-

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00

Come Into My Trading Room: A Complete Guide to Trading with Alexander Elder

1 × $6.00 -

×

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00 -

×

Strategy Week: Using High Probability Options Strategies with Don Kaufman

1 × $6.00

Strategy Week: Using High Probability Options Strategies with Don Kaufman

1 × $6.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00

A Trader's Guide to Self-Discipline: Proven Techniques to Improve Trading Profits

1 × $6.00 -

×

Does a Holy Grail Really Exist with John Hayden

1 × $6.00

Does a Holy Grail Really Exist with John Hayden

1 × $6.00 -

×

Complete Portfolio and Stock Comparison Spreadsheet with Joseph Hogue

1 × $6.00

Complete Portfolio and Stock Comparison Spreadsheet with Joseph Hogue

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

The MissionFX Compounding Course with Nick Shawn

1 × $5.00

The MissionFX Compounding Course with Nick Shawn

1 × $5.00 -

×

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00

RiskDoctor RD1 – Introduction to Options Trading the RiskDoctor Way with Charles Cottle

1 × $6.00 -

×

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00 -

×

Masterclass 5.0 with RockzFX

1 × $5.00

Masterclass 5.0 with RockzFX

1 × $5.00 -

×

Capital Flows and Crises with Barry Eichengreen

1 × $6.00

Capital Flows and Crises with Barry Eichengreen

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Candlesticks Explained with Martin Pring

1 × $6.00

Candlesticks Explained with Martin Pring

1 × $6.00 -

×

The Python for Traders Masterclass with Mr James

1 × $10.00

The Python for Traders Masterclass with Mr James

1 × $10.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00

Formula to a Fortune with Steve Briese, Glen Ring

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Outsmarting the Smart Money with Lawrence A.Cunningham

1 × $6.00

Outsmarting the Smart Money with Lawrence A.Cunningham

1 × $6.00 -

×

The Market Maker’s Edge with Josh Lukeman

1 × $6.00

The Market Maker’s Edge with Josh Lukeman

1 × $6.00 -

×

Computational Financial Mathematics with Mathematica

1 × $6.00

Computational Financial Mathematics with Mathematica

1 × $6.00 -

×

60 Minute Trader with Chris Kobewka

1 × $6.00

60 Minute Trader with Chris Kobewka

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00

Commodities Rising: The Reality Behind the Hype and How To Really Profit in the Commodities Market - Jeffrey Christian

1 × $6.00 -

×

The Banker’s Edge Webinar & Extras

1 × $6.00

The Banker’s Edge Webinar & Extras

1 × $6.00 -

×

Trading with Wave59 with Earik Beann

1 × $6.00

Trading with Wave59 with Earik Beann

1 × $6.00 -

×

Letal Forex System with Alex Seeni

1 × $6.00

Letal Forex System with Alex Seeni

1 × $6.00 -

×

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00 -

×

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00

Mastering Collar Trades Pro with Vince Vora - TradingWins

1 × $6.00 -

×

Trade What You See How To Profit from Pattern Recognition with Larry Pesavento & Leslie Jouflas

1 × $6.00

Trade What You See How To Profit from Pattern Recognition with Larry Pesavento & Leslie Jouflas

1 × $6.00 -

×

Fibonacci Analysis with Constance Brown

1 × $6.00

Fibonacci Analysis with Constance Brown

1 × $6.00 -

×

The Ten Most Powerful Option Trading Secrets with Bernie Schaeffer

1 × $6.00

The Ten Most Powerful Option Trading Secrets with Bernie Schaeffer

1 × $6.00 -

×

The Complete XAUUSD GOLD Forex Scalping System On Real Trading Account with Forex Lia

1 × $5.00

The Complete XAUUSD GOLD Forex Scalping System On Real Trading Account with Forex Lia

1 × $5.00 -

×

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00

4-Hour Income Strategy with Todd Mitchell & Craig Hill

1 × $62.00 -

×

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00 -

×

Support and Resistance Trading with Rob Booker

1 × $6.00

Support and Resistance Trading with Rob Booker

1 × $6.00 -

×

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00 -

×

Candlestick Charts with Clive Lambert

1 × $6.00

Candlestick Charts with Clive Lambert

1 × $6.00 -

×

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00

Finding Alpha: The Search for Alpha When Risk and Return Break Down with Eric Falkenstein

1 × $6.00 -

×

Forex Trading MasterClass with Torero Traders School

1 × $5.00

Forex Trading MasterClass with Torero Traders School

1 × $5.00 -

×

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00

Advanced Technical Strategies Home Study Course with T3 LIVE

1 × $31.00 -

×

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00 -

×

Chaos and order in the Capital Markets with Edgar E.Peters

1 × $6.00

Chaos and order in the Capital Markets with Edgar E.Peters

1 × $6.00 -

×

Dynamite TNT Forex System with Clarence Chee

1 × $6.00

Dynamite TNT Forex System with Clarence Chee

1 × $6.00 -

×

Quant Edge with T3 Live

1 × $6.00

Quant Edge with T3 Live

1 × $6.00 -

×

The Risk-Wise Investor: How to Better Understand and Manage Risk with Michael Carpenter

1 × $6.00

The Risk-Wise Investor: How to Better Understand and Manage Risk with Michael Carpenter

1 × $6.00 -

×

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00 -

×

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan

$39.00 Original price was: $39.00.$6.00Current price is: $6.00.

File Size: 571 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

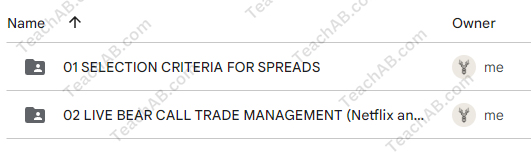

You may check content proof of “CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan” below:

Credit Spread Surgery: Mastering Bear Call and Bull Put Spreads with Hari Swaminathan

Dive deep into the world of options trading with “Credit Spread Surgery,” a specialized course designed by renowned options educator Hari Swaminathan. This course focuses on mastering bear call spreads and bull put spreads, two essential strategies for traders looking to enhance their profitability while managing risk effectively.

Introduction to Credit Spread Surgery

Credit spreads are a cornerstone of conservative options trading, providing a balance between risk and return. With Hari Swaminathan’s expert guidance, traders of all levels can learn to implement these strategies to capitalize on market movements while protecting their investment.

Who is Hari Swaminathan?

Background and Expertise

Hari Swaminathan is a respected figure in the options trading community, known for his ability to simplify complex trading concepts and strategies.

Philosophy on Options Trading

Hari’s trading philosophy revolves around risk management and the strategic use of options spreads to achieve consistent returns.

Understanding Credit Spreads

What are Credit Spreads?

A basic overview of credit spreads, including their structure and how they are used in trading.

Benefits of Trading Credit Spreads

Explore the advantages of using credit spreads, such as reduced risk and improved probability of profit.

Bear Call Spreads Explained

Setting Up a Bear Call Spread

Step-by-step guidance on how to establish a bear call spread, including selecting strike prices and expiration dates.

Risk Management with Bear Call Spreads

Techniques for managing risk when utilizing bear call spreads in various market conditions.

Bull Put Spreads Demystified

Constructing a Bull Put Spread

Detailed instructions on building a bull put spread to maximize your earnings potential.

Advantages of Bull Put Spreads

Discussion on why bull put spreads can be a lucrative strategy for bullish or neutral market scenarios.

Analyzing Market Conditions

Identifying Ideal Conditions for Credit Spreads

Learn how to analyze market conditions to determine the best times to employ bear call or bull put spreads.

Adjustments and Exit Strategies

How to make necessary adjustments to your spreads to protect profits or minimize losses.

Tools and Indicators

Essential Tools for Credit Spread Traders

Overview of the tools and indicators that are most effective for traders specializing in credit spreads.

Using Technical Analysis to Enhance Decisions

How to integrate technical analysis to improve decision-making in credit spread trading.

Trade Management

Monitoring and Adjusting Open Positions

Tips on how to monitor and adjust open credit spread positions effectively.

Dealing with Assignment Risk

Guidance on managing the risk of option assignment, a common concern with credit spreads.

Advanced Techniques

Utilizing Greeks in Credit Spread Trading

Understanding how options ‘Greeks’ can influence your credit spread strategies and decision-making process.

Combining Multiple Spreads

Strategies for combining multiple credit spreads to increase potential returns and diversify risk.

Learning from Mistakes

Common Pitfalls in Credit Spread Trading

Identify and learn how to avoid the most common mistakes made by credit spread traders.

Case Studies and Real-World Examples

Analyzing real-world examples to illustrate successful and unsuccessful credit spread trades.

Joining the Trading Community

Benefits of Community Learning

The advantages of joining a trading community, including shared knowledge and emotional support.

Ongoing Support and Education

Information on continuing education and support available through Hari Swaminathan’s training programs.

Conclusion

“CREDIT SPREAD SURGERY” with Hari Swaminathan provides a comprehensive roadmap to mastering bear call and bull put spreads. This course is an invaluable resource for anyone looking to enhance their options trading skills through structured, strategic approaches that prioritize risk management.

FAQs

1. How long does it take to complete the Credit Spread Surgery course?

- Typically, the course can be completed within a few weeks, depending on the learner’s pace.

2. Is prior experience in options trading necessary?

- Basic knowledge of options is recommended, but beginners can also benefit as the course starts with foundational concepts.

3. What additional resources does Hari Swaminathan offer?

- Hari provides additional webinars, live trading sessions, and one-on-one coaching for deeper learning.

4. Can these strategies be applied in any market environment?

- Yes, bear call and bull put spreads are versatile strategies that can be adapted to various market conditions.

5. How can I sign up for the course?

- Visit the Simpler Trading website to enroll in the “Credit Spread Surgery” course and start your journey to options mastery.

Be the first to review “CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.