-

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

90 Minute Cycle withThe Algo Trader

1 × $5.00

90 Minute Cycle withThe Algo Trader

1 × $5.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

6 Dynamic Trader Real Time and End Of Day

1 × $39.00

6 Dynamic Trader Real Time and End Of Day

1 × $39.00 -

×

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00

Day Trading Systems & Methods with Charles Le Beau, David Lucas

1 × $6.00 -

×

A Day Trading Guide

1 × $54.00

A Day Trading Guide

1 × $54.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

AstroFibonacci 7.3722 magisociety

1 × $6.00

AstroFibonacci 7.3722 magisociety

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00

5-Day Master Trader Program 2022 with Mark Minervini

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Trading as a Business with Alexander Elder

1 × $6.00

Trading as a Business with Alexander Elder

1 × $6.00 -

×

Bond Markets, Analysis and Strategies with Frank Fabozzi

1 × $6.00

Bond Markets, Analysis and Strategies with Frank Fabozzi

1 × $6.00 -

×

Alexander Elder Package ( Discount 28% )

1 × $31.00

Alexander Elder Package ( Discount 28% )

1 × $31.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00

ART Online 4 Weeks Home Study Course with Bennett McDowell

1 × $78.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00

A Grand Supercycle Top Webinar with Steven Hochberg

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

BCFX 2,0 and 2,5 with Brandon Carter

1 × $5.00

BCFX 2,0 and 2,5 with Brandon Carter

1 × $5.00 -

×

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00

3 Technical Indicators to Help You Ride the Elliott Wave Trend with Chris Carolan

1 × $6.00 -

×

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00 -

×

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00 -

×

Trading to Win with Ari Kiev

1 × $6.00

Trading to Win with Ari Kiev

1 × $6.00 -

×

Chart Analysis Boot Camp Course Webinar with Mike Albright

1 × $6.00

Chart Analysis Boot Camp Course Webinar with Mike Albright

1 × $6.00 -

×

Advanced Trading Strategies

1 × $31.00

Advanced Trading Strategies

1 × $31.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan

$39.00 Original price was: $39.00.$6.00Current price is: $6.00.

File Size: 571 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan” below:

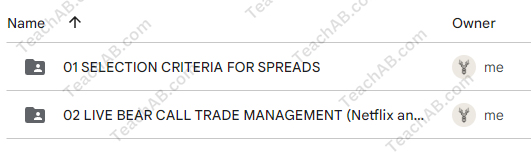

Credit Spread Surgery: Mastering Bear Call and Bull Put Spreads with Hari Swaminathan

Dive deep into the world of options trading with “Credit Spread Surgery,” a specialized course designed by renowned options educator Hari Swaminathan. This course focuses on mastering bear call spreads and bull put spreads, two essential strategies for traders looking to enhance their profitability while managing risk effectively.

Introduction to Credit Spread Surgery

Credit spreads are a cornerstone of conservative options trading, providing a balance between risk and return. With Hari Swaminathan’s expert guidance, traders of all levels can learn to implement these strategies to capitalize on market movements while protecting their investment.

Who is Hari Swaminathan?

Background and Expertise

Hari Swaminathan is a respected figure in the options trading community, known for his ability to simplify complex trading concepts and strategies.

Philosophy on Options Trading

Hari’s trading philosophy revolves around risk management and the strategic use of options spreads to achieve consistent returns.

Understanding Credit Spreads

What are Credit Spreads?

A basic overview of credit spreads, including their structure and how they are used in trading.

Benefits of Trading Credit Spreads

Explore the advantages of using credit spreads, such as reduced risk and improved probability of profit.

Bear Call Spreads Explained

Setting Up a Bear Call Spread

Step-by-step guidance on how to establish a bear call spread, including selecting strike prices and expiration dates.

Risk Management with Bear Call Spreads

Techniques for managing risk when utilizing bear call spreads in various market conditions.

Bull Put Spreads Demystified

Constructing a Bull Put Spread

Detailed instructions on building a bull put spread to maximize your earnings potential.

Advantages of Bull Put Spreads

Discussion on why bull put spreads can be a lucrative strategy for bullish or neutral market scenarios.

Analyzing Market Conditions

Identifying Ideal Conditions for Credit Spreads

Learn how to analyze market conditions to determine the best times to employ bear call or bull put spreads.

Adjustments and Exit Strategies

How to make necessary adjustments to your spreads to protect profits or minimize losses.

Tools and Indicators

Essential Tools for Credit Spread Traders

Overview of the tools and indicators that are most effective for traders specializing in credit spreads.

Using Technical Analysis to Enhance Decisions

How to integrate technical analysis to improve decision-making in credit spread trading.

Trade Management

Monitoring and Adjusting Open Positions

Tips on how to monitor and adjust open credit spread positions effectively.

Dealing with Assignment Risk

Guidance on managing the risk of option assignment, a common concern with credit spreads.

Advanced Techniques

Utilizing Greeks in Credit Spread Trading

Understanding how options ‘Greeks’ can influence your credit spread strategies and decision-making process.

Combining Multiple Spreads

Strategies for combining multiple credit spreads to increase potential returns and diversify risk.

Learning from Mistakes

Common Pitfalls in Credit Spread Trading

Identify and learn how to avoid the most common mistakes made by credit spread traders.

Case Studies and Real-World Examples

Analyzing real-world examples to illustrate successful and unsuccessful credit spread trades.

Joining the Trading Community

Benefits of Community Learning

The advantages of joining a trading community, including shared knowledge and emotional support.

Ongoing Support and Education

Information on continuing education and support available through Hari Swaminathan’s training programs.

Conclusion

“CREDIT SPREAD SURGERY” with Hari Swaminathan provides a comprehensive roadmap to mastering bear call and bull put spreads. This course is an invaluable resource for anyone looking to enhance their options trading skills through structured, strategic approaches that prioritize risk management.

FAQs

1. How long does it take to complete the Credit Spread Surgery course?

- Typically, the course can be completed within a few weeks, depending on the learner’s pace.

2. Is prior experience in options trading necessary?

- Basic knowledge of options is recommended, but beginners can also benefit as the course starts with foundational concepts.

3. What additional resources does Hari Swaminathan offer?

- Hari provides additional webinars, live trading sessions, and one-on-one coaching for deeper learning.

4. Can these strategies be applied in any market environment?

- Yes, bear call and bull put spreads are versatile strategies that can be adapted to various market conditions.

5. How can I sign up for the course?

- Visit the Simpler Trading website to enroll in the “Credit Spread Surgery” course and start your journey to options mastery.

Be the first to review “CREDIT SPREAD SURGERY – Bear Call and Bull Put Mastery with Hari Swaminathan” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.