-

×

War Room Technicals Vol 1 with Trick Traders

1 × $6.00

War Room Technicals Vol 1 with Trick Traders

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Austin Passamonte Package ( Discount 25 % )

1 × $15.00

Austin Passamonte Package ( Discount 25 % )

1 × $15.00 -

×

Math for the Trades with LearningExpress

1 × $6.00

Math for the Trades with LearningExpress

1 × $6.00 -

×

Trading Masterclass 2.0 with Irek Piekarski

1 × $5.00

Trading Masterclass 2.0 with Irek Piekarski

1 × $5.00 -

×

News FX Strategy with Zain Agha

1 × $6.00

News FX Strategy with Zain Agha

1 × $6.00 -

×

Insider’s Guide To Forex Trading Howard Gilmore

1 × $6.00

Insider’s Guide To Forex Trading Howard Gilmore

1 × $6.00 -

×

Ichimokutrade - Fibonacci 101

1 × $15.00

Ichimokutrade - Fibonacci 101

1 × $15.00 -

×

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00 -

×

Trend Trading Techniques with Rob Hoffman

1 × $6.00

Trend Trading Techniques with Rob Hoffman

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Blueprint Course 2.0 with Mike Anderson

1 × $17.00

The Blueprint Course 2.0 with Mike Anderson

1 × $17.00 -

×

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00 -

×

The Power of Position Sizing Strategies SQN Secrets Revealed with Van Tharp

1 × $5.00

The Power of Position Sizing Strategies SQN Secrets Revealed with Van Tharp

1 × $5.00 -

×

W.D.Ganns Astrological Method

1 × $6.00

W.D.Ganns Astrological Method

1 × $6.00 -

×

Inner Circle Course with Darius Fx

1 × $24.00

Inner Circle Course with Darius Fx

1 × $24.00 -

×

Intermediate to Advance Trading Strategies

1 × $6.00

Intermediate to Advance Trading Strategies

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00 -

×

Brian James Sklenka Package

1 × $31.00

Brian James Sklenka Package

1 × $31.00 -

×

REMORA OPTIONS TRADING (Silver Membership)

1 × $23.00

REMORA OPTIONS TRADING (Silver Membership)

1 × $23.00 -

×

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00

The Stock Index Futures Market with B.Thomas Byme Jr.

1 × $6.00 -

×

Backtrade Marathon NEW with Real Life Trading

1 × $23.00

Backtrade Marathon NEW with Real Life Trading

1 × $23.00 -

×

Options Trading Business with The Daytrading Room

1 × $23.00

Options Trading Business with The Daytrading Room

1 × $23.00 -

×

Ultimate Day Trading Program with Maroun4x

1 × $5.00

Ultimate Day Trading Program with Maroun4x

1 × $5.00 -

×

Forex Rebellion Trading System

1 × $5.00

Forex Rebellion Trading System

1 × $5.00 -

×

The World in Your Oyester with Jeff D. Opdyke

1 × $6.00

The World in Your Oyester with Jeff D. Opdyke

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Instant Forex Profits Home Study Course

1 × $23.00

Instant Forex Profits Home Study Course

1 × $23.00 -

×

The Wizard Training Course with Mitch King

1 × $6.00

The Wizard Training Course with Mitch King

1 × $6.00 -

×

The Top Tier Pro System Basic with Raghee Horner

1 × $41.00

The Top Tier Pro System Basic with Raghee Horner

1 × $41.00 -

×

TTM Trading with the Anchor Indicators Video

1 × $6.00

TTM Trading with the Anchor Indicators Video

1 × $6.00 -

×

MAM EA (Unlocked) with Christopher Wilson

1 × $6.00

MAM EA (Unlocked) with Christopher Wilson

1 × $6.00 -

×

Big Mike Trading Webinars

1 × $6.00

Big Mike Trading Webinars

1 × $6.00 -

×

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00 -

×

Trader BO Divergence System with Aleg A.Bot

1 × $6.00

Trader BO Divergence System with Aleg A.Bot

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

We Trade Waves

1 × $5.00

We Trade Waves

1 × $5.00 -

×

The Essays of Waren Buffet. Lessons for Corporate America with Lawrence A.Cunningham

1 × $6.00

The Essays of Waren Buffet. Lessons for Corporate America with Lawrence A.Cunningham

1 × $6.00 -

×

Divergent swing trading

1 × $54.00

Divergent swing trading

1 × $54.00 -

×

Options Made Easy with Optionpit

1 × $62.00

Options Made Easy with Optionpit

1 × $62.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Strategy Factory Workshop

1 × $23.00

Strategy Factory Workshop

1 × $23.00 -

×

Dynamic Trading Multimedia E-Learning Workshop - 6 CD with Robert Miner

1 × $39.00

Dynamic Trading Multimedia E-Learning Workshop - 6 CD with Robert Miner

1 × $39.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Joshua ICT ChartLab 2023

1 × $5.00

Joshua ICT ChartLab 2023

1 × $5.00 -

×

Trading Courses Bundle

1 × $31.00

Trading Courses Bundle

1 × $31.00 -

×

Using Fundamental Analysis with Andrew Baxter

1 × $6.00

Using Fundamental Analysis with Andrew Baxter

1 × $6.00 -

×

Bulk REO 2.0

1 × $23.00

Bulk REO 2.0

1 × $23.00 -

×

Forex Master Class with Falcon Trading Academy

1 × $5.00

Forex Master Class with Falcon Trading Academy

1 × $5.00 -

×

Spotting Big Money with Market Profile with John Kepler

1 × $23.00

Spotting Big Money with Market Profile with John Kepler

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

PROFESSIONAL TRADING EDUCATION with The MarketDelta Edge

1 × $78.00

PROFESSIONAL TRADING EDUCATION with The MarketDelta Edge

1 × $78.00 -

×

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00 -

×

The Expected Return Calculator

1 × $23.00

The Expected Return Calculator

1 × $23.00 -

×

Making The Leap Learning To Trade With Robots with Scott Welsh

1 × $15.00

Making The Leap Learning To Trade With Robots with Scott Welsh

1 × $15.00 -

×

Trading Indicators for the 21th Century

1 × $15.00

Trading Indicators for the 21th Century

1 × $15.00 -

×

Black Edge FX – Professional Forex Trader

1 × $31.00

Black Edge FX – Professional Forex Trader

1 × $31.00 -

×

Orderflows - The Imbalance Course

1 × $8.00

Orderflows - The Imbalance Course

1 × $8.00 -

×

The Dynamic Trend Confirmation Indicator with Alphashark

1 × $54.00

The Dynamic Trend Confirmation Indicator with Alphashark

1 × $54.00 -

×

Live Video Revolution

1 × $15.00

Live Video Revolution

1 × $15.00 -

×

Turtle Soup Course with ICT Trader Romeo

1 × $5.00

Turtle Soup Course with ICT Trader Romeo

1 × $5.00 -

×

W.D. Gann’s Best Trading Systems with Myles Wilson-Walker

1 × $27.00

W.D. Gann’s Best Trading Systems with Myles Wilson-Walker

1 × $27.00 -

×

Atlas Edition Course with Apex Paragon Trading

1 × $6.00

Atlas Edition Course with Apex Paragon Trading

1 × $6.00 -

×

Options Trading for the Conservative Trader with Michael Thomsett

1 × $6.00

Options Trading for the Conservative Trader with Michael Thomsett

1 × $6.00 -

×

Option Hydra - June 2020 Edition - Basics By Rajandran R

1 × $23.00

Option Hydra - June 2020 Edition - Basics By Rajandran R

1 × $23.00 -

×

Stock Split Secrets (2nd Ed.)

1 × $6.00

Stock Split Secrets (2nd Ed.)

1 × $6.00 -

×

Winter 2016 Ignite Trading Conference (2016)

1 × $23.00

Winter 2016 Ignite Trading Conference (2016)

1 × $23.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Hot Trading Investing Strategy: ETF and Futures with QSB Funds

1 × $6.00

Hot Trading Investing Strategy: ETF and Futures with QSB Funds

1 × $6.00 -

×

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00 -

×

Trading With Market Timing and Intelligence with John Crain

1 × $23.00

Trading With Market Timing and Intelligence with John Crain

1 × $23.00 -

×

Uncover Resilient Stocks in Today’s Market with Peter Worden

1 × $6.00

Uncover Resilient Stocks in Today’s Market with Peter Worden

1 × $6.00 -

×

Weekly Power Options Strategies

1 × $6.00

Weekly Power Options Strategies

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Getting Started in Options (3rd Ed.) with Michael Thomsett

1 × $6.00

Getting Started in Options (3rd Ed.) with Michael Thomsett

1 × $6.00 -

×

Toolkit For Thinkorswim with Bigtrends

1 × $54.00

Toolkit For Thinkorswim with Bigtrends

1 × $54.00 -

×

Harmonic Patterns for ThinkorSwim Bat, Butterfly, Crab, and Gartley

1 × $6.00

Harmonic Patterns for ThinkorSwim Bat, Butterfly, Crab, and Gartley

1 × $6.00 -

×

Donchian’s 20 Guides to Trading Commodities with Barbara S.Dixon

1 × $4.00

Donchian’s 20 Guides to Trading Commodities with Barbara S.Dixon

1 × $4.00 -

×

The Power of Beliefs in Trading with Gabriel Grammatidis - Van Tharp

1 × $13.00

The Power of Beliefs in Trading with Gabriel Grammatidis - Van Tharp

1 × $13.00 -

×

JimDandy’s Mql4 Courses - All Lessons

1 × $6.00

JimDandy’s Mql4 Courses - All Lessons

1 × $6.00 -

×

Lifetime Membership

1 × $840.00

Lifetime Membership

1 × $840.00 -

×

Technical Analysis. The Basis with Glenn Ring

1 × $6.00

Technical Analysis. The Basis with Glenn Ring

1 × $6.00 -

×

The In-N-Out Butterfly

1 × $6.00

The In-N-Out Butterfly

1 × $6.00 -

×

Turning Point. Analysis in Price and Time

1 × $6.00

Turning Point. Analysis in Price and Time

1 × $6.00 -

×

Market Profile Training with Futexlive

1 × $23.00

Market Profile Training with Futexlive

1 × $23.00 -

×

ETFMax

1 × $31.00

ETFMax

1 × $31.00 -

×

TTM Indicators Package for eSignal

1 × $6.00

TTM Indicators Package for eSignal

1 × $6.00 -

×

Trading Connors VIX Reversals & Tradestation Files with Larry Connors

1 × $6.00

Trading Connors VIX Reversals & Tradestation Files with Larry Connors

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Trading the Fast Moves for Maximum Profit with William McLaren

1 × $4.00

Trading the Fast Moves for Maximum Profit with William McLaren

1 × $4.00 -

×

Thetimefactor - TRADING WITH PRICE

1 × $15.00

Thetimefactor - TRADING WITH PRICE

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Ultimate Options Trading Blueprint

1 × $23.00

Ultimate Options Trading Blueprint

1 × $23.00 -

×

TTM Directional Day Filter System for TS

1 × $6.00

TTM Directional Day Filter System for TS

1 × $6.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

Gaining Option Leverage: Using Market Makers Tactics with Jon Najarian

1 × $4.00

Gaining Option Leverage: Using Market Makers Tactics with Jon Najarian

1 × $4.00 -

×

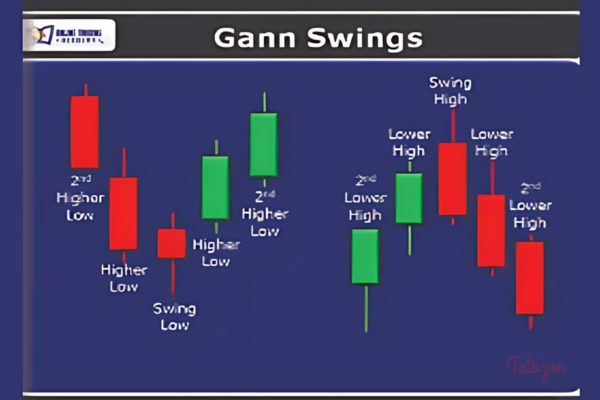

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Beat The Binaries

1 × $15.00

Beat The Binaries

1 × $15.00 -

×

Start Trading Stocks Using Technical Analysis with Corey Halliday

1 × $6.00

Start Trading Stocks Using Technical Analysis with Corey Halliday

1 × $6.00 -

×

Smart Money with Chart Engineers

1 × $7.00

Smart Money with Chart Engineers

1 × $7.00 -

×

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00 -

×

VagaFX Academy Course with VAGAFX

1 × $41.00

VagaFX Academy Course with VAGAFX

1 × $41.00 -

×

MTI - Scalping Course

1 × $15.00

MTI - Scalping Course

1 × $15.00 -

×

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00 -

×

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00 -

×

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00 -

×

Trading Without Gambling with Marcel Link

1 × $6.00

Trading Without Gambling with Marcel Link

1 × $6.00 -

×

The Motley Fool Million Dollar Portfolio: How to Build and Grow a Panic-Proof Investment Portfolio with David Gardner & Tom Gardner

1 × $6.00

The Motley Fool Million Dollar Portfolio: How to Build and Grow a Panic-Proof Investment Portfolio with David Gardner & Tom Gardner

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00 -

×

BETT Strategy with TopTradeTools

1 × $35.00

BETT Strategy with TopTradeTools

1 × $35.00 -

×

Transparent FX Course

1 × $6.00

Transparent FX Course

1 × $6.00 -

×

Combo 4 New Courses From AmiBroker

1 × $54.00

Combo 4 New Courses From AmiBroker

1 × $54.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Central Bank Trading Strategies with AXIA Futures

1 × $5.00

Central Bank Trading Strategies with AXIA Futures

1 × $5.00 -

×

Security Analysis (The Classic 1934 Ed.) with Benjamin Graham

1 × $6.00

Security Analysis (The Classic 1934 Ed.) with Benjamin Graham

1 × $6.00 -

×

Winning with Options with Michael Thomsett

1 × $6.00

Winning with Options with Michael Thomsett

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00 -

×

Trend Trading Course

1 × $15.00

Trend Trading Course

1 × $15.00 -

×

The Tape Reader’s Bundle with The Price Action Room

1 × $62.00

The Tape Reader’s Bundle with The Price Action Room

1 × $62.00 -

×

Oil & Gas Modeling Course with Wall Street Prep

1 × $27.00

Oil & Gas Modeling Course with Wall Street Prep

1 × $27.00 -

×

Voodoo Lines Indicator

1 × $62.00

Voodoo Lines Indicator

1 × $62.00 -

×

60 Minute Trader with Chris Kobewka

1 × $6.00

60 Minute Trader with Chris Kobewka

1 × $6.00 -

×

Instant Profits System with Bill Poulos

1 × $6.00

Instant Profits System with Bill Poulos

1 × $6.00 -

×

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00 -

×

Tick Trader Day Trading Course with David Marsh

1 × $6.00

Tick Trader Day Trading Course with David Marsh

1 × $6.00 -

×

Calendar Spreads with Todd Mitchell

1 × $31.00

Calendar Spreads with Todd Mitchell

1 × $31.00 -

×

New York Super Conference 2016 Videos

1 × $31.00

New York Super Conference 2016 Videos

1 × $31.00 -

×

Stock Market Forecast Tools SMFT-1 (Sept 2013)

1 × $6.00

Stock Market Forecast Tools SMFT-1 (Sept 2013)

1 × $6.00 -

×

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00 -

×

Trading Forecasts Manual with Yuri Shramenko

1 × $4.00

Trading Forecasts Manual with Yuri Shramenko

1 × $4.00 -

×

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00 -

×

Pristine - Cardinal Rules of Trading

1 × $6.00

Pristine - Cardinal Rules of Trading

1 × $6.00 -

×

Price action profits formula v2

1 × $31.00

Price action profits formula v2

1 × $31.00 -

×

Technical & Fundamental Courses with Diamant Capital

1 × $5.00

Technical & Fundamental Courses with Diamant Capital

1 × $5.00 -

×

MACD Divergence Semi-Automatic Scanner For Tradestation with Elder

1 × $31.00

MACD Divergence Semi-Automatic Scanner For Tradestation with Elder

1 × $31.00 -

×

The Power of the Hexagon

1 × $6.00

The Power of the Hexagon

1 × $6.00 -

×

Trading Options Using Auction Market Principles with Alexander Trading

1 × $54.00

Trading Options Using Auction Market Principles with Alexander Trading

1 × $54.00 -

×

The Thirty-Second Jewel in PDF with Constance Brown

1 × $8.00

The Thirty-Second Jewel in PDF with Constance Brown

1 × $8.00 -

×

Tradeciety Online Forex Trading MasterClass

1 × $5.00

Tradeciety Online Forex Trading MasterClass

1 × $5.00 -

×

Momentum Explained. Vol.1

1 × $6.00

Momentum Explained. Vol.1

1 × $6.00 -

×

Volcano Trading with Claytrader

1 × $15.00

Volcano Trading with Claytrader

1 × $15.00 -

×

Characteristics and Risks of Standardized Options

1 × $6.00

Characteristics and Risks of Standardized Options

1 × $6.00 -

×

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00 -

×

Futures Masterclass with Market Flow Trader

1 × $17.00

Futures Masterclass with Market Flow Trader

1 × $17.00 -

×

Claytrader - Risk vs Reward Trading

1 × $23.00

Claytrader - Risk vs Reward Trading

1 × $23.00 -

×

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00 -

×

Eye Opening FX

1 × $5.00

Eye Opening FX

1 × $5.00 -

×

The Option Pit VIX Primer

1 × $31.00

The Option Pit VIX Primer

1 × $31.00 -

×

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

1 × $6.00

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

1 × $6.00 -

×

Out of the Pits with Caitlin Zaloom

1 × $6.00

Out of the Pits with Caitlin Zaloom

1 × $6.00 -

×

Theotrade - Essential Skills for Consistency in Trading Class

1 × $15.00

Theotrade - Essential Skills for Consistency in Trading Class

1 × $15.00 -

×

ART Trading - Fine Tuning Your Money Management Skills & Controlling Your Trade Risk

1 × $15.00

ART Trading - Fine Tuning Your Money Management Skills & Controlling Your Trade Risk

1 × $15.00 -

×

Trading Breakouts with Options By Keith Harwood - Option Pit

1 × $23.00

Trading Breakouts with Options By Keith Harwood - Option Pit

1 × $23.00 -

×

Top 20 VSA Principles & How to Trade Them

1 × $31.00

Top 20 VSA Principles & How to Trade Them

1 × $31.00 -

×

Training Program

1 × $15.00

Training Program

1 × $15.00 -

×

Order Flow Trading Course with Orderflows

1 × $23.00

Order Flow Trading Course with Orderflows

1 × $23.00 -

×

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00 -

×

The Use The Moon Trading 2020 Group Webinars Series with Market Occultations

1 × $62.00

The Use The Moon Trading 2020 Group Webinars Series with Market Occultations

1 × $62.00 -

×

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00 -

×

The Ultimate Coach's Corner Forex Video Library with Vic Noble & Darko Ali

1 × $39.00

The Ultimate Coach's Corner Forex Video Library with Vic Noble & Darko Ali

1 × $39.00 -

×

Ultimate Candlestick Training Package and Bonus Candlestick Analysis Technician Seminar

1 × $23.00

Ultimate Candlestick Training Package and Bonus Candlestick Analysis Technician Seminar

1 × $23.00 -

×

Tomorrow's Gold: Asia's Age of Discovery with Marc Faber

1 × $6.00

Tomorrow's Gold: Asia's Age of Discovery with Marc Faber

1 × $6.00 -

×

![The Art of Trading Covered Writes [1 video (AVI)] image](https://www.totozon.com/wp-content/uploads/2024/07/A-trader-analyzing-earnings-reports-on-a-computer-screen.png) Learn To Trade Earnings with Dan Sheridan

1 × $23.00

Learn To Trade Earnings with Dan Sheridan

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Advanced Course

1 × $39.00

Advanced Course

1 × $39.00 -

×

Make Money While You Sleep with Forex Night Train

1 × $6.00

Make Money While You Sleep with Forex Night Train

1 × $6.00 -

×

Wave Trading Masterclass: Elliott's Wave Theory/Fibonacci Principles with Wave Trader

1 × $116.00

Wave Trading Masterclass: Elliott's Wave Theory/Fibonacci Principles with Wave Trader

1 × $116.00 -

×

Options Trading with Adam Grimes - MarketLife

1 × $5.00

Options Trading with Adam Grimes - MarketLife

1 × $5.00 -

×

Porsche Dots For NinjaTrader

1 × $31.00

Porsche Dots For NinjaTrader

1 × $31.00 -

×

Trading Indicators NT7

1 × $85.00

Trading Indicators NT7

1 × $85.00 -

×

The Stock Market Trading Secrets of the Late (1940, scaned)

1 × $6.00

The Stock Market Trading Secrets of the Late (1940, scaned)

1 × $6.00 -

×

FX At One Glance - Ichimoku Advanced Japanese Techniques

1 × $15.00

FX At One Glance - Ichimoku Advanced Japanese Techniques

1 × $15.00 -

×

The Golden Rule with Jim Gibbons

1 × $6.00

The Golden Rule with Jim Gibbons

1 × $6.00 -

×

FXCharger

1 × $23.00

FXCharger

1 × $23.00 -

×

Raghee Horner - Submarket Sonar - Live Trading + Indicator

1 × $39.00

Raghee Horner - Submarket Sonar - Live Trading + Indicator

1 × $39.00

Create Your Own Hedge Fund with Mark Wolfinger

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Create Your Own Hedge Fund with Mark Wolfinger” below:

Create Your Own Hedge Fund with Mark Wolfinger

Introduction to Hedge Funds

Hedge funds represent a powerful investment vehicle for generating high returns by leveraging various strategies. For those who aspire to create their own hedge fund, Mark Wolfinger, a renowned options trader and educator, provides invaluable guidance. This article will delve into the steps and strategies needed to establish and run a successful hedge fund.

Who is Mark Wolfinger?

Renowned Options Trader and Educator

Mark Wolfinger is a veteran options trader and author with decades of experience in the financial markets. His insights and teachings have helped many traders understand the complexities of options trading.

Educational Contributions

Wolfinger has authored several books and conducted numerous seminars, focusing on options trading strategies. His expertise makes him a valuable resource for anyone looking to create their own hedge fund.

Understanding Hedge Funds

What is a Hedge Fund?

A hedge fund is a pooled investment fund that employs various strategies to earn active returns for its investors. Hedge funds can invest in a wide array of assets and employ techniques such as leverage, derivatives, and short selling.

Key Characteristics

- Flexible Strategies: Can use a wide range of investment strategies.

- Accredited Investors: Typically open to accredited investors with substantial net worth.

- Performance Fees: Managers often earn a percentage of the profits.

Why Create a Hedge Fund?

Creating a hedge fund allows you to leverage your investment expertise to generate significant returns, attract capital from investors, and gain professional recognition.

Steps to Create Your Own Hedge Fund

Step 1: Develop a Strategy

Your hedge fund’s strategy is its foundation. It defines how you will invest and manage risk.

Types of Strategies

- Long/Short Equity: Buying undervalued stocks and shorting overvalued ones.

- Market Neutral: Balancing long and short positions to limit market exposure.

- Global Macro: Capitalizing on macroeconomic trends through various asset classes.

- Event-Driven: Investing based on events like mergers, acquisitions, or bankruptcies.

Step 2: Create a Business Plan

A detailed business plan outlines your hedge fund’s strategy, target market, and operational framework.

Components of a Business Plan

- Executive Summary: Overview of your hedge fund’s objectives and strategy.

- Investment Strategy: Detailed explanation of your trading strategies and risk management techniques.

- Market Analysis: Research on your target market and competitive landscape.

- Operations Plan: Details on fund structure, legal considerations, and operational logistics.

Step 3: Legal and Regulatory Considerations

Hedge funds are subject to various legal and regulatory requirements.

Key Legal Steps

- Form a Legal Entity: Typically, a limited partnership (LP) or limited liability company (LLC).

- Register with the SEC: If managing more than $150 million, registration with the Securities and Exchange Commission is required.

- Compliance: Adhere to regulations such as the Investment Advisers Act of 1940 and Anti-Money Laundering (AML) rules.

Step 4: Raise Capital

Attracting capital is crucial for the success of your hedge fund.

Strategies for Raising Capital

- Pitch Deck: Create a compelling pitch deck highlighting your strategy, team, and past performance.

- Networking: Leverage personal and professional networks to find potential investors.

- Marketing: Use marketing strategies such as seminars, webinars, and digital marketing to attract investors.

Step 5: Establish Operations

Setting up the operational infrastructure is essential for the smooth functioning of your hedge fund.

Operational Considerations

- Prime Brokerage: Partner with a prime broker for trading and financing needs.

- Technology: Implement trading platforms, risk management systems, and back-office software.

- Personnel: Hire key personnel such as analysts, traders, and compliance officers.

Strategies for Hedge Fund Success

Risk Management

Effective risk management is crucial for protecting your capital and ensuring long-term success.

Risk Management Techniques

- Diversification: Spread investments across various asset classes and strategies.

- Hedging: Use derivatives and other instruments to hedge against market risks.

- Stop-Loss Orders: Set stop-loss orders to limit potential losses.

Performance Measurement

Tracking and measuring performance helps in assessing the success of your strategies.

Key Performance Metrics

- Alpha: Measures the fund’s performance relative to a benchmark.

- Beta: Assesses the fund’s sensitivity to market movements.

- Sharpe Ratio: Evaluates risk-adjusted returns.

Continuous Learning and Adaptation

The financial markets are dynamic, requiring continuous learning and adaptation.

Strategies for Continuous Improvement

- Education: Regularly attend seminars, workshops, and courses.

- Research: Stay updated with market trends and new investment strategies.

- Feedback: Seek feedback from investors and peers to improve your strategies.

Common Challenges and Solutions

Regulatory Compliance

Navigating the regulatory landscape can be challenging.

Solution

Hire experienced legal counsel and compliance officers to ensure adherence to all regulations.

Investor Relations

Maintaining strong relationships with investors is crucial for raising and retaining capital.

Solution

Communicate regularly with investors, providing transparent updates on fund performance and strategy adjustments.

Market Volatility

Market volatility can pose significant risks to your hedge fund’s performance.

Solution

Implement robust risk management techniques and diversify your investment strategies.

Conclusion

Creating your own hedge fund with guidance from Mark Wolfinger is an achievable goal with the right strategy, planning, and execution. By understanding the intricacies of hedge fund operations, developing a solid business plan, adhering to legal requirements, and implementing effective risk management, you can establish a successful hedge fund. Continuous learning and adaptation are key to staying competitive in the ever-evolving financial markets.

FAQs

1. What is a hedge fund?

A hedge fund is a pooled investment fund that employs various strategies to earn active returns for its investors, often using leverage, derivatives, and short selling.

2. Why should I consider creating a hedge fund?

Creating a hedge fund allows you to leverage your investment expertise, attract capital, and generate significant returns while gaining professional recognition.

3. What are the key steps to creating a hedge fund?

Key steps include developing a strategy, creating a business plan, addressing legal and regulatory requirements, raising capital, and establishing operations.

4. How important is risk management in a hedge fund?

Risk management is crucial for protecting capital and ensuring long-term success. It involves diversification, hedging, and setting stop-loss orders.

5. What strategies can help in raising capital for a hedge fund?

Strategies include creating a compelling pitch deck, leveraging networks, and using marketing strategies such as seminars and digital marketing to attract investors.

Be the first to review “Create Your Own Hedge Fund with Mark Wolfinger” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.