 -

×

The Compleat Day Trader with Jake Bernstein

1 × $6.00

The Compleat Day Trader with Jake Bernstein

1 × $6.00 -

×

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

A-Z Course with InvestiTrade Academy

1 × $5.00

A-Z Course with InvestiTrade Academy

1 × $5.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

Systems Mastery Course with Chris Dover - Pollinate Trading

1 × $5.00

Systems Mastery Course with Chris Dover - Pollinate Trading

1 × $5.00 -

×

TECHNICAL ANALYSIS MODULE

1 × $6.00

TECHNICAL ANALYSIS MODULE

1 × $6.00 -

×

The Late-Start Investor with John Wasik

1 × $6.00

The Late-Start Investor with John Wasik

1 × $6.00 -

×

Textbook Trading DVD with InvestorsLive

1 × $6.00

Textbook Trading DVD with InvestorsLive

1 × $6.00 -

×

Empirical Market Microstructure

1 × $6.00

Empirical Market Microstructure

1 × $6.00 -

×

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00 -

×

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00

CANDLESTICKS APPLIED with Steve Nison & Syl Desaulniers - Candle Charts

1 × $15.00 -

×

Defending Options with Simpler Options

1 × $6.00

Defending Options with Simpler Options

1 × $6.00 -

×

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00

Fundamentals of Forex Trading with Joshua Garrison

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00

Edz Currency Trading Package with EDZ Trading Academy

1 × $5.00 -

×

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00 -

×

Scientific Forex with Cristina Ciurea

1 × $6.00

Scientific Forex with Cristina Ciurea

1 × $6.00 -

×

Setups of a Winning Trader with Gareth Soloway

1 × $521.00

Setups of a Winning Trader with Gareth Soloway

1 × $521.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00 -

×

Ahead of the Curve with Joseph Ellis

1 × $6.00

Ahead of the Curve with Joseph Ellis

1 × $6.00 -

×

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00 -

×

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00 -

×

How To Become StressFree Trader with Jason Starzec

1 × $4.00

How To Become StressFree Trader with Jason Starzec

1 × $4.00 -

×

Futures & Options Course with Talkin Options

1 × $15.00

Futures & Options Course with Talkin Options

1 × $15.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

Divergence Super BluePrint with Bill Poulos

1 × $6.00

Divergence Super BluePrint with Bill Poulos

1 × $6.00 -

×

Studies in Stock Speculation (Volume I & II) with H.J.Wolf

1 × $6.00

Studies in Stock Speculation (Volume I & II) with H.J.Wolf

1 × $6.00 -

×

Supercharge your Options Spread Trading with John Summa

1 × $6.00

Supercharge your Options Spread Trading with John Summa

1 × $6.00 -

×

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Age of Turbulence with Alan Greenspan

1 × $6.00

The Age of Turbulence with Alan Greenspan

1 × $6.00 -

×

The Loyalty Effect with Frederick Reichheld

1 × $6.00

The Loyalty Effect with Frederick Reichheld

1 × $6.00 -

×

NY 6 - Jason McDonald – Why Shorts are Hard to Find and How You Can Find Great Shorts

1 × $6.00

NY 6 - Jason McDonald – Why Shorts are Hard to Find and How You Can Find Great Shorts

1 × $6.00 -

×

GANNacci Code Elite + Training Course

1 × $31.00

GANNacci Code Elite + Training Course

1 × $31.00 -

×

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

1 × $6.00

Channel Analysis. The Key to Improved Timing of Trades with Brian J.Millard

1 × $6.00 -

×

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00 -

×

The Art of the Trade: What I Learned (and Lost) Trading the Chicago Futures Markets - Jason Alan Jankovsky

1 × $6.00

The Art of the Trade: What I Learned (and Lost) Trading the Chicago Futures Markets - Jason Alan Jankovsky

1 × $6.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00

Covered Calls Income Generation for Your Stocks With Don Kaufman

1 × $6.00 -

×

Japanese Trading Systems with Tradesmart University

1 × $9.00

Japanese Trading Systems with Tradesmart University

1 × $9.00 -

×

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00 -

×

Day Trade Futures Online with Larry Williams

1 × $6.00

Day Trade Futures Online with Larry Williams

1 × $6.00 -

×

Trading With an Edge with Bruce Gilmore

1 × $6.00

Trading With an Edge with Bruce Gilmore

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan

$39.00 Original price was: $39.00.$6.00Current price is: $6.00.

File Size: 571 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

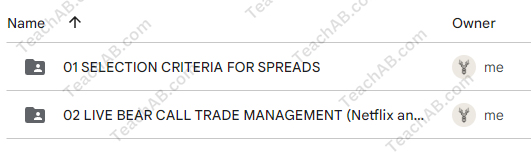

You may check content proof of “CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan” below:

Credit Spread Surgery: Mastering Bear Call and Bull Put Spreads with Hari Swaminathan

Dive deep into the world of options trading with “Credit Spread Surgery,” a specialized course designed by renowned options educator Hari Swaminathan. This course focuses on mastering bear call spreads and bull put spreads, two essential strategies for traders looking to enhance their profitability while managing risk effectively.

Introduction to Credit Spread Surgery

Credit spreads are a cornerstone of conservative options trading, providing a balance between risk and return. With Hari Swaminathan’s expert guidance, traders of all levels can learn to implement these strategies to capitalize on market movements while protecting their investment.

Who is Hari Swaminathan?

Background and Expertise

Hari Swaminathan is a respected figure in the options trading community, known for his ability to simplify complex trading concepts and strategies.

Philosophy on Options Trading

Hari’s trading philosophy revolves around risk management and the strategic use of options spreads to achieve consistent returns.

Understanding Credit Spreads

What are Credit Spreads?

A basic overview of credit spreads, including their structure and how they are used in trading.

Benefits of Trading Credit Spreads

Explore the advantages of using credit spreads, such as reduced risk and improved probability of profit.

Bear Call Spreads Explained

Setting Up a Bear Call Spread

Step-by-step guidance on how to establish a bear call spread, including selecting strike prices and expiration dates.

Risk Management with Bear Call Spreads

Techniques for managing risk when utilizing bear call spreads in various market conditions.

Bull Put Spreads Demystified

Constructing a Bull Put Spread

Detailed instructions on building a bull put spread to maximize your earnings potential.

Advantages of Bull Put Spreads

Discussion on why bull put spreads can be a lucrative strategy for bullish or neutral market scenarios.

Analyzing Market Conditions

Identifying Ideal Conditions for Credit Spreads

Learn how to analyze market conditions to determine the best times to employ bear call or bull put spreads.

Adjustments and Exit Strategies

How to make necessary adjustments to your spreads to protect profits or minimize losses.

Tools and Indicators

Essential Tools for Credit Spread Traders

Overview of the tools and indicators that are most effective for traders specializing in credit spreads.

Using Technical Analysis to Enhance Decisions

How to integrate technical analysis to improve decision-making in credit spread trading.

Trade Management

Monitoring and Adjusting Open Positions

Tips on how to monitor and adjust open credit spread positions effectively.

Dealing with Assignment Risk

Guidance on managing the risk of option assignment, a common concern with credit spreads.

Advanced Techniques

Utilizing Greeks in Credit Spread Trading

Understanding how options ‘Greeks’ can influence your credit spread strategies and decision-making process.

Combining Multiple Spreads

Strategies for combining multiple credit spreads to increase potential returns and diversify risk.

Learning from Mistakes

Common Pitfalls in Credit Spread Trading

Identify and learn how to avoid the most common mistakes made by credit spread traders.

Case Studies and Real-World Examples

Analyzing real-world examples to illustrate successful and unsuccessful credit spread trades.

Joining the Trading Community

Benefits of Community Learning

The advantages of joining a trading community, including shared knowledge and emotional support.

Ongoing Support and Education

Information on continuing education and support available through Hari Swaminathan’s training programs.

Conclusion

“CREDIT SPREAD SURGERY” with Hari Swaminathan provides a comprehensive roadmap to mastering bear call and bull put spreads. This course is an invaluable resource for anyone looking to enhance their options trading skills through structured, strategic approaches that prioritize risk management.

FAQs

1. How long does it take to complete the Credit Spread Surgery course?

- Typically, the course can be completed within a few weeks, depending on the learner’s pace.

2. Is prior experience in options trading necessary?

- Basic knowledge of options is recommended, but beginners can also benefit as the course starts with foundational concepts.

3. What additional resources does Hari Swaminathan offer?

- Hari provides additional webinars, live trading sessions, and one-on-one coaching for deeper learning.

4. Can these strategies be applied in any market environment?

- Yes, bear call and bull put spreads are versatile strategies that can be adapted to various market conditions.

5. How can I sign up for the course?

- Visit the Simpler Trading website to enroll in the “Credit Spread Surgery” course and start your journey to options mastery.

Be the first to review “CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.